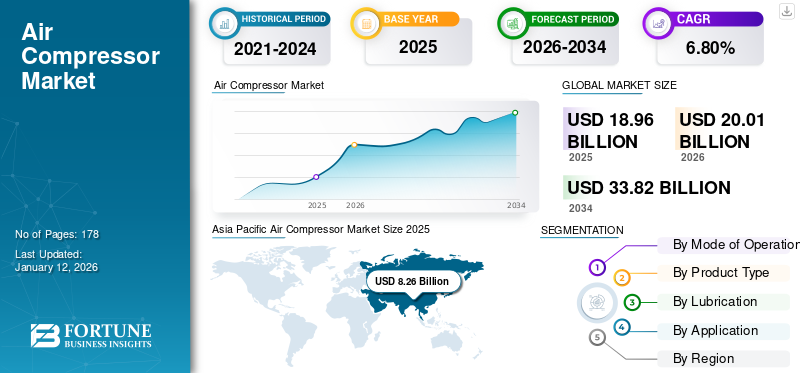

Air Compressor Market Size, Share & Industry Analysis, By Mode of Operation (Rotary, Centrifugal, and Reciprocating), By Product Type (Stationary and Portable), By Lubrication (Oil Filled and Oil Free), By Application (Manufacturing, Oil & Gas, Energy & Power, Electronics and Semiconductor, Healthcare, Food and Beverages, and Others (Aerospace)), Regional Forecast, 2026-2034

Air Compressor Market Size

The global air compressor market size was valued at USD 18.96 billion in 2025 and is projected to grow from USD 20.01 billion in 2026 to USD 33.82 billion by 2034, exhibiting a CAGR of 6.80% during the forecast period. Asia Pacific dominated the global market with a share of 43.60% in 2025. The air compressors market in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.36 billion by 2032, driven by the growing adoption of Industry 4.0 for rising operational efficiency.

There are three basic modes in which air compressors operate: rotary, centrifugal, and reciprocating. Rotary compressors, which use a screw-type mechanism to compress air and vary by design, are dominant in the industry due to their ease of maintenance and higher efficiency. Centrifugal and reciprocating compressors find widespread use in various operations, including air and gas filling. The market is led by stationary compressors, which are predominantly preferred by commercial manufacturing and industrial sectors.

A slight decrease in demand has been experienced by the global compressor industry in recent years due to stringent regulations and limited infrastructure development and investments. Nevertheless, the market is forecasted to steadily expand in the coming years. In addition, oil-filled compressors are extensively utilized for a variety of tasks such as cleaning, blowing, sandblasting, and others. This increased usage of compressors has driven their applications in diverse industrial sectors, including manufacturing, oil & gas, energy and power, electronics, and semiconductor industries. Importantly, the demand for compressors in key regions around the world is projected to stimulate market growth throughout the forecast period.

The COVID-19 pandemic led to a slight decrease in global market growth, but it bounced back in 2021 due to increased demand from the medical sector. The initial decline was caused by disruptions in supply chains and reduced industrial activities. However, the need for medical equipment, such as ventilators, which rely on air compressors, spurred a recovery. Additionally, the pandemic accelerated the adoption of automation and remote monitoring technologies in the compressor industry to maintain operational efficiency despite workforce limitation. These compressors play a crucial role in production lines across various industries, including manufacturing, automotive, and electronics & semiconductors. Industrial products are also utilized in sectors such as petrochemicals & gas, manufacturing, and others. These compressors are designed to efficiently clean the air, even in challenging conditions and environments.

Air Compressor Market Trends

Integration of Smart and Connected Compressors to Escalate the Market Growth

The integration of IoT (Internet of Things) technology is transforming air compressors into smart devices. These connected compressors enable real-time monitoring, predictive maintenance, remote diagnostics, and performance optimization, leading to reduced downtime and improved efficiency. Smart air compressors enable real-time monitoring of key operational parameters such as pressure, temperature, and energy consumption. This capability allows for proactive maintenance scheduling and troubleshooting, reducing downtime and optimizing efficiency.

Moreover, by leveraging data analytics and machine learning algorithms, connected compressors can predict potential failures or maintenance needs based on operational data trends. This predictive maintenance approach minimizes unexpected breakdowns, extends equipment lifespan, and improves overall reliability. Smart compressors with advanced control systems, such as variable frequency drives (VFDs), can adjust compressor speed and output based on real-time demand. This optimization reduces energy consumption during periods of low demand, leading to significant cost savings and lower carbon emissions.

Download Free sample to learn more about this report.

Air Compressor Market Growth Factors

Technological Upgradation for Air System Control and Management to Drive the Market Growth

The air compressor industry is expanding, and it is crucial to effectively regulate airflow. Many companies in this sector offer solutions to help end users tackle complex industrial challenges and improve operations. Energy is harnessed within the air compressor industry, with piping playing a key role in transporting air from one point to another, although significant losses occur in this area. As a result, companies are working on and offering centralized system solutions that enable comprehensive control of airflow and the monitoring of nearly every aspect or point within compressor systems.

- For example, Kaeser, an air compressor manufacturer, has a loaded compressor system with a PC and SAM (Sigma Air Manager) that provides basic analog and digital signals input and output, with additional connectivity and some memory. Furthermore, it also helps the individual evaluate the compressor based on historical and current data. The latest SAM2 offers more reliability and is more efficient with predictive maintenance capabilities.

Technological advancements in compressors are thriving, enabling users to achieve more effective air management in industrial facilities through a central master control system.

RESTRAINING FACTORS

Economic Losses Owing to Air Leaks and Rising Part Costs are hindering the Market Growth

These compressors ingest air from the atmosphere, mainly nitrogen, oxygen, and hydrogen, along with contaminants and water vapor. Still, they cannot hold it in the same state because of inefficiencies. Hence, the water to be ejected is in the form of water, and the temperature at the exit is higher and needs to be removed to minimize the discharge with lower air leaks. The drain valve is a less expensive component in the entire air compressor system. Air leaks can be highly costly, especially when the manufacturing facility loses air through a partially opened valve, which entails large amounts of money.

Air Compressor Market Segmentation Analysis

By Mode of Operation Analysis

Rotary Segment to Lead the Market Driven by Reliability

By mode of operation, the market is classified into rotary, centrifugal, and reciprocating.

The rotary segment is anticipated to dominate the market with a share of 62.07% in 2026 and CAGR during the forecast period. The basic mechanism they use is two rotating screws to produce compressed air, but their advanced operational capabilities and reliability make the compressors a preferred solution for professional and industrial applications across the globe. These compressors stand out due to their efficiency, lower maintenance needs, and suitability for continuous operation, making them ideal for ideal diverse industries ranging from manufacturing to construction.

In addition, centrifugal compressors are becoming more prevalent machinery that converts kinetic energy into potential energy through the generation of air pressure. These compressors are predominantly utilized in manufacturing sectors for air-based process activities.

On the other hand, reciprocating compressors operate based on the concept of reciprocating motion, where the positive displacement created by the piston in reciprocating devices raises and compresses air pressure.

To know how our report can help streamline your business, Speak to Analyst

By Product Type Analysis

Suitability for Heavy-Duty Applications to Boost Stationary Segment Growth

Based on product type, the market is bifurcated into stationary and portable.

The stationary segment is leading the market with a share of 87.31% in 2026 and is poised to register the highest CAGR over the forecast period. These products are typically larger and more powerful than portable compressors, which makes them suitable for heavy-duty applications. In addition, they are designed to be installed in a specific location, such as workshops or industrial settings.

On the other hand, the portable segment is also emerging as a significant segment due to its lightweight and design for easy transport, allowing flexibility across various job sites or around the house. Moreover, it is also available in both electric-powered (corded or cordless) and gas-powered variants, offering flexibility in power sources.

By Lubrication Analysis

Oil Filled Segment Dominates Due to Rising Demand in Heavy-duty Applications

Based on lubrication, the market is segmented into oil filled and oil free.

The oil filled segment is dominating the market with a share of 72.76% in 2026 and is poised to account for the highest CAGR during the forecast period. Given the increasing heavy-duty and commercial uses, using lubrication is crucial for preventing high maintenance problems. Oil-filled compressors enable users to maintain desired operational capabilities without interrupting continuity.

Oil-free compressors find applications in the hospitality industry and oxygen plants because of their clean operation, focus on hygiene, and consistent need for compressed air. This factor is expected to contribute to the steady growth of the global air compressor market share during the forecast period.

By Application Analysis

Energy & Power Segment Leads Fueled by Utilization in Power Generation Facilities

By application, the market is categorized into manufacturing, oil & gas, energy & power, electronics and semiconductor, healthcare, food and beverages, and others (aerospace).

The energy & power segment is leading the market and is slated to capture the highest CAGR during the forecast period. These products are used in power generation facilities for equipment maintenance, control systems, and pneumatic actuators. They are also crucial for wind turbine operations and maintenance. Some of the industrial applications include power plants (both conventional and renewable) and wind farms.

Furthermore, In 2026, the Manufacturing segment is projected to lead the market with a 35.38% share. manufacturing industries are experiencing a growth in demand for these products as they are crucial for powering pneumatic tools such as drills, impact wrenches, grinders, and spray guns. They also play a role in operating automated machinery and assembly lines.

Moreover, compressors find applications in industries such as electronics, semiconductor, and healthcare for tasks including air blowing, cleaning, pneumatic devices, and gas generation. The growing need for compressed air in various operations, including sandblasting, cleaning, and blowing, has led to an increased application in the manufacturing sector. Owing to their continuous heavy-load operations, these products are essential components utilized in production and manufacturing facilities.

REGIONAL INSIGHTS

The report covers a detailed analysis of five main regions: North America, Asia Pacific, the Middle East & Africa, Europe, and South America.

Asia Pacific Air Compressor Market Size 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 8.26 billion in 2025 and USD 8.79 billion in 2026. Asia Pacific is ruling and is slated to show major growth in the market during the forecast period due to robust demand for the integration of advanced technology, such as smart IIoT-enabled compressors from main countries including Japan, India, and China. Furthermore, rapid industrialization, infrastructure development, and expanding manufacturing sectors in countries such as China, India, and Southeast Asia are further boosting market growth. The significant regional growth is due to increased construction activities, automotive production, and the adoption of industrial automation. The demand for the product is also rising in the healthcare and electronics sectors. The Japan market is valued at USD 1.28 billion by 2026, the China market is valued at USD 5.47 billion by 2026, and the India market is valued at USD 0.7 billion by 2026.

China is experiencing significant growth driven by investments in energy infrastructure and expansions in power capacity. The Chinese market is also influenced by the rising demand for semiconductors, essential for manufacturing of integrated circuits and PCB boards. End-users are looking for more reliable compressors that offer improved performance, effective heat dissipation, and minimize energy and effluent loss. Furthermore, the growing use of compressors in automotive and manufacturing, particularly in sandblasting, fabrication, and other production operations, is anticipated to drive industry expansion in the foreseeable future.

To know how our report can help streamline your business, Speak to Analyst

The North American market is expected to experience continuous growth in the coming years due to the increasing need for improved functionality and capabilities in areas such as manufacturing, oil & gas, and energy & power applications. Moreover, the presence of key industries such as automotive, aerospace, and oil & gas, along with technological advancements in manufacturing and a strong industrial base, contributes to this growth. The demand for energy-efficient compressors and their growing need in sectors including construction and healthcare are also driving this upward trend. The U.S. market is valued at USD 3.69 billion by 2026.

- For instance, in December 2022, ELGi Equipments Limited, a part of ELGi Compressors USA, Inc (ELGi), revealed plans to enhance its footprint by renaming its North America portable air compressor, which was formerly referred to as Rotair.

The steady growth of the European market is anticipated due to the quick uptake of compressors in industrial and residential use for activities such as cleaning, air blowing, and other manufacturing processes, which is increasing the market presence of oil-filled compressors. In addition, technological advancements, stringent regulations promoting energy efficiency, and growth in the automotive and manufacturing sectors are leading to regional growth. The increasing demand for energy-efficient compressors in industries such as automotive manufacturing, food & beverages, and healthcare is further contributing to air compressor market growth. The UK market is valued at USD 1.03 billion by 2026, while the Germany market is valued at USD 1 billion by 2026.

The South American market is projected to experience significant growth in the coming years. This is attributed to the increasing usage of compressors for air compression in the oil and gas industry, automotive sector, and other manufacturing industries. The practice of replacing outdated compression equipment with newer ones in production departments has boosted the sales of innovative technology-based products in South America. Moreover, there is an anticipation that rotary air compressors will dominate the market share from 2017 to 2030, primarily attributed to their sturdy construction, cost-effective maintenance, and operational advantages. The increased utilization of air compression equipment in the market is propelled by the growing mining and construction activities, both from international and domestic industry leaders.

The increasing use of the product and gas-based power generation to meet the demands of a growing population is slated to contribute to moderate growth in the Middle East & Africa. In addition, rapid growth in Saudi Arabia is anticipated, leading to significant expansion of the compressor market in the region as gas usage for generating electricity rises. Furthermore, mining operations in African nations and the swift industrial growth driven by the geological importance of minerals are poised to support air compression activities. As a result, the demand for compressors in the Middle East & Africa region is expected to be bolstered by power generation, mining, and industrialization, leading to an increased market share during the forecast period.

KEY INDUSTRY PLAYERS

Major Players Focus on Implementing Various Strategies to Boost Their Expansion

Manufacturers are continuously making efforts to examine the deficiencies and launch new and advanced products. These updated products incorporate innovative technologies such as IIoT and real-time monitoring and are constructed using durable materials to ensure long-lasting and dependable operation. Customized air compression equipment solutions and pay-as-you-use options are also being offered by manufacturers to enhance sales. This factor is slated to notably enhance the industry players' revenue stream.

The market share is dominated by a few key companies, accounting for around 20%-25%. These companies are consistently pursuing expansion strategies. The market is considered moderately fragmented and is a part of the machinery and equipment industry. However, due to technological advancements and evolving market conditions, the global market size is steadily increasing.

LIST OF TOP AIR COMPRESSOR COMPANIES:

- ELGi Equipments Limited (India)

- Atlas Copco AB (Sweden)

- Sulzer Ltd. (Switzerland)

- Hitachi Ltd. (Japan)

- Ingersoll Rand (U.S.)

- Campbell Hausfeld (U.S.)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Doosan Infracore Portable Power (South Korea)

- Siemens AG (Germany)

- EBARA CORPORATION (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: GE Vernova signed a framework agreement with Forestalia to install up to 693 MW of onshore wind turbines across 16 future project sites throughout the Aragon region in Spain.

- March 2023 - Sullair revealed the introduction of the E1035H, an advanced air compressor. The creation of this product is in line with Hitachi's extensive environmental goal, Hitachi Environmental Innovation 2050. The new compressor offers equivalent durability, reliability, and performance compared to its diesel equivalents.

- December 2022: Atlas Copco agreed to acquire a German manufacturer of blowers & industrial vacuum pumps, i.e., CVS Engineering GmbH, for mobile use on tanker trucks and other types of transport.

- August 2022: Sauer compressors, a global compressor provider, added the latest feature to its 6000 series. The products feature hermetic gas tightness with the integration of magnetic coupling between the electric motor and compressor.

- May 2022: Elgi Equipment launched high-performance, energy-efficient, and reliable electric and diesel portable air compressors at EXCON 2022. The electric-powered PG 110E -13.5 and the diesel-powered PG 575 – 225 machines were launched at the elgi outdoor stand OD 81.

REPORT COVERAGE

The research report covers a detailed analysis on the basis of mode of operation, product type, lubrication type, and application. It provides information about leading players in the market and their business overview, product offerings, investments, revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation

By Product Type

By Lubrication

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 18.96 billion in 2025.

The market is expected to be valued at USD 33.82 billion by 2034.

The global market is estimated to have a noteworthy CAGR of 6.80% over the estimated period.

Asia Pacific market, valued at USD 7.81 billion in 2025, accounts for the largest share.

By mode of operation, the rotary segment is expected to be the leading segment in the market during the forecast period.

The technological upgradation for air system control and management is slated to drive the market growth.

ELGi Equipments Limited, Atlas Copco AB, Sulzer Ltd, Hitachi Ltd., Ingersoll Rand, Campbell Hausfeld, Mitsubishi Heavy Industries Ltd., Doosan Infracore Portable Power, Siemens AG, and EBARA CORPORATION are the leading companies in the market.

By application, the energy & power segment leads the market.

The major players constitute approximately 20%-25% of the market share, which is majorly owed to their brand image and presence in multiple regions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us