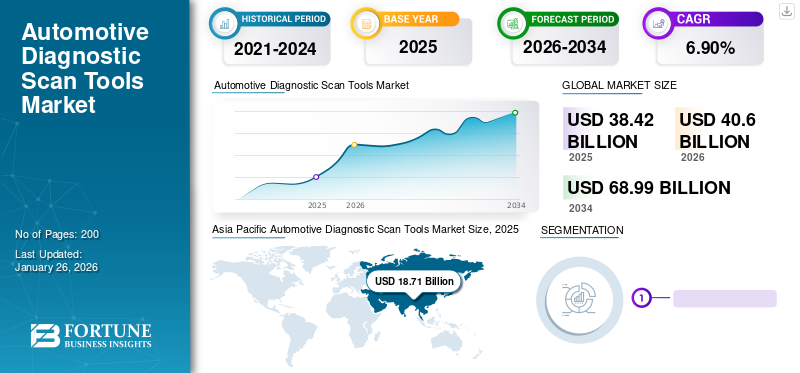

Automotive Diagnostic Scan Tools Market Size, Share & Industry Analysis, By Product Type (Diagnostic Equipment/Hardware, Diagnostic Software), By Vehicle Type (Passenger Cars, Commercial Vehicles), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global automotive diagnostic scan tools market size was valued at USD 38.42 billion in 2025 and is projected to grow from USD 40.6 billion in 2026 to USD 68.99 billion by 2034, exhibiting a CAGR of 6.90% during the forecast period. Asia Pacific dominated the global market with a share of 48.69% in 2025.

The automotive diagnostic scan tools market refers to the sector of the automotive industry that involves the design, manufacturing, and distribution of diagnostic equipment used by automotive technicians, mechanics, and vehicle owners to identify, analyze, and troubleshoot issues within vehicles. These tools enable users to access the onboard diagnostics systems of modern vehicles, retrieve diagnostic trouble codes (DTCs), and perform various tests and measurements to diagnose mechanical, electrical, or software-related problems. The market encompasses a wide range of diagnostic tools, including handheld scanners, code readers, diagnostic software applications, and advanced diagnostic systems.

Handheld diagnostic scanners are portable devices equipped with a display screen, keypad, and interface ports for connecting to the vehicle's onboard diagnostics (OBD) port. They allow users to read and clear diagnostic trouble codes (DTCs), view live sensor data, and perform basic diagnostic functions.

The COVID-19 pandemic-induced lockdowns during Q2 2020 and the subsequent restrictions through the rest of 2020 to mitigate COVID-19 led to a significant reduction in passenger transport. For instance, according to a study published by the International Energy Agency (IEA) regarding changes in transport behavior during the COVID-19 crisis, road transport activity decreased by nearly 50% by the end of Q2 2020 compared to 2019.

Download Free sample to learn more about this report.

Automotive Diagnostic Scan Tools Market Trends

Increased Adoption of OBD-II Standard by Fleet Owners to Propel Demand

Stringent government regulations have mandated the use of OBD-II (On-Board Diagnostics II) in all vehicles in the U.S. and Europe. OBD-II allows GPS fleet tracking devices to record information such as fuel usage, engine revolutions, fault codes, and vehicle speed. This information can be used by telematics devices to determine fuel consumption, start and finish of a trip, speeding, among other parameters. A software interface can then be used to access this information that allows fleet operators to monitor the performance and use of their vehicles.

Hence, increased adoption of on-board diagnostics in commercial fleets is likely to emerge as a positive factor for the automotive diagnostic scan tools market growth.

Automotive Diagnostic Scan Tools Market Growth Factors

Increased Production and Usage of Vehicles to Spur Demand

The growing demand of vehicles due to rapid urbanization especially in the developing countries is anticipated to boost the demand for vehicle diagnostics solutions over the next few years. The customers are emphasizing on buying a vehicle with embedded in-vehicle diagnostic scanning solutions. Moreover, as the awareness about such tools shall grow among the users, their demand will drastically boost in such countries.

Technological Advancement of Vehicles to Promote Growth

Vehicle architecture has become increasingly complex with the greater application of technologies such as electronic control modules and advanced driver assistance systems. Fault diagnosis for such systems is technically challenging for regular end-users. Hence, these scan tools with the provision of standard fault codes and other services provide a simple interface to consumers to determine the issues with the car and avoid expensive workshop repair for minor problems. Hence, the greater complexity of automotive electronics is likely to drive the growth of the market.

RESTRAINING FACTORS

High Cost and Complex Functioning of Scan Tools to Hinder Growth

The product penetration among numerous consumers across the globe has been restricted by the high cost of technologically advanced automotive diagnostic scan tools. Furthermore, the complex functioning of scan tools requires highly skilled technicians, which further hinders its adoption among consumers.

Automotive Diagnostic Scan Tools Market Segmentation Analysis

By Product Type Analysis

Diagnostic Equipment/Hardware Expected to Hold the Largest Share Due to the Mandatory Implementation of Diagnostic Hardware in Europe and the U.S.

By product type, the market is segmented into diagnostic equipment/hardware and diagnostic software. The diagnostic equipment/hardware segment held the largest share of the market in 2023, primarily assisted by the mandatory implementation of diagnostic hardware such as the OBD-II ports on all vehicles in Europe and the U.S. It is also incorporated in all passenger cars in emerging economies. The diagnostic software segment is anticipated to exhibit a significantly higher CAGR during the next few years owing to the increasing adoption of 5G-based automotive communication and decreasing development costs. The diagnostic equipment/hardware segment is projected to dominate the market with a share of 76.53% in 2026.

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Passenger Cars Segment Dominated the Market in 2023 Due to the Increasing Sales of Passenger Cars Globally

Based on vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger car segment held the largest market share in 2023. The increasing awareness among consumers regarding fault-tolerance and continuous operation capabilities via the use of automotive diagnostic scan tools are responsible for the dominant position of the passenger car segment. Further, the commercial vehicle segment is expected to show considerable growth in the market owing to the greater adoption of OBD standards in heavy-duty vehicles. The passenger cars segment is projected to dominate the market with a share of 76.97% in 2026.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Automotive Diagnostic Scan Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

As per the Asia Pacific automotive diagnostic scan tools market analysis, the region holds the largest share of the market and was valued at USD 19.8 billion in 2026. A substantial increase in the number of service stations and automotive workshops coupled with the high production of automobiles, particularly in China and India, are factors attributed to the dominance of Asia Pacific region in this market. Moreover, growing production of electric vehicles in the region is anticipated to further boost the demand for such tools. The Japan market is forecast to reach USD 2.89 billion by 2026, the China market is set to reach USD 11.2 billion by 2026, and the India market is likely to reach USD 1.97 billion by 2026.

Europe

Europe is expected to show significant growth in the market owing to mandatory OBD requirements and stringent emission regulations. Furthermore, early adoption of telematics devices and technologically advanced diagnostic software such as driver assistance functionalities propel the demand for diagnostics solutions in this region. The UK market is expected to reach USD 1.8 billion by 2026, while the Germany market is anticipated to reach USD 2.49 billion by 2026.

North America

North America is expected to show considerable growth in the market due to guidelines in various states regulate data storage and data accessibility. This factor is expected to promote the use of diagnostic scan tools among consumers, which further fuels the growth of this market. Moreover, the growing demand for cloud based diagnostic features is expected to fuel the North American market. The U.S. market is estimated to reach USD 6.68 billion by 2026.

The Rest of the World market is poised to reach USD 2.19 billion by 2026.

List of Key Companies in Automotive Diagnostic Scan Tools Market

Denso, Bosch, and Snap-on Incorporated are Leading Players in the Market owing to Industry-Leading Products

Global players such as Snap-on Incorporated, Continental, Denso, and Bosch hold dominant positions in the market with the expansion of product portfolio and entry into emerging markets via partnerships and strategic alliances a key area of focus for the majority of the manufacturers. For instance, SGS SA completed its acquisition of Advanced Metrology Solutions S.L. (AMS) in 2018. AMS specializes in precision services in 3D metrology as well as highly technical inspection measurement processes. The acquisition enables SGS to expand its product portfolio in the aforementioned services across Spain and Europe.

Key automakers such as Daimler AG, General Motors, and Volvo are developing proprietary interface technology or collaborating with other key players to enhance in-built diagnostic technology in the vehicles. Hence, the expansion of scan tool functionalities is expected to enhance diagnostic capabilities and enable greater collaboration among OEMs and diagnostic scan tool manufacturers. This factor can contribute to the growth of the automotive diagnostic scan tool market over the next few years.

LIST OF KEY COMPANIES PROFILED:

- ACTIA Group (Toulouse, France)

- Snap-on Incorporated (Wisconsin, U.S.)

- Softing AG (Haar, Germany)

- Robert Bosch GmbH (Gerlingen, Germany)

- Delphi Technologies (London, U.K.)

- Denso Corporation (Aichi, Japan)

- SPX Corporation (North Carolina, U.S.)

- Continental AG (Hanover, Germany)

- SGS SA (Geneva, Switzerland)

- Horiba, Ltd. (Kyoto, Japan)

KEY INDUSTRY DEVELOPMENTS:

- In October 2023, Matco Tools introduced its newest diagnostic scan tool - the Maximus Plus. Designed with automotive technicians in mind, the Maximus Plus is the ultimate diagnostic scan tool that provides complete coverage flexibility, OE-level functionality, and the power of Android at your fingertips.

- In November 2023, Repairify, Inc., singed a partnership with Autel. Repairify and Autel have enhanced the efficiency of the collision and glass repair shop workflow and documentation process by seamlessly integrating Repairify's remote services and authentic OEM tool scans into the Autel Remote Expert platform.

- In October 2023, Opus IVS singed a partnership with Diagnostic Network to Redefine Automotive Diagnostics with the Launch of IVS Mobile. IVS Mobile represents a paradigm shift in the industry, empowering technicians with unparalleled access to diagnostic solutions and expert support, transforming the way vehicle repairs are approached and executed.

- May 2021 – Snap-on Incorporated launched the new John Bean Tru-Point advanced driver assistance system (ADAS) calibration tool at Auto Glass Week in Florida, U.S. It provides shops with the ability to streamline the ADAS calibration process from beginning to end.

- April 2021 – HORIBA Automotive announced an electrification offering to the industry that includes solutions ranging from single component testing to turnkey testing solutions and includes consulting and other services throughout the total vehicle development process.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Furthermore, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

An Infographic Representation of Automotive Diagnostic Scan Tools Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.90% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 38.42 billion in 2025 and is projected to reach USD 68.99 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 18.71 billion.

Growing at a CAGR of 6.90%, the market will exhibit good growth over the forecast period (2026-2034).

The passenger car segment is expected to be the leading segment in this market during the forecast period.

Rapid electrification of automotive components, particularly in passenger cars, is a key factor driving the growth of the market.

Snap-on Incorporated, Denso Corporation, and Robert Bosch GmbH are major players in the global market.

The Asia Pacific region held the largest share of 48.69% in the market in 2025.

Stringent government regulations mandating the use of OBD standards in the majority of vehicles and increased awareness regarding vehicle safety among consumers is expected to drive the adoption of this market over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic