Automotive Air Filters Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Product Type (Air Intake Filters and Cabin Air Filters), By End-User (OEM and Aftermarket) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

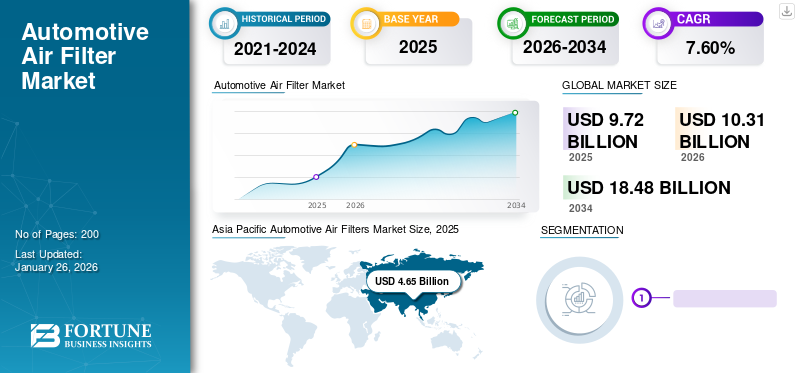

The global automotive air filters market size was valued at USD 9.72 billion in 2025. The market is projected to grow from USD 10.31 billion in 2026 to USD 18.48 billion by 2034, exhibiting a CAGR of 7.60% during the forecast period. Asia Pacific dominated the global market with a share of 47.86% in 2025. The automotive air filter market in the U.S. is projected to grow significantly, reaching an estimated value of USD 3,677.9 million by 2032, driven by the growing advancements in filtration technology such as HEPA filters and SmartFilte.

An automotive air filter is designed to capture dust particles, dirt, sand, and other debris from the outside air. It prevents them from damaging the engine parts, cylinder walls, and piston rings and reaching the combustion chamber. Automotive air filters come in various types, including paper, foam, cotton, and synthetic materials, and they require periodic replacement or cleaning to maintain their effectiveness.

Download Free sample to learn more about this report.

Global Automotive Air Filters Market Overview

Market Size:

- 2025 Value: USD 9.72 billion

- 2026 Value: USD 10.31 billion

- 2034 Forecast Value: USD 18.48 million, with a CAGR of 7.60% from 2026–2034

Market Share:

- Asia Pacific dominated in 2026 with a regional share of 47.83%, valued at around USD 4.27 billion, owing to strong passenger vehicle demand in China, India, and Malaysia.

- North America is expected to grow steadily, with the U.S. automotive air filters market projected to reach USD 3,677.9 million by 2032.

- Other significant regions include Europe and the Rest of the World, driven by emissions regulations and rising aftermarket demand.

Industry Trends:

- A surge in demand for high-performance filters (e.g. HEPA, advanced particulate systems) to maximize engine protection and airflow efficiency.

- Automotive OEMs and aftermarket brands are launching advanced filter products to meet diesel engine requirements of 99.9% particulate efficiency and extended lifespan.

- Cabin air filters and air intake filters remain dominant product types, driven by increasing consumer awareness of air quality and health.

Driving Factors:

- Increasing vehicle production and sales, especially in emerging markets, is fuelling demand for engine protection and performance-enhancing filters.

- Stringent emission and air quality regulations, such as EPA mandates and diesel particulate standards, push adoption of more efficient filtration systems.

- Growing health and environmental awareness among consumers increases demand for cabin air filters with HEPA-grade performance.

- Technological advancements in filtration media and materials—-driven by R&D investments in filtration solutions for engine performance and longevity.

- Rising EV adoption poses a constraint, as electric vehicles do not require traditional engine air filters, potentially reducing future demand.

The demand for automotive air filters is primarily driven by factors such as increasing vehicle production, stringent emission regulations, growing awareness of air pollution and its impact on health, and the need for improved engine performance and fuel efficiency.

The global automobile manufacturing industry was severely impacted by the outbreak of COVID-19 and halted the production of vehicles worldwide. Since the growth of this industry is directly proportional to the production of vehicles, the decline in sales of vehicles negatively impacted the automotive air filter market growth. Moreover, the high cost of filters, disruptions in the supply chain, shortage of raw materials & labor, and price fluctuations slowed the growth of automotive air filters.

Automotive Air Filters Market Trends

Surge in Demand for High-Performance Air Filters Set a Positive Trend in the market

Manufacturers are focused on providing new and advanced air filtration products with improved particulate-capturing efficiency to ensure optimal engine performance.

Proper air filtration is vital to ensure the proper functionality of a vehicle’s engine. Most diesel engine manufacturers require air filters to be at least 99.9% efficient for eliminating particulate from the air to prevent premature wear and fouling of components such as turbochargers, cylinder walls, charged air coolers, and piston rings. Air filter manufacturers are investing in new technologies to increase dirt-holding caspacity and particle-removal efficiency and reduce air flow restriction to ensure optimal engine performance.

For instance, in February 2021, Champion Laboratories, Inc., filter brand, Luber-finer, launched Finer-Flow, an advanced air filter designed for heavy-duty automotive engines. Finer-Flow filters are integrated with enhanced filtration technology to maximize airflow and provide greater engine protection from harmful pollutants. These filters are made with a rugged, high-impact plastic frame for added durability and contain a soft gasket for precision sealing and easy installation.

Automotive Air Filters Market Growth Factors

Implementation of Stringent Government Regulations for Cleaner Air and Rise in Auto Sales is Driving Market Growth

The introduction of stringent government regulations to control air pollution levels is one of the major factors driving the demand for automotive air filters. For instance, the U.S. government introduced the Clean Air Act that requires new engines and equipment distributed in the U.S. to be certified to meet The Environmental Protection Agency (EPA)-established emissions standards to protect public health and the environment from air pollution. Similarly, in February 2022, (EPA) proposed a rule to reduce air pollution from heavy-duty vehicles and engines, including ozone, particulate matter, and greenhouse gases. Moreover, the surge in auto sales, especially cars, and growing awareness among consumers regarding the importance of air filters for purified air in cars will further drive the automotive air filter market over the forecast period. For instance, GM and Toyota expect auto sales to increase to nearly 15 million by 2023, a roughly 9% increase over 2022.

RESTRAINING FACTORS

Growing Adoption of Electric Vehicles May Restrain Market Growth of Automotive Air Filters

The shift in mobility preference from ICEs to EVs to control emission levels may restrain the sale of automotive air filters, as EVs do not have engine air filters. EVs consist of only two filters battery air filter and cabin air filter. The growing EV sales are predicted to hamper the market size of automotive air filters over the forecast period.

Automotive Air Filters Market Segmentation Analysis

By Product Type Analysis

Air Intake Filters to Register a Higher CAGR Owing to their Booming Sale

Based on the product type, the market is bifurcated into air intake filters and cabin air filters.

The air intake filters segment held the major automotive air filter market share contributing 74.67% globally in 2026. These filters are placed in engines. Growing investments in R&D activities by automotive companies to improve the engine's performance and develop solutions to minimize emission levels in adherence to environmental laws are major drivers propelling the market growth of automotive air filters. For instance, in May 2020, Donaldson Company, Inc., one of the leading manufacturers of filtration products and solutions, launched its Filter Minder, a wireless monitoring system for air filters on heavy-duty engines. This wireless monitoring system optimizes fleet maintenance practices in on-road truck fleets and off-road equipment. With the help of this connected technology, fleet maintenance managers can make an informed decision regarding air filtration maintenance instead of changing filters based on distance intervals.

Cabin air filters held a significant market share in 2023. The cabin air filter is a major component of a vehicle’s ventilation system. The cabin air filter, filters the air entering the vehicle's cabin through heating and air conditioning. It ensures that there is a proper ventilation system for the health and safety of all passengers. Besides improving every passenger's health and quality of life, cabin air filters also help reduce vehicle maintenance costs. Dirty, contaminated air restricts airflow and forces a vehicle’s ventilation system to work harder. This causes air conditioners to operate less efficiently, reducing the vehicle’s horsepower. All these factors support the growing demand for cabin air filters.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Aftermarket Segment Is Expected to Dominate the Market Owing to the Entrance of New Players

The market is categorized into OEM and aftermarket based on end-user. The aftermarket segment is currently the largest shareholder and is anticipated to maintain its dominance in the global market.

The aftermarket segment in the market is surging owing to the entrance of new market players who are focused on providing good quality, reliable, and affordable air filters, with a share of 66.91% in 2026. The growing need for the aftermarket services such as maintenance, repair, and customization also indirectly supports the segment's growth. Moreover, OEMs are tapping into aftermarket services by expanding their core businesses in parts, repair, and maintenance services. For instance, in October 2022, Premium Guard Inc., one of the market leaders in aftermarket filtration solutions, introduced an all-new premium engine air filter solution, HIGHFLOW Premium Air Filters, for light-duty vehicles.

The premium air filter solution is designed to protect the engine and optimize vehicle performance without compromising the efficiency of internal engine components. The product is designed for high flow, high-capacity performance for 12,000 miles.

The OEM segment held a significant market share in 2023. The rising production of vehicles is a major factor driving the segment's growth. OEMs in the automotive industry primarily offer high-quality air filters to increase fuel economy and enhance passenger comfort. According to OICA’s report, passenger cars and commercial vehicles production in 2021 stood at over 80 million, a 3% increase over 2020. The upward trend of vehicle production, in turn, will increase the deployment of air filters over the forecast period.

By Vehicle Type Analysis

Light Commercial Vehicle Led in 2023 Due to High Adoption of Filters

By vehicle type, the market is classified into passenger cars, light commercial vehicles, and heavy commercial vehicles, accounting for 61.48% market share in 2026. Increasing awareness about the benefits of air filters amongst the people to ensure fuel efficiency, and increase engine life, is anticipated to propel the growth of the passenger car segment. Also, increasing passenger car sales worldwide, especially electric vehicles, is also expected to drive the passenger car segment. In 2023, around 75.3 million passenger cars were sold across the globe, which is a nearly 12% increase over the previous year.

The heavy commercial vehicle segment is estimated to grow at a CAGR of 5.4% over the forecast period. The positive market outlook can be attributed to frequent air filter replacements in commercial vehicles. Rapid industrialization growing logistics industry are some of the reasons driving the sale of heavy commercial vehicles. In addition, the frequent use of heavy commercial vehicles for different industrial applications daily requires high maintenance for major components, including engines and air filters. Thus, regular use of such components results in high wear & tear, which contributes majorly to aftermarket services of the market.

The light commercial vehicle segment held a significant automotive air filter market share in 2023 and is growing at a CAGR of 3.4% over the forecast period. Air filters are witnessing significant adoption in light commercial vehicles to keep vehicles, drivers, and engines safe. Moreover, high commercial usage of pickup trucks and vans requires timely air filter replacement to ensure proper engine working. New product launches for light commercial vehicles will drive segmental growth. For instance, in September 2022, MANN-Filter expanded its product portfolio of air filters for light commercial vehicles offering 95% market coverage for vehicle fleets in the European market.

REGIONAL ANALYSIS

Asia Pacific is the largest market in terms of value. It will dominate in the forecast period.

Asia Pacific Automotive Air Filters Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific’s market size dominated the global market in 2023 at USD 4.27 billion and is estimated to grow at a CAGR of 6.6% through the forecast period. Growing demand for passenger cars across major Asia countries such as China, India, and Malaysia is leading to rising demand for air filters, thereby driving regional growth. The rise in pollution levels and the dire need to improve the air quality index further propel the demand for highly efficient air filters.

North America is expected to show significant growth over the forecast period. The positive market outlook can be attributed to increased vehicle sales, adoption of the latest technology, increasing demand for efficient & safe driving, and many others. The U.S. market is valued at USD 2.22 billion by 2026.

The rapid expansion of aftermarket services and the presence of leading automotive players are driving the Europe air filters market growth. Moreover, stringent government regulations to control vehicular emission levels and protect human health drive the demand for high-performing automotive air filters. In August 2020, Land Rover launched a new cabin air system to block harmful emissions entering its 4x4s. The new technology filters out harmful air particulates. The new cabin air purification system purifies and recirculates air within the cabin to keep drivers and passengers healthier on the road. The UK market is valued at USD 0.6 billion by 2026, while the Germany market is valued at USD 4.56 billion by 2026.

List of Key Companies in Automotive Air Filters Market

Companies are Emphasizing on New Product Launches and Partnerships to Gain Competitive Edge

The companies are focusing on cost-reduction strategies, strategic partnerships, and acquisitions to enhance their product offerings. For instance, In October 2021, Honda Car, in partnership with Freudenberg, launched a new air filter to keep pollutants, harmful germs, and even viruses out of the vehicle to keep the occupants safe.

List of Key Companies Profiled:

- Mann+Hummel GmbH (Germany)

- K&N Engineering, Inc. (U.S.)

- Denso Corporation (Japan)

- Donaldson Company, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Cummins, Inc. (U.S.)

- Hengst SE (Germany)

- Parker Hannifin Corporation (U.S.)

- Ahlstrom Corporation (Finland)

- Lydall Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In January 2024, Bosch announced that the company is replacing the proven FILTER+ cabin filter with the enhanced FILTER+pro. Following extensive air-quality tests, the independent certification body OFI CERT, based in Vienna, Austria, had previously confirmed the product’s excellent filtration performance.

- In December 2023, Uno Minda signed a partnership contract with Roki to provide a wide range of automotive filters, consisting of air filters, oil filters, and fuel filters, in the Indian aftermarket for commercial vehicles. The new Uno Minda car filters block fine particles, improve performance, and reduce wear and tear of engine components. The air filter is designed to safeguard the engine against impurities. In contrast, the fuel filter is designed to screen out dust and dirt particles and water content from the fuel, which can have adverse effects on the fuel injection and engine components.

- In January 2023, the MANN+HUMMEL Group announced that the company had made a strategic investment in M-Filter Group. The company's majority of growth investment will be used to drive product expansion and allow it to invest in sales and operational capabilities. The agreement would help strengthen the European footprint and unlock growth opportunities in Scandinavia and the Baltic states.

- In January 2023, K&N Engineering announced that its new industrial group was created to bring high-performance, sustainable air filtration solutions to providers of mission-critical infrastructure, including data centers and other industrial applications and markets. K&N Engineering's proprietary air filtration technology saves money, lowers energy costs, and provides significant sustainability benefits for data centers and other industrial applications everywhere.

- October 2022 – Audi, a leading automotive company, partnered with MANN + HUMMEL, an automotive air filter manufacturer, to develop air filters for the front of electric vehicles. This new air filter can collect particulate matter during driving and charging.

REPORT COVERAGE

The report provides an automotive application type market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

An Infographic Representation of Automotive Air Filter Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousand Units) |

|

Segmentation |

By Vehicle Type

|

|

By Product Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 9.72 billion in 2025.

The market is likely to grow at a CAGR of 7.60% over the forecast period (2024-2032).

The air intake filter segment is the leading segment and held a key market share in 2023 due to the development of high-performance filters to improve engine performance over the forecast period.

Some of the top players in the market are Mann+Hummel GmbH, K&N Engineering, Inc., Donaldson Company, Inc., and Cummins, Inc.

The Asia Pacific region dominated the market in terms of market size in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic