Automotive Seat Belt Market Size, Share & Industry Analysis, By Seat Belt Type (Three-point and Five-Point), By Distribution Channel (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

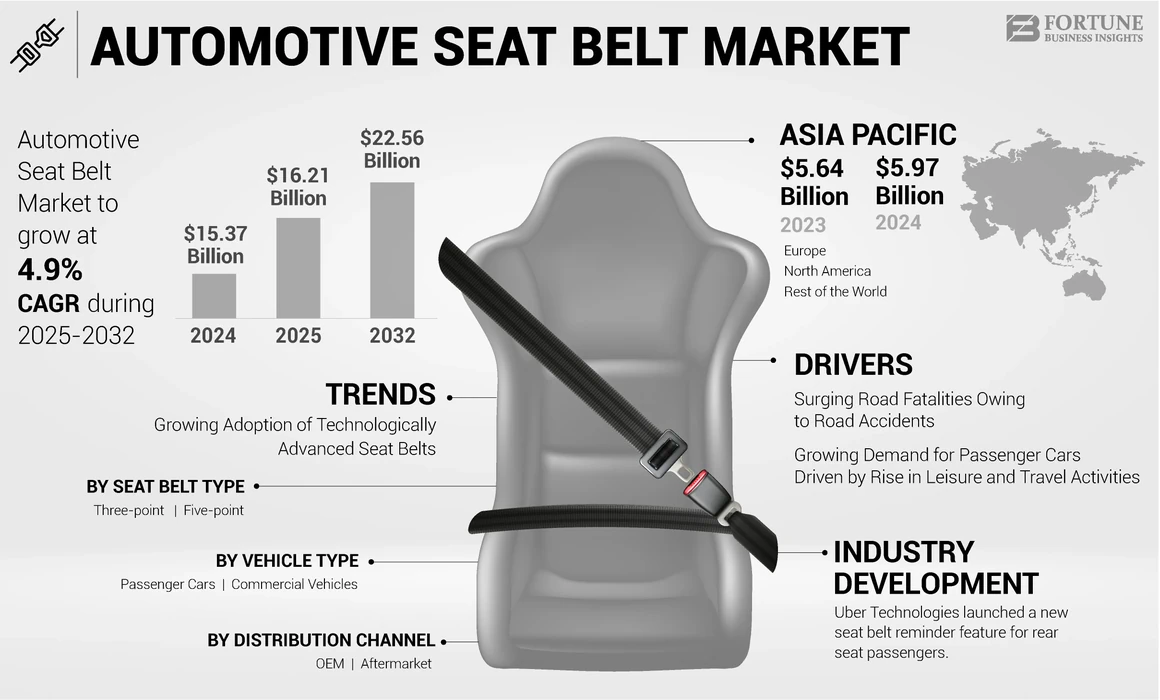

The global automotive seat belt market size was valued at USD 15.37 billion in 2024. The market is projected to grow from USD 16.21 billion in 2025 to USD 22.56 billion by 2032, exhibiting a CAGR of 4.9% over the forecast period. Asia Pacific dominated the global market with a share of 38.82% in 2023.

The automotive industry advocates rapid advances in safety features. A key goal in implementing these features is to provide a more comfortable, safer, and efficient driving experience. Car seat belts are an integral part of the vehicle. Seat belts are designed to prevent injury to drivers in an accident. Automotive seat belts reduce contact between occupants and the vehicle, reducing the risk of the driver being thrown out of the vehicle in an accident. It helps vehicle occupants to maintain their posture, especially on sharp turns.

According to the World Health Organization, yearly road accidents kill about 1.25 million people with the number of injuries being around 20 to 50 million. The main cause of traffic accidents is carelessness and mistakes caused by driver fatigue. Moreover, government regulators in many developing countries for using seat belts in automobiles are creating awareness regarding safety norms, propelling market growth.

Rising automobile sales and production along with increasing consumer disposable income are the main drivers fueling the industry expansion. However, fluctuations in commodity prices may restrain the automotive seat belt market growth to some extent. Governments across the globe enforce regulations mandating the installation and use of seat belts in vehicles.

Compliance with these regulations drives the demand for seat belt systems, contributing to market growth. Governments and organizations conduct public awareness campaigns to educate people about wearing seat belts. These campaigns encourage compliance with seat belt regulations and foster a safety-conscious culture, contributing to market growth.

Automotive Seat Belt Market Trends

Rising Adoption of Technologically Advanced Seat Belts to Drive Industry Growth

The adoption of technologically advanced inflatable seat belts is increasing in both developed and developing countries and the market is expected to expand due to the rising demand for luxury vehicles. These belts act as mini airbags to protect rear seat occupants in the event of an accident and prevent head injuries from front seats. In addition, it acts as a cushion for sensitive bones in adults and children, helping prevent collarbone fractures and fractures in other areas. Increasing demand for installing inflatable seat belts in passenger vehicles, especially in many upcoming models and luxury vehicles, is expected to drive the market growth during the forecast period.

Technologically advanced seat belts are equipped with features, such as pretensions, load limiters, and seat belt reminders. These features significantly enhance occupant safety by minimizing the risk of injury during a collision. As safety remains a top priority for consumers and regulatory bodies, the demand for seat belts with advanced safety features continues to grow. Stringent safety regulations mandate the use of advanced seat belt systems in vehicles. Automakers must comply with these regulations, driving the adoption of technologically advanced seat belts in new vehicle models. Additionally, regulatory bodies often update safety standards, pushing automakers to continually innovate their seat belt systems to meet or exceed these requirements.

Download Free sample to learn more about this report.

Automotive Seat Belt Market Growth Factors

Increasing Road Fatalities Owing to Road Accidents to Drive the Market Expansion

Road traffic accidents are one of the leading causes of death worldwide. With the growing number of vehicles on roads, there's a corresponding increase in the potential for accidents. As a result, there's greater demand for effective safety measures, such as seat belts, to mitigate the risk of injuries and fatalities in a crash. According to the World Health Organization (WHO), about 1.35 million people die each year in road accidents. In addition, another 49 million people suffer non-fatal injuries, many of whom are disabled due to such accidents. Given the alarming number of traffic accident victims worldwide, governments have introduced strict guidelines for wearing automotive seat belts.

High-profile road accidents often lead to increased public awareness about road safety and the importance of wearing seat belts. As a result, there's a heightened emphasis on enforcing seat belt usage laws and promoting safety measures, which drives the demand for seat belts. Leading companies are developing advanced technologies such as reminding drivers to fasten their seat belts while driving. For example, the smart seat belt developed by Nissan uses an electric retractor to control the seat and the locking action of this system helps occupants and drivers feel safe during sudden maneuvers and skidding. These factors are driving the market growth.

Rising Demand for Passenger Cars Driven by Increase in Leisure and Travel Activities to Boost Market Growth

Increased sustainability, shared mobility, connected cars, including electric vehicles, changing consumer behavior, and improved lifestyles are pushing the automotive industry to set new records. According to the Federation of Automobile Dealers Associations (FADA), the number of passenger cars sold in 2022 was estimated to hit 3,431,497 compared to 2021 when the number of passenger cars was 2,949,182. The sales in 2022 increased by 16.35% compared to 2021. The demand for SUVs is increasing all over the world due to an increase in leisure and travel activities around the world. In addition, increasing government pressure on automakers to produce efficient, low-emission vehicles puts a lot of pressure on them to invest in research and development. Electric and hybrid vehicles are in great demand worldwide due to their low emissions and high fuel efficiency. This factor increases the global seat belt demand.

RESTRAINING FACTORS

Injuries Due to Seat Belt Failure to Restrain Market Growth

The vehicle crash speed and seat belt type greatly affect the type of injury. However, faulty seat belts can directly lead to or exacerbate injuries. A seat belt failure can cause injuries from minor cuts and bruises, spinal cord injuries, and other serious injuries. The most common injuries include fractures, contusions, quadriplegia, brain injuries, visceral injuries, spinal cord injuries, head injuries, paraplegia, death, or other fatal injuries. The reliability and efficiency of broken seat belts can pose several risk factors to life. Besides, the high maintenance and operating costs are additional factors hampering the market growth.

Automotive Seat Belt Market Segmentation Analysis

By Seat Belt Type Analysis

Three-point Held the Largest Market Share Owing to Rapid Urbanization and OEM Preference for Standard Fitment

By type, the market is segmented into three-point and five-point. The three-point segment dominated the market in 2023 and is estimated to expand at a healthy CAGR growth over the analysis period. A three-point seat belt is a safety restraint system used primarily in passenger cars and commercial vehicles to secure occupants in their seats. The lap belt, shoulder belt, and buckle are together called the three-point belt as it consists of three main components.

A lap belt wraps around and buckles around the pelvic area of an occupant and is used to immobilize the lower body, especially the pelvis and hip joints. The shoulder belt runs diagonally across the chest and shoulder, providing upper-body restraints. Compared to two-point seat belt, this belt distributes the force generated by a crash across the body’s strongest bones and muscles. It also helps to reduce the risk of severe injuries such as head, chest, and abdominal injuries.

Three-point seat belt has become a standard feature in passenger and commercial vehicles across the globe. It is required by law in most countries for all occupants to wear seat belts while the vehicle is in motion. Over the forecast period, increasing passenger car sales across the globe are fueling the demand for three-point belts.

Five-point seat belt is similar to a regular three-point seat belt and consists of two separate shoulder straps running across each shoulder and the chest. This shoulder harness stabilizes the torso during sudden stops and impacts, reducing the risk of head and torso injuries. One of the biggest advantages of five-point seat belts is their lower straps. These straps extend in a Y shape from the lap to the shoulder belt. Bottom straps prevent occupants from slipping or sliding out of the seat in high-impact situations. It also distributes the impact force across the pelvis and chest, reducing the risk of serious injury. Five-point safety belts are mainly used in racing cars and high-performance vehicles. This factor will help the five-point segment maintain its second-largest position over the forecast period.

By Distribution Channel Analysis

OEM Segment Captured a Major Share Owing to Increasing Demand for Vehicles

By distribution channel, the market is categorized into OEM and aftermarket.

The OEM segment dominates the distribution channel segment in the market. OEM seat belts are designed and manufactured for specific vehicle makes and models to ensure a perfect fit in the vehicle, ensuring proper installation and compatibility. These belts are rigorously tested and certified to meet the highest safety standards set by car manufacturers. The advantage of OEM seat belts is that they have a manufacturer or supplier warranty. This factor is expected to increase the demand for the OEM segment during the forecast period.

The aftermarket segment is anticipated to hold the second-largest position in the market. OEMs do not manufacture these belts for specific vehicle makes and models. Instead, they are manufactured by third-party companies and designed to be compatible with various vehicles. Aftermarket seat belts offer a wider range of options than OEM seat belts. These belts can also be deployed in very old and less common vehicles. However, OEM seat belts are difficult to find and more expensive. Comparatively, aftermarket seat belts can be customized to meet consumer needs and are affordable.

Aftermarket seat belts offer limited warranty or no insurance compared to OEM seat belts. These seat belts might not meet the stringent safety law or requirements required for the vehicle. The OEM seat belts do not require high maintenance and feature a protracted existence compared to aftermarket seat belts. Hence, the aftermarket segment is anticipated to show sluggish growth over the forecast period.

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Passenger Cars Segment to Depict Prominent Growth Owing to Increased Vehicle Production

Based on vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment is projected to dominate the market over the forecast period owing to increased production and sales of passenger cars. Additionally, increase in sales of electric vehicles globally and the rise in consumers' per capita income in developing countries are further anticipated to drive the passenger cars segment growth over the forecast period.

The commercial vehicles segment is expected to show significant growth, accounting for the second-largest position in the market during the forecast period. The expansion comes amid increasingly stringent commercial vehicle safety regulations, soaring commercial vehicle accident rates, and increasing litigation.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Asia Pacific, Europe, and the rest of the world.

Asia Pacific Automotive Seat Belt Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to dominate the automotive seat belt market share over the forecast period in terms of value and volume due to increased vehicle production and sales in developing countries such as China, India, and Japan. For instance, as of 2003, only 24 million vehicles had been registered in China; by 2018, that number increased to 232.21 million cars, and in 2022 the number increased to 319 million cars. Increasing vehicle production, upgrading of road infrastructure, and stringent road safety norms are expected to drive the China’s market. The increased demand for luxury vehicles in countries such as Japan will further propel the market growth.

In North America, the use of automotive seat belt is widely enforced and regulated to improve road safety. Each jurisdiction regulates automotive seat belt laws but requires all vehicle occupants to wear seat belts while in motion. Failure to comply with these laws may result in fines or other penalties. In the U.S., seat belt laws are enforced at the state level. For example, all U.S. states except New Hampshire will require adults to wear seat belts. Increasing street trading activity in the region is also another factor that will propel the market growth during the forecast period.

List of Key Companies in Automotive Seat Belt Market

Companies are Focusing on Building New Strategies and Partnerships to Secure a Competitive Edge

The key players are focusing on acquisitions, strategic partnerships, and cost-reduction strategies to improve their product offerings. For instance, in May 2021, Continental Engineering Services announced a partnership with Tri Eye. The focus of this collaboration is the implementation of SWIR imaging systems in driver monitoring systems. Tri Eye's technology enables Continental Engineering Services to provide customers with valuable sensor solutions such as improved user identification and accurate seat belt detection. With this partnership, the company is looking forward to offering technology-based products and services and enhancing its product portfolio to meet the global product demand.

LIST OF KEY COMPANIES PROFILED:

- Holmbergs Safety System Holding AB (Sweden)

- GWR Safety Systems (U.S.)

- Ashimori Industry Co., Ltd (Japan)

- Joyson Safety Systems (U.S.)

- TOKAIRIKA, CO, LTD. (Japan)

- ZF Friedrichshafen AG (Germany)

- Autoliv Inc. (Sweden)

- AB Volvo (Sweden)

- Hyundai Mobis (South Korea)

- Robert Bosch GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: NIO, a Chinese EV manufacturer, entered into an agreement with Autoliv, the world’s largest manufacturer of airbags and seat belts to manufacture safety products for electric vehicles. This development of safety technologies will increase the demand for seat belts as the airbag deployment works only when the seat belts are intact.

- April 2023: Uber Technologies introduced a new seat belt reminder feature for rear seat passengers. The 'audio seat belt reminder' is an industry-first feature that reduces injuries from unbelted rear seat occupants and increases platform safety.

- January 2023: A total of 5.35 million NEVs were newly registered across China in 2022, up more than 81% compared to the previous year and accounting for over 23% of all new automobile registrations. This, in turn, is increasing the demand for seat belts in China.

- September 2022: The Indian Government was planning to mandate the rear seat belt for passengers after the accident of former Tata Sons Mr. Cycrus Mistry. Moreover, a fine under Rule 138 (3) of the Central Motor Vehicle Rules (CMVR) was implemented.

- February 2022: The Government of India's Ministry of Transport announced that it will be mandatory for the middle passenger in the back seat of a passenger car to wear a three-point seat belt. Currently, the second-row center seat is equipped with aircraft seat belts as standard but will soon be replaced with three-point seat belts as are the front and rear window seats.

REPORT COVERAGE

The report provides an analysis of the market and focuses on key aspects such as leading companies, product/service types, and key products. Besides, the report offers insights into the market trends and highlights key industry developments. The report delivers an in-depth analysis of several factors contributing to the market growth in recent years.

An Infographic Representation of Automotive Seat Belts Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

Segmentation |

By Seat Belt Type

|

|

By Distribution Channel

|

|

|

By Vehicle Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 15.37 billion in 2024.

The market is likely to grow at a CAGR of 4.9% over the forecast period (2025-2032).

The passenger cars segment is expected to lead the market due to the development of smart city projects.

Some of the top players in the market are ZF Friedrichshafen AG, Autoliv Inc, and Joyson Safety Systems.

Asia Pacific dominated the market in terms of market size in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic