Small Cell 5G Network Market Size, Share, Trends & Industry Analysis, By Operating Environment (Indoor and Outdoor), By Application (Residential, Commercial, and Industrial), By Small Cell Type (Femtocell, Metrocell, Picocell, and Microcell), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

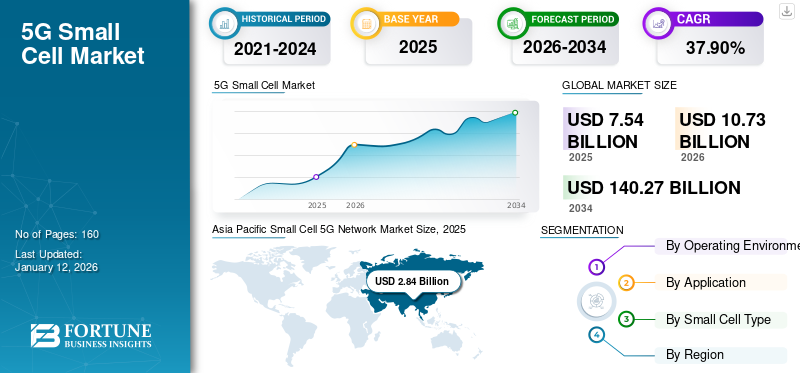

The global small cell 5G network market size was valued at USD 7.54 billion in 2025. The market is projected to grow from USD 10.73 billion in 2026 to USD 140.27 billion by 2034, exhibiting a CAGR of 37.90% during the forecast period. Asia Pacific dominated the global market with a share of 37.70%% in 2025.

Small cell 5G networks are low-powered cellular radio access modules that function in a spectrum with a range of 10 meters to around a few kilometers. Rising investment by governments and key players in various IT projects, such as 5G infrastructure and others, will aid market growth. For instance, in October 2022, HFCL, an Indian-based telecom operator, partnered with Qualcomm to enhance their all-in-one small cell 5G modules. The module supports standalone and non-standalone modes while offering flexibility in terms of deployment in buildings, rooftops, traffic hotspots, and street poles. Through this partnership, HFCL aims to increase rollouts and enhance their 5G user experience for improved efficiency.

The increasing data traffic and surge in the number of internet users around the globe have propelled the demand for small-cell 5G networks and aided in market growth. According to Ericsson’s Mobile Data Traffic Outlook, the proportion of mobile data traffic attributed to 5G was projected to reach 17% by the conclusion of 2022, rising from 10% at the end of 2021. Additionally, it is anticipated that this proportion should further increase to 68% by 2028. Several leading players in the market are launching a small cell 5G network based on advanced technology with higher bandwidth for small cell 5G deployments within urban and rural areas. For instance,

- In October 2022, Mavenir, a cloud-native network software provider, launched its 5G small cell coined ‘E511’. The cell leveraged the company’s end-to-end RAN software solution, including a control unit (CU) and common management system, resulting in enhanced deployment flexibility.

COVID-19 IMPACT

Suspension of Numerous 5G Deployment Activities during the Pandemic to Decline Market Growth

Globally, the COVID-19 pandemic has disrupted IT and networking activities owing to government restrictions on production, deployment, innovation centers, and ongoing developments. The global impact of COVID-19 has shown a slight decline in the market, and it witnessed slow growth across all regions amid the pandemic. The overall demand in the market has declined due to a delay in the deployment of the 5G infrastructure and the closure of deployment sites. According to Kagan's 2020 global survey on 5G infrastructure, around 63% of mobile network operators had reduced their 5G deployment activities during the pandemic. Additionally, according to a Gartner report, wireless infrastructures such as 5G deployments and broadband connections, among others, declined by 4.4%, reaching around USD 38.1 billion in 2020.

Furthermore, several leading companies in the market have also innovated and launched small-cell 5G network solutions after the post-pandemic period. They are also investing vast amounts in 5G network deployments to extend their high-speed internet connectivity services in compliance with government regulations. For instance,

- In April 2023, T-Mobile requested the U.S. Federal Communications Commission (FCC) to grant it Special Temporary Authority (STA) to access USD 300 million worth of spectrum licenses, which the company received in an action in 2022. The temporary access allows T-Mobile to enhance its 5G network. Expand coverage and potentially offer home internet services to households.

LATEST TRENDS

Download Free sample to learn more about this report.

Surging Developments in Advanced Indoor and Outdoor Small Cell Offerings to Aid Market Growth

Several leading players in the market are launching advanced indoor and outdoor 5G networking technologies for enhancing internet connectivity. In February 2023, Ericsson developed a small cell 5G Radio access network to meet the growing demand for advanced indoor 5G mobile broadband performance. Additionally, Samsung Electronics deployed small cell 5G network infrastructure to Reliance Company in large volumes for indoor coverage for the Indian population. Several leading players in the market have also developed and launched indoor and outdoor small cell 5G networks. For instance,

- In February 2023, Arctic Semiconductors, formerly known as SiTune, partnered with Compal Electronics and NXP to launch a 5G small cell platform. The small cell operated across multiple 5G frequency bands and offered gigabit data speeds using a 4x4 MIMO antenna. The platform combined Arctic IceWings’ design with NXP’s Layerscape Access LA1200x processor, providing power efficient and cost efficient solutions for 5G small cells.

- In February 2023, Astella Technologies launched commercial-grade 5G infrastructure solutions, including a 5G core network and integrated small cells in Barcelona. The demonstration featured the company’s 5G end-to-end network connected to a commercial phone, achieving high system throughput and showing the capabilities of their sub-6 and mmWave frequency.

SMALL CELL 5G NETWORK MARKET GROWTH FACTORS

Surging Adoption of 5G Network Technologies by Governments and Implementation of Internet of Thing (IoT) Devices to Aid Market Growth

Globally, the deployment of 5G infrastructure is rapidly growing in developed countries such as the U.S., Germany, France, the U.K., and others. According to Small Cell Forum (SCF) report, there should be 5.3 million small cells deployed in the enterprises' sector by 2027, which consists of 57% of the total deployments in the forecast. Also, according to the Cellular Telecommunications Industry Association (CTIA), in 2021, an estimated more than 1,26,000 small cell sites (excluding microcell) have been installed in the U.S., and have been estimated to rise up to 1,50,399 units in 2022. The rising deployments of small cell 5G networks across the globe have strengthened the global market growth.

According to the Global System for Mobile Communications (GSMA), there were 252 industrial 5G network providers operating in 86 countries serving more than 1 billion users. The 5G connection is expected to grow to 5 billion users by 2030.

Furthermore, the increasing implementation of Internet of Things (IoT) devices into smartphones, wireless devices, and others has strengthened the demand for robust internet connections. In addition, the rising adoption of Open RAN small cell networks by the enterprises and telecommunication industry is expected to strengthen the small cell 5G network market growth.

RESTRAINING FACTORS

Higher Deployment Costs of Small Cell Networks Infrastructure to Hamper Market Growth

Deployment of 5G infrastructure in the initial stage is a costly affair for the network operators. Key players are investing a significant amount of resources in the setup of small cell 5G network infrastructure. The cost of resilient strength fiber and power distribution in these networks is a major financial restraint. According to AT&T Inc., the average costs of a small cell network setup ranges from USD 6.8 Million to USD 60.0 Million, depending upon the rural and urban areas. The cost of installing the 5G network infrastructure in rural areas is high compared to urban areas due to the lack of availability of resources.

SEGMENTATION

By Operating Environment

Surging Practice of Back-to-Work and Work-from-Office to Boost Indoor Deployments

The operating environment segment is expected to dominate the market share 58.71% in 2026. The market is bifurcated into indoor and outdoor on the basis of operating environment. Indoor deployment of a small cell 5G network entails the installation of networking electronics within buildings such as commercial establishments, shopping arenas, and shopping centers, with the aim of enhancing indoor coverage and connectivity. This facilitates improved connectivity and higher data speeds for users within those indoor environments. Rising adoption of work-from-office practices and the increasing demand for high-speed network infrastructure are fueling the demand for small cell 5G networks.

Additionally, outdoor deployment of 5G small cells involves installation in outdoor environments, which include utility poles, street lights, and rooftops to enhance outdoor coverage and capacity, particularly in densely populated areas.

By Application Analysis

Increasing Demand for Small Cell 5G Networks across Industries to Drive Market Growth

The market is distributed into residential, commercial, and industrial based on application. Industrial segment is estimated to hold the largest share of 51.25% in the market at 2026, owing to rising investment and surging adoption of 5G devices around the globe. For instance,

- In March 2023, HFCL collaborated with Microsoft Corporation to launch the latest 5G solutions for intuitions and enterprises, encouraging digital transformation. The partnership resulted in the integration of IoT, edge computing, and AI analytics, among others into its pilot program and indoor small cell 5G network, resulting in enhanced deployments.

By Small Cell Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Latest Launches of Integrated Communication Platforms by Prominent Players to Fuel the Market Growth

Based on small cell type, the market is segmented into femtocell, metrocell, picocell, and microcell. Femtocell segment is projected to dominate the market with the largest share of 37.28% in 2026, owing to increasing innovations and deployments of 5G small cells. For instance,

- In February 2023, LITEON Technology launched several 5G small cell solutions, including split7.2 O-RU, split2 O-RDU, RIC platform, and all-in-one small cell. The company showcased its networking products in MWC, which included mmWave O-RU and residential femtocell solutions, among others to demonstrate 5G capabilities.

Additionally, the market size of metrocell, picocell, and microcell is significantly increasing, owing to the rising implementation of IoT devices and internet penetration. According to IoT Analytics, there were approximately 14.3 billion connected active endpoints in 2022 and is projected to increase up to 16% into 16 billion in 2023.

REGIONAL INSIGHTS

Asia Pacific Small Cell 5G Network Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is distributed into five major regions, North America, South America, Europe, Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 2.84 billion in 2025 and USD 4.15 billion in 2026. Asia Pacific dominated the small cell 5G network market share in 2026, Owing to the rising adoption of advanced technology and investment in 5G technology by the leading players for high-speed internet. Rapid technological advancements in China, Japan, and South Korea are boosting the networking and 5G infrastructure market in the region. Additionally, IDC forecasts the IoT spending of the region to reach USD 437 billion in 2025. The Japan market is projected to reach USD 0.74 billion by 2026, the China market is projected to reach USD 1.47 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026. For instance,

- In April 2023, Advanced Info Services (AIS) partnered with Qualcomm to achieve a significant milestone in Thailand’s telecommunication landscape. The collaboration resulted in the attainment of 5G speeds of 3 Gbps on AIS’s operational mmWave network in 26 GHz frequency. This resulted in enhanced consumer experience and enabled a range of applications such as self-driving cars, online gaming, and robot control, among others.

- In November 2022, NTT DoCoMo partnered with SK Telecom to develop new cellular technologies for 5G and 6G networks, with a focus on open and virtualized radio access network (RAN) technology. The collaborations aimed to enhance existing networks, including standalone mmWave spectrum and open RAN, and support revenue-generating edge use cases.

North America

North America is projected to demonstrate healthy market growth during the forecast period. The growth is due to the increasing investment and growth strategies adopted by the leading players and governments in the IT & telecommunication sector. According to the Small Cell Forum Organization, North America played a crucial role in driving the implementation of small cells during the 2010s and is expected to reach its highest annual deployment rate in 2023. It is also expected to contribute to 13% of the global deployment in 2027. The U.S. market is projected to reach USD 2.39 billion by 2026.

Europe

In Europe, government authorities have invested significant resources in deploying 5G networks to meet the growing demand for the latest and high-speed internet. The European Commission, in coordination with regional IT players, has dedicated 20% of its resilience and recovery facility from each country toward digital transition. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 0.2 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America and Middle East & Africa

In South America, governments and enterprises across countries such as Brazil and Argentina have shown a significant adoption of IoT devices. Furthermore, the Middle East & Africa is estimated to showcase the highest growth rate during the forecast period, owing to innovative city initiatives and rising investment by the governments in transformation projects and the 5G industry. According to the GSMA Intelligence Report, 5G mobile connections in the MENA region are expected to reach 50 million by 2025, with over 20 million in the GCC countries.

COMPETITIVE LANDSCAPE:

Players are Offering Diverse 5G Small Cells Portfolio to Expand Market Opportunity

Governments in developed countries are focusing on deploying the 5G network solutions and services such as the 5G RAN network architecture in urban and rural areas. Major players are expanding their 5G offerings by launching customized advanced 5G networks to cater to the requirements. The leading players in the market are adopting several business strategies, such as product launches, mergers, partnerships, collaborations, and acquisitions, to remain competitive. For instance,

- In February 2023: AWS launched Integrated Private Wireless, a portal that simplified the deployment and management of private wireless networks for enterprises in collaboration with telcos and included small cell RAN deployments. It also offered its own private 5G service, AWS Private 5G, which included small cell RAN units, core and RAN software, edge servers, and SIM cards.

List of Key Companies Profiled in Small Cell 5G Network Market:

- Nokia Corporation (Finland)

- Sterlite Technologies Limited (India)

- Samsung Group (South Korea)

- Cisco Systems, Inc. (U.S.)

- NEC Corporation (Japan)

- Huawei Technologies Co., Ltd. (China)

- ZTE Corporation (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Fujitsu Limited (Japan)

- Radisys Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – Nokia Corporation announced a trial with Chunghwa Telecom Laboratories (CHT-TL) that verified the capability of 25G PON technology for small cell fronthaul in 5G. The trial declared that this technology could meet stringent capacity and low latency demands of fronthaul, providing operators with the opportunity for significant cost savings and network convergence.

- September 2022 – Samsung partnered with Comcast to enhance 5G connectivity for Xfinity Mobile and Comcast Business Mobile customers in Comcast’s service areas. It supplied 50 RAN solutions, including baseband units, CBRS, 600 MHz radios, and compact CBRS Strand small cells. This partnership enabled Comcast to deliver seamless cellular connectivity.

- June 2022 – MosoLabs launched several networking solutions, such as small cells, cameras, and witness devices, which are designed to support and empower users to build and grow through the utilization of the Helium 5G network. Through the partnership with Sercomm, the company provided innovative software and hardware solutions, including plug-and-play products such as small cells, witness devices, and cameras, enhancing participation in the Helium 5G network.

- March 2022 – Movandi, a provider of 5G mmWave RF silicon technologies and solutions, partnered with Wistron NeWeb Corp. (WNC) to deliver dual-band smart repeaters optimized for indoor networks. The repeaters featured 39 GHz and 28 GHZ BeamXR chipsets and offered cost-effective solutions for 5G enterprise private networks and enhanced coverage for indoor applications.

- October 2022 – Sterlite Technologies Ltd launched 5G Cosmos, an optical solution for speedy deployment of small cells and towers for 5G networks. The solutions address the need for increased tower fiberization and aims to connect every tower, small cell, and node.

REPORT COVERAGE

The small cell 5G network market report highlights leading regions worldwide to understand the user better. Furthermore, the report provides insights into industry and market trends and analyses technologies deployed rapidly globally. It further highlights some growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 37.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Operating Environment, Application, Small Cell Type, and Region |

|

By Operating Environment |

|

|

By Applications |

|

|

By Small Cell Type |

|

|

By Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the global market was valued at USD 10.73 billion in 2026.

The market is likely to grow at a CAGR of 37.90% over the forecast period (2026-2034).

Femtocell is expected to lead the small cell type segment due to cost-effectiveness and diverse deployability.

The market size in Asia Pacific stood at USD 4.15 billion in 2026.

Surging adoption of 5G network technologies by governments and implementation of Internet of Things (IoT) devices to aid market growth.

Some prominent players in the market are Nokia, Ericsson, Sterlite, and Huawei.

The U.S. dominated the market in terms of market size in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us