Automotive Infotainment Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Application (Navigation, Media, Communication, Payment Services, and Telematics), By Distribution Channel (OEM and Aftermarket), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

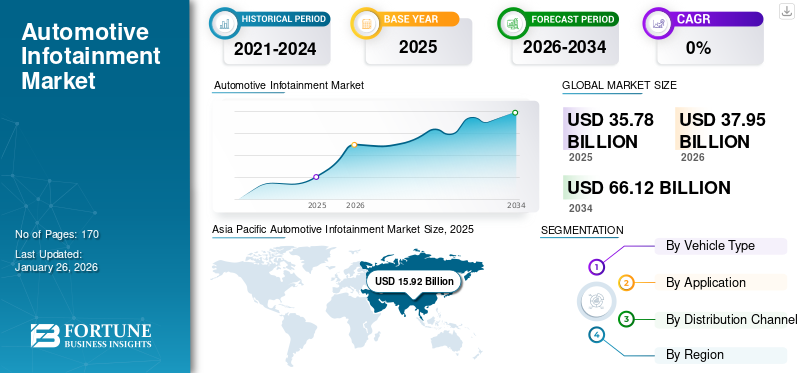

The global automotive infotainment market size was valued at USD 35.78 billion in 2025. The market is projected to grow from USD 37.95 billion in 2026 to USD 66.12 billion by 2034, exhibiting a CAGR of 7.19% during the forecast period. Asia Pacific dominated the global market with a share of 44.51% in 2025.

A vehicle’s infotainment system is an integrated media and information system providing the driver and passengers with information and entertainment. The system consists of a digital screen, also known as head unit, which controls various aspects such as cabin temperature, media, and information. The head unit also provides information modules such as navigation, telematics information, and internet connectivity. The automotive industry is a highly evolving industry with major players consistently competing with each other by delivering new technologies and newer advancements to the existing technology. Integrating data and calling sim cards is one of the major trends observed in this market, along with features such as in-vehicle payment systems and displaying telematics data to the OEMs and users operating the vehicle.

The infotainment system consists of various microelectrical units and is prone to failure due to improper wiring. These factors may affect the automotive infotainment market growth during the forecast period. However, the market is projected to grow significantly over the forecast period, with an increased focus on vehicle telematics, infotainment systems, media, and streaming services.

Global Automotive Infotainment Market Overview

Market Size:

- 2025 Value: USD 35.78 billion

- 2026 Value: USD 37.95 billion

- 2034 Forecast Value: USD 66.12 billion by 2034, with a CAGR of 7.19% from (2026–2034).

Market Share:

- Asia Pacific led the global infotainment market in 2025, holding roughly 44.51% market share, due to robust automotive volume and strong OEM presence .

- By vehicle type, passenger cars dominated with 80.99% share in 2024, and are expected to maintain leadership through 2032

- From a distribution perspective, the OEM channel accounted for the largest share in 2024, while the aftermarket channel is gaining traction as more consumers upgrade systems post-purchase .

Industry Trends:

- Growing integration of connected features — in-vehicle calling, data access, real-time navigation, and telematics services — is shaping infotainment capabilities .

- OEMs are enhancing the in-cabin experience with media streaming, diagnostics, and application integration directly via infotainment screens .

- The emergence of in-vehicle payments is enabling convenient transactions like parking or tolls directly through infotainment systems .

Driving Factors:

- Consumer demand for seamless connectivity is fueling infotainment upgrades, as users seek consistent streaming, calling, and navigation experiences .

- Vehicle telematics adoption is expanding, enabling remote diagnostics, maintenance alerts, and analytics — making infotainment systems more central to both user convenience and vehicle management .

- Post-pandemic recovery and renewed R&D momentum (including resumed vehicle production and reduced supply chain constraints) are accelerating tech adoption in infotainment .

- Data security and privacy concerns tied to increasingly complex infotainment features, especially payment systems, highlight the need for strong safeguards in system design .

The COVID-19 pandemic significantly impacted the global automotive infotainment market, with disruptions in supply chains, production halts, and reduced consumer demand due to economic uncertainties. Despite challenges, the market showed resilience with the gradual recovery of automotive sales. According to recent industry reports, there's cautious optimism, with the market expected to rebound as economies reopen and consumer confidence improves, driven by increased adoption of connected car technologies and rising demand for in-vehicle entertainment solutions.

Automotive Infotainment Market Trends

Enriched in-cabin Experience by Major Automotive OEMs is a Trend Observed in the Market.

The automotive sector is stirring toward inventing and developing innovative technologies to develop connectivity solutions, advance vehicle safety, and enrich the in-vehicle user experience. Additionally, automotive infotainment is one of the prominent technologies that works as a central point of all the current automotive systems and combines their functions to be monitored and controlled from one central unit.

The manufacturers are directing on integrating additional data accessibility features into their infotainment to make the journey enjoyable and effortless. The modern vehicle automotive infotainment connects with all smart automotive technologies, such as 2X connectivity solutions, ADAS systems, smartphones, telematics devices, and sensors. These trends are anticipated to boost the growth of this market over the forecast period.

Download Free sample to learn more about this report.

Automotive Infotainment Market Growth Factors

Integration of Connectivity Features such as in-vehicle Calling and Data Connectivity to Drive the Market

The integration of connectivity features, such as in-vehicle calling and data connectivity, is expected to be a significant driver for the global automotive infotainment market. As consumers increasingly demand seamless connectivity and enhanced in-car experiences, automakers focus on incorporating advanced communication technologies into their vehicles. With the proliferation of smartphones and the growing popularity of connected services, the demand for in-vehicle calling and data connectivity is rising.

Recent data from automotive industry analysts highlights the increasing adoption of connected car technologies. For instance, according to a study conducted by Strategy Analytics, the number of connected cars on the road will reach around 265 million globally by 2023, representing a significant increase from previous years. This surge in connected vehicles is expected to fuel the demand for advanced infotainment systems that offer robust connectivity features.

In addition to in-vehicle calling and data connectivity, other connected services, such as real-time navigation, streaming media, and remote vehicle diagnostics, are becoming increasingly important to consumers. Automakers are leveraging partnerships with technology companies and investing in research and development to enhance the connectivity capabilities of their vehicles. Overall, the integration of connectivity features is poised to drive growth in the global automotive infotainment market as automakers continue to innovate and deliver immersive and personalized in-car experiences to meet the evolving needs of consumers.

Demand for Vehicle Telematics to Drive Market Growth for Automotive Infotainment Systems

A smart infotainment system equipped with connected vehicles allows users and OEMs to preview vehicle insights that provide the manufacturers as well as buyers with enhanced vehicle data, allowing them to understand various aspects of the vehicle such as component condition, vehicle repairs, and other insights that are shared on the head unit of the vehicle. The data collected from individual vehicles helps further improve the vehicle performance and allows the manufacturers room to upgrade their existing vehicle fleets. Moreover, the users are also aware of the vehicle's condition, providing an enhanced driving and in-cabin experience. Thus, these features are expected to drive the market growth of automotive infotainment systems.

RESTRAINING FACTORS

Potential Security Breaches and Data Hacking to Hamper Market Growth

Integrating the advanced infotainment system gives users a richer and more informative experience. However, it required complex security systems and firewalls to protect the software, in-vehicle, and user data from potential data leaks. The risk of data manipulation and code overwriting may lead to fatal vehicle failures as well as data hacking of users. Since the users integrate their phones with in-cabin infotainment systems, various vital data points such as personal IDs and payment transactions are at risk of high exposure. Thus, a robust security system is necessary to prevent data leaks and hacking. These few factors are expected to damage product adoption. However, such attacks can be avoided with proper security bridges and firewalls.

Automotive Infotainment Market Segmentation Analysis

By Vehicle Type Analysis

Higher Demand for Advanced Entertainment and Informatics in Passenger Cars is Surging the Demand for Automotive Infotainment Systems in this Segment

By vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Passenger cars segment dominated the market share of 80.69% in 2026. It accounted for 80.99% in 2024 and is anticipated to proliferate at a steady CAGR during 2025-2034, owing to features such as in-vehicle calling, OTA vehicle updates, connected cabin experience, and others. Due to the high demand for passenger cars among urban and suburban commuters, infotainment for passenger cars is estimated to witness higher demand. Additionally, the growing penetration of connected vehicle technology, autonomous driving technology, and electric vehicles is expected to add more value and demand for automotive infotainment for passenger vehicles.

Light commercial vehicles are highly popular for light commercial goods purposes. Thus, major OEM players are aiming to capitalize on this by introducing advanced infotainment systems to provide users with an in-cabin experience similar to that of passenger vehicles. OEMs also provide various information-sharing services to track fleet operations, thus increasing the efficiency of various operations. Additionally, major players aim to introduce aftermarket models to support further adoption of automotive infotainment technology to tackle climate change.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Payment Services Segment to Grow at a Significant Pace Owing to Ease of In-vehicle Payment Transactions

Based on application, the market is segmented into navigation, media, communication, payment services, and telematics. The navigation segment dominated the market share in 2026 with 48.06%. Navigation is one of the most used features of the infotainment system. Additionally, navigation is a primary feature associated with an infotainment system, providing the driver with appropriate direction and traffic congestion data solutions.

Payment service is one of the sub-segments within the application segment, which is expected to grow at a significant growth rate due to the ease of payments processed directly through the vehicle, reducing the hassle involved in online smartphone payments. Thus, the ease of payment options further enriches the in-cabin and driving experience and is expected to grow rapidly in the forthcoming years.

By Distribution Channel Analysis

Owing to Technological Advancement Introduced by Automotive Manufacturers, OEM Segment Dominates the Market Share

Based on the distribution channel, the market is fragmented into OEM and aftermarket. The OEM segment held the largest market share of 73.04% in 2026. This is attributed to the high reliability and performance delivered by OEM automotive infotainment systems compared to aftermarket products, leading to higher market share.

The aftermarket segment is expected to grow significantly during the forecasted period owing to the rapid penetration of advanced automotive infotainment technology across various automotive aftermarkets. Additionally, OEM automotive infotainment systems are highly reliable and expensive; thus, many consumers may opt for a cheaper aftermarket product offering nearly as good as OEM-level performance. Thus, these factors are expected to drive market growth.

REGIONAL INSIGHTS

Asia Pacific Automotive Infotainment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Due to the High Production Rate of Automotive vehicles in Asia Pacific, the Region is Expected to Dominate

Asia Pacific dominated the market with a valuation of USD 15.92 billion in 2025 and USD 16.74 billion in 2026, owing to the higher production rate of automotive vehicles and parts. Additionally, major companies within the market belong to the Asia Pacific region. The Japan market is projected to reach USD 3.26 billion by 2026, the China market is projected to reach USD 8.58 billion by 2026, and the India market is projected to reach USD 2.15 billion by 2026.

North America is expected to grow at the highest CAGR during the forecast period, owing to a stronger adoption rate of newer automotive technologies within the region. The U.S. market is projected to reach USD 5.42 billion by 2026.

Europe accounted for a significant market share owing to the greater adoption rate for connected vehicle technology due to growing supporting infrastructure within the region. As the major automotive vehicle companies are present in the region, the market is expected to develop at a steady rate. The UK market is projected to reach USD 1.59 billion by 2026, while the Germany market is projected to reach USD 3.49 billion by 2026.

The rest of the world is likely to follow the growth trends of the major regions and grow significantly as major European regions aim to expand their manufacturing operations in the African continent.

Key Industry Players

Major Players Are Aiming Toward Introducing Technological Advancements to Offer Additional Value for Consumer Products

Key players in the market include Harman International Industries, Inc., Visteon Corporation, Denso Corporation, Robert Bosch GmbH, and LG Electronics. The companies aim to launch new models equipped with advanced technology and aftermarket models to provide an enhanced in-cabin experience and lead the competitive landscape.

Several players are also aiming toward collaborations and partnership contracts with major companies to capture majority of the market size. However, due to a strong competitive environment, automobile manufacturers are provided with a bigger leverage to choose companies suitable for their vehicle models creating a favorable product mix.

LIST OF TOP AUTOMOTIVE INFOTAINMENT COMPANIES:

- Harman International Industries, Inc. (U.S.)

- Visteon Corporation (U.S.)

- Aptiv PLC (U.S.)

- Alpine Electronics (Japan)

- Pioneer Corporation (Japan)

- Panasonic Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Continental AG (Germany)

- KenWood (Japan)

- Garmin Ltd. (U.S.)

- LG Electronics (South Korea)

- FORVIA Faurecia (France)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 - L&T Technology Services Limited collaborated with Marelli, a leading mobility technology supplier to the automotive sector, to redefine the landscape of automotive infotainment and information cluster design by introducing Marelli’s groundbreaking Digital Twin solutions. These innovative solutions are built on Qualcomm's AWS & Snapdragon cockpit platform to cut software development and prototype costs.

- January 2024 - Cinemo, a global provider of fully integrated digital media products, showcased a series of new in-car infotainment innovations that build on and continue to enrich its core product offerings, such as with innovation in in-car entertainment, immersive audio, video conferencing, and much more. These companies aim to take automotive digital media experiences to the next level.

- January 2023 – Panasonic Automotive Systems Corporation introduced its new update for the skipgen in-vehicle infotainment system that provides the user access to Siri while using Apple carplay or Alexa on voice commands of “Hey Siri” or “Alexa”

- November 2022 – Tietoevry announced its partnership with HaleyTek, a joint venture between Volvo Cars and ECARX to develop an Android Open Source system project oriented infotainment system for the existing and upcoming fleets of Volvo and Polestar vehicles.

- July 2022 – LG Electronics, Inc. announced receiving the order for USD 6.2 billion, which will include vehicle components, telematics, and infotainment systems. The figure represents the company’s 13% backlog. The company aims to lead the in-vehicle infotainment system by providing its products and solutions to major car manufacturers such as Mercedes, Renault, and General Motors.

REPORT COVERAGE

The research report covers a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report delivers in-depth analysis of several factors that have contributed to its growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.19% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to reach USD 66.12 billion by 2034

Registering a CAGR of 7.19%, the market will exhibit good growth over the forecast period (2026-2034).

The passenger cars segment is expected to be the leading segment in this market during the forecast period.

Asia Pacific held the largest share in the market in 2025.

Harman Industries, LG Electronics, Panasonic Corporation, Kenwood, and Garmin Ltd. are some of the major players in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us