India Automotive Cabin Air Filter Market Size, Share & Industry Analysis, By Type (Particulate Filter and Combination Filter), By Vehicle Type (Passenger Car (Sedan, Hatchback, and SUV) and Commercial Vehicle (Light Commercial Vehicle and Heavy Commercial Vehicle)), By Distribution Channel (OEM and Aftermarket), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

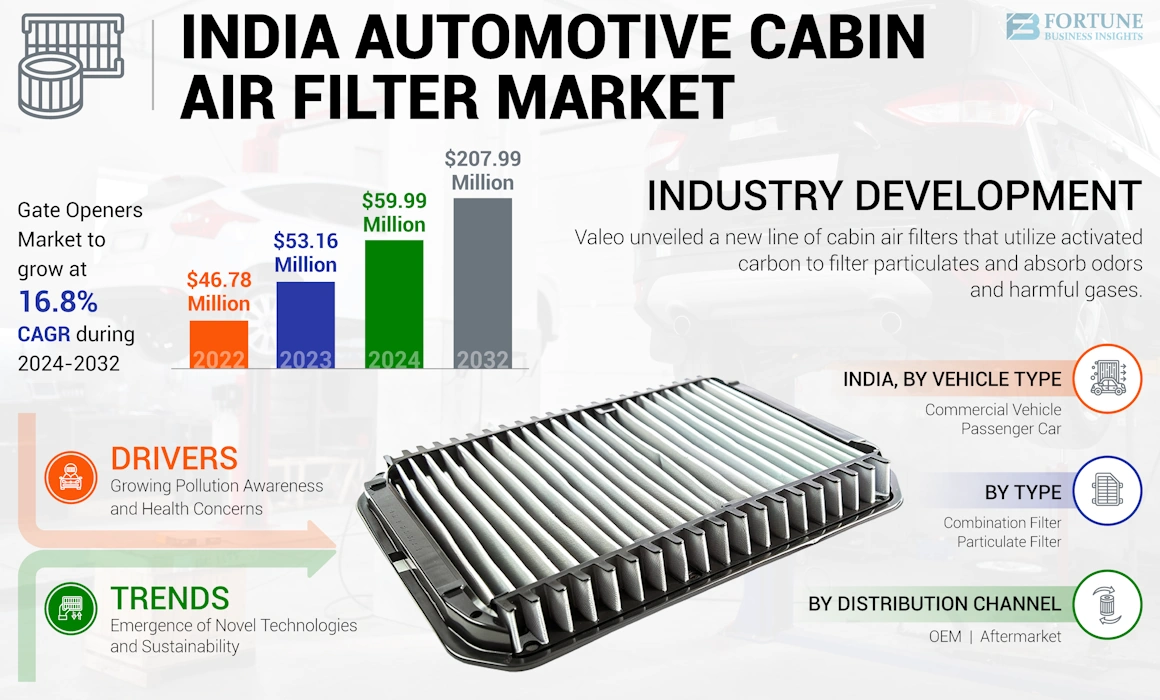

The India automotive cabin air filter market size was valued at USD 53.16 million in 2023. It is expected to grow from USD 59.99 million in 2024 to USD 207.99 million by 2032, recording a CAGR of 16.8% during the forecast period of 2024-2032.

The India automotive cabin air filter market is primarily driven by increasing vehicle production and a growing emphasis on air quality and passenger comfort. Additionally, rising awareness about health issues related to air pollution and stricter government regulations regarding emissions are propelling the market’s growth.

An automotive cabin air filter is a component of a vehicle's ventilation system that cleans the air entering the passenger cabin. It is designed to trap dust, pollen, mold spores, and other airborne particles, ensuring that the air inside the vehicle remains clean and free of contaminants. Some cabin air filters are equipped with activated carbon to absorb odors and harmful gases, improving the overall air quality. Regular replacement of this filter is essential for maintaining optimal airflow, enhancing passenger comfort, and ensuring the efficient operation of the vehicle's heating and cooling systems.

The COVID-19 pandemic further impacted the market by disrupting supply chains and reducing vehicle sales in the short term. However, it also heightened consumer awareness about air quality. This has led to an increased demand for automotive cabin air filters as the vehicle industry recovers from the effects of the pandemic.

MARKET DYNAMICS

Market Drivers

Growing Pollution Awareness and Health Concerns to Drive Demand for Cabin Air Filters in India

With increasing air pollution in India, particularly in populous cities like New Delhi, there has been a rise in public awareness about the risks that come with having poor air quality. This concern might accelerate the India automotive cabin air filter market growth as people are now seeking ways to improve the indoor air quality of their cars. Cabin air filters, especially with the inclusion of advanced technologies, such as HEPA and activated carbon, are fast becoming a necessity, especially in filtering air contaminants, such as the PM 2.5 levels of particulates and SO2 gas extractions. These filters are crucial in protecting passengers from diseases caused by air pollution. With the growing awareness about public health and the steps taken by the government to curb pollution, it can be anticipated that there will be a surge in the demand for these high-grade filters.

Download Free sample to learn more about this report.

Market Restraints

High Cost of Advanced Filtration Technologies to Restrain Market

Automotive cabin air filters in India are in high demand due to factors such as increasing awareness of pollution and a growing focus on improving health and well-being. However, the high cost of advanced filtration technologies stands as a major restraint for the market. Most of the high-end filters, such as those having HEPA or activated carbon, tend to be priced higher than the standard air filters. This may be a problem for price-sensitive customers and small automotive companies who want to remain competitive in pricing, as this higher cost is likely to hurt their pricing strategies. In a country where pricing plays an instrumental role, especially in the medium- and low-priced car segments, the apprehension of paying for sophisticated filtration systems is likely to limit their extensive use. The periodic replacement of these expensive filters can also be a limitation for some users, particularly in low-income regions. Therefore, even though clean air is observed as a necessity, the cost of high-end automotive cabin air filters is a major consideration for many people in India.

Market Opportunities

Urbanization and Electrification to Offer Lucrative Market Growth Opportunities

The automotive cabin air filter market in India is expected to witness strong growth due to increasing urbanization and growing vehicle electrification. As cities expand and pollution levels rise, so does the demand for personal and shared mobility options with an emphasis on cabin comfort and air quality. This opens up an opportunity for electric and hybrid vehicles to develop dedicated cabin air filters. Moreover, several air filter producers are partnering with car manufacturers to integrate their filtration systems into new vehicles. Moreover, the increasing health concerns among consumers are also pushing the requirement for better filters so that their driving experience is healthier and safer.

Market Challenges

Market Growth Challenges to Arise from Consumer Awareness and Competitive Pricing

Notwithstanding the growth prospects, several factors can hinder the development of the India automotive cabin air filter market, some of them being low awareness among consumers and intense competition. Most automobile owners are not aware of the importance of filter maintenance and replacement on a regular basis. Hence, they do not care about the air quality. Such a lack of information may prove to be a drawback for the market’s growth. Price competition among canister manufacturers can ruin the market’s profit margins, which, in turn, can affect the quality and new product development process. Price volatility of raw materials and interruptions in the supply chain can also affect output, making it challenging to achieve the necessary levels of demand at a profitable margin.

INDIA AUTOMOTIVE CABIN AIR FILTER MARKET TRENDS

Emergence of Novel Technologies and Sustainability to Become Major Market Trends

Several factors are currently affecting the development of the India automotive cabin air filter market, some of which are the emergence of new technologies and the adoption of sustainable practices. The integration of smart technologies into filtration systems allows occupancy sensors to measure air quality levels and filter performance in real-time, enhancing user experience. This is also accompanied by the high demand for less harmful and biodegradable raw materials to make these air filters. In addition, changing consumer behavior due to the availability of various online retail channels is making it easier for customers to buy automotive cabin air filters. Also, government initiatives to promote better air quality and the adoption of clean vehicles are causing a rise in the demand for better air filters, further improving the health and safety aspects of automotive design.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Particulate Filters Dominate Due to Growing Awareness and Improved Filtration

On the basis of type, the market is divided into particulate filter and combination filter.

The particulate filter segment held the largest India automotive cabin air filter market share in 2023. The segment’s dominance is due to a few key factors. Firstly, the air quality in most urban areas, such as Delhi and Mumbai and their surroundings, has relatively improved consumers’ awareness of the effects of air pollution on their health. Particulate filters are made to protect the passengers by filtering out contaminants from the air, such as dust, pollen, and PM2.5. Another factor is the growing prevalence of respiratory and allergic conditions among the Indian population, which has created a market for advanced filtration systems. It is being observed that consumers are willing to buy cars with improved particulate filters.

The combination filter segment is expected to record the highest growth rate over the forecast period. These filters integrate multiple technologies, such as particulate and activated carbon filtration, thereby offering comprehensive protection against a wide range of pollutants, including dust, allergens, and harmful gases. This multi-layered approach can appeal to health-conscious consumers who are becoming aware of the air quality issues in the urban environment. Moreover, the development of regulatory frameworks aimed at reducing vehicle emissions and improving air quality standards will further support the adoption of these advanced filters. As consumers and manufacturers prioritize health and safety, the combination filter segment is well-positioned for rapid growth in the Indian market.

By Vehicle Type

High Vehicle Ownership Helped Passenger Car Segment Dominate Market

Based on vehicle type, the market is segmented into passenger car and commercial vehicle. The passenger car segment is further divided into sedan, hatchback, and SUV, while the commercial vehicle segment is classified into light commercial vehicle and heavy commercial vehicle.

The passenger car segment dominated the market in 2023 due to the growing middle-class population and increasing disposable incomes, which have led to higher vehicle ownership rates, particularly for personal cars. As more consumers opt for personal vehicles, the demand for automotive cabin air filters in this segment is expected to rise significantly. Additionally, the expansion of the automotive market in India, supported by both domestic and foreign manufacturers, has led to a rise in the production of passenger vehicles. As manufacturers integrate advanced filtration systems into their designs to meet consumer expectations and regulatory requirements, the passenger car segment will benefit significantly.

The commercial vehicle segment is experiencing the highest growth rate in the market due to several key factors. The rapid growth of the logistics and transportation industries, driven by rapid e-commerce expansion and increased goods movement, has led to a surge in the demand for commercial vehicles. As these vehicles are integral to supply chains, their operators are increasingly investing in quality cabin air filters to enhance driver and passenger comfort.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Aftermarket Segment Dominates Market Owing to Increasing Vehicle Ownership and Maintenance Awareness

The distribution channel is segmented into OEM and aftermarket.

The aftermarket segment holds the highest market share due to several key factors. Firstly, the growing vehicle ownership rate, particularly in urban areas, has led to a rising demand for replacement parts, including cabin air filters. As more consumers own vehicles, the need for regular maintenance and servicing becomes essential.

The OEM segment is expected to register a significant CAGR in the coming years. The segment is expected to record a tremendous CAGR of 16.3% during the forecast period and will touch USD 58.84 million by 2032. The Indian automotive market encompasses a wide range of vehicles, including passenger cars, commercial vehicles, two-wheelers, and Electric Vehicles (EVs). The growing preference for SUVs and utility vehicles has further fueled the demand for original automotive components.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Develop Advanced Filtration Systems to Gain Major Market Share

The India cabin air filter market is dominated by two leading players - Freudenberg and MANN + HUMMEL. With a strong presence in the automotive sector and a wide range of clients, including major brands such as Maruti Suzuki, Tata, and Mahindra, Freudenberg has solidified its position as a trusted OEM supplier. Its ability to produce filters that enhance passenger comfort and health has made it a preferred choice among automakers. Also, Mann + Hummel has been at the forefront of developing advanced filtration technologies, including multi-stage cabin air filter systems that effectively protect vehicle occupants from ultra-fine particles using HEPA filter elements.

List of Key India Automotive Cabin Air Filter Companies Profiled:

- Mann+Hummel (Germany)

- Freudenberg Filtration Technologies SE & Co. KG (Germany)

- Doowon Climate Control Co. Ltd. (South Korea)

- UFI Filters (Italy)

- Toyota Boshoku Corporation (Japan)

- MAHLE ANAND FILTER SYSTEMS (India)

- Atmus Filtration Technologies (U.S.)

- Robert Bosch LLC (U.S.)

- Zenith Filters (India)

Key Industry Developments

- December 2023: ACDelco expanded its distribution network across India to improve accessibility to its cabin air filters, particularly in tier-2 and tier-3 cities. This initiative aims to enhance market penetration and ensure that vehicle owners can easily access high-quality replacement filters, responding to the growing vehicle ownership in these regions.

- October 2023: K&N introduced a new line of washable cabin air filters designed for high-performance vehicles. This product caters to vehicle enthusiasts looking for sustainable and cost-effective solutions without compromising air quality, appealing to the growing segment of environmentally conscious consumers.

- August 2023: Valeo unveiled a new line of cabin air filters that utilize activated carbon to filter particulates and absorb odors and harmful gases. This product launch targets consumers seeking enhanced comfort and air quality in their vehicles, particularly in polluted urban environments.

- July 2023: Freudenberg expanded its manufacturing facility in India to increase production capacity for cabin air filters. This expansion is aimed at meeting the rising demand from both OEMs and the aftermarket sector, ensuring a timely supply of high-quality filtration solutions to the Indian market.

- June 2023: Denso launched an innovative cabin air filter equipped with IoT sensors capable of monitoring air quality in real-time. This smart technology allows drivers to receive alerts regarding filter replacement and air quality levels, prompting proactive vehicle maintenance and creating healthier driving conditions.

Report Coverage

The report analyzes the market in-depth and highlights crucial aspects, such as prominent companies, market segmentation, competitive landscape, types, vehicle types, and distribution channels. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 16.8% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Vehicle Type

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 53.16 million in 2023 and is anticipated to reach USD 207.99 million by 2032.

The market will exhibit a CAGR of 16.8% over the forecast period of 2024-2032.

By type, the particulate filters segment leads the market due to its advanced filtration system.

Increased health awareness and growing air pollution in India will fuel the market’s growth.

Freudenberg and MANN + HUMMEL are the leading players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us