Autism Spectrum Disorder Therapeutics Market Size, Share & Industry Analysis, By Drug Type (Antipsychotic Drugs, Selective Serotonin Reuptake Inhibitors, Stimulants, Sleep Medications, and Others), By Disease (Autistic Disorder, Asperger Syndrome, Pervasive Developmental Disorder, and Others), By Age Group (Pediatrics and Adults), By Distribution Channel (Hospital Pharmacies, Drugs Stores & Retail Pharmacies, and Online Pharmacies) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

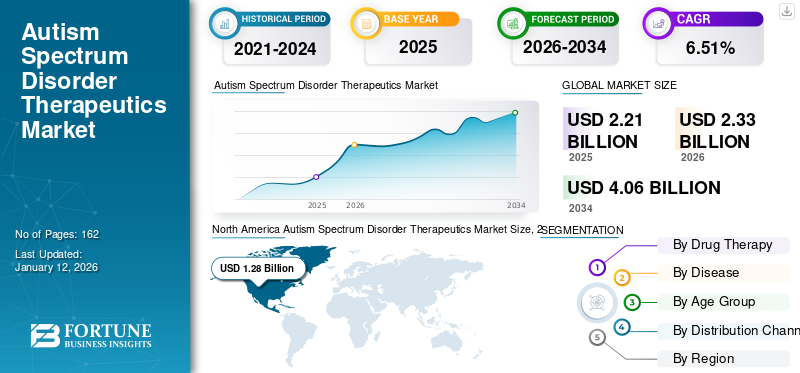

The global autism spectrum disorder therapeutics market size was valued at USD 2.21 billion in 2025 and is projected to grow from USD 2.33 billion in 2026 to USD 4.06 billion by 2034, exhibiting a CAGR of 6.51% during the forecast period. North America dominated the autism spectrum disorder therapeutics market with a market share of 58.1% in 2025.

Autism spectrum disorder, also known as ASD, refers to a group of neurological disorders characterized by persistent deficits in social interaction and communication and a repetitive/restricted pattern of behavior or activities. Autistic disorder, Asperger’s syndrome, and Pervasive Development Disorder (PDD) are the three main types of disorder, which affect millions of people globally. The market is witnessing a considerable expansion trajectory due to growing prevalence of ASD, increasing awareness among the general population, and supportive government initiatives around the world.

Furthermore, the market represents a fragmented structure with the presence of both manufacturers of branded as well as generic forms of drugs. Otsuka Pharmaceutical Co., Ltd., Johnson & Johnson Services Inc., and H. Lundbeck A/S are some of the leading players operating in the market.

MARKET DYNAMICS

MARKET DRIVERS

Government Initiatives to Increase Awareness Regarding ASD to Boost Market Growth

A prominent factor driving the market growth is the increasing number of government initiatives regarding the awareness of autism spectrum disorder (ASD) in several countries. Initiatives include forming various foundations and sanctioning different funding for the awareness of ASD among people. This increasing number of initiatives made by various regulatory bodies for awareness regarding the treatments and therapies available for ASD would eventually lead to early diagnosis of the symptoms and timely treatment through medication and therapies.

- For instance, in May 2025, Brazil’s Ministry of Sports showcased an autism-focused sports program at the 17th Conference of States Parties to the Convention on the Rights of Persons with Disabilities. This program is aimed to promote social inclusion of individuals suffering from autism spectrum disorder (ASD) through sports.

Such an increasing number of initiatives for patients with the condition would eventually lead to early diagnosis of the symptoms and boost the market growth. Furthermore, demand for autism treatment drugs after diagnoses is expected to contribute to the market growth.

MARKET RESTRAINTS

Presence of Complementary and Alternative Therapies for Autism May Limit Market Growth

A key challenge faced by the autism spectrum disorder (ASD) treatment market is the rising use of complementary and alternative medicine (CAM). As these therapies gain popularity among patients and caregivers, they can restrict the uptake of conventional communication and behavioral interventions. Common CAM approaches for ASD include chelation, hyperbaric oxygen therapy (HBOT), acupuncture, dietary modifications, chiropractic care, and others.

- For example, a March 2023 publication by the American Academy of Pediatrics noted that nearly 95% of children with ASD have experimented with at least one form of CAM, highlighting the extensive presence of these alternative treatment options in the patient community.

MARKET OPPORTUNITIES

Development of Drugs Targeting Core ASD Symptoms to Offer Market Growth Opportunities

Currently, there are only two U.S. FDA approved therapies that are commercially available in the market. This has created opportunities for the pharmaceutical companies to discover and develop effective and innovative therapies for autism. The approved therapies such as risperidone and aripiprazole only address irritability and aggression, with core symptoms such as social communication deficits, repetitive behaviors, or sensory processing issues. This offers opportunity for the operating players to capture the unmet market demand and differentiate themselves from existing symptom-management therapies.

- For instance, AB-2004, a first-in-class, small molecule therapeutic developed by Axial Therapeutics, Inc. is a gut-targeted molecule.

MARKET CHALLENGES

High Cost of Treatments to Cause Hindrances to Market Growth

The comprehensive autism spectrum disorder (ASD) treatments, including therapies and medications, can be expensive. This creates financial barriers for many individuals and families, especially those with limited healthcare coverage or high out-of-pocket expenses. This is considered to be a significant challenging factor for the overall autism spectrum disorder therapeutics market growth.

Even though the market has generic versions of approved branded drugs, these formulations remain expensive, resulting in limited access to low- and middle-income countries (LMICs).

- For instance, according to the data published by Northwest Pharmacy in January 2020, the retail cost of Branded Aripiprazole (Abilify) ranges between USD 550 to USD 900 per month.

AUTISM SPECTRUM DISORDER THERAPEUTICS MARKET TRENDS

Innovations & Expansion of Clinical Pipeline for ASD is Identified as Prominent Trend

As there are only two U.S. FDA approved drugs currently available on the market, a significant number of drugs are used off-label to treat the symptoms associated with the disease. This shows the increasing need for innovative therapies to fulfill the growing market requirements. Additionally, the market is witnessing an introduction of new and emerging interventions for autism spectrum disorder (ASD) treatment. This includes biofeedback and neuromodulation, and exploring the potential of oxytocin and glutamatergic agents.

- For instance, Curemark developed a drug CM-AT that received a “Fast Track” designation from the U.S. FDA for children with autism, who have an unusually low level of chymotrypsin. This enzyme is essential for breaking down dietary protein into amino acids that the body cannot make on its own. Due to various positive avenues, enzyme replacement therapy is proving to be a positive therapy for treating this disorder.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug Type

Stimulants to Emerge as the Dominant Segment Due to Decrease of Hyperactivity in People with Autism

In terms of drug type, the global market is segmented into antipsychotic drugs, SSRIs/antidepressants, stimulants, sleep medications, and others.

In 2026, stimulants segment held a dominant market share of 28.65% in the global market. This higher demand is due to the increasing need for growing focus and decreased hyperactivity in autism individuals. Stimulants are primarily prescribed for ADHD comorbidities in ASD patients (hyperactivity, inattention). The segment is expected to expand at a considerably high growth rate during the forecast period. Stimulants substantially contribute to the maintenance of certain symptoms associated with autism.

The SSRIs/antidepressants segment held the second dominant global autism spectrum disorder therapeutics market share. This drug type is the most commonly prescribed class of drug to individuals suffering from autism. Antidepressants are widely used off-label to manage comorbid anxiety, depression, or OCD in ASD, but lack direct ASD approvals. This segment is expected to witness a considerably high growth during the forecast period.

The antipsychotic drugs segment is expected to notice the fastest growth rate during the forecast period as currently, the only two FDA approvals (risperidone and aripiprazole) available to treat the irritability associated with the disorder belong to this segment.

By Disease

Increased Prevalence of Autistic Disorder to Lead to Segment’s Dominance

Based on disease, the global market is segmented into autistic disorder, Asperger syndrome, pervasive developmental disorder, and others.

The autistic disorder segment dominated the market with a share of 55.41% in 2026. The growing concern related to the increasing number of autistic people in the country emphasized healthcare authorities to collaborate with department agencies of distinctive countries and extend their support by providing special education and other support services for children with disabilities.

- For instance, in October 2022, The Turkish Cooperation and Coordination Agency (TIKA) inaugurated the first vocational training center for disadvantaged and autistic people aged between 15 and 45 in Guadalajara municipality in Mexico’s Jalisco state.

Furthermore, according to Pfizer’s report, 1 of every 6 to 8-year-old children are affected by autistic disorder. Therefore, the demand for effective treatment availability is the need of the hour. Hence, pharmaceutical companies are striving to get approvals for products for the management of disorders and reducing the disease burden on the industry.

On the other hand, the pervasive developmental disorder (PDD) captured a notable share in 2024 and is expected to exhibit a swift growth rate over the forecast period. Some of the factors propelling the segment growth include growing adoption of therapeutic options among the patients and increasing prevalence of PDD.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Pediatrics Segment to Witness Fastest Growth Due to Increasing Number of Diagnosed Patients

The global market can be segmented into pediatrics and adults based on the age group.

The pediatrics segment is estimated to witness the fastest growth in the global market owing to rising prevalence of autism spectrum disorders in children. Additionally, increasing awareness among parents regarding the diseases results in growing demand for therapeutics to treat the disease symptoms. Furthermore, the rise in diagnosis of the condition at an early age supports the segment growth.

- According to an article published by YUVA in April 2023, autism spectrum disorders affect 1 in 100 children in India.

However, even with the highest share, the adult segment is likely to grow at a moderate CAGR over the study period. This is due to the relatively lower drug uptake; as adult patients remain underdiagnosed. The adult segment contributing 71.3% globally in 2026

By Distribution Channel

Higher Procurement of Therapeutics through Hospital Pharmacies Augments the Segment Dominance

Based on the distribution channel, the global market is segmented into hospital pharmacies, drug stores & retail pharmacies and online pharmacies.

In 2026, the hospital pharmacies segment captured the leading share of 39.57% in the global market. This is driven by factors such as specialist-led prescriptions, regulatory compliance, and insurance-linked supply chains. These settings play a vital role in initial treatment, ongoing monitoring, and drug safety management.

On the other hand, the drugs stores & retail pharmacies segment held the second-largest market share in 2024 and is expected to expand during the forecast period due to increase in settings usage for procurement of drug refills.

Contrastingly, the online pharmacies segment is estimated to grow at a fastest rate especially in developed countries over the forecast period. This is due to the shifting consumer preference toward online channels owing to their advantages such as at-home delivery.

AUTISM SPECTRUM DISORDER THERAPEUTICS MARKET REGIONAL OUTLOOK

Based on the region, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Autism Spectrum Disorder Therapeutics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, North America dominated the global market with the revenue generation of USD 1.28 billion. Key factors driving the regional growth include increasing the number of autism cases, growing adoption of drugs, and strong support from government authorities. Additionally, a supportive reimbursement scenario for disease treatment in the region also boosted the regional market growth. The U.S. market is projected to reach USD 1.26 billion by 2026.

- For instance, in March 2025, Government of Canada announced a funding of USD 6.3 million to Sinneave Family Foundation for the establishment of a new National Autism Network, in collaboration with Autism Alliance of Canada.

U.S.

The U.S. dominated the North American market with highest market share. The dominance can be attributed to high awareness of autism, favorable reimbursement scenario, rise in prevalence of autism disorders, and other factors. In addition, initiatives undertaken by operating players to create disease awareness also propels the market growth.

- For instance, in October 2023, SUCCESS ON THE SPECTRUM hosted a free autism carnival for everyone with autism.

Europe

The European market held the second leading position in 2024. Rising awareness and screening, increasing access to aid, and broadened diagnostic criteria have supplemented the regional market growth. Additionally, the growing prevalence of autism spectrum disorder in the region has brought opportunities for many pharmaceutical players to introduce new drug therapies in the market and has emphasized them to focus on research and development of drugs. The UK market is projected to reach USD 0.1 billion by 2026, while the Germany market is projected to reach USD 0.07 billion by 2026.

- For instance, Aelis Farma, a France- based clinical-stage biopharmaceutical company is analyzing the feasibility of developing AEF0217 for autism spectrum disorder.

Asia Pacific

Asia Pacific is projected to grow with the highest CAGR due to rising demand for effective treatment in Asian countries. The growing focus of pharmaceutical drug manufacturers and research institutions on research and development of innovative therapies is primarily contributing to the growth of the segment. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.1 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- For instance, in December 2024, a team of Japanese researchers published a study in JCI Insights journal where they stated that low-dose opioids have potential in enhancing social behaviors for individuals with autism spectrum disorder.

Latin America & Middle East Africa

In regions such as Latin America and the Middle East & Africa, a lower rate of reported autism disorders and lack of product approvals has resulted in a slower growth rate than other regions.

COMPETITIVE LANDSCAPE

Key Market Players

Continuous R&D Initiatives and Strong Geographical Presence by Key Players to Boost Market Dominance

Owing to the limited number of U.S. FDA approved drugs for autism spectrum, a significant number of off-label drugs are being used for treatment of symptoms associated with the disease. This results in market fragmentation in terms of competitive structure with the presence of several companies.

Otsuka Pharmaceutical Co., Ltd., Johnson & Johnson Services Inc., and Pfizer Inc. are some of the prominent players in the market. Strong global distribution network, emphasis on R&D initiatives, and presence of approved products are key factors supporting the dominance of these companies in the market.

Furthermore, other key players include Alembic Pharmaceuticals Limited, Teva Pharmaceutical Industries Ltd., and Aurobindo Pharma. These players specialize in the manufacturing of generic versions of the various drugs to treat the condition.

LIST OF KEY AUTISM SPECTRUM DISORDER THERAPEUTICS COMPANIES PROFILED

- Curemark, LLC (U.S.)

- Yamo Pharmaceuticals (U.S.)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AstraZeneca (UK)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Otsuka Holdings Co. Ltd. (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- H. Lundbeck A/S (Denmark)

KEY INDUSTRY DEVELOPMENTS

- February 2025: FamilieSCN2A Foundation entered into a strategic partnership with Cellectricon, aiming at the development of a drug for the top autism and epilepsy gene.

- December 2022: Johnson & Johnson Services, Inc., has JNJ-5279, a new molecular entity under clinical trials for the treatment of generalized anxiety disorder and autism spectrum disorder. The drug candidate has completed phase II study and has strengthened the company’s clinical pipeline.

- March 2022: AstraZeneca supported employees suffering from neurodivergent conditions, including hyperactivity disorder (ADHD), autism, dyslexia, and dyspraxia.

- February 2022: Pfizer Inc., extended its support to Arkuda Therapeutics, a biotechnology company emphasizing on discovering therapies for neurodegenerative diseases.

- February 2021: Janssen Pharmaceuticals, Inc., participated in the EU-AIMS initiative, Aims-2-Trail initiative, and NIMH autism biomarker consortium. This initiative of the company reflects its commitment to new science in this critical therapeutic area.

REPORT COVERAGE

The global autism spectrum disorder therapeutics market forecast provides an in- depth analysis of the industry. It focuses on key facts such as the overview of the drug types, regulatory scenarios by key countries, reimbursement scenarios by key countries, overview of new product launches/approvals, and pipeline analysis. In addition, the market report includes detailed insights into market dynamics, and key industry developments such as mergers, partnerships, & acquisitions. The market analysis also encompasses detailed profiles of key companies operating in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.51% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Type

|

|

By Disease

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.21 billion in 2025 and is projected to reach USD 4.06 billion by 2034

In 2025, the North American market size stood at USD 1.28 billion.

Registering a CAGR of 6.51%, the market will exhibit significant growth in the forecast period (2026-2034).

Among the drug type segment, the stimulants type is expected to lead this market during the forecast period.

The rapidly growing incidence of the condition and increased initiatives for the fast-track product approvals for novel therapeutics are the major key factors that are likely to drive the market in the forthcoming years.

Otsuka Pharmaceutical Co., Ltd., Johnson & Johnson Services Inc., and H. Lundbeck A/S are some of the key players in the global market.

North America dominated the market in terms of share in 2026.

An increasing number of diagnosed patients coupled with rising awareness regarding the disease are expected to drive the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us