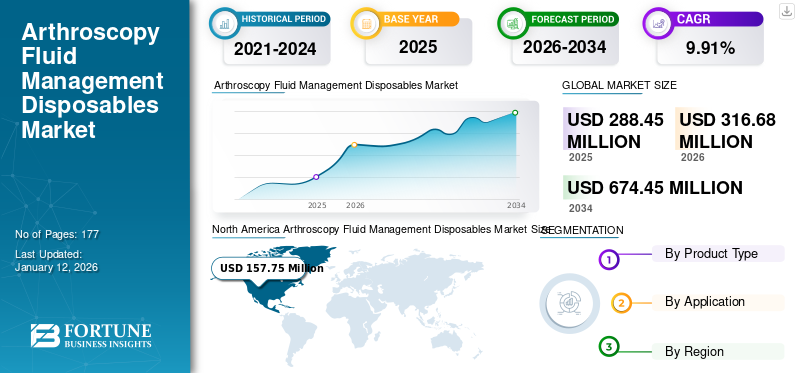

Arthroscopy Fluid Management Disposables Market Size, Share & COVID-19 Impact Analysis, By Product (Pump Management Disposables and Gravity Management Disposables), By Application (Hospitals, Medical Centers, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global arthroscopy fluid management disposables market size was USD 288.45 million in 2025. The market is projected to grow from USD 316.68 million in 2026 to USD 674.45 million by 2034, exhibiting a CAGR of 9.91% during the forecast period. North America dominated the arthroscopy fluid management disposables market with a market share of 54.69% in 2025.

In the last 10-15 years, there has been a considerable growth in popularity and adoption of arthroscopy procedures among orthopedic surgeons. A recent study conducted by the Arthroscopy Association of North America concluded that around 1.8-2 million arthroscopy procedures are being conducted in the U.S. annually at present. Advances in the equipment and devices used in the arthroscopy procedures, such as improvements in visualization, imaging, and fluid management combined with regulatory approvals and reimbursement available for expanded indications/procedures are factors that have significantly boosted the market's growth in recent years.

Declined Orthopedic Surgeries Due to COVID-19 Pandemic to Impact Industry

The increasing cases of COVID-19 around the world have significantly impacted the supply chain dynamics of orthopedic devices. Due to rising cases, many hospitals have suspended elective surgeries to accommodate COVID-infected patients. Based on a survey conducted in the U.S., almost 50% of surgeons, cardiologists, and anesthesiologists mentioned that they expect patients to either cancel or delay elective surgeries in the current pandemic scenario. This has led to a significant decline in the growth rate of the arthroscopy fluid management disposables market.

Global Arthroscopy Fluid Management Disposables Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 288.45 million

- 2026 Market Size: USD 316.68 million

- 2034 Forecast Market Size: USD 674.45 million

- CAGR: 9.91% from 2026–2034

Market Share:

- North America dominated the arthroscopy fluid management disposables market with a 54.69% share in 2025, driven by the strategic presence of key orthopedic device companies and favorable reimbursement policies.

- By product type, the pump management disposables segment is expected to retain its largest market share owing to technological advancements that enhance fluid optimization and visualization during arthroscopy procedures.

Key Country Highlights:

- United States: The market benefits from a strong base of orthopedic device manufacturers and growing adoption of advanced arthroscopic techniques across hospitals and medical centers.

- Europe: The region’s market is propelled by robust healthcare infrastructure, well-established reimbursement systems, and faster acceptance of innovative orthopedic devices.

- China: Rising healthcare expenditure, increasing orthopedic procedures, and growing focus on expanding medical device distribution channels drive the market’s momentum.

- Japan: Increasing adoption of minimally invasive surgeries and advancements in arthroscopy techniques are key factors supporting market expansion.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing Adoption of Minimally Invasive Surgeries to Aid Adoption

Over the past few years, patients have increasingly started referring to web-based tools and online resources to avail information for specific diseases. Government initiatives for regulating the cost of different types of orthopedic surgery in the region combined with the increasing geriatric population can contribute positively to the arthroscopy fluid management disposables market growth. Increasing preference for minimally invasive surgical procedures in countries such as Germany, U.K, and Scotland is a trend witnessed in Europe.

DRIVING FACTORS

Enhanced Treatment Capability and Adoption of Innovative Technologies to Spur Market Growth

Innovative technological advancements leading to enhanced arthroscopic procedures will continue to boost the market growth. Moreover, fluid management systems are expected to spur demand on account of their capability to optimize the visualization process. In July 2019, Smith & Nephew announced the first-ever prospective clinical trial results to evaluate the effectiveness of repairing Horizontal Cleavage Tears (HCTs) using Smith & Nephew's NOVOSTITCH Meniscal Repair System.

Furthermore, the growing adoption of the all-arthroscopic Latarjet (aL) procedure for managing recurrent shoulder instability is likely to offer lucrative growth opportunities for market players. In September 2019, researchers from Villa Maria Cecilia Hospital and Campus Bio-Medico University, Italy, reported that the arthroscopic Latarjet procedure is a potential solution for managing recurrent anterior shoulder instability.

Higher Prevalence of Traumatic Injuries to Propel Product Demand

A rapid rise in the incidence of musculoskeletal injuries leading to limited mobility & agonizing physical pain is the primary factor that is likely to drive the demand for arthroscopic fluid management products during the forecast period. According to a report published by the American Academy of Orthopedic Surgeons (AAOS), about 6.8 million patients with orthopedic injuries come to medical attention each year in the United States alone.

Combined with this, a growing number of sports-related accidents and injuries are anticipated to the market's positive growth. For instance, according to the National High School Sports-Related Injury Surveillance Study 2017-2018, 1,367,490 cases of sport-related were recorded in high schools in the U.S. Anterior cruciate ligament (ACL) injury is a major injury in professional sports that can be treated by arthroscopy.

RESTRAINING FACTORS

Declining Rate of Arthroscopic Knee Surgeries to Hamper Market Growth

Various studies have been published on the lack of keyhole knee surgery benefits on patients with degenerative knee conditions such as osteoarthritis. Recommendations by associations/agencies such as the National Institute for Health and Care Excellence (NICE) and the British Orthopaedic Association are consistent with these studies' findings.

In the last decade, these studies and recommendations have resulted in declining arthroscopic knee surgeries in many countries. In England, the rate of knee arthroscopy procedures increased from 169/100,000 population in 1998 to 242/100,000 people in 2010. The procedure rate has steadily declined in the 2010-2016 period (the rate of knee arthroscopy procedures was 178/100,000 population in 2016).

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Pump Management Disposables Segment to Hold Highest Market Share in 2019

Based on the product, the market for arthroscopy fluid management disposables is categorized into pump management disposables and gravity management disposables. The pump management disposables dominated the market share of 72.42% in 2026. The increase in orthopedic surgeries has propelled the growth of the entire market. However, the technological advancement of sin pump management devices is projected to fuel the growth of the product's demand.

Gravity management pumps are highly adopted in developing countries such as China and India, owing to their lower cost and maintenance. Additionally, the limited availability of trained professionals to operate arthroscopy pump management devices has increased the adoption of gravity pumps in these countries.

By Application Analysis

Hospitals Segment Ruled the Market in 2019

Based on applications, the market for arthroscopy fluid management disposables has been segmented into hospitals, medical centers, and others. Among the applications, the hospital segment dominated the global market share of 55.90% in 2026. This is mainly due to the presence of advanced facilities and rising healthcare infrastructure in hospitals. The hospital segment is anticipated to continue its dominance in the forthcoming years. This is attributed to the rise in the number of orthopedic surgeries performed in hospitals and the growing number of hospital visits by patients with orthopedic injuries.

REGIONAL INSIGHTS

North America Arthroscopy Fluid Management Disposables Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a maximum revenue of USD 157.75 million in 2025 and will continue to dominate the market throughout the forecast period. The growth is attributable to the strategic presence of key orthopedic device companies in the U.S. and improved reimbursement policies by Medicare for medical devices in the country. According to the International Trade Administration that used data from the Census Bureau, there are roughly 5,300 to 5,600 U.S. companies in the medical devices sector, with approximately 330,000 to 365,000 employees working in the country. The U.S. market is projected to reach USD 47.5 billion by 2026.

Europe

The growth of the market in Europe is attributable to various factors such as developed healthcare infrastructure, well-established reimbursement systems for hospitals, and faster adoption of new orthopedic device technologies in the country are driving the growth of the market. Additionally, the U.K. has a strong foundation of around 2,500, mostly small to medium-sized companies worldwide. A higher number of multinational companies, including many of the leading U.S. orthopedic device manufacturers have subsidiaries and head offices in the U.K. The UK market is projected to reach USD 11.78 billion by 2026, while the Germany market is projected to reach USD 17.44 billion by 2026.

Asia Pacific

On the other hand, the Asia Pacific market for arthroscopy fluid management disposables is anticipated to witness the highest growth during the forecast duration. The growing purchasing power of the masses in the emerging economies, namely, India and China, provides a huge opportunity for the market's growth. Increasing healthcare spending and expanding the distribution network of key players in the emerging nations are predominant factors influencing the Arthroscopy Fluid Management Disposables market in Latin America, the Middle East, and Africa. The Japan market is projected to reach USD 18.97 billion by 2026, the China market is projected to reach USD 19.84 billion by 2026, and the India market is projected to reach USD 2.41 billion by 2026.

KEY INDUSTRY PLAYERS

Market is Dominated by Prominent Companies Operating in the Global Market

Arthrex is estimated to dominate the market owing to its diversified product portfolio and new product launches in the arthroscopic fluid management disposables market. Stryker and Smith & Nephew together hold a major position in the market. Other major players operating in the market are DePuy, ConMed, Zimmer Biomet, Karl Storz, various local companies, and other players. Strategies such as the inauguration of new manufacturing facilities, adoption of new technology, and collaboration with distributors are among the predominant steps taken by the players to establish market share in 2024.

LIST OF KEY COMPANIES PROFILED:

- Arthrex (U.S)

- Stryker (U.S)

- Smith & Nephew (U.K)

- DePuy (U.S)

- Zimmer Biomet (U.S()

- ConMed (U.S)

- Karl Storz (Germany)

- Richard Wolf (U.S)

- Other Players

KEY INDUSTRY DEVELOPMENTS:

- Year 2020: Insightra Medical Inc. announced that the company has agreed to acquire certain assets of Medical Vision AB (Stockholm, Sweden), a company specializing in innovative arthroscopic pumps and fluid management solutions

- Year 2018: Stryker Corporation acquired K2M Group Holdings, Inc. for $1.4 billion. This acquisition will strengthen and expand Stryker's offerings in the arthroscopy, minimally invasive spine portfolio, and increased additive manufacturing capabilities.

REPORT COVERAGE

The Arthroscopy Fluid Management Disposables market research report provides qualitative and quantitative insights on the Arthroscopy Fluid Management Systems industry and a detailed analysis of market size and growth rate for all possible segments in the market. Along with this, the report provides an elaborative market analysis about the market dynamics and competitive landscape. Various key insights provided in the report are the number of joint replacement procedures for key countries, new product launches, the regulatory scenario for key countries, Overview of reimbursement policies in key countries, recent industry developments such as mergers & acquisitions, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size for arthroscopy fluid management disposables was USD 316.68 million in 2026 and is projected to reach USD 674.45 million by 2034.

In 2025, the North American market stood at USD 157.75 million.

The market will exhibit a stunning growth rate of 9.91% during the forecast period (2026-2034).

The pump management disposable segment is expected to be the leading segment in this market.

The increasing number of orthopedic surgeries is a major factor driving the growth of the market.

Arthrex, Smith & Nephew, and Stryker are the major players in the global market.

North America dominated the arthroscopy fluid management disposables market with a market share of 54.69% in 2025.

Improvement in robotic surgeries is expected to drive the adoption of this product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us