Alcoholic Beverages Market Size, Share & Industry Analysis, By Type (Beer, Wine, Distilled Spirits, and Others), By Distribution Channel (Retail [Mass Merchandisers, Specialty Stores/Liquor Stores, Convenience Stores, and Online Retail] and Food Service), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

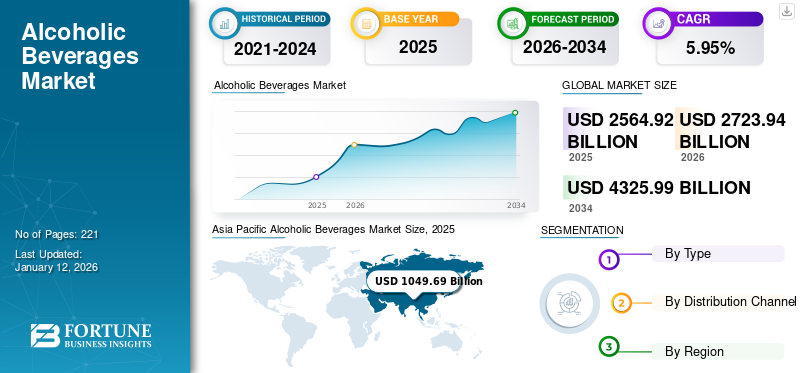

The alcoholic beverages market size was valued at USD 2,564.92 billion in 2025. The market is projected to grow from USD 2,723.94 billion in 2026 to USD 4,325.99 billion by 2034, exhibiting a CAGR of 5.95% during 2026-2034. Asia Pacific dominated the alcoholic beverages market with a market share of 40.92% in 2025.

Alcoholic beverages are categorized into three general categories: wines, beers, and spirits. According to the National Center for Biotechnology Information (NCBI), U.S., to produce specific types of alcohol, variable production methods are used. The beer manufacturing process includes the fermentation of malted barley and the addition of hops to it, which will give the final output in terms of beer. Wine production consists of the fermentation of crushed grapes. Moreover, distilled spirits are produced from various sources such as sugar or starch, molasses (from sugar beets), cherries, cereals, grapes, plums, potatoes, or other fruits, and then the completion of fermentation of sugar is followed by distillation of the liquid.

Increased inclusion of natural and functional ingredients in making premium category alcohols provides a massive opportunity for premium alcoholic drinks. Hence, leading manufacturers of alcohol-based beverages are emphasizing entering into partnerships with key players manufacturing premium alcohol-based beverages. For instance, in April 2025, DeVANS Modern Breweries Ltd., maker of “Godfather beer” and “GianChand single malt”, entered the premium craft gin market by launching DeVANS’ premium craft gin. The new product range would be launched in Haryana, Delhi, Maharashtra, and other parts of India.

Additionally, alcoholic drinks are produced by fermenting grains, berries, sugars in fruits, and other ingredients such as tubers, plant saps, honey, and milk. They can be distilled to decrease the original watery liquid to a liquid having greater alcoholic strength.

Global Alcoholic Beverages Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 2,564.92 billion

- 2026 Market Size: USD 2,723.94 billion

- 2034 Forecast Market Size: USD 4,325.99 billion

- CAGR: 5.95% from 2026–2034

Market Share:

- Asia Pacific dominated the alcoholic beverages market in 2026 with a market size of USD 1121.49 billion, driven by changing social lifestyles, rising demand for premium alcoholic drinks, growing middle-class income, higher purchasing power, and rapid urbanization. Alcoholic beverage manufacturers such as Asahi Group and Suntory Holdings Limited are focusing on mergers, acquisitions, and expansions to strengthen market positions in the region.

- By type, distilled spirits held the largest market share in 2024, supported by the increasing number of distilleries, consumer enthusiasm for premium spirits, and growing social media influence promoting new product awareness.

Key Country Highlights:

- United States: Strong consumer demand for premium spirits and the growing popularity of spirit-based RTDs such as vodka sodas are driving market growth, supported by an expanding winery industry that contributes significantly to tourism revenue.

- Germany: Maintains leadership in beer production and consumption in Europe, supported by a robust brewing culture and rising craft beer popularity.

- India: Rapid growth in premium alcohol consumption, supported by rising disposable incomes and new market entries such as Suntory Holdings Limited establishing Suntory India Private Limited in 2024.

- Brazil: Rising middle-class incomes are fueling demand for super-premium and flavored spirits, with Gen Z and millennials driving growth in ethnic premium spirits.

- Middle East & Africa: Experiencing rapid growth in demand for hard drinks such as gin and whiskey, fueled by changing consumer preferences, rapid urbanization, and increasing disposable incomes.

Alcoholic Beverages Market Trends

Growing Popularity of a Variety of Hybrid Alcohol Beverages to Aid Market Growth

Alcoholic beverage manufacturers have begun introducing Ready-to-Drink (RTD) hybrid beverages to meet evolving consumer preferences and tastes. These mixed beverages are alcoholic cocktails that combine elements from various beverage categories. These are prepared with attractive flavor ingredients and production processes in combination with various drinks. For this purpose, these manufacturers produce beers or spirits in wine barrels to provide them with a particular flavor. Hybrid beverages blended with tea and rum, and mixed with vodka, are trending in the spirit category. Kahlua Midnight (rum and Kahlua), Malibu Red (rum and tequila), and Absolut Tune are some of the popular hybrid alcohol drinks, which have highly increased consumer demand as these RTD beverages are premium alcoholic drinks. Different flavors of beer play a vital role in shaping the market growth, as consumers are considerably more open and flexible to experimenting. Beer is a multi-generational product category in demand, as all generations can associate with different beer flavors. Tasting rooms of alcohol-based beverages are becoming increasingly popular as consumers can try new flavors, which aids in crowd-sourcing beer innovations. With more alcoholic beverage companies focusing on producing RTD alcoholic beverages, this trendy category is attracting new customers. Asia Pacific witnessed a growth from USD 918.1 Billion in 2023 to USD 981.9 Billion in 2024.

Download Free sample to learn more about this report.

Impact of U.S. Tariff

The U.S. tariffs on the alcoholic beverages industry are expected to impact the market growth significantly, leading to high prices for consumers, lowered sales of imported products, and possible job losses. The U.S. Customs and Border Protection (CBP) reported that in March 2025, the U.S. imposed 25% tariffs on most Canadian and Mexican imports of wine, beer, and spirits. Increased tariffs raise the price of imported alcoholic drinks, which are passed on to customers in the form of increased prices of wine, beer, and liquor. Due to this, buyers might choose more affordable domestic brands or turn to cheaper substitutes, further affecting the market growth.

Market Dynamics

Market Drivers

Increased Alcohol Consumption among Young Adults Due to Rise in Disposable Income Drives Market Growth

In various developing economies, such as China, India, Singapore, and Indonesia, spending on alcoholic beverages is increasing faster due to the increasing number of young adults in the workforce. This factor is emerging as one of the key drivers fueling market growth, mainly in Asia Pacific. According to the National Survey on Drug Use and Health (NSDUH), in the U.S., 218.7 million adults aged 18 and older, i.e., 84.9% in this age group, drank alcohol at some point in their lifetime. At the same time, the consumption of alcoholic drinks increased at home, with a substantial increase in sales in retail and online stores as well. The rising global economy and robust growth of developing economies such as India, Brazil, and China are likely to increase the disposable income of consumers. This rise in growth can result in increased purchases of premium alcoholic drinks. Therefore, the increasing alcohol consumption among young adults due to a rise in disposable income is significantly driving the alcoholic beverages market growth.

Increasing Wineries and Breweries are Supporting Market Growth

The number of wineries and breweries has been increasing over the past few years. According to the Brewers Association, in the U.S., the total number of breweries increased to 9,922 in 2024, up from 9,838 in 2023. Growing brewery establishments offer intense competition, which further leads to more innovative products, improved product quality, and better prices. The rise in the number of breweries also creates employment opportunities, further contributing to economic growth. Moreover, the rising demand for alcoholic drinks has led to an increase in wineries, and some craft, micro, and artisanal alcohol producers are entering the winery industry. With the young generation looking for new experiences, wine tourism has become a successful venture, contributing to market growth.

Market Restraints

Rising Consumer Inclination to Consume Non-alcoholic Beverages May Pose Challenges to Market Growth

No alcohol and low-alcohol beverages are making their way in the market as more consumers accept a moderate approach to alcohol consumption. Non-alcoholic content beverages have found a considerable niche in established and emerging economies, with increasingly health-conscious consumers seeking substitutes to alcoholic or sweet soft drinks. IFT's recent research states that one in five consumers has reduced alcohol consumption to make healthier beverage choices. The study states that global non-alcoholic or low-alcoholic spirits consumption is anticipated to increase by over 70% by 2024. Consumers who refrain from alcohol due to religious, cultural, or personal motives form another major consumer segment.

Additionally, consumers are practicing moderation, choosing to reduce alcohol consumption or going in for "mocktails" as a way to enjoy social occasions without alcohol. Hence, several startups are entering the no-alcohol beverage space. Moreover, consumers are becoming more aware of the health issues caused due to excess consumption of alcohol Thus, due to increased health awareness among consumers, they are shifting their preference toward consuming non-alcoholic beverages or low-alcohol beverages. An increasing understanding of the adverse effects of alcoholic type of beverages on consumers' health is shifting consumers away from alcoholic drinks, thereby restraining market growth.

Market Opportunities

Growing Focus on Diversification of Product Offerings to Offer a Major Opportunity for Growth

Product diversification offers the greatest scope for expansion in the alcoholic drink market, allowing brands to take advantage of changing consumer tastes and differentiate themselves within a competitive environment. As lifestyles, health consciousness, and consumption patterns change, consumers are seeking a wide variety of alcoholic drinks, generating demand for innovative and personalized products. This shift is especially evident for premium, craft, low-alcohol, and non-alcoholic options, propelling brands to diversify their product portfolios. For instance, in June 2024, Associated Alcohols & Breweries Ltd. (AABL), an Indian distillery, expanded its alcoholic beverage portfolio with the launch of premium whiskey Hillfort and Kultur in five new Indian states.

Market Challenges

Growing Regulations for Alcoholic Beverage Industry to Hamper Business Growth

One of the significant challenges in the global market is to navigate the complex regulatory landscape across different countries. Each country is known to have its own set of regulations and laws regarding the production, distribution, sale, and marketing of alcoholic drinks. Compliance with these regulations may be time-consuming and costly for alcohol manufacturers, especially smaller producers, impacting business growth.

Segmentation Analysis

By Type

Distilled Spirits Segment Holds Largest Share Backed by Increasing Number of Distilleries

Based on type, the market is segmented into beer, wine, distilled spirits, and others.

The distilled spirits segment holds the most significant market with a share of 37.57% in 2026. Some of the factors that are significantly driving the market growth are the rising number of distilleries. The upswing of social media has made it easier for consumers to learn about new releases in the spirits category and to identify local distilleries. The consumers' enthusiasm for distilled spirits continued as they spent more than usual to enhance their cocktail experiences with super-premium brands. According to the DISCUS, in 2023, the premixed cocktails revenue was up by 26.8% to USD 2.8 billion compared to the previous year.

- The distilled spirits segment is expected to hold a 37.29% share in 2024.

Beer is the second-largest segment in the market. The beer industry is mainly fragmented, with many local and international players competing with each other to capture markets. The U.S. is a major exporter of beer in the world. According to the United States Department of Agriculture (USDA), U.S. beer exports in 2024 amounted to USD 383.34 million. Newly launched lively and rich flavors are highly appealing to millennials and Gen Z. Beer manufacturers are engaged in product innovations due to the young population's rising demand for innovative beer flavors. Additionally, the adoption of Western culture and cultural changes has highly influenced the consumer perception toward alcohol-based beverages, specifically beer, in Southeast Asian nations. It is the most consumed alcoholic type of beverage among young adults, as young consumers seek for more diverse and higher quality beer.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Food Service Segment Holds a Larger Share Owing to an Increase in Socializing

Based on distribution channel, the market is segmented into retail (mass merchandisers, specialty stores/liquor stores, convenience stores, and online retail), and food service.

The food service segment dominated the global market with a share of 52.24% in 2026. A tremendous increase in post-pandemic socializing and social gatherings is observing an upswing in alcoholic beverage consumption, boosting alcohol sales in the food service sector. Most consumers have been switching from beer to brown liquor such as rum, scotch, whisky, and brandy. Food service establishments have a large variety of spirits. Hence, consumers are keen on trying new types of spirits at food service establishments. Socializing and hoteling have been a long trend in the industry, but in the wake of COVID-19, alcohol sales through food service establishments were heavily impacted. Sales through convenience, retail, and specialty stores also decreased. But after the COVID-19, as restrictions were removed, consumers stepped out to socialize in clubs, bars, pubs, hotels, and restaurants. Thus, the rising trend of socializing and the increase in the number of social gatherings and get-togethers after COVID-19 have generated the demand for the expansion of chains of restaurants, pubs, clubs, hotels, and bars. It has increased alcohol consumption at all these places, thereby driving the sales of these beverages in the food service sector.

The retail segment is expected to grow significantly over the forecast period. It consists of mass merchandisers, specialty stores/liquor stores, convenience stores, and online retail. The growth is driven by ease of accessibility and convenience. Moreover, expansion in e-commerce and online food retailing further drove the segment growth, offering consumers discounts, special offers, and a variety of alcoholic beverages.

Alcoholic Beverages Market Regional Outlook

Based on geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Alcoholic Beverages Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the majority of the alcoholic beverages market share. Aisa Pacific dominated the global market in 2025, with a market size of USD 1049.69 billion. The working population's social lifestyle has significantly changed consumers' eating and drinking habits, which is a significant factor enabling the market growth in the region. The market's steady growth can also be attributed to the rising demand for premium alcoholic drinks. Additionally, the growing income of middle-class consumers, the higher purchasing power, and rapid urbanization have pushed consumers toward trying super premium alcohols. Alcoholic beverage manufacturers in Asia Pacific, such as Asahi Group and Suntory Holdings Limited, are engaged in mergers and acquisitions, expansions, and product launches to strengthen their market positions. The Japan market is projected to reach USD 54.63 billion by 2026, the China market is projected to reach USD 548.56 billion by 2026, and the India market is projected to reach USD 156.11 billion by 2026.

For instance, in December 2024, Suntory Holdings Limited ventured into its business in India by the formation of Suntory India Private Limited. The new venture marked a significant milestone in Suntory's global expansion strategy and would help the company to focus on fortifying its foothold in the spirits sector in India.

Europ

Europe contributes to a significant market share, followed by Asia Pacific. Millennials in Europe are increasingly drawn to craft beers, with the rise of brewpubs playing a significant role. Moreover, the rise of microbreweries introduces new tastes and reforms traditional styles, which helps drive growth in the industry. Germany is known to be the leader in both the production and consumption of beer, followed by Spain and Poland. The UK market is projected to reach USD 116.26 billion by 2026, and the Germany market is projected to reach USD 140.56 billion by 2026.

North America

North America has a substantial market share, followed by Europe, due to increased alcoholic beverage consumption among urban consumers. The alcoholic drinks industry in this region is anticipated to grow in the coming years due to the introduction of honey-based drinks, which will appeal to health-conscious consumers. Companies such as Boston Beer and Anheuser-Busch InBev, and Constellation Brands are some of the prominent players in the market. Moreover, the winery industry in the U.S. is a tourist attraction and contributes to the economy by infusing large amounts of tourism-driven expenses. Spirit-based Ready-to-Drink (RTDs) such as vodka sodas have also witnessed a surge in popularity among young consumers in the region, owing to the rising trend toward premiumization. The U.S. market is projected to reach USD 354.48 billion by 2026.

South America

The market in South America is growing at a significant rate, owing to rising disposable incomes, which are driving the demand for premium alcoholic drinks. With the growing middle class, there is an increased demand for super-premium spirits, ethnic premium spirits, and flavored spirits, especially among Gen Z and millennials in the region. Moreover, the region boasts a strong cultural heritage, which further fuels the consumption of domestic spirits, including pisco and cachaça, propelling the market growth.

Middle East & Africa

The alcoholic beverage sector in the Middle East & Africa is an evolving and dynamic industry deeply rooted in the region's economic landscape and cultural heritage. In recent years, the market in the region has been witnessing substantial growth, owing to changing consumer preferences, rapid urbanization, and increasing disposable incomes. The region is also witnessing a surging demand for hard drinks such as gin and whiskey.

Competitive Landscape

Get comprehensive study about this report by, Download free sample copy

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

The global alcoholic beverages market is known to be highly fragmented, with the presence of large multinational players and small local players who are consistently making efforts to formulate advanced strategies to take a competitive advantage. The key players in the market are focusing on merger and acquisition strategies to broaden their portfolio and consumer reach. For instance, in January 2025, KATI PATANG LIFESTYLE LIMITED entered the U.K. market with the acquisition of a 23% stake through its U.K. subsidiary in CHADKP HOLDINGS LIMITED, the parent company of Chadlington Brewery. Companies are expanding their business by establishing manufacturing facilities in different regions globally to expand their geographical presence and increase consumer reach.

List of Key Alcoholic Beverage Companies Profiled

- Anheuser-Busch InBev (BUD) (Belgium)

- Asahi Group (Japan)

- Ambev (Brazil)

- Brown Forman (U.S.)

- Carlsberg (Denmark)

- Constellation Brands (U.S.)

- Diageo (U.K.)

- Heineken (Netherlands)

- Pernod Ricard (France)

- Suntory (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – Carlsberg Group planned to deepen its presence in India by establishing two to three new breweries in Mysuru, Karnataka. The company planned to quadruple its yearly production capacity from 80 to 160 million liters.

- January 2025 - United Breweries (UB) unveiled its latest innovation in the alcoholic beverage segment by launching the Kingfisher Flavors range. The new range includes two flavors, such as lemon masala and mango berry twist.

- August 2024 - Tilray Brands, Inc., a consumer-packaged goods company, acquired four craft breweries from Molson Coors Beverage Company. This acquisition includes breweries such as Revolver Brewing, Atwater Brewery, Terrapin Beer Co., and Hop Valley Brewing Company.

- September 2023: Illva Saronno Holding SpA, a popular Italian company, acquired Sagamore Spirit, a rye whiskey brand and distillery. This acquisition is expected to offer growth opportunities for Illva Saronno to expand its presence business of American rye whiskey.

- March 2023: Pernod Ricard acquired a majority stake in Skrewball. It will join the company’s portfolio of popular brands, including Absolut vodka and Jameson Irish Whiskey.

REPORT COVERAGE

The alcoholic beverages market research report provides detailed market analysis and focuses on key aspects such as leading companies, product types, and leading applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.95% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2,723.94 billion in 2026 and is anticipated to reach USD 4,325.99 billion by 2034.

Ascending at a CAGR of 5.95%, the global market will exhibit steady growth over the forecast period (2026-2034).

By type, the distilled spirits segment dominates the market.

An increase in the number of wineries and breweries in the industry is accelerating market growth.

The leading companies operating in the market are Anheuser-Busch InBev SA/NV, Heineken N. V., Diageo, Constellation Brands, Inc., and Ambev.

Asia Pacific holds the highest market position.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us