Active Wound Care Market Size, Share and Industry Analysis by Product Type (Biological Skin Equivalents, Growth Factors, Biological Dressings, Others), By Indication (Diabetic Foot Ulcers, Pressure Ulcers, Lower Limb Ulcers), By End User (Hospitals, Clinics, Home Care Settings), and Regional Forecast 2026-2034

KEY MARKET INSIGHTS

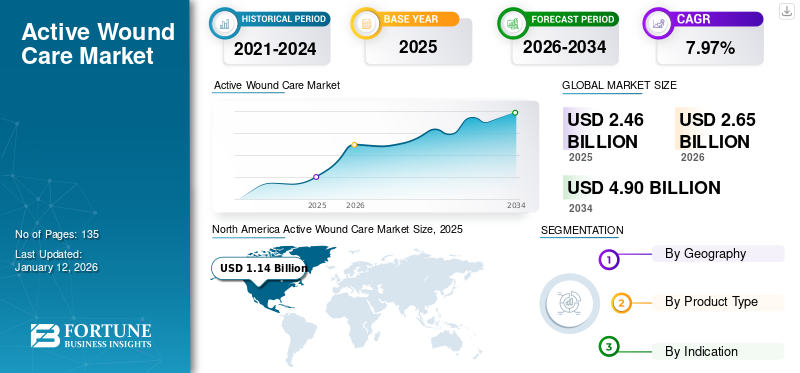

The active wound care market size was valued at USD 2.46 billion in 2025 and is projected to grow from USD 2.65 billion in 2026 to USD 4.9 billion by 2034, exhibiting a CAGR of 7.97% during 2026-2034. North America dominated the global market with a share of 46.26% in 2025.

A significantly rising aging population and prevalence of chronic and lifestyle diseases including diabetes and obesity are some of the factors boosting active wound care market share. A large patient pool suffering from chronic wounds such as surgical wounds, diabetic foot ulcers, pressure ulcers, and others is also promoting growth in the market.

Tissue Regenix, a U.S. based regenerative medicine company, introduced its dermal substitute product - DermaPure HD in 2014. This product is based on dCELL technology, a patented regenerative medicine technology by Tissue Regenix. Various new entrants are entering the market, introducing products in the allograft, xenograft, dermal substitutes, and cell-based therapies segment, with an aim to cater to the unmet needs and growing demands of the patient population in the global market.

Download Free sample to learn more about this report.

- North America witnessed a growth from USD 1.14 billion in 2025 to USD 1.23 billion in 2026.

Global Active Wound Care Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 2.46 billion

- 2026 Market Size: USD 2.65 billion

- 2034 Forecast Market Size: USD 4.9 billion

- CAGR: 7.97% from 2026–2034

Market Share:

- North America dominated the active wound care market with a 46.26% share in 2025, driven by a high prevalence of chronic wounds, a growing elderly population, strong reimbursement frameworks, and recent regulatory approvals for advanced wound care products.

- By product type, biological dressings accounted for 8.1% of the global market share in 2024. However, biological skin equivalents (including allografts, xenografts, and cell-based therapies) and growth factors are expected to witness faster growth due to their regenerative capabilities and expanding clinical applications for complex chronic wounds.

Key Country Highlights:

- Japan: Increasing incidence of diabetic foot ulcers and pressure ulcers among the aging population is spurring demand for advanced biological dressings and growth factor therapies. Strong government focus on elderly care is enhancing adoption of innovative wound care solutions.

- United States: The Infrastructure Investment and Jobs Act is indirectly supporting healthcare infrastructure expansion, including wound care centers. Combined with favorable reimbursement policies, recent FDA approvals, and rising economic burden of chronic wounds, the U.S. remains the largest national market.

- China: A large diabetic population and increasing awareness about chronic wound treatment are pushing demand for biological and cell-based therapies. Government initiatives to modernize healthcare facilities are contributing to greater access to active wound care.

- Europe: The region’s market is driven by high prevalence of pressure ulcers and diabetic wounds, coupled with strong regulatory support for biological wound care products. Countries like Germany and the U.K. are promoting R&D and fast-tracking approvals of advanced wound healing technologies.

"Unmet Needs in the Treatment of Chronic Wounds Globally is Driving the Demand for Innovative Treatment Options in the Market."

The growing economic cost burden of chronic wounds including direct and indirect costs of treatment, along with prolonged treatment duration and lack of efficiency of wound dressings and devices in treating chronic wounds, has presented significant unmet needs in the global market. This is presenting a huge opportunity for market players to enter the active wound care market by introducing new products based on regenerative technologies, with an aim to reduce overall treatment duration and cost.

This, coupled with efficient treatment outcomes to patients suffering from chronic wounds, will fuel demand for innovative active wound care treatment options. In April 2024, MTF Biologics (previously known as Musculoskeletal Transplant Foundation) announced the launch of AminoBand Viable Membrane at the Wound Healing Society (WHS) meeting in the U.S.

Market Segmentation

To know how our report can help streamline your business, Speak to Analyst

- The biological skin equivalents segment is expected to hold a 80.66% share in 2026.

On the basis of product type, the global active wound care segments include biological skin equivalents (allografts, xenografts, cell-based therapies), growth factors (platelet-derived growth factors, epidermal growth factors, others), biological dressings (collagen dressings, active dressings), and others. The biological dressings segment accounted for 8.1% global active wound care market share in 2024. On the basis of indication, the global active wound care market segments include diabetes foot ulcers, pressure ulcers, lower limb ulcers, and others. On the basis of end-user, the global market is segmented into hospitals, specialty clinics, home care settings, and others. The diabetes foot ulcers segment led the market accounting for 36.27% market share in 2026. The hospitals segment will account for 52.35% market share in 2026.

Regional Analysis

North America Active Wound Care Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

"Recent Regulatory Approvals in the U.S., Combined with Adequate Reimbursement Policies, are Driving the Adoption of Active Wound Care Products in North America"

North American

There is an increasing demand for innovative treatment options for chronic wounds in North America, owing to rising prevalence of wounds, increasing economic cost burden, and increasing efforts by regional and national governments to reduce the overall treatment duration. All above factors indicate that the North American active wound care market growth in on the dominating side. The U.S. market is projected to reach USD 1.34 billion by 2026.

These factors have led to increasing number of regulatory approvals for active wound care products including skin substitutes and growth factors in the U.S. This, along with adequate reimbursement policies in the region, are factors responsible for dominant share in North American market in 2024.

The increasing prevalence of diabetes in Asia Pacific, Europe, and Middle East & Africa regions, is poised to propel the active wound care products demand for treatment of diabetic foot ulcers. Latin America is anticipated to register moderate CAGR during 2026-2034.

Europe

The UK market is projected to reach USD 0.12 billion by 2026, while the Germany market is projected to reach USD 0.22 billion by 2026.

Asia Pacific

The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.06 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Key Market Drivers

"Presence of a Strong and Innovative Portfolio for Dermal Substitutes and Biological Skin Equivalent Products, has Propelled Organogenesis, MiMedex, and Integra LifeSciences to Lead the Global Market."

The current active wound care market is consolidated owing to the strong portfolio and diverse product offerings by major players in the active wound care products space. Organogenesis, Inc., MiMedex, and Integra Life Sciences are among the leading players in the active wound care industry. A well-established brand presence and a strong distribution channel have been instrumental in the success of these players in the market. Other market players operating in the market include MTF Biologics, Osiris Therapeutics, Inc., Tissue Regenix, Smith & Nephew, Acell Inc., and Solsys Medical.

List of Companies Profiled

- MiMedx

- Tissue Regenix

- Smith & Nephew

- Organogenesis Inc.

- Acell Inc.

- Integra Life Sciences

- Solsys Medical

- Osiris Therapeutics, Inc.

- Other Prominent Players

Report Coverage

An increasing number of new approvals for products such as growth factors, biological skin equivalents, and biological dressings are factors leading to increasing demand for new active wound care products in the global market. Players functioning in active wound care market are focusing on R&D to innovate their product offerings with improved clinical efficiency.

This is projected to lead to an increasing number of new products entering the global market during the forecast period. However, comparatively higher costs of active wound therapies are one major factor projected to restrain the adoption of active wound care products in emerging countries.

The report on the active wound care market provides qualitative and quantitative insights on active wound care industry trends and detailed analysis of market size & growth rate for all possible segments in the market. The market is segmented as per product type, indication, and end-user.

On the basis of product type, the global market is further segmented into biological skin equivalents (allografts, Xenografts, and Cell-based Therapies), growth factors (Platelet-derived Growth Factors, Epidermal Growth Factors, and Others), biological dressings (Collagen Dressings and Biological Dressings), and others. On the basis of indication, the global active wound care devices market is segmented into diabetic foot ulcers, pressure ulcers, lower limb ulcers, and others.

On the basis of end-user, the global market is segmented into hospitals, clinics, home care settings, and others. Geographically, the market is segmented into five major regions, which are North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regions are further categorized into countries.

Along with this, the report on active wound care market analysis includes market dynamics and competitive landscape. Additionally, the report offers insights on the prevalence of key disease indications (diabetic foot ulcers, pressure ulcers, lower limb ulcers etc.) for key countries/region, recent industry developments such as partnerships, mergers & acquisitions, new product launch, regulatory framework by key countries, global reimbursement scenario, and economic cost burden for the treatment of chronic wounds by key countries/ region.

Key Industry Developments

- In April 2023, Kerecis introduced MariGenShield, featuring a composite of fish-skin graft and a silicone contact layer, specifically designed for addressing complex and chronic wounds.

- In July 2022, Tides Medical released ArtacentAC, a robust tri-layer skin substitute suitable for treating conditions such as diabetic foot ulcers, chronic wounds, burns, Mohs surgery, and various surgical applications. It distinguishes itself by being three times more durable and twice as thick as conventional dual-layer wound care products, facilitating its application to wound sites.

Report Scope & Segmentation

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.97% from 2026-2034 |

|

Segmentation |

By Product

|

|

By Indication

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Based on the detailed study conducted by Fortune Business Insights, the active wound care market was valued at USD 2.46 Billion in 2025.

Fortune Business Insights has estimated the active wound care market to reach USD 4.9 Billion in 2034.

The active wound care market is projected to grow at a CAGR of 7.97% during the forecast period (2026-2034).

Active wound care market in North America generated a revenue of USD 1.14 Billion in 2025.

Unmet needs in treatment of chronic wounds coupled with the high efficiency of active wound care products is driving the growth of global active wound care market.

MiMedx, Smith & Nephew, Integra Life Sciences and Tissue Regenix are the companies that dominated the market in 2025.

Based on the analysis by Fortune Business Insights, the active wound care market is expected to see a diverse opportunities owing to the increasing patient pool suffering from chronic wounds, creating a huge demand for new products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us