Automatic In Motion Checkweighers Market Size, Share & COVID-19 Impact Analysis, By Capacity (Up to 12 kg Checkweigher, 12 to 60 kg Checkweigher, and Above 60 kg Checkweigher), By End-use Industry (Food & Beverage, Pharmaceuticals, Chemical, Automotive, and Others (Personal Care Products)), and Regional Forecast, 2026-2034

Automatic In Motion Checkweighers Market Size

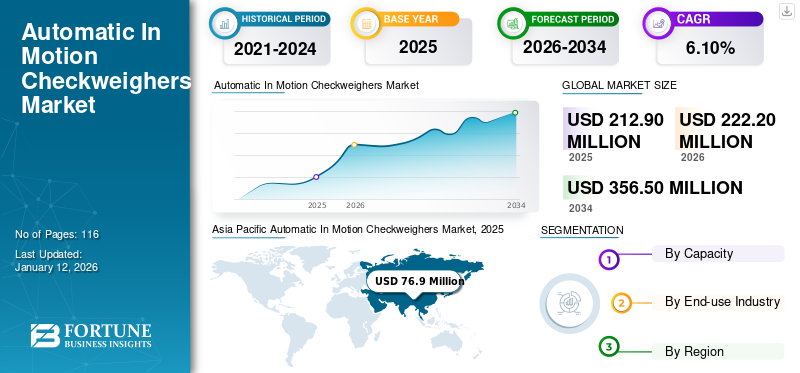

The global automatic in motion checkweighers market size was valued at USD 212.9 million in 2025 and is projected to grow from USD 222.2 million in 2026 to USD 356.5 million by 2034, exhibiting a CAGR of 6.10% during the forecast period. The Asia Pacific dominated global market with a share of 36.10% in 2025.

An automatic in motion checkweigher is used to weigh products under dynamic conditions. These checkweighers transport the products through the production line, weigh them through the transport weighing platform, and remove unqualified products from the production line through the blower rejector. They can check the weight of a moving product 100% automatically.

Global Automatic In Motion Checkweighers Market Overview

Market Size:

- 2025 Value: USD 212.9 million

- 2026 Value: USD 222.2 million

- 2034 Forecast Value: USD 356.5 million

- CAGR (2026–2034): 6.10%

Market Share:

- Regional Leader: Asia Pacific held approximately 36.10% market share in 2025

- Fastest-Growing Region: Asia Pacific, driven by packaging automation and manufacturing expansion

- Top End-Use Segment: Food & beverage industry is the largest user, with strong demand in pharmaceuticals and chemicals

Industry Trends:

- Industry 4.0 Integration: Real-time data, remote monitoring, and predictive maintenance features are increasingly adopted

- Automation Expansion: Seamless integration with robotics, conveyors, and production management systems

- Quality Control Focus: Heightened emphasis on product inspection, compliance, and waste reduction

- Emerging Markets: Growth in Asia Pacific, South America, and Middle East & Africa due to rising industrialization

Driving Factors:

- Stringent Quality Standards: Regulatory and consumer demand for accurate, consistent product weights

- Production Efficiency: Automated checkweighers reduce labor, improve throughput, and minimize errors

- Growth in Key Industries: Expansion in food & beverage, pharmaceuticals, and personal care drives adoption

- Supply Chain Optimization: Real-time weighing data supports inventory management and process control

These checkweighers are generally installed at the back end of production lines, such as production instruments and automatic packaging. The purpose is to dynamically weigh and count product weights, perform sorting, prevent defective products from leaving the factory, and protect consumers while analyzing measurement data for further management of production. The automatic in motion checkweigher can also feed data back to the production equipment. By controlling the production equipment in this way, it can prevent unnecessary loss of raw materials.

COVID-19 IMPACT

Demand For In Motion Checkweighers Increased Due to Introduction of Safety Standards during Pandemic

The pandemic caused disruptions in the global supply chain, impacting the production and delivery of automatic in motion checkweighers. Restrictions on transportation, shortage of raw materials, and temporary closure of manufacturing facilities led to delays and challenges in meeting customer demands. Manufacturers faced difficulties in sourcing components, resulting in extended lead times and reduced production capacities.

However, during the pandemic, industries, such as food & beverage, pharmaceuticals, and healthcare experienced a surge in demand for their products. The increased production volume necessitated stringent quality control measures, including accurate weighing processes. Automatic in motion checkweighers became essential tools for these industries to ensure accurate and efficient weighing, leading to an increased demand for these systems.

Automatic In Motion Checkweighers Market Trends

Expansion of Emerging Markets and Integration of Industry 4.0 to Boost Market Growth

Adopting Industry 4.0 principles and automation in manufacturing and logistics environments is presenting opportunities for automatic in-motion weight checkers. Integration with other innovative factory technologies, such as robotics, conveyor, and production management systems can create a seamless and highly efficient production line.

The ability of automatic in motion checkweighers to provide real-time data and integrate with centralized control systems improves process optimization, inventory management, and supply chain visibility. The digitalization trend is driving the development of advanced features in weight checkers, including real-time monitoring, remote access, and predictive maintenance capabilities.

Download Free sample to learn more about this report.

Automatic In Motion Checkweighers Market Growth Factors

Increased Emphasis on Quality Control to Bolster Market Growth

Industries, such as food & beverage, pharmaceuticals, and manufacturing place a strong emphasis on quality control to ensure product integrity and customer satisfaction. Automatic in motion checkweighers play a vital role in quality control processes by accurately weighing products and identifying any deviations or anomalies.

In the food & beverage industry, for example, maintaining consistent product weights is essential for packaging and pricing accuracy. Overweight or underweight products can lead to customer dissatisfaction, regulatory non-compliance, and financial losses. Automatic in-motion weight checkers ensure that products are weighed accurately and within the specified limits, thereby reducing the risk of delivering non-compliant products to the market.

Similarly, in the pharmaceutical industry, ensuring precise weight measurement of active ingredients in medications is critical for product efficacy, patient safety, and regulatory compliance. Automatic in-motion weight checkers help pharmaceutical manufacturers monitor and control the weight of individual tablets, capsules, or vials, ensuring that they meet the required standards. This factor is contributing toward the automatic in motion checkweighers market growth.

RESTRAINING FACTORS

Limited Applicability in Certain Industries to Hinder Market Development

Some industries deal with fragile or delicate products that cannot withstand the speed and handling of in-motion weighing systems.

- For example, industries that handle glassware, fine china, or sensitive electronic components may require more gentle and controlled weighing methods to prevent damage or breakage. In such cases, alternative weighing techniques, such as static weighing on dedicated scales or specialized enclosures may be preferred over in-motion weight checkers.

Specific industries require non-contact or volumetric measurements instead of weight-based measurements.

- For instance, industries dealing with powders, granules, or liquids may prioritize volumetric measurements, such as fill level, volume, or density, rather than relying solely on weight. In-motion weight checkers are primarily designed for weight-based measurements. Although they can indirectly provide volumetric information, there may be more suitable options for industries prioritizing non-contact or volumetric measurements.

Industries with unconventional packaging or product formats may face challenges with automatic in motion checkweighers. If a business deals with irregularly shaped products, oversized items, or non-standard packaging, achieving accurate and consistent weight measurements with in-motion weight checkers may be challenging. Alternative weighing methods, such as manual or specialized weighing equipment tailored to unique formats may be more suitable.

Automatic In Motion Checkweighers Market Segmentation Analysis

By Capacity

12 to 60 Kg Checkweighers to Gain Major Traction Due to Accuracy & High Weighing Range

Based on capacity, the market is divided into up to 12 kg checkweigher, 12 to 60 kg checkweigher, and above 60 kg checkweigher. The up to 12 kg checkweigher segment is dominating the market due to the presence of regulations and countless codes of practice for inspection of goods and checking their weight. This is to ensure that all commodities in the manufacturing line are weighed precisely and follow the industry’s packaging standards.

The 12 to 60 kg checkweigher is witnessing fastest growth in terms of CAGR and market share with 44.51% in 2026. This growth is attributed to the accuracy of the equipment. Any weighing instrument has two potential points of error that will affect the apparatus and accuracy. First is repeatability, followed by exactness to a known mass, such as a calibrated weight. A 12 to 60kg capacity checkweigher reduces the chance of error due to its high weighing range for any product.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Food & Beverage Industry to be Major End-Users Owing to High Adoption of Product Inspection Techniques

Based on end-use industry, the automatic in motion checkweighers market is classified into food & beverage, pharmaceuticals, chemical, automotive, and others (personal care products). The food & beverage segment is gaining major traction & leading this market share with 35.01% in 2026 as this inspection technique provides the means to process products at an accurate weight. This is precisely where the competing demands of food safety and food waste overlap – and where the latest inspection technology can help cut waste and ensure safety and quality.

The pharmaceuticals industry is experiencing a rise in the demand for these checkweighers as they verify whether the final products are fitting within the quality control guidelines. It is quite significant to distribute a valid and consistent amount of products to a consumer to ensure product safety and consumer satisfaction.

REGIONAL INSIGHTS

The report's scope comprises five major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Automatic In Motion Checkweighers Market, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 76.9 million in 2025 and USD 80.8 million in 2026. Asia Pacific is anticipated to increasingly require automatic checkweighers. Consumer awareness regarding labeling and packaging of finished products has increased as the packaging industry is expanding. This scenario has also increased the need for automation. The biggest markets for automatic checkweighers will continue to be Australia, South Korea, Japan, China, and India. The Japan market is projected to reach USD 13.2 million by 2026, the China market is projected to reach USD 37.9 million by 2026, and the India market is projected to reach USD 6.7 million by 2026.

North America

North America exhibited a noteworthy growth in this market, especially the U.S. The country’s market size grew due to the growth of its food & beverage and pharmaceutical industries over the years and is considered to be a mature market due to significant expenditure in manufacturing. Also, the U.S. is consistently working on upgrading its manufacturing techniques, lowering its cost of production, and packaging process. The U.S. market is projected to reach USD 45.9 million by 2026.

Europe

Europe is a significant market for automatic in motion checkweighers due to the wide variety of industries that need production checkers, such as chemical, food & beverage, and many others. The market’s growth in this region is anticipated to be driven by the rising demand for potable water and existence of strict regulations relating to water treatment. Moreover, a number of conveyor belts and an indicator that displays the weight reading are features found on a majority of checkweighers, which is further driving the regional automatic in motion checkweighers market share. The UK market is projected to reach USD 13.9 million by 2026, while the Germany market is projected to reach USD 22.4 million by 2026.

South America

South America is expected to grow at a moderate rate during the forecast period. The market’s growth in the region is supported by the surge in R&D investments in food & beverage and pharmaceutical industries, boost in technological advancements, and increase in high-tech inspection machines. Furthermore, in the Middle East & Africa, the market’s rise is on account of strong growth in the medical sector, increasing aging population across the region, and investment in new manufacturing facilities.

KEY INDUSTRY PLAYERS

Rising Rate of Industrialization & Companies’ Focus on Product Expansion to Create Substantial Growth Opportunities

This market is highly competitive with the presence of multiple players operating at a global level as well as certain regions where the domestic players have a substantial market share. Anritsu Corporation, METTLER TOLEDO, Minebea Intec GmbH, Thermo Fisher Scientific Inc., and Ishida Co., Ltd. are the prominent players in the market, accounting for a decent market share.

List of Top Automatic In Motion Checkweighers Companies:

- Nimax (Italy)

- Anritsu Corporation (Japan)

- Ishida Co., Ltd. (Japan)

- Loma Systems (U.K.)

- METTLER TOLEDO (U.S.)

- Minebea Intec GmbH (Germany)

- MULTIVAC (Germany)

- PRISMA INDUSTRIALE S.r.l. (Italy)

- Thermo Fisher Scientific Inc. (U.S.)

- Wipotec Group (Germany)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: The Wipotec Group established a subsidiary in Australia as part of its expansion strategy.

- March 2021: Mettler-Toledo announced the acquisition of PendoTECH, a company that manufactures transmitters, single-use sensors, control systems, and software for monitoring, measuring, and collecting data primarily in the bioprocess applications industry.

- February 2020: Mettler-Toledo acquired D.C. Martin & Son Scales, a company that sells, installs, maintains, and calibrates industrial weighing and scales systems.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Capacity

By End-use Industry

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 356.5 million by 2034.

In 2025, the market was valued at USD 212.9 million.

The market is projected to record a CAGR of 6.10% during the forecast period.

The 12 to 60 kg checkweigher capacity segment is expected to lead the market.

Increased emphasis on quality control is one of the key factors driving market growth.

Nimax, Anritsu Corporation, Ishida Co., Ltd., Loma Systems, METTLER TOLEDO, Minebea Intec GmbH, MULTIVAC, PRISMA INDUSTRIALE S.r.l., Thermo Fisher Scientific Inc., Wipotec Group are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By end-use industry, the food & beverage sector is expected to register a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us