Aircraft Antenna Market Size, Share & Industry Analysis, By Platform (Fixed-Wing (Commercial Aircraft, Business Aircraft, Regional Jets, General Aviation, Military Aircraft, and Fixed-Wing UAVs) and Rotary-Wing (Military Helicopter, Civil Helicopter, and Rotary-Wing UAVs)), By Frequency Band (VHF & UHF Band, Ka/Ku/K Band, HF Band, X Band, C Band, and Others), By End-user (OEM and Aftermarket), By Application (Commercial and Navigation & Surveillance), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

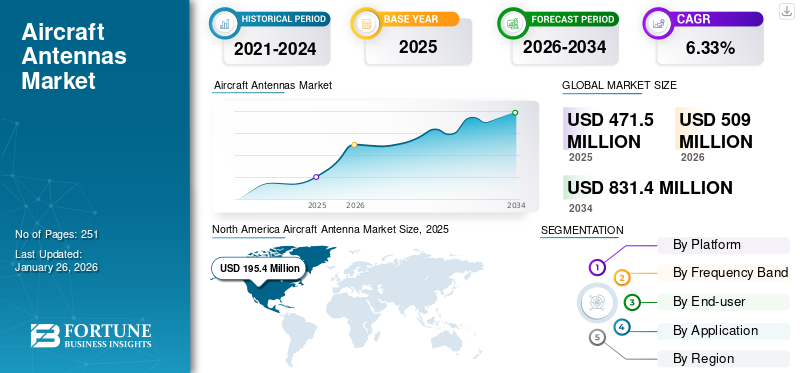

The global aircraft antenna market size was valued at USD 471.50 million in 2025 and is projected to grow from USD 509.00 million in 2026 to USD 831.40million by 2034, exhibiting a CAGR of 6.33% during the forecast period. North America dominated the aircraft antenna market with a market share of 41.43% in 2025.

An aircraft antenna is a device used to navigate the aircraft by using radio frequencies. It is used to communicate with other aircraft and ground-based control stations. Communication and navigation are the major applications of aviation antennas. These antennas are installed on top or bottom of an aircraft. The development of reconfigurable liquid antennas for aircraft adaptability is the latest trend, reshaping the market. Different types, such as communication antennas, loop antennas, GPS antennas, marker beacon antennas, and others, provide real-time information for communication, surveillance, and navigation applications. For instance, navigation antennas play a crucial role in ensuring accurate positioning and guidance for aircraft, as well as supporting systems such as GPS. The aircraft antenna market graph indicates a steady growth trajectory primarily due to increasing air travel and the rising adoption of advanced communication systems.

The COVID-19 pandemic had an unprecedented and staggering effect on the market as aircraft antennas experienced lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global market exhibited a decline of 17.35% in 2020 compared to 2019.

GLOBAL AIRCRAFT ANTENNA MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2025 Market Size: USD 471.50 million

- 2026 Market Size: USD 509.00 million

- 2034 Forecast Market Size: USD 831.40 million

- CAGR: 6.33% from 2026–2034

Market Share:

- North America dominated the aircraft antenna market with a 41.43% share in 2025, attributed to a well-established aviation sector, ongoing technological advancements, and large-scale defense investments.

- By Frequency Band, the Ka/Ku/K Band segment is expected to register the highest growth rate, driven by increasing 5G adoption in aviation and demand for high-speed in-flight connectivity.

- Key Country Highlights:

- United States: Investments in advanced satellite and electronically scanned array (AESA) antennas under defense programs, like the DEUCSI project, are enhancing tactical aircraft communications and connectivity.

- China: The development of advanced military aircraft like the KJ-3000 equipped with 360-degree radar antenna systems is boosting regional demand for surveillance and navigation antennas.

- India: Increased defense expenditure and procurement of rotary- and fixed-wing military platforms with high-precision antennas are contributing to market growth.

RUSSIA-UKRAINE IMPACT

Impact of Russia-Ukraine War Crisis on Aviation Sector to Reshape Global Dynamics of Market

- During the Russia and Ukraine wars, SpaceX's Starlink antenna project amplified the virtue of GPS and anti-detection systems. The rise in the war situation around the world has given rise to the demand for secure transmission systems along with the agility for accurate operations.

- Ukraine reportedly destroyed Russia's tank and heavily armored vehicles with Tb2 drones, which lack a basic level of communication systems. This situation suggests that the existing war fleet needs modernization along with superior connectivity systems.

- The war has showcased the use of multi-platform anti-jamming antennas being used to prevent detection and intrusion from enemies. Multi-platform anti-jamming antennas can be boarded on UAVs and vehicles as they are capable of operating over the ground and for aviation applications as well. Such undiscoverable systems are anticipated to drive growth in the coming years.

- Moreover, there was a rise in Unmanned Aerial Vehicle (UAV) procurement and production to enhance military capabilities during war. For instance, in October 2024, Ukraine committed USD 3.5 billion to procure 1.8 million UAVs in 2024-2025, emphasizing diverse models for battlefield tasks. Such a surge in UAV acquisition is expected to boost demand for aircraft antenna systems.

- Due to the ongoing war, Russia recently faced a major decline in airline contracts from various countries and companies; the country announced the start of home production of jet aircraft, which will result in self-sustained growth and revenues generated from exports in the coming years.

- Thus, the aviation industry in Europe was hindered as the war crisis led to a slowdown in the economy, disruptions of raw material supply chains, and declining air traffic.

Market Dynamics

Market Drivers

Rise in Need for High-Speed Data Connectivity to Augment Market Growth

The growing need for high-speed data connectivity is a significant driver for growth. As global air travel demand continues to rise, the aviation industry is expected to experience sustained growth over the next two decades. According to the International Air Transport Association (IATA), global passenger numbers are projected to double to 8.2 billion by 2037. In October 2024, IATA reported a 7.1% increase in global air travel demand compared to October 2023.

As air traffic increases, airlines are expanding their fleets to accommodate more passengers. This surge in demand has led various airlines to place new aircraft orders at a higher rate. For instance, Airbus delivered 735 commercial aircraft in 2023, marking an 11% increase from 2022. Similarly, Boeing received a total of 1,314 net new orders in 2023, up from 774 net new orders in 2022. The number of aircraft orders is expected to continue rising in 2024 due to increased global air traffic. Additionally, Pegasus Airlines ordered up to 200 Boeing 737-10 aircraft to modernize its fleet.

This increase in aircraft production directly relates to a heightened demand for advanced aircraft antennas, which are essential components of communication systems onboard aircraft. As airlines modernize their fleets and integrate new technologies, there is a growing need for sophisticated antennas that support enhanced communication and navigation capabilities. All these factors collectively contribute to the aircraft antenna market growth.

Increasing Demand for Unmanned Aerial Vehicles for Commercial and Military Applications to Drive Market Growth

A surge in aircraft up-gradation, an increase in demand for military UAV exercises, and a rise in the adoption of advanced communication & navigation systems are a few major factors that drive the global market. Military agencies are investing in developing military-class drones that are being used on the battlefield. Reliable communication has become a key aspect in the military applications of UAVs. Major key players are getting productive accreditation, inspiring market growth toward innovations, and operative resemblance in the industry.

In April 2020, Lockheed Martin concluded the first phase of the Multi-Function Electronic Warfare Air Large (MFEW-AL) program for the U.S. Army. MFEW-AL program focuses on antenna technology for incorporating electronic warfare and cyber techniques in Unmanned Aerial Systems (UAS). The increase in demand for military UAVs is driving the growth of the market, as these unmanned systems require advanced antennas for reliable communication and data transmission.

Moreover, the defense forces of various countries are allocating significant budgets for unmanned systems and associated technologies. For instance, in 2025, the U.S. Department of Defense's (DoD) budget requested to allocate USD 61.2 billion for Unmanned Aircraft Systems (UAS) such as the MQ-4 Triton and MQ-25 Stingray. As the production and development of UAVs increase, the demand for high-performance antennas to support communication, navigation, and surveillance rises. Thus, an increase in demand for unmanned systems from the defense forces and commercial applications leads to the growing demand for next-generation communication and navigational antennas that drive the aircraft antenna market growth.

Market Restraints

Growing Number of Aircraft Backlogs and Stringent Government Regulations to Hinder Market Growth

Airlines across the globe are seeking budget-friendly solutions related to aircraft antennas. However, the current war situation has resulted in severe disruption of supply and distribution chains. Moreover, airline operators have failed to generate a considerable profit.

Major restraints affecting the market growth include the increase in the number of cancellations of aircraft orders. This may include the decline in aircraft deliveries that occurred due to Boeing's retaliation from the contract of the BOEING 737 Max jet. Such incidents affect the overall market growth.

Additionally, the initial stage of aircraft antenna manufactured for each aircraft and drone used has a high cost and varies in each sector.

The Federal Aviation Administration (FAA) is adopting a new Airworthiness Directive (AD) for all the company’s model airplanes to avoid the interference of 5G bands with the installed components, which could impact its functionality. These safety directives must be in effect for overall safety and need to be considered seriously.

Implementation of 5G frequency bands in airports is restricting a few aircraft from following the guidelines, as some fleets have old systems installed. A few components get damaged when a plane lands at the airport because they are not compatible with new frequencies. This could act as a restraining factor for the market.

Market Opportunities

Modernization of Air Traffic Management Infrastructures to Boost Market Growth

The demand for technologically advanced aircraft has increased drastically over the last few years. Major players in developed countries are currently focusing on the innovative manufacturing of advanced aircraft. Modernization of air traffic management infrastructure improves the efficiency of the global aviation industry. Air traffic management infrastructure consists of air navigation services to handle air traffic and reduce flight delays more efficiently. Antennas help improve the connectivity to the aircraft, from air-air and air to land.

Under the Federal Aviation Administration’s Next-Generation Air Transportation System program, the current communication infrastructure in the U.S. aviation industry is projected to be updated. The success of the program will increase the safety standards for passengers and the efficiency of air traffic management systems.

Furthermore, ViaSat provides Ka-Band frequency, which will provide the same internet as in the office. High speed, usually greater than 20 Mbps, will be offered for unparalleled in-flight connectivity. Thus, the introduction of advanced technologies and modernization of air traffic control centers boost the market growth.

Aircraft Antenna Market Trends

Introduction of 3D Printing Technology in Aircraft Antenna has Emerged as a Recent Trend in the Market

3D printing technology has been increasingly adopted to fabricate 3D electromagnetic complex structures in the aerospace and defense sector. On-site production is highly beneficial from 3D printing. Transportation of parts and supplies can cost both time and money, whereas additive manufacturing modified components, which are created on-site, incurs less cost and time. North America witnessed a growth from USD 179.5 Million in 2023 to USD 183.9 Million in 2024.

The potential for a globally distributed manufacturing network enhances overall efficiency. It saves costs, allowing businesses to keep appropriate inventory levels to maximize output and create new value chains across industries. 3D printing creates opportunities for OEMs to produce antenna connectors and antenna sealants through advanced technologies.

For instance, in January 2025, NASA successfully developed and tested a 3D-printed antenna designed to communicate scientific data back to Earth. This antenna was tested in flight using an atmospheric weather balloon. Such developments highlight the efficiency of additive manufacturing in aerospace applications and promote the use of 3D printing in the development of complex antenna structures in the aircraft parts manufacturing industry.

Download Free sample to learn more about this report.

Segmentation Analysis

By Platform

Fixed-Wing Segment Dominated the Market Due to Growing Air Traffic and Increasing Aircraft Deliveries

Based on the platform, the market is segmented into fixed-wing and rotary-wing.

The fixed-wing segment is further classified into commercial aircraft, business aircraft, regional jets, general aviation, military aircraft, and fixed-wing UAVs. The rotary-wing segment is divided into military helicopters, civil helicopters, and rotary-wing UAVs.

The fixed-wing segment held the highest aircraft antenna market with a share of 65.97% in 2026. This dominance is due to the increase in the number of aircraft deliveries and rising spending on the aviation sector due to the growing number of air travelers. In 2024, Boeing delivered a total of 348 commercial aircraft. In contrast, Airbus achieved 766 aircraft deliveries during the same period. Both manufacturers are focusing on meeting market demands, with Airbus maintaining a strong delivery performance compared to its delivery of 735 aircraft in 2023. The Military Helicopter segment held the highest market with a share of 18.17% in 2026.

The rotary-wing segment will witness remarkable growth during the forecast period. This growth is attributed to the rising demand for small drones for commercial and defense applications. For instance, in February 2022, The U.S. Department of Defense awarded a contract to XTEND worth USD 8.8 million for the development of AI-powered tactical drone technology. The contract focuses on delivering Precision Strike Indoor & Outdoor (PSIO) and small Unmanned Aerial Systems (sUAS). This contract promotes the advancements in tactical drone technology, which includes AI-powered autonomy and precision strike capabilities. Such advancements stimulate the demand for more sophisticated and reliable antenna systems, which is expected to drive the growth of the segment.

By Frequency Band

Ka/Ku/K Band Segment to Showcase Highest Growth Rate Due to the Increasing 5G Network Adoption in Aviation

Based on frequency band, the market is segmented into VHF & UHF band, Ka/Ku/K band, HF band, X band, C band, and others.

The Ka/Ku/K band segment is expected to hold a 13.9% share in 2024. This growth is due to the rapid adoption of 5G in aviation. The Ka/Ku/K band hybrid aviation satcom antenna enables global broadband connectivity services for government and commercial users on worldwide high-capacity and conventional satellite networks.

The X-band segment is projected to be the largest segment during the forecast period with a share of 26.11% in 2026. The X band is a microwave radiofrequency. It is used for in-flight radar communication with Earth-based air traffic control stations. The X-band segment is expected to grow significantly owing to the rise in the use of military aircraft and UAVs for tactical communication, surveillance, and electronic warfare.

To know how our report can help streamline your business, Speak to Analyst

By End-user

OEM Segment led the Market Due to the Presence of a Large Number of Antenna Providers

Based on end-user, the market is divided into OEM and aftermarket.

The OEM segment dominated the market and will continue to dominate during the forecast period. The presence of a large number of aviation antenna providers for numerous applications, such as communication, navigation, and surveillance for real-time data, drives the segment’s growth in the market. Original Equipment Manufacturers (OEMs) in the market constantly focus on integrating advanced antenna technologies into new aircraft designs. For instance, in May 2024, Eclipse Global Connectivity, ThinKom, Kontron, and Display Interactive announced a collaboration for retrofitting over 50 narrow-body aircraft with high-speed connectivity solutions, utilizing the ThinAir Ka2517 antenna for enhanced in-flight connectivity. Therefore, the surge in demand for sophisticated communication systems and in-flight entertainment capabilities further propels OEMs to innovate their product line and increase their market share in the industry.

The aftermarket segment will witness the highest growth during the forecast period. Regular replacement of aircraft antennas due to limited life span and maintenance services of an aircraft for enhanced operations drive the growth of the aftermarket segment. For instance, in November 2023, VSE Aviation, a segment of VSE Corporation, secured six new distribution agreements valued at approximately USD 750 million from Honeywell International, Inc. This is an expansion of its existing agreement with Honeywell to be the sole aftermarket distributor for their JetWave tail-mounted antenna systems in Europe, the Middle East, Africa, and India (EMEAI).

By Application

Navigation & Surveillance Segment to Exhibit Remarkable Growth Owing to Rising Installation of Next-Generation GPS Antennas

Based on application, the market is divided into commercial and navigation & surveillance.

The navigation & surveillance segment will grow with the highest compound annual growth rate during the forecast period. Increased demand for next-generation navigational antennas, such as GPS antennas, marker beacon antennas, emergency locator transmitting antennas, and others, drives the segment's growth.

The commercial segment dominated the market with a share of 18.42% in 2026. UHF band antennas are used for communication applications in aircraft. These antennas are used for transponders and Distance Measuring Equipment (DME). The aircraft's short-range communication uses a VHF band between 118 MHz and 137 MHz to talk with air traffic control. Thus, the rising number of aircraft deliveries drives the growth of the segment.

Aircraft Antenna Market Regional Outlook

Geographically, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Aircraft Antenna Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025 and was valued at USD 195.4 million. This growth is attributed to the presence of a well-flourished aviation industry, and the highest aircraft fleet in the U.S. Furthermore, rising investments in developing technologically advanced aircraft antennas boost the market growth in the region. The military forces of the countries in this region are investing in reliable connectivity solutions for military operations. For instance, in September 2024, Viasat, Inc. received a USD 33.6 million contract from the U.S. Air Force Research Laboratory (AFRL) under the Defense Experimentation Using Commercial Space Internet (DEUCSI) program. The contract aims to develop and deliver Active Electronically Scanned Array (AESA) systems for resilient satellite communications for tactical aircraft, including rotary-wing platforms. Such developments will drive other aircraft antenna providers in the region to focus on innovation and production of advanced satellite antenna systems. The U.S. aircraft antennas market is valued at USD 197.90 million by 2026.

Asia Pacific

The Asia Pacific region will grow with the highest CAGR during the forecast period. The rapid expansion of the aviation sector and growing urbanization lead to rising demand for commercial aircraft. Furthermore, increasing defense expenditure from emerging economies, such as China and India, leads to rising procurement of military aircraft and helicopters that drive the growth of the market. Moreover, there has been a rise in the installation of advanced antenna systems for surveillance applications on military aircraft in various countries in the region. For instance, in December 2024, the KJ-3000next generation military aircraft conducted its maiden flight. The aircraft is integrated with a radar antenna system for 360-degree situational awareness and to improve the detection of stealth targets. Therefore, this promotes the development of more advanced antenna technologies to enhance the surveillance capabilities of the region. The Japan aircraft antennas market is valued at USD 14.9 million by 2026, the China aircraft antennas market is valued at USD 47.9 million by 2026, and the India aircraft antennas market is valued at USD 36.1 million by 2026.

Europe

Europe will showcase significant growth during the forecast period. A growing number of aircraft deliveries due to increasing air traffic and the rising use of reconfigurable liquid antennas, majorly in aircraft from France, propels the market growth. Moreover, the European Union (EU) is planning to mandate the installation of 5G connectivity in all aircraft. This initiative will allow passengers to use cellular connectivity on flights. 5G connectivity needs aircraft antennas to transmit and receive signals between the aircraft and ground-based or satellite networks. Therefore, the region’s plan to install 5G connectivity is expected to increase the demand for aircraft antennas during the forecast period. The UK aircraft antennas market is valued at USD 18.4 million by 2026, while the Germany aircraft antennas market is valued at USD 23.3 million by 2026.

The rest of the world

The rest of the world would register significant growth during the forecast period. Growing tourism, increasing air travelers, and growing defense spending from the Middle Eastern countries drive the market growth across the regions. Various regions in the rest of the world, such as Latin America, strive for advanced aviation connectivity. For instance, in August 2023, Satcom Direct, a satellite communication solution provider, installed the first Plane Simple Ku-band antenna on a Brazilian Gulfstream G550 jet. This installation enables the aircraft to utilize high-speed data services connected to the Intelsat FlexExec satellite network. Therefore, the rise in the integration of high-performance aircraft antennas to improve aviation connectivity is expected to fuel the growth of the region's market.

Competitive Landscape

Key Industry Players

Focus on Technological Advancements is a Notable Strategy Adopted by Key Market Players to Sustain Competition

The introduction of technologically advanced aircraft antennas for surveillance and communication applications is the upcoming trend in the market. A diversified product portfolio of GPS antennas and rising spending on research and development of advanced technology from aircraft antenna manufacturers propel the market growth. Moreover, key players in the market focus on the introduction of advanced antenna technologies, such as Electronically Steered Antennas (ESAs). They phased array antennas to enhance performance and allow for broader coverage without mechanical movement. Such innovations aimed at meeting high-speed in-flight connectivity and improved communication demands are expected to stimulate market growth further.

LIST OF KEY AIRCRAFT ANTENNA COMPANIES PROFILED

- Antcom Corporation (U.S.)

- Smiths Interconnect (U.S.)

- Boeing (U.S.)

- Cobham Limited (U.K.)

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Maxtena Inc. (U.S.)

- Harxon Corporation (China)

- Chelton Limited (U.K.)

- Sensor Systems (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024: ThinKom Solutions and Sierra Nevada Corporation (SNC) announced that it has integrated the ThinAir GT 2517 phased-array satcom antenna on SNC’s RAPCON-X aircraft, which recently completed its inaugural flight. This advanced antenna system is expected to offer high-performance, Beyond-Line-Of-Sight (BLOS) network connectivity.

- October 2024: Gogo Galileo HDX antenna built by Hughes Network Systems completed a test flight on a Bombardier Challenger 300 aircraft, demonstrating its capability to connect with Low-Earth Orbit (LEO) satellites. This Electronically Steered Array (ESA) antenna is set to launch a commercial aviation variant in the first half of 2025, enhancing in-flight connectivity for business aircraft.

- May 2024: Intelsat was contracted by Japan Airlines to provide multi-orbit in-flight connectivity for over 20 upcoming Boeing 737 MAX aircraft, utilizing Intelsat’s new electronically steered array (ESA) antenna. This service will leverage both Geostationary (GEO) satellites and Eutelsat OneWeb’s low Earth orbit (LEO) satellite constellation.

- May 2024: Thales, a French aerospace and defense company acquired Israeli antenna-maker Get SAT to enhance its satellite communication capabilities. Get SAT provides efficient antenna and terminals, including the Milli Sling Blade, which utilizes electronically steered phased array antenna technology, and the Lesa Blade aero ESA, with high-data-rate communications for defense, civil aeronautics, and emergency services.

- January 2023: Satcom Direct installed the first Plane Simple Ka-band antenna on its Gulfstream G550, a business jet. This prototype terminal, consisting of two line-replaceable units (the tail-mount antenna and SD Modem Unit), is designed to test compatibility with Inmarsat’s Jet ConneX service and operates under a specific Supplemental Type Certificate (STC) for the aircraft.

REPORT COVERAGE

The global aircraft antenna market research report provides an in-depth technical analysis of the market and majorly focuses on key aspects such as leading market players, the Russia-Ukraine war affecting government bell-out packages on the market, antenna systems, and leading technological trends. Besides, the report offers insights into the aviation market trends and highlights key industry developments and trends. In addition to the factors described above, the report provides several aspects that will contribute to the growth of the market during the market forecast.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 6.33% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Platform

|

|

By Frequency Band

|

|

|

By End-user

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 509.00 million in 2025 and is projected to reach USD 831.40 million by 2034.

In 2025, the North America market stood at USD 195.4 million.

Growing at a CAGR of 6.33%, the market will exhibit steady growth in the forecast period (2026-2034).

Increasing air traffic leading to a rise in demand for new aircraft is the key factor driving the market.

Antcom Corporation, Sensor Systems, Chelton Limited, Honeywell International Inc., L3Harris Technologies Inc., and Cobham Limited are the major players operating in the market.

North America dominated the market share in 2025

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us