Automation Testing Market Size, Share & Industry Analysis, By Component (Solution (API Testing, Performance Testing, Test Management, Code Quality, and Others) and Services), By Testing Type (Static and Dynamic), By Interface (Desktop Testing, Web Testing, Mobile Testing, and Test Design), By Vertical (BFSI, IT & Telecom, Manufacturing, Retail, Healthcare, Government, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

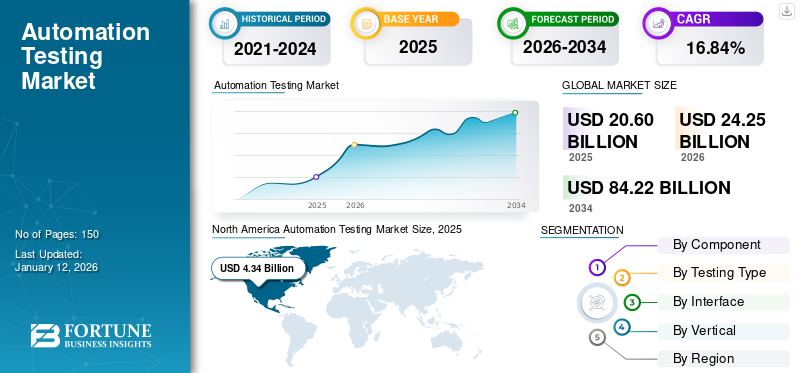

The global automation testing market size was valued at USD 20.60 billion in 2025 and is projected to grow from USD 24.25 billion in 2026 to USD 84.22 billion by 2034, exhibiting a CAGR of 16.84% during the forecast period. Asia Pacific dominated the automation testing market with a market share of 34.78% in 2025.

Automated tests are best suited for large or repetitive test cases.The method of running the same test suite recurrently is time-consuming. Therefore, with a test automation tool, it is much quicker to inscribe the test suite, re-play it as requisite, reduce human interaction, and advance ROI testing. For instance,

- June 2023: Appium is a popular open-source automated mobile app testing framework. It allows developers to automate the testing of hybrid or native iOS and Android applications. In this, the developers can use various online and mobile testing platforms to test their programs and applications on real and virtual devices before release.

Agile and DevOps approaches also enable rapid troubleshooting, post-deployment debugging, and software integration of unexpected changes. These benefits are expected to drive the demand for elegant DevOps-based automated analytics across a variety of sectors, including financial services, government, automotive, telecommunications, and public administration. To stay competitive, various market players are focusing on developing test automation solutions based on Agile and DevOps methodologies.

COVID-19 has had a significant impact on various industries, and the field of automation testing is one of them. The pandemic affected the testing market in the initial quarter of lockdown. During this period, the demand for digital products and services has increased as more and more people relied on online platforms for work, education, shopping, and entertainment.

Automation Testing Market Trends

Increase in Agile and DevOps Practices in Software Development to Enhance the Market Growth

The increasing adoption of advanced technologies such as Agile and DevOps practices is driving the growth of the market. Automation testing aligns well with these practices, as it allows continuous testing and integration, ensuring that software changes are thoroughly tested before deployment.

In an agile environment with iterative and incremental modeling, test automation delivers rapid quality in sprints as features can be developed and tested quickly. In this development process, software is developed in small iterations, with different features being tested and added in each iteration. Agile test automation allows the testing team to keep up with the speedy pace of advancement by automating the testing of time-consuming and repetitive tasks, such as regression testing.

However, cloud-based test automation tools allow teams to access the tool from any device and collaborate toward delivering a quality product. Thus, it has also been observed that the number of tests keeps growing exponentially with each iteration in agile scenarios. The automation tool will handle it efficiently and ensure an early launch. In addition, under agile, individuals can automate functional and regression testing to ensure that the product works quickly and exactly as required. For instance,

- October 2022: Tricentis, an enterprise continuous testing firm, announced the launch of new products such as Tricentis NeoLoad 9.0, Tricentis Test Management of Jira, and Tricentis Test Automation for Salesforce. The solutions expand the company's market-leading capabilities in continuous performance testing, test management, and test automation to improve application quality and delivery time for better business-critical outcomes.

Therefore, these benefits are expected to increase the demand for sophisticated DevOps-based automated analytics in various industries, including money services, telecommunications, automotive, government, and the public. Thus, to stay competitive, several market players are aiming to create test automation solutions based on Agile and DevOps methodologies.

Download Free sample to learn more about this report.

Automation Testing Market Growth Factors

Integration of AI and Machine Learning in Test Automation to Boost the Market

The growing need to automate testing processes and solutions to deliver seamless customer experiences and the increasing use of advanced AI-enabled technologies for software testing environments are driving test market automation. However, factors such as the increasing complexity of transitioning from manual to automated testing will likely hold back the market growth in the coming years. Thus, Artificial Intelligence (AI) and Machine Learning (ML) are key drivers of automation testing as AI is gaining popularity in all aspects of testing such as automation, regression, functional, and performance testing.

In addition, there is increasing adoption of cloud-based automation tools as they are agile, cost-effective, and scalable, and thus are popular among SMEs and startups. Therefore, integrating machine learning and artificial intelligence in cloud-based testing significantly facilitates the use of tools, which is expected to promote the automation testing market growth.

RESTRAINING FACTORS

Lack of Data Security in Test Automation May Hinder the Market Growth

When executing automation testing solutions, data security is one of the most significant factors to consider. With the popularity of connected smart systems, IoT-enabled devices are gathering and transmitting huge amounts of data, which exposes them to numerous dangers.

Data theft is a continual threat to organizations and businesses in the current cyber threat scenario. Additionally, numerous flaws are frequently found when using the software, which entails debugging the complete process before proceeding, making the process time-consuming and expensive. All these factors are estimated to restrain revenue growth to some extent.

Automation Testing Market Segmentation Analysis

By Component Analysis

Growing Adoption of Professional Services to Drive Market Growth

Based on component, the market is segmented into solution and services.

The services segment accounting for 54.75% of the market share in 2026 due to the growing utilization of specialized consulting and implementation services to assist organizations in establishing and optimizing their automated testing processes. Third-party vendors or consulting firms typically provide these services with expertise in test automation and testing best practices. Thus, adopting professional services in testing is beneficial, particularly for organizations that lack in-house expertise or want to accelerate their test automation initiatives.

Additionally, the solution segment is predicted to grow with the highest CAGR during the forecast period. Adopting automation testing solutions allows organizations to achieve faster testing cycles, improve test coverage, and reduce the reliance on manual testing efforts. In addition, these solutions contribute to delivering high-quality software products while optimizing testing efforts and resources. Therefore, selecting the right testing solutions based on specific project requirements and goals is crucial to maximizing the benefits of test automation.

By Testing Type Analysis

Static Testing to Gain Traction with Rising Demand for Software Applications

By testing type, the market is bifurcated into static and dynamic.

The static segment held a major market share in 2022 as it enabled users to examine the documents and find out mistakes, redundancies, and ambiguities. In addition, static testing also enhances collaboration among team members and promotes better quality code, leading to more effective and efficient automation testing processes.

Furthermore, the dynamic segment dominated the market with a 59.50% share in 2026. The method is implemented for error detection by code execution. These tests help increase the efficiency and accuracy of testing and the number of test cases executed, resulting in faster and more efficient software deployment.

By Interface Analysis

Rapid Growth in the Adoption of Desktop Testing to Boost the Market Growth

Based on interface, the market is segmented into desktop testing, web testing, mobile testing, and test design.

Desktop testing holds the highest market share as the product is deployed in the process of testing applications specifically on desktop operating systems, including Windows, macOS, and Linux. Therefore, it is an essential part of software testing, especially for applications that are primarily desktop-based. Thus, the adoption of these software applications, especially in industries where cloud-based or web applications, may not be feasible or secure enough. This testing remains essential in such scenarios.

The web testing segment accounted for 33.57% of the market share in 2026. It is the process of testing web applications and websites to ensure they function correctly, perform well, and deliver a positive user experience across different web browsers and devices. The shift toward web-based applications has been significant due to their accessibility across cross-platform compatibility and ease of deployment. The increasing demand for web-based applications across businesses creates a growth opportunity for market players.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Testing Platforms in the Healthcare Industry to Increase Product Adoption

By vertical, the market is segmented into BFSI, IT & telecom, manufacturing, retail, healthcare, government, and others.

The healthcare segment epresented the largest sub-segment, holding a 26.99% share in 2026 due to its significant digital transformation, with a greater reliance on software applications, Electronic Health Records (EHRs), medical devices, and other technologies to improve patient care, enhance operational efficiency, and ensure regulatory compliance. Thus, test automation plays a crucial role in the healthcare industry.

The BFSI segment holds the highest CAGR during the forecast period as it heavily relies on software applications to deliver a wide range of financial services to customers, manage transactions, and ensure regulatory compliance. Furthermore, automation testing allows BFSI organizations to accelerate their testing processes and release software updates more quickly. Thus, this is crucial in a highly competitive industry where time-to-market can make a significant difference. As the industry continues to evolve with technological advancements, adopting these tests will remain a strategic imperative for BFSI organizations to stay competitive, secure, and compliant while meeting the evolving needs of their customers.

REGIONAL INSIGHTS

In terms of region, the global market is divided into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into countries.

North America Automation Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America holds the largest global automation testing market share in the market due to its growing popularity of cloud-based testing and increasing adoption of Agile and DevOps methodologies.

In addition, technologically advanced companies such as Amazon, Google, Microsoft, and Apple are investing heavily in test automation to improve the quality of their software products.

Moreover, the region’s growth is attributed to the huge presence of leading testing vendors such as IBM, HP, and Tricentis, providing a wide range of testing solutions to meet the needs of businesses in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to witness rapid growth during the forecast period due to the rising demand for mobile applications. Mobile applications are becoming increasingly complex and require a high level of quality assurance. Therefore, automation testing in this region helps ensure that mobile applications are free of defects and meet users' needs.The Japan market reaching USD 1.69 billion by 2026, the China market reaching USD 1.98 billion by 2026, and the India market reaching USD 1.80 billion by 2026.

Europe

Europe is expected to exhibit stable growth during the forecast period. The regional growth can be attributed to various government initiatives to support digitization, cloud computing, and automation in numerous industries and public enterprises. Companies operating in the European testing market also aim to incorporate numerous business strategies to advance new tools & software solutions and showcase high competitiveness among other players. The UK market reaching USD 0.81 billion by 2026 and the Germany market reaching USD 0.89 billion by 2026.

South America

Similarly, South America shows significant growth in the testing market as the cost of labour increases, and businesses are looking for ways to reduce their testing costs. Additionally, the complexity of software applications is rising. As software becomes more complex, it becomes more difficult to test them manually. Thus, testing in the region helps businesses to test their software applications more effectively.

Middle East & Africa

The Middle East & Africa (MEA) market is expected to witness growth in the coming years. The extensive distribution of technology providers is driving the market in the region. Increased popularity of smart consumer devices, such as home appliances, smart TVs, and laptops is driving the market growth. Web applications, software, and Operating Systems (OS) are closely related to smart consumer electronics.

Key Industry Players

Market Players Focus on Business Expansion Strategies to Gain Strong Footing

The top players are focused on expanding their geographical boundaries across the globe by introducing industry-specific solutions. These players are strategically collaborating and acquiring local players to gain a strong foothold in the region. Moreover, key players in the market are introducing new products to attract and retain their customer base. Besides, continuous investments toward the research and development of product offerings are propelling global market growth. By adopting such corporate strategies, players sustain their competitiveness in the market.

List of Top Automation Testing Companies:

- Accenture (Ireland)

- Microsoft (U.S.)

- Tricentis (Austria)

- SmartBear Software (U.S.)

- Ranorex (U.S.)

- Parasoft (India)

- Cigniti Technologies Limited (U.S.)

- Applitools (U.S.)

- Cygnet Infotech (India)

- IBM (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: Tricentis patented the faster optical character recognition technology to automate AI testing. The single-pass OCR methodology and system were developed as the technology for Vision AI, the AI-based test automation capability of Tricentis Tosca, the company's intelligent test automation product.

- June 2023: ESCRIBA AG, a provider of scanning software and solutions, partnered with Software AG, bringing further innovation to the global market. The Software AG partnership provides the ideal tool for end-to-end applications to drive digital transformation in businesses of all sizes and industries.

- May 2023: UiPath partnered with Peraton to offer the UiPath business automation platform as a managed service based on the cloud for high-security environments in the U.S. intelligence, civilian agencies, and defense sector. Through this partnership, the company will bring the benefits of its AI-powered automation platform, UiPath, as a managed service in sensitive environments via the cloud or on-premises deployment model.

- April 2023: Emerson announced the acquisition of NI for USD 60 per share in cash at an equity value of USD 8.2 billion. With this expansion into testing and measurement, Emerson would enhance its automation capabilities and attract more customers to trust NI solutions at critical development stages. These capabilities would enable Emerson to expand into attractive and growing distinct markets such as transportation and electric vehicles, semiconductors and electronics, aerospace and defence, and markets ready to benefit from long-term growth trends.

- March 2023: Crank AMETEK declared the launch of a powerful new embedded GUI testing framework built into Storyboards for visitors to Embedded World 2023. The launch software is a powerful, easy-to-use GUI testing framework that makes sense to modernize the testing process for GUI development built-in Application Storyboard, improving development efficiency.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.84% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Testing Type

By Interface

By Vertical

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market value is projected to reach USD 84.22 billion by 2034.

In 2025, the market was valued at USD 20.60 billion.

The market is projected to register a CAGR of 16.84.

The desktop testing segment is expected to lead the market.

Advancements associated with artificial intelligence and machine learning in automation testing to drive the market growth.

Accenture, Microsoft, Tricentis, SmartBear Software, Ranorex, Parasoft, Cigniti Technologies Limited, Applitools, Cygnet Infotech, and IBM are the top players in the market.

North America is expected to hold the highest market share.

By vertical, the BFSI is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us