Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Function (Human Resources, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, Supply-chain Management), By Technology (Machine Learning, Natural Language Processing, Computer Vision), By Industry (Healthcare, Automotive, Retail, BFSI, Manufacturing, Agriculture) & Regional Forecast, 2026 – 2034

ARTIFICIAL INTELLIGENCE MARKET SIZE AND FUTURE OUTLOOK

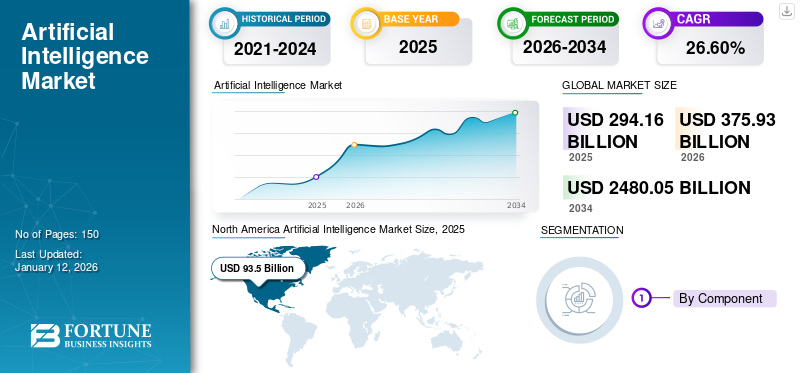

The global artificial intelligence market size was valued at USD 294.16 billion in 2025 and is projected to grow from USD 375.93 billion in 2026 to USD 2480.05 billion by 2034, exhibiting a CAGR of 26.60% during the forecast period. North America dominated the global market with a share of 31.80% in 2025.

The use of machines to simulate human intelligence processes is known as Artificial Intelligence. It involves the development of smart software and hardware to mimic human abilities, such as learning and problem-solving. Many companies are turning to AI to analyze their data for making informed decisions, with approximately 35% of businesses having integrated AI and 9 out of 10 organizations using this technology to stay ahead in the market. Governments worldwide are making substantial investments in AI research and development, and according to Goldman Sachs, global AI investments are projected to reach around USD 200 billion by 2025.

Download Free sample to learn more about this report.

The above graph states that in the year 2024, the total number of AI companies funded in the was 2,049 and U.S. funded were 1,143 AI companies. This signals ongoing interest and optimism in the sector’s potential. Looking ahead, 2025 is anticipated to bring continued innovation, with promising funding opportunities and further growth of the AI market.

What is the impact of generative artificial intelligence on the industry?

AI Technologies Continue to Dominate with Introduction of ChatGPT

Generative AI tools have the capacity to generate text that resembles human writing, covering a wide range of tasks, such as crafting short stories, composing term papers & music, solving math problems, coding basic programs, and performing translations. OpenAI reported that within five days of its release in November 2022, ChatGPT, its AI tool, attracted more than one million users. The statistics below illustrate the length of time it took for popular online services to achieve the same number of users. In comparison, other well-known online platforms required a longer period of time to reach the milestone of one million users.

In response to the recent release of an AI tool, major tech companies across the world have been rolling out their own AI-driven chatbots. These chatbots are designed to compete with ChatGPT and assist these organizations in maintaining their position in this industry. Some of the latest launches in response to ChatGPT include,

- February 2023 – Baidu, Inc. launched its own AI chatbot named Ernie bot in English and Wenxin Yiyan in Chinese. With this, the shares of Baidu increased by more than 13% in Hong Kong.

Thus, ChatGPT's arrival has led to businesses actively engaging and investing in AI technologies to utilize these AI-powered tools. This push for AI technologies has been driving the market growth. This demand is expected to sustain AI's leading position in the years to come.

The expansion of generative AI across various industries globally is expected to continue in 2024. Bloomberg Intelligence (BI) presented a report forecasting the generative AI market to reach USD 1.3 trillion within the next decade. Moreover, as per Fortune Business Insights, the size of the global generative AI market reached USD 43.87 billion in 2023. Presently, generative AI is utilizing transformer-based text generation models and diffusion-based image generation models. These models allow systems to learn from existing data and produce extensive information closely resembling the input data. Additionally, AI models, such as chatGPT and LLM (Large Language Model) are being increasingly applied in sectors, such as banking & financial services, healthcare, and travel & hospitality, leading to reduced human intervention.

What is the impact of reciprocal tariff on artificial intelligence industry?

Artificial intelligence incorporates advanced components such as GPUs, servers, sensors, cameras, and edge computing chips. When tariffs such as the U.S. imposing duties on Chinese AI chips or China retaliating on U.S.-made servers are imposed, it leads to a rise in production costs. Due to this, companies in cloud computing, autonomous systems, and AI research labs are particularly affected due to their dependency on specialized imported hardware. The increasing manufacturing cost leads to higher prices for consumers. Reciprocal tariffs can push companies to reconsider their global sourcing strategies. Key AI components such as FPGA boards, high-performance networking units, and AI servers, may need to be sourced from alternative suppliers or manufacturing sites outside the tariff-imposed countries. These shifts create operational complexities including longer lead times, requalification of new vendors, regulatory re-certifications. Reciprocal tariffs affect company’s ability to export AI-enabled products and services cost-effectively. Firms relying on cross-border AI deployments (cloud AI APIs, smart city solutions, or enterprise AI suites) may face higher compliance costs and need for region-specific deployments or forced localization.

"What are the key AI market trends, breakthroughs, and investment opportunities that will shape the next decade?"

The AI market stands at the brink of a seismic shift, fueled by groundbreaking advancements in quantum AI, neuromorphic computing, and next-gen generative models. Over the next decade, we’ll witness an explosion of investment in AI-driven automation, precision medicine, autonomous systems, and ethical AI governance. But the real game-changer lies in industry convergence—where AI seamlessly intertwines with biotech, finance, and IoT, reshaping entire ecosystems. As AI moves beyond mere efficiency into realms of creativity and autonomous decision-making, businesses must not only adopt but anticipate these disruptions. The future belongs to those who don’t just keep pace with AI’s evolution but actively shape it.

MARKET DYNAMICS

Market Drivers

How AI Assistance for Human Agents will help to grow the market?

AI certainly empowers contact centers with customer-experience chatbots to assist with common inquiries and guide customers to relevant resources. By 2024, AI will support virtual agents by serving as agent assistants. One example is AI's ability to analyze customer sentiment and offer suggested responses to aid human agents in delivering improved customer service. Additionally, AI can handle some of the repetitive tasks that agents usually carry out, such as summarizing and categorizing conversations for future reference.

AI provides comprehensive support for all customer service offerings, handling basic tasks to minimize agent requests. When human agents are needed, AI enhances their effectiveness to improve customer interactions across all touchpoints. As AI advances, it will offer even greater capabilities to assist human agents. Therefore, the adoption of AI assistance for human agents is driving the artificial intelligence market share worldwide.

Market Restraints

Can the All-at-Once Adoption of AI Tools Create Challenges that Might Hamper the Market Growth?

The lack of AI talent in developing countries, challenges associated with the all-at-once adoption of AI tools, and the black box effect account for the market's restraining factors. Companies have upgraded their solutions to counter these factors with more ethical and explainable AI models to eliminate the black box effect. The black box effect means that the AI algorithms sometimes develop results that are not easily verified. The outcomes of these algorithms may have a hidden bias that is difficult to spot. Therefore, there is no sufficient explanation for the results. Thus, users tend to lack trust and safety in adopting AI tools.

Moreover, governments and corporations have been developing research institutes and educational centers to overcome the lack of AI talent globally. Thus, these factors promise to accelerate the growth of this industry across the globe in the coming years.

Market Opportunities

Could offering AI Supercomputers as Service Open up Lucrative Opportunities for Players in the Market?

Supercomputing provides powerful processing capabilities similar to those of High Performance Computing (HPC). However, unlike an HPC server, which can be used to support multiple applications, a supercomputer will only consist of a single computer which can be customized to perform a dedicated task. The pandemic surged the demand for supercomputer clusters, which helped researchers in developing various drugs and enabled governments and other organizations to complete pandemic-related initiatives successfully.

Hyperscalers, such as Microsoft and Hewlett Packard Enterprise (HPE), among others, are engaged in developing and investing in this lucrative market to capture the largest share. These investments and technological expertise help these vendors position themselves as market leaders. For instance, Microsoft Azure released its high precision public cloud supercomputer service which is driven by NVIDIA‘s A100 Tensor Core GPUs. The company joins AWS, Oracle, and Google by launching similar supercomputing-as-a-service offerings, based on NVIDIA’s platform.

- February 2023 - IBM built an AI supercomputer in the cloud to train the company’s massive AI models.

- January, 2022 - Meta built an “AI supercomputer” which is specifically developed to train machine learning systems.

Thus, the increasing popularity of AI supercomputers being offered as a service is expected to create lucrative opportunities for the key vendors operating in the AI market.

ARTIFICIAL INTELLIGENCE MARKET TRENDS

How Quantum AI will Impact the Market?

The use of quantum computing principles in AI is known as Quantum AI. This form of AI is becoming increasingly popular due to its ability to enhance AI algorithms. Quantum AI has the potential to drive advancements in fields, such as material science, complex system optimization, and encryption by rapidly solving intricate problems that traditional computers struggle with. One of the key benefits of Quantum AI is its ability to significantly improve machine learning models by efficiently handling large datasets and performing computations that are currently unfeasible. As Quantum AI continues to evolve, it will catalyze innovation and progress in areas that were previously limited by traditional processing power. This type of AI is poised to revolutionize various industries. For example,

- Quantum AI has the potential to speed up the identification of new molecules for potential therapeutic drugs in the field of drug discovery. With its ability to simulate complex chemical reactions with exceptional accuracy, it may lead to significant advancements in treating diseases that have been difficult to address. The potential impact on human health could be revolutionary.

- In the finance sector, Quantum AI has the potential to revolutionize risk evaluation and portfolio management. Through the analysis of detailed market data and considering countless variables simultaneously, it could offer valuable insights that provide investors with a substantial advantage. It might be able to forecast market patterns with a level of precision that would render today's top algorithms as mere guesswork.

Download Free sample to learn more about this report.

Quantum AI has the potential to enhance climate modeling by improving the accuracy of predictions for climate change and its impacts, which is essential for developing effective mitigation strategies. In the field of cybersecurity, Quantum AI could present both significant risks, such as potentially compromising current encryption methods, and opportunities, such as creating new quantum-resistant encryption. The transformative capabilities of Quantum AI have implications for almost every sector. In manufacturing, it has the potential to enhance supply chains and production processes to an extent that is currently hard to imagine. In transportation, it has the potential to transform traffic management and autonomous vehicle technology. In the energy sector, it could accelerate the development of new, more effective renewable energy technologies.

Major tech companies and startups alike are investing heavily in this field, and governments around the world are launching initiatives to support quantum research and development. Also, players are collaborating to accelerate the development of this form of AI. For instance,

- In July 2024, Zapata and D-Wave formed a partnership to enhance the fusion of quantum AI. The aim of this collaboration is to speed up the development and implementation of combined quantum and generative AI solutions on D-Wave’s Leap cloud platform.

Thus, the popularity of quantum AI will create artificial intelligence market growth opportunities.

How is the market segmented, and what are the key insights from the segmentation analysis?

By Component Insights

Will the increasing adoption of AI across multiple industries contribute to the growth of AI software?

On the basis of component, the market is segmented into hardware, software, and services.

The software dominated the market share by 44.94% in 2026. Demand for AI solutions is increasing as AI software plays a critical role in the entire AI workflow process. A variety of end-to-end AI software platforms are now accessible, offering tools to simplify the training of models for non-data scientists. This reduces reliance on hiring specialists and speeds up development and time-to-market. Additionally, numerous software tools are employed to leverage hardware capabilities and enhance resource management and code efficiency, thus boosting the overall performance of software applications.

Services is estimated to grow with highest CAGR during the forecast period, as more enterprises adopt AI, they seek external expertise for deployment, customization, training, and maintenance and this is driving the demand for AI services. IBM, Accenture, PwC, TCS, and Capgemini report 2–3x growth in demand for AI consulting services from 2022 to 2024.

By Deployment Insights

Is growing cloud adoption among organizations fueling the demand for cloud-based deployment?

Based on deployment, the market is segmented into cloud and on-premise.

The cloud dominates the market in 2026. The cloud segment accounts for 71.64% of the market share in 2025 and expecting a remarkable CAGR of 30.70% during the forecast period. AI keeps developing daily; for instance, the ongoing trend of generative AI has pushed companies to invest in and develop AI tools. This indicates growing demand for cloud solutions across the globe. Moreover, the surge in adopting cloud computing technologies amid the pandemic has further contributed to rising cloud deployments.

On-premise is expected to grow significantly in coming years. On-premise solution ensures that data stays within a specific geographic region, which is crucial for companies operating in jurisdictions with strict data sovereignty laws.

By Enterprise Type Insights

"Is the adoption of AI primarily driven by large enterprises seeking to enhance productivity?"

Based on enterprise type, the market is bifurcated into large enterprises and small and medium-sized enterprises.

The large enterprises captured a large market share in 2024. IBM reports that approximately 42% of large enterprises have implemented AI in their business operations, while 59% of IT professionals at these organizations have confirmed the active deployment of AI. The large enterprises segment holds 58.99% of the market share in 2026.

The small and medium-sized enterprises is expected to register the highest CAGR of 32.10% during the forecast period. Utilizing AI technologies can enhance innovation and performance of SMEs in multiple areas, including financial management, sales & marketing, human capital management, and product development. A SAP study suggests that SMEs can anticipate a 6-10% increase in their revenue by adopting AI.

By Function Insights

Does service operation dominate the market due to its increasing popularity?

Based on function, the market is categorized into human resources, marketing & sales, product/service deployment, service operation, risk, supply-chain management, and others.

The service operation dominates the market in 2024. Artificial intelligence minimizes service management work and further enhances customer service by solving problems more quickly. According to a recent BMC survey, 69% of businesses are implementing advanced technologies, such as artificial intelligence in their IT service management and IT operations management processes, which are called ServiceOps. The reason for integrating AI into their services was to improve operational efficiencies. The service operation accounts 20.86% of the market share in 2026.

Risk is estimated to grow with highest CAGR of 32.40% during the forecast period. Modern enterprises face multi-dimensional risks such as fraud, data breaches, regulatory violations, climate-related impacts, and supply chain disruptions. Traditional risk management systems are static and reactive, whereas AI enables real-time and predictive risk intelligence.

Supply chain management, and marketing/sales functions have been adopting AI at an accelerated pace. These business functions have been leveraging AI to make the most of the technology and enhance their customers’ experience. Thus, in the coming years, these segments are expected to showcase a promising growth rate.

By Technology Insights

Is machine learning leading due to its widespread use for accuracy and precision?

By technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, expert systems.

The machine learning segment accounts for 40.00% of the share in 2025 and estimated to record the highest CAGR of 32.60% during the forecast period as this technology has the ability to improve accuracy and precision of various tasks. It can also process vast amounts of data and identify patterns that might be overlooked by humans. By identifying trends, correlations, and anomalies, machine learning helps businesses and organizations make data-driven decisions. As per Fortune Business Insights, the global machine learning market value is estimated to reach around USD 50 billion by 2025.

The natural language processing is expected to grow significantly during the forecast period. With the help of NLP technologies, such as Interactive Voice Response (IVR), virtual assistants, real-time translation, and chatbots, the efficiency of various business operations is increasing. Natural language processing facilitates seamless collection of data as AI interacts with the customer directly. Also, it builds agility in synchronization of huge data, helps optimize operation cost, and helps enhance business productivity. Technological advancements have brought tremendous accuracy and enhanced productivity in industries.

By Industry Insights

To know how our report can help streamline your business, Speak to Analyst

"Is growing increasing financial fraud driving the BFSI sector to secure the largest share of the market?”

Based on industry, the market has been divided into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy & utilities, and education.

BFSI dominated the market in 2024, AI enables personalized financial advice, chatbots, and omnichannel support are enhancing customer engagement and satisfaction. Implementation of AI in financial institution is being used to develop innovative solutions that address traditional barriers to financial access, allowing more people and small businesses to participate in the formal financial system. According to industry experts, AI could contribute up to 13.6% of the GCC’s GDP through the banking sector alone by 2030, indicating significant efficiency gains. The BFSI segment holds 18.90% of the market share in 2025.

The healthcare industry is expected to record the highest CAGR of 36.50% during the forecast period due to the rising development of artificial intelligence applications specifically targeting this industry. AI is being utilized by healthcare institutions to enhance the efficiency of various processes, ranging from administrative tasks to patient care. According to an IBM study, approximately 64% of patients are open to the use of AI for 24/7 access to answers that support nurses provide. AI can also be employed to detect errors in how patients self-administer medication. For example, as per Nature Medicine study, up to 70% of patients do not adhere to the prescribed dosage of insulin. An AI-powered tool, much like a Wi-Fi router in the patient's environment, can be utilized to identify mistakes in the way a patient uses an insulin pen or inhaler.

ARTIFICIAL INTELLIGENCE MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Artificial Intelligence Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market due to the presence of hyper scalers, such as IBM Corporation, Microsoft Corporation, and others. The recent ongoing generative AI trend has pushed these hyper scalers to upgrade their AI technologies and develop solutions that will cater to changing user requirements. In 2023, around 25% of investments in American start-ups went to AI-related companies. Furthermore, North America plays a vital role in AI technological innovations. Owing to the above-mentioned reasons, the region dominates the market.

The artificial intelligence industry growth in U.S. is expected to experience a strong growth rate during the forecast period. The market size in this country is anticipated to hit USD 82.63 billion in 2026. The U.S. has many newly-funded AI companies. According to the AI index report 2022, 1,392 AI companies worldwide received funding of more than USD 1.5 million each, with the U.S. accounting for 542 of these companies. Furthermore, around 73% of the U.S. companies use AI in some aspect of their business. Generative AI has witnessed significant growth and investment in recent years in the U.S., and as per Fortune Business Insights, the generative artificial intelligence market in the U.S. reached USD 82.63 billion in 2026. According to a Skynova survey in 2023, nearly 80% of U.S.-based small business owners were optimistic about their AI deployments. Furthermore, the U.S.-based respondents were asked about the AI tool they used for sales, marketing, and other use cases, the responses of which are provided in the tabular format below.

Asia Pacific

Asia Pacific market size is estimated to be USD 112.16 billion in 2026 and estimated to witness the second-highest CAGR of 34.70% during the forecast period, due to increasing investments in Artificial Intelligence (AI). AI is projected to add up to USD 3 trillion to the region’s GDP by 2030. Google.org and Asian Development Bank launched AI Opportunity Fund of USD 15 million in May 2024, to equip Asia’s workforce with essential AI knowledge and tools required for the evolving work landscape, thereby ensuring that jobs and roles presented by AI are accessible to more people in the region, especially those from communities with unmet needs.

The market in China is estimated to hit at USD 37.16 billion, followed by India at a significant value of USD 18.08 billion and Japan showcasing a value of USD 20.9 billion in 2026. Countries in the region are focusing on introducing initiatives related to AI safety and are also focusing on advancing their AI capabilities. In February 2025, India and Korea advancing their AI capabilities with dual focus on strengthening sovereignty and deepening collaboration. India announced the plan to provide 18,000 high-end GPU based computing facilities for AI development and in Korea, a Presidential AI Committee meeting outlined a project to develop a world-class large language model (LLM).

Europe

Europe is expected to show significant market size of USD 81.97 billion in 2026, due to its richness in large volumes of public and industrial data, which holds the potential for developments in AI. In February 2025, European Commission launched USD 225 billion initiative named “AI Continent Action Plan” to position Europe at the forefront of AI revolution. In this initiative, around USD 25.51 billion will be provided for AI startups, research institutions, emerging technologies, and gigafactories, which will specialize in training very large AI models. Each facility will have around 100,000 cutting-edge AI chip, around four times more than the AI factories currently being set up.

The U.K. market is estimated to be USD 19.38 billion, with Germany leading behind at USD 14.96 billion in 2026. and France market size at USD 12.12 billion in 2025.

Middle East & Africa

The Middle East & Africa is anticipated to grow at USD 46.71 billion in 2026. In May 2025, Cisco launched a series of strategic initiatives aimed at all phases of the AI revolution in the Gulf region. These initiatives position Cisco at the forefront of this transformation, delivering world-class and trusted technology in collaboration with its partners. The GCC countries are showcasing USD 15.60 billion as the market size in 2025.

South America

The South American market is likely to register a steady growth rate over the forecast period. Global players and local investors are funding AI startups and digital innovation centers in South America. According to Latin American Private Equity and Venture Capital Association, in 2023, AI startup funding in Latin America reached USD 2.5 billion, a 40% increase from previous year.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Artificial intelligence market leaders are upgrading their existing AI solutions to keep up with the changing user requirements. With the recent trend of generative AI tools, companies are upgrading their product portfolio with AI technologies. In addition to the existing AI enhancements, the key players in the AI market are seeking relevant partnerships and acquisitions to offer its clients advanced and enhanced services. This strategy is being adopted by players to combine the best of their own concepts and capabilities with the expertise of acquired partners and technologies available in the market.

List of Key Companies Studied:

- Microsoft Corporation (U.S.)

- com, Inc. (U.S.)

- IBM Corporation (U.S.)

- Alphabet Inc. (Google LLC) (S.)

- com, Inc. (U.S.)

- Baidu, Inc. (China)

- NVIDIA Corporation (S.)

- ai (U.S.)

- Oracle Corporation (S.)

- Hewlett Packard Enterprise Development LP (S.)

- Cisco (U.S.)

- Alibaba Cloud (China)

- Huawei (China)

- Appier (Taiwan)

- Gamaya (Switzerland)

- Hailo (Israel)

- Lumen5 (Canada)

- Graphcore (U.K.)

- OpenAI (U.S.)

… and more

What Are the Latest Key Industry Developments?

- May 2025 – OpenAI has unveiled Codex, a newly developed AI-driven coding assistant now accessible as a research preview to certain ChatGPT subscribers. This release represents a major achievement for the company, indicating its goal to transform how software developers engage with artificial intelligence in their everyday tasks.

- May 2025 – HP has introduced its newest advancement, the OmniBook 5 series of AI-powered PCs, during Computex 2025. These state-of-the-art machines are equipped with Snapdragon X and Snapdragon X Plus processors, which include a specialized neural processing unit (NPU) that can achieve remarkable computational performance of up to 45 tera operations per second (TOPS).

- May 2025 – Oracle revealed that NVIDIA AI Enterprise, a comprehensive, cloud-native software solution designed to enhance data science and simplify the creation and implementation of AI ready for production, will be accessible on Oracle Cloud Infrastructure (OCI).

- May 2025 – OpenAI plans to assist in the construction of a large new data center in the United Arab Emirates, which could potentially become one of the largest globally, marking a substantial investment in the Middle East and a significant increase in the company’s global AI infrastructure goals.

- May 2025 – NVIDIA has launched DGX Cloud Lepton, a cloud-based software solution focused on AI that simplifies the process for AI factories to lease their hardware to developers seeking high-performance computing access worldwide.

What are the Key Factors Influencing Investment Analysis & Opportunities in AI Market?

Several small-sized companies are securing funds to speed up and enhance their Artificial Intelligence ecosystem. As compared to non-AI startups, AI startups are witnessing considerably higher valuations, and this gap continues to widen as they progress. During the B-series funding stage, AI startups are valued 60% higher than their non-AI counterparts. The funding for AI experienced a substantial surge in 2023, with investments in generative AI alone reaching USD 25.2 billion, marking an almost eight-fold increase from 2022. AI-focused startups raised USD 12.2 billion through 1,166 deals in Q1 2024, reflecting a modest 4% increase from the USD 11.7 billion invested in 1,072 deals during Q4 2023. In February 2024, AI companies secured USD 4.7 billion in venture funding, representing over 20% of the total venture capital invested in February.

REPORT COVERAGE

The artificial intelligence market research report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, the report contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Technology

By Function

By Industry

By Region

|

|

Companies Profiled in the Report |

Oracle Corporation (U.S.), Microsoft Corporation (U.S.), Amazon, Inc. (U.S.), Alphabet Inc. (U.S.), Salesforce.com, Inc. (U.S.), Baidu, Inc. (China), NVIDIA Corporation (U.S.), H2O.ai (U.S.), HPE (U.S.), and Others. |

Frequently Asked Questions

The market is projected to reach a valuation of USD 2480.05 billion by 2034.

In 2025, the market was valued at USD 294.16 billion.

The artificial intelligence market is estimated to showcase CAGR of 26.60% during the forecast period.

The software segment is expected to lead the market in terms of share.

Increasing adoption of AI assistance for human agents will boost the market growth.

Oracle Corporation, Microsoft Corporation, Amazon, Inc., Alphabet Inc., Salesforce.com, Inc., Baidu, Inc., NVIDIA Corporation, H2O.ai, and HPE are the top players in the market.

North America is expected to hold the highest market share.

The healthcare industry is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us