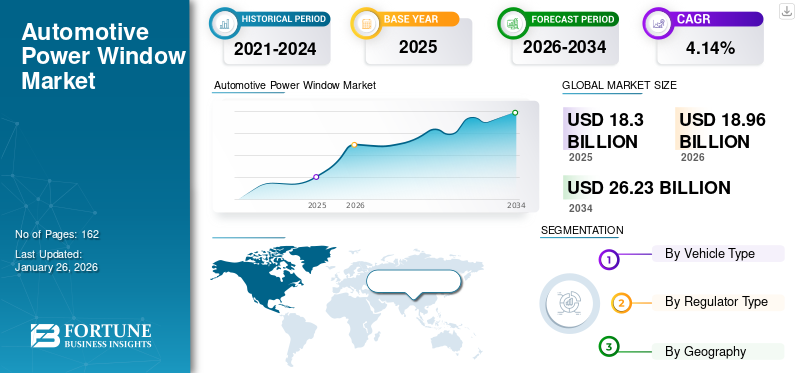

Automotive Power Window Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Cars and Commercial Vehicles), By Regulator Type (Cable Type and Scissor Type), and Regional Forecast, 2026-2034

Automotive Power Window Market Size and Future Outlook

The global automotive power window market size was valued at USD 18.30 billion in 2025. The market is projected to grow from USD 18.96 billion in 2026 to USD 26.23 billion by 2034, exhibiting a CAGR of 4.14% during the forecast period. Asia Pacific dominated the global market with a share of 49.09% in 2025.

Automotive power windows, also known as electric windows, are windows in vehicles that can be raised or lowered using an electric motor activated by a switch or button. Introduced in the 1940s, these systems have largely replaced manual crank handles, providing convenience and ease of use. Modern power windows typically feature a master switch for the driver to control all windows and may include safety mechanisms such as automatic reversal to prevent injury from closing windows.

As consumer preferences are shifting toward automation in vehicle technology, comfort, convenience, and usability, the demand for power windows propels accordingly. Key players in the market include Brose, Magna, Bosch, HI-LEX Corporation, and Denso Corporation, among others. These companies focus on product innovation, enhancement in technology, and development of their products for the emerging electric vehicles demand.

Market Dynamics

Market Drivers

Rising Demand for Electric Vehicles to Propel Market Growth

EVs are often positioned as premium, technology-forward vehicles compared to their Internal Combustion Engine (ICE) counterparts. Manufacturers aim to differentiate EVs by integrating advanced features, including power windows, as standard. The quiet operation of EVs highlights cabin noise, which encourages automakers to use high-quality, smooth-operating power window systems to complement the overall vehicle experience.

Power windows are an integral part of vehicle electrification. With EVs inherently relying on electrical systems for operation, the adoption of powered components such as windows aligns with the electrification theme. EV manufacturers leverage the already robust electrical infrastructure of these vehicles, ensuring seamless integration of power windows.

According to the International Energy Agency, nearly fourteen million new electric passenger cars were registered worldwide in 2023, increasing the global total to 40 million. Electric car sales in 2023 surpassed those of 2022 by 3.5 million, reflecting a 35% year-over-year growth. With over 250,000 new registrations occurring each week in 2023—exceeding the total annual registrations from a decade earlier in 2013—electric vehicles represented approximately 18% of all cars sold, up from 14% in 2022. Of the global electric car stock, battery-electric vehicles made up 70% in 2023.

Market Restraints

Complexity and Maintenance Issues Restrain Market Growth

The complexity and maintenance issues related to automotive power windows pose significant challenges to market growth by increasing costs, reducing consumer satisfaction, and slowing down adoption, particularly in cost-sensitive regions and among certain consumer segments. Modern power window systems have evolved to include sophisticated features such as electronic motors, integrated sensors (e.g., anti-pinch), automatic up/down functionalities, and even remote control systems. These advanced systems provide greater convenience and safety, but they also introduce higher complexity. The integration of multiple electronic components makes the system more prone to failure since a malfunction in one component (motor, sensor, or control unit) can affect the entire mechanism. This complexity also leads to longer design and production times, which increases vehicle manufacturing costs.

In September 2022, Tesla initiated a recall of over one million vehicles due to an issue with its power window safety controls. The NHTSA states that the automatic reversal system for the windows may fail to detect obstructions, posing a risk of injury if something is in the path of the window as it closes. The power window mechanisms and controls do not meet the "Power-Operated Window Systems" federal standards. The recall affected 1,096,762 vehicles, including specific 2017-2022 Model 3, 2020-2021 Model Y, and 2021-2022 Model S and Model X models.

Market Opportunities

Rising Demand for Comfort and Convenience Features to Create Market Opportunity

The rising request for comfort and convenience in vehicles is a noteworthy growth opportunity for the automotive power window market. As consumer preferences evolve, the automotive industry is focusing more on enhancing the in-car experience by offering features that improve comfort, ease of use, and overall convenience. Power windows, which offer several advantages over traditional manual windows, are one such feature.

In today’s automotive market, consumers are increasingly seeking vehicles that offer greater comfort and ease of use. Power windows are a key part of this shift, offering significant advantages over manual windows. With power windows, passengers no longer need to exert physical effort to roll down or raise the window, which can be particularly important for passengers seated in the back of the vehicle. In contrast, manual windows require physical effort, which may be inconvenient for certain individuals, especially those with physical disabilities or elderly passengers. The demand for vehicles with features that make everyday driving tasks easier, such as power windows, is fueling growth in this segment.

Market Challenge

High Maintenance Cost Hamper Market Development

High maintenance costs significantly challenge the automotive power window market growth. Repairing power windows is considered expensive, with average costs ranging from USD 200 to USD 600 depending on the vehicle and the definite issue, such as motor or regulator failure. These costs can deter consumers from purchasing vehicles equipped with power windows, particularly when they consider the potential for future repairs. Additionally, regular upkeep is necessary to ensure the longevity of power window systems, which adds to the overall cost of ownership. As consumers become more budget-conscious, high maintenance expenses may lead them to prefer simpler window mechanisms or used vehicles without power windows, thereby stunting market expansion.

Market Trends

Trends Toward Luxury and Premium Vehicles Escalate Market Demand

As consumer preferences shift toward luxury vehicles, automakers are increasingly including advanced features that enhance comfort, convenience, and overall driving experience. Power windows, being a standard feature in modern vehicles, are expected to evolve in line with the demand for higher-end features. In luxury vehicles, power windows are not just for convenience but are integrated into more sophisticated systems that enhance user experience. This includes features such as one-touch window control, anti-pinch sensors, and auto-up and auto-down functionalities, all of which add to the appeal of power window systems in premium segments.

In September 2024, Polestar, the Swedish electric car brand, revealed the entry level version of its inaugural electric SUV, the Polestar 3, in Australia, offering a range of up to seven hundred kilometers. Priced from USD 118,420 before on-road costs, the new single-motor MY25 variant is approximately USD 14,480 more affordable than the previously launched MY24 dual-motor long-range version.

Download Free sample to learn more about this report.

Impact of COVID-19

Disruption in Vehicle Production and Sales Hampered Market Growth During Pandemic

The global outbreak of the COVID-19 pandemic had a severe impact on the overall supply chain and logistics industry, as it has been stalled due to the rapid spread of COVID-19 in the world. This pandemic caused immense uncertainty and panic in the industry for all industrial value chain members involved. To avoid the blowout of the COVID-19 pandemic, governments across the world adopted strict social distancing policies, partial to total lockdown interventions. As a consequence, it led to fewer public commutes on roads. Moreover, with social distancing rules still in place, the demand for automobiles reduced, which, in turn, affected the demand for automotive power windows in the initial period of the pandemic.

Lockdown measures caused production and demand disruptions to automobile manufacturers and their component suppliers. According to the International Organization of Motor Vehicle Manufacturers (OICA), production declined by 16% overall worldwide to less than around 78 million vehicles, which is equivalent to sales levels in 2010. Europe, which accounted for almost 22% of the total production, witnessed a decline of around 21%. All the key producing countries in the region witnessed a decline in production ranging from 11% to 40%.

Segmentation Analysis

By Vehicle Type

Rise in Global Passenger Cars to Foster Market Adoption

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles.

The passenger cars segment dominates the market, holding the largest market share at 67.66% in 2026. The overall increase in automobile production, particularly in emerging markets, has led to a higher demand for vehicles equipped with modern features such as power windows. As manufacturers respond to consumer preferences for enhanced safety and convenience, the passenger car segment is expected to continue its dominance in the market. According to the OICA (International Organization of Motor Vehicle Manufacturers), global passenger car sales reached 65.3 million units in 2023 from 58.6 million units in 2022.

The commercial vehicles segment was estimated to develop by the highest CAGR of 4.8% over the forecasted period. The growth in various end-user industries, such as logistics, construction, and food & beverages, is driving the demand for commercial vehicles. As businesses expand and require more transportation options, there is a corresponding increase in the need for vehicles equipped with modern features, including power windows, which drives the market growth. In 2023, commercial vehicle sales rose to 27.4 million from around 24.2 million in 2022.

To know how our report can help streamline your business, Speak to Analyst

By Regulator Type

Advancement in Technology Boosts Market Development

Based on the regulator type, the market has included cable type and scissor type.

The cable type segment dominates the market and is expected to develop at a fastest-growing CAGR of 4.3%. The segment held the leading market share of 76.7% in 2024. Advances in technology have allowed cable type regulators to incorporate features, such as anti-pinch systems, which enhance safety by preventing windows from closing on objects or passengers. This capability aligns with consumer demands for safer vehicle features and compliance with stringent safety regulations. The segment is set to capture 76.99% of the market share in 2025.

The scissor type segment market held a sustainable share in the market in 2024. Scissor type regulators are known for their robust design, which provides reliable performance over time. This durability makes them suitable for various vehicle types, particularly in applications where heavy use is expected, such as in commercial vehicles. This fuels the market growth over the forecast period. This segment is likely to grow with a considerable CAGR of 3.30% during the forecast period (2025-2032).

Automotive Power Window Market Regional Outlook

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific dominated the market with a valuation of USD 8.98 billion in 2025 and USD 9.29 billion in 2026. The region held the largest automotive power window market share of 49.2% in 2024. The region, particularly countries such as China, India, and Japan, is experiencing significant growth in vehicle production. For instance, China produced approximately 30.2 million vehicles in 2023, marking around a 12% increase from the previous year. The Chinese market is set to expand with a valuation of USD 4.92 billion in 2026. This surge in manufacturing is largely fueled by a growing mid-class population with increasing disposable incomes, which enhances the demand for vehicles equipped with modern features such as power windows. India is estimated to reach USD 0.93 billion in 2026, while Japan is predicted to gain USD 0.85 billion in the same year.

North America

North America is the second largest market estimated to be worth USD 4.04 billion in 2026, registering a CAGR of 4.50% during the forecast period (2025-2032). The region America held the second-largest market share in 2024. Growing demand for better comfort and convenience in vehicles, especially in high-end and mid range vehicle models, has increased the adoption of power windows. Consumers prefer vehicles equipped with features that enhance user experience and provide ease of operation, further fueling the market growth of automotive power windows in the region. Moreover, there is a higher demand for LCVs in the North American region. According to OICA (International Organization of Motor Vehicle Manufacturers), light truck sales in the U.S., Canada, and Mexico together reached around 12.4 million in 2023 from 10.9 million in 2022, witnessing a rise of 13.7% year-on-year. The Ford F-150, a widely used light-duty truck in commercial operations, includes power windows as a standard feature to improve driver experience. This fuels the region's market progress. The U.S. market is anticipated to be valued at USD 3.34 billion in 2026.

Europe

Europe is the third largest region poised to gain USD 3.53 billion in 2026. Europe holds a sustainable share of the market in 2024. The region is home to leading luxury automakers such as BMW, Mercedes-Benz, and Audi, which integrate power windows as a standard feature. Thus, increasing consumer preference for premium vehicles with enhanced comfort drives demand for advanced power window systems in the European region. The U.K. market continues to expand, projected to reach a market value of USD 0.41 billion in 2025. In 2023, According to the Group, Mercedes Benz sold 659,400 passenger cars in Europe, witnessing an uptick of 7% as compared to the previous year, 2022. Germay is expected to hold USD 0.73 billion in 2026, while France is foreseen to grow with a value of USD 0.36 billion in the 2025.

Rest of the World

The rest of the world is the fourth largest market expected to hit USD 3.43 billion in 2025.The Rest of the World markets, comprising South America and the Middle East & Africa, held a decent share of the market in 2024. As global automakers expand into these markets, they introduce models with modern features, including advanced power window systems with anti-pinch mechanisms and one-touch functionality. Technological advancements gradually penetrated these regions, enhancing the appeal of vehicles with power windows, which fuels the market demand in the region.

Competitive Landscape

Key Market Players

The global automotive power window market is fragmented, with many established and emerging players operating in the market. These companies focus on product innovation, enhancement in technology, and development of their products for the emerging electric vehicles demand. Major players have established their presence in major countries and are focusing on expanding their business in emerging countries. Emerging players in the market are offering advanced products compatible with modern vehicles. These companies are forming strategic partnerships with OEMs to expand their customer base and business across the world. Top 5 key market players in the market include Magna International, Brose, Bosch, HI-LEX Corporation, and Denso Corporation, among others. Other players include Grupo Antolin, Valeo SA, Inteva Products, Aisin Corporation, and Johnan Manufacturing Inc., among others, which led the market in 2024.

List of Key Companies Profiled In The Report

- Magna International Inc. (Canada)

- Brose Fahrzeugteile SE & Co. (Germany)

- Robert Bosch GmbH (Germany)

- HI-LEX Corporation (Japan)

- Denso Corporation (Japan)

- Grupo Antolin (Spain)

- Valeo SA (France)

- Inteva Products (U.S.)

- Aisin Corporation (Japan)

- Johnan Manufacturing Inc. (Japan)

Key Industry Developments

November 2024 - Inteva Products LLC, a global automotive systems and components supplier, planned to expand its manufacturing facility in Chakan, Pune. This USD 3.3 million investment is aimed at increasing production capacity and enhancing operational efficiency to meet the growing demands of India's automotive industry. The expansion will boost the plant's production area by 70%, increasing it to 85,000 square feet, along with an additional 26,000 square feet designated for office space. This development will enable Inteva to implement new production lines for window regulators, latches, and motor assemblies, thereby improving supply chain capabilities and supporting its current customer base in India.

June 2024 - Valeo expanded its window lift range to meet market demands, launching 183 new references in 2023 and an additional 184 for key European vehicles. Their portfolio now includes over 1,900 references, covering more than 230 million vehicles globally, with easy installation instructions for each model. Valeo's window lifts offer high-quality solutions to common issues like slow or noisy operation, ensuring compliance with their stringent standards. This comprehensive range allows customers to choose the best technology for their needs, enhancing visibility and safety on the roads.

January 2023 - Bosch inaugurated its new business unit at the Pecinci comfort actuators factory, dedicated to manufacturing car window lifters. The establishment of this production unit resulted in an additional 300 jobs at the facility. Expanding the product range brought Bosch closer to becoming a leading automotive factory, projecting a workforce of approximately 3,000 employees by year-end.

May 2022 - Aisin, a global leader in supplying OE-quality premium parts, expanded its product line for the North American automotive aftermarket by introducing a new range of premium window regulators. This launch includes applications for late-model vehicles from Asian, domestic, and European manufacturers.

July 2021 - Tokai Rika Co., Ltd. merged two of its subsidiaries, NSK Co., Ltd. and Ena Tokai Rika Co., Ltd., to form a new company called Tokai Rika NExT, launched in July 1, 2021. NSK specializes in manufacturing power window switches and heater control switches, while Ena Tokai Rika produces door mirrors and wheel caps. The merger aims to leverage Ena Tokai Rika's expertise in plastic molding and painting alongside NSK's automated assembly capabilities, facilitating integrated manufacturing of aesthetically appealing products. This consolidation is intended to enhance profitability, improve responsiveness to customer needs, and boost the overall competitiveness of the Tokai Rika group.

Investment Analysis and Opportunities

Rising Vehicle Demand and Technological Advancements Fuels Market Opportunity

The market of electric windows offers significant growth opportunities which is driven by the rising vehicle production and sales, technological advancements, and increasing consumer preference for convenience and luxury. Key investment factors include the expanding demand for passenger cars in emerging economies, regulatory emphasis on safety, and innovations such as anti-pinch and auto control technology. Market opportunities exist in both developed and developing regions. Companies investing in lightweight materials and energy-efficient systems can gain a competitive edge. Strategic collaborations, R&D initiatives, and expansion into untapped markets present attractive investment avenues, aligning with the industry’s transition toward electrification and sustainability.

Report Coverage

The global automotive power window market report analyzes the market in-depth and highlights crucial aspects such as prominent companies, market segmentation, competitive landscape, train type, propulsion type, electrification type, and technology adoption. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.14% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Regulator Type

|

|

By Region North America (By Vehicle Type, By Regulator Type) · U.S. (By Vehicle Type) · Canada (By Vehicle Type) · Mexico (By Vehicle Type) Europe (By Vehicle Type, By Regulator Type) · Germany (By Vehicle Type) · France (By Vehicle Type) · U.K. (By Vehicle Type) · Rest of Europe (By Vehicle Type) Asia Pacific (By Vehicle Type, By Regulator Type) · China (By Vehicle Type) · India (By Vehicle Type) · Japan (By Vehicle Type) · South Korea (By Vehicle Type) · Rest of Asia Pacific (By Vehicle Type) Rest of the World (By Vehicle Type, Regulator Type) |

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 18.30 billion in 2025 and is anticipated to record a valuation of USD 26.23 billion by 2034.

The market will exhibit a CAGR of 4.14% during the forecast period.

By regulator type, the cable type segment dominated the market with a share of 76.99% in 2025.

The top five players in the market include Magna, Brose, Bosch, HI-LEX Corporation, and Denso Corporation.

Asia Pacific dominated the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us