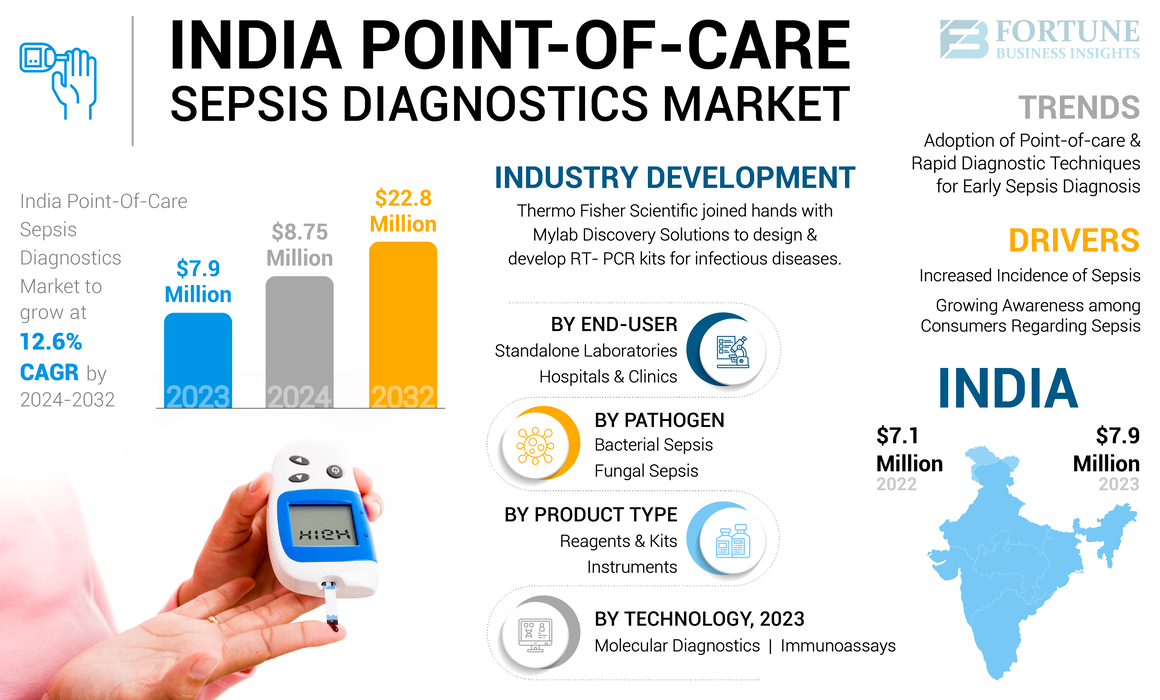

India Point-of-Care Sepsis Diagnostics Market Size, Share & Industry Analysis, By Product Type (Instruments and Reagents & Kits), By Technology (Molecular Diagnostics and Immunoassays), By Pathogen (Bacterial Sepsis and Fungal Sepsis), By End-User (Hospitals & Clinics and Standalone Laboratories), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

India point-of-care sepsis diagnostics market size was valued at USD 7.9 million in 2023. The market is expected to grow from USD 8.8 million in 2024 to USD 22.8 million by 2032, exhibiting a CAGR of 12.6% during the forecast period.

Sepsis is a life-threatening emergency that happens when the body responds to an infection that damages vital organs and often causes death. This medical emergency requires rapid diagnosis and treatment as it can lead to severe sepsis and septic shock. Any infection can lead to sepsis; this includes bacterial, viral, or fungal infections. The growing cases of bacterial and fungal sepsis, increasing hospital-acquired infection incidences, and the usage of point-of-care devices for early diagnosis in India are propelling market growth.

- According to an article published by Pediatric Infectious Disease in 2022, a study was conducted to evaluate the epidemiological trend of neonatal fungal infection, the organisms responsible, and their susceptibility patterns to diverse antifungal agents. It also included analysis of various risk factors, clinical features, and laboratory manifestations of fungal sepsis in neonates. This retrospective observational study was initiated in the Neonatal Intensive Care Unit (NICU) of a pediatric tertiary care hospital in Kolkata (India) from January 2018 to December 2020. The study found that fungal infections in neonates were mostly caused by non-albicans Candida species, accounting for 97.3%, with C. pelliculosa being the common organism, responsible for 43.0% of infection. Such growing cases of fungal sepsis are expected to expand the segmental growth.

Additionally, the growing number of chronic cases that lead to sepsis and the improvement of healthcare infrastructure in India are contributing to market expansion. Furthermore, major players and regional players are putting efforts in order to advance their product portfolios through frequent product launches and strategic initiatives. These efforts to strengthen market presence are further driving market growth.

India's market was positively impacted during the COVID-19 pandemic as COVID-19 patients were prone to developing sepsis, leading to an increased number of sepsis cases. This had positively impacted the sales of point-of-care sepsis diagnostics products in India. The number of patient visits and company revenues returned back to its normal levels in 2021, and the market was normalized completely in 2022 and 2023, after the sudden growth it had experienced in 2020.

India Point-of-Care Sepsis Diagnostics Market Trends

Adoption of Point-of-care and Rapid Diagnostic Techniques for Early Sepsis Diagnosis is a Prominent Trend

The Indian point-of-care sepsis diagnostics market has experienced a significant trend in recent years, driven by the increasing acceptance of rapid diagnostics and point-of-care sepsis diagnostic procedures. These rapid diagnostic or point-of-care techniques have greatly improved the speed, standardization, and efficacy of sepsis diagnostics. Hence, rapid diagnostic POC techniques development for early sepsis diagnosis is gaining traction in the market. The increasing acceptance of point-of-care solutions is driving companies to launch innovative product offerings.

- For instance, in March 2022, SphingoTec GmbH (SphingoTec) and Rivaara Labs Pvt Ltd. (Rivaara) entered into a multi-year distribution agreement to commercialize SphingoTec’s point-of-care diagnostic methods in the Indian subcontinent. The Nexus IB10 analyzer and its portfolio of rapid tests allow convenient assessment of biomarkers relevant to critical care conditions such as sepsis, acute kidney injury, cardiogenic shock, acute heart failure, and myocardial infarction. Such advancement in technologies is expected to propel the growth of the market in the future.

Such rising strategic activities to commercialize new rapid diagnostic or point-of-care techniques is expected to boost the India point-of-care sepsis diagnostics market forecast.

Download Free sample to learn more about this report.

India Point-of-Care Sepsis Diagnostics Market Growth Factors

Increased Incidence of Sepsis to Propel Market Growth

The escalating incidence of sepsis is the primary driver for the India point-of-care sepsis diagnostics market growth. The increase in both the number and frequency of sepsis cases often leads to a significant demand for sepsis diagnostic tests in India. Furthermore, the quicker and more precise diagnoses offered by point-of-care sepsis devices are expected to drive the market's growth.

- For instance, according to an article published by Chest Journal in 2022, the estimated sepsis cases in India were 11.3 million, with 2.9 million deaths (297.7 per 100,000 population) in 2017.

A strong demand for point-of-care sepsis diagnostics due to the incidence of hospital acquired infections has increased the number of sepsis cases. Sepsis is a condition that occurs when a person is hospitalized or recently admitted. A substantial rise in the prevalence of the disease caused increased demand for sepsis diagnostic procedures. Rising concern about early diagnosis coupled with favorable reimbursement policies contribute to India point-of-care sepsis diagnostics market growth during the forecast period (2024-2032).

Growing Sepsis Awareness among Consumers Propel Market Expansion

In India, various public and private governments are actively working to spread knowledge about sepsis among the population. Initiatives include screening for sepsis, educating about sepsis, evaluating the implementation of sepsis care bundles, and enhancing patient results. Such rising awareness initiatives regarding sepsis are propelling market growth.

- For instance, one of the most prominent organizations is the Global Sepsis Alliance, which has partnered with various organizations in regions, including the Indian Society of Critical Care Medicine, to raise awareness regarding sepsis. Furthermore, the World Health Organization (WHO) has partnered with 52 countries and implemented the Global Maternal Sepsis Study and Campaign (GLOSS) in 2018. It aims to assess the burden and management of maternal sepsis and to raise awareness amongst healthcare workers on this issue.

Moreover, information and training regarding sepsis have been provided by various government and non-government bodies to healthcare providers. Therefore, an increase in various government organizations' and foundations' initiatives for awareness and support is expected to augment the overall growth of the market.

RESTRAINING FACTORS

Shortage of Skilled Healthcare Professionals to Deter Market Expansion

The increased need for sepsis diagnostics faces challenges that may hamper the market growth in the upcoming years. Early recognition and prompt treatment are crucial for patient survival in cases of sepsis, but limitations such as the inadequacy of equipment and lack of skilled healthcare professionals may negatively impact market expansion.

Resource-poor settings, especially in emerging nations, exacerbate these challenges, which include limited supply of bedside monitoring equipment, insufficient staffing, poorly equipped laboratory materials and personnel, and no protocol for the management of sepsis. For instance, in September 2020, the Regents of the University of Minnesota published an article stating that approximately 2.9 million deaths occurred in children under five years of age in 2017 due to low-resource settings in Low- and Middle-income Countries (LMIC), including India.

The increased concern for sepsis diagnosis and treatment is expected to increase the demand for diagnostic devices. However, a shortage of skilled healthcare professionals to carry out diagnostic protocols for sepsis limits the market growth.

India Point-of-Care Sepsis Diagnostics Market Segmentation Analysis

By Product Type Analysis

Growing Awareness for Early Sepsis Diagnosis Enabled Reagents & Kits Domination

The market is divided into instruments and reagents & kits on the basis of product type.

The reagents & kits segment held the highest market share due to the increasing volume of sepsis cases and early diagnosis awareness among the Indian population. The segment’s growth is also credited to the large quantities of reagents and consumables used in the various technologies.

- In February 2024, The Indian Society of Critical Care Medicine (ISCCM) undertook the initiative to raise nationwide awareness regarding sepsis and its fatal complications through programs conducted by ISCCM branches. The Critical Care Department of Bhaikaka University, Karamsad, in association with ISCCM, Karamsad organized a sepsis awareness program for the general public and doctors. Such awareness programs are expected to drive enhanced sepsis diagnostics usage of reagents & kits in the country.

The instrument segment held a significant share of the market fueled by the increasing adoption of point-of-care devices. Moreover, key players in the market are collaborating with various organizations to expand their business in India.

By Technology Analysis

Immunoassays Holds Leading Position Backed by Advancements in its R&D

In terms of technology, the market is bifurcated into molecular diagnostics and immunoassays.

In 2023, the immunoassays segment held a dominant India point-of-care sepsis diagnostic market share. Advancements in immunoassay research and development are anticipated to boost sectoral expansion. The segment’s growth is being driven by strategic partnerships between key players in order to launch advanced immunoassay products.

The molecular diagnostic segment is expected to grow during the forecast period. Molecular diagnostics are more sensitive, specific, and less time-consuming. Point-of-care molecular solutions are being developed for a wide variety of bacterial and viral pathogens. Such factors are expected to support the growth of the market during the forecast period.

- For instance, in October 2018, Siemens expanded its Canadian Epoc blood analysis system manufacturing facility. Epoc blood analysis system, a portable, wireless blood gas analyzer, performs 11 critical tests at the patient-side, including sepsis testing with serum lactate results in less than 60 seconds. The 5000 square foot expansion is expected to be completed by June 2021 and will complement the company’s other point-of-care operations in the U.S., U.K, and India.

To know how our report can help streamline your business, Speak to Analyst

By Pathogen Analysis

Bacterial Sepsis is the Leading Pathogen Due to its Significant Cases

Based on pathogen, the market is divided into bacterial sepsis and fungal sepsis. The bacterial sepsis segment held dominant market share in 2023. The segment’s growth is attributed to the growing occurrence of bacterial sepsis and increasing awareness initiatives for the detection of bacteria causing sepsis.

- For instance, according to an article published by Chest Journal in 2022, a study enrolled 680 patients in a study from 35 ICUs (85.7% private, 14.3% public) that spanned several Indian states. It was found that bacterial infections were most common (77.9%), with the majority being gram-negative bacteria, followed by fungal infections (9.6%).

The fungal sepsis segment held a notable share of the India point-of-care sepsis diagnostic market and is expected to expand during the forecast period. Many patients suffer from sepsis due to fungal infections. The rising incidence of sepsis caused by fungal infections is propelling this segment's expansion.

By End-User Analysis

Hospitals & Clinics are Leading End-Users Fueled by Robust Number of Patient Visits

The market segmentation by end-user is divided into hospitals & clinics and standalone laboratories.

The hospitals & clinics segment held a lion’s share of the market in 2023. The segment’s dominance is attributed to significant sepsis prevalence in hospitalized patients. The growing hospital infrastructure and strong adoption of point-of-care devices are propelling the development of the segment.

- According to an article published by the National Institutes of Health (NIH) in 2022, a study was conducted to analyze community-acquired sepsis patients admitted to a 1,300-bedded tertiary care hospital in South India. The study, which used data from the Surviving Sepsis Campaign (SSC) guideline-compliant e-sepsis registry, found that a total of 13.5% (136) were under septic shock, with an in-hospital mortality rate of 25.0%. Such a substantial number of hospital-acquired sepsis is contributing to the segmental growth.

Standalone laboratories hold the second largest India point-of-care sepsis diagnostics market share on the basis of end-user. The augmenting number of laboratories and rising demand for cost-effective sepsis care are anticipated to contribute to the expansion of the segment.

KEY INDUSTRY PLAYERS

Strategic Partnerships and Strong Brand Presence to Foster Company’s Market Growth

The competitive landscape of the market is semi-consolidated. bioMérieux, Inc. accounts for a majority of the market share. The established distribution network and robust product offerings such as VIDAS B·R·A·H·M·S PCT are contributing to the company’s dominance in the Indian market.

Abbott, Boditech Med Inc., Radiometer Medical ApS (Danaher Corporation), and Wondfu are also some of the other prominent players in the Indian market. Additionally, growing partnerships among the industry players are likely to aid the penetration of companies in developing countries, thereby fostering the growth of the key market players.

- In May 2021, Abbott and Generic Pharmasec entered into an agreement to distribute, market, and promote the entire range of products by Abbott Point of Care (APOC) in India. Such initiatives are expected to propel their market share in the forecast period.

LIST OF TOP INDIA POINT-OF-CARE SEPSIS DIAGNOSTICS COMPANIES:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Radiometer Medical ApS (Danaher) (U.S.)

- bioMérieux, Inc. (France)

- DiaSorin S.p.A. (Italy)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthineers AG (Germany)

- Wondfu (China)

- Boditech Med Inc. (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: bioMérieux, Inc., and The French Embassy in India co-organized the one-day symposium titled “Antimicrobial Stewardship: Improved Diagnosis for Better Management’’ in New Delhi, India.

- February 2023: Thermo Fisher Scientific partnered with Mylab Discovery Solutions to design and develop RT- PCR kits for infectious diseases and other diseases of public health importance in India.

- May 2018: Lepu Medical Technology (Beijing) Co. Ltd announced that it will enter into the Indian medical devices and equipment market through its subsidiary, Lepucare (India) Vascular Solutions Pvt. Ltd.

- June 2015: Radiometer Medical ApS (Danaher) launched a new point of care test for Procalcitonin for the diagnosis of sepsis. The company’s AQT90 FLEX PCT assay provides results in less than 21 minutes.

REPORT COVERAGE

The India point-of-care sepsis diagnostics market research report emphasizes analysis and forecasting of the market. It focuses on key aspects, such as leading companies, product types, technology, pathogen, and end-users. Besides, it offers insights into the market dynamics, sepsis prevalence, regulatory scenarios, product launches, industry developments, and technological advancements in India. Moreover, the impact of COVID-19 pandemic has also been highlighted in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 12.6% from 2024-2032 |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Pathogen

|

|

|

By End-User

|

Frequently Asked Questions

Fortune Business Insights says that the Indian market stood at USD 7.9 million in 2023 and is projected to reach USD 22.8 million by 2032.

The market is expected to exhibit a CAGR of 12.6% during the forecast period (2024-2032).

By technology, the immunoassays segment led the market in 2023.

The key driving factors include growing sepsis prevalence, rising awareness, and adoption of point-of-care sepsis diagnostic products in the market.

Increasing adoption of point-of-care sepsis diagnostics products is the key trend in the market.

bioMérieux, Inc. and Abbott are the prominent players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us