Automotive Sensors Market Size, Share & Industry Analysis, By Sensor Type (Temperature Sensor, Pressure Sensor, Speed Sensor, Position Sensor, Others), By Application Type (Powertrain, Chassis, Exhaust, ADAS, Others), By Vehicle Type (Passenger Car, LCV, HCV) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

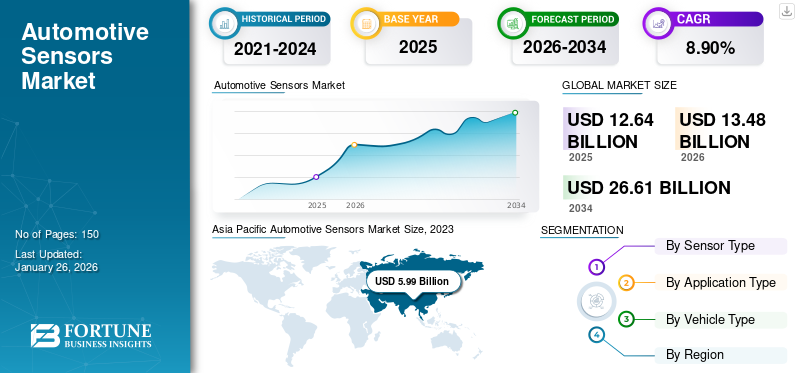

The global automotive sensors market size was valued at USD 12.64 billion in 2025 and is projected to grow from USD 13.48 billion in 2026 to USD 26.61 billion by 2034, exhibiting a CAGR of 8.90% during the forecast period. Asia-Pacific dominated the automotive sensors industry with a market share of 53.69% in 2025. Additionally, the automotive sensors market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.72 Billion By 2032.

An automotive sensor is a device that detects and responds to changes in the environment, converting physical inputs, such as temperature, pressure, light, motion, or other phenomena, into electrical signals. In the automotive context, sensors play a crucial role in monitoring, controlling, and enhancing various aspects of vehicle performance, safety, efficiency, and comfort. The automotive sensor market encompasses a wide range of sensor types, such as temperature sensors, pressure sensors, position and motion sensors, proximity sensors, and others.

Download Free sample to learn more about this report.

Global Automotive Sensors Market Overview

Market Size:

- 2025 Value: USD 12.64 billion

- 2026 Value: USD 13.48 billion

- 2034 Forecast Value: USD 26.61 billion, with a CAGR of 8.90% from 2026–2034

Market Share:

- Asia Pacific held the largest share of the global market in 2025, with a valuation of USD 7.29 billion, accounting for 53.69% of the global revenue.

- The region is expected to reach USD 12.91 billion by 2032, maintaining its leading position.

- North America and Europe also contributed significantly, with rising demand for ADAS features and electrification across passenger and commercial vehicles.

Industry Trends:

- Increasing integration of ADAS (Advanced Driver Assistance Systems) is driving the demand for smart sensors, including radar, ultrasonic, and LiDAR.

- Development of non-contact 3D magnetic sensors is replacing traditional potentiometers and optical systems.

- OEMs are emphasizing electrification, vehicle autonomy, and connectivity, requiring more sophisticated sensing solutions.

- Miniaturization and increased functionality in sensors are enhancing vehicle performance, safety, and fuel efficiency.

Driving Factors:

- Rising demand for vehicle safety, emissions control, and in-vehicle automation is fueling sensor integration.

- Government regulations mandating safety features such as airbags, crash sensors, and lane-keeping assistance.

- Growth in EV (Electric Vehicle) production and connected cars is expanding the role of sensors in monitoring battery systems, powertrain, and real-time diagnostics.

- Technological advancement and cost-effective sensor solutions are encouraging broader adoption, especially in emerging markets.

Automotive sensors gather data from various vehicle systems and components, transmitting signals to the vehicle's electronic control unit (ECU) or other control modules. This data is used for real-time monitoring, diagnostics, feedback control, and decision-making processes to optimize vehicle performance, safety, and efficiency. The growth of the automotive sensor market is driven by factors, such as increasing vehicle electrification and connectivity, rising demand for advanced driver assistance systems (ADAS) and autonomous vehicles, stringent safety and emissions regulations, and technological advancements in sensor design and manufacturing.

The lockdown and economic crisis due to the COVID-19 pandemic severely impacted many automotive sensors companies. Many automotive sensor manufacturers have experienced significant resource bottlenecks in the global supply and logistics chains in the year that had a perceptibly negative effect on their businesses.

Automotive Sensors Market Trends

Increasing Demand for Advanced Technologies, Comfort and Safety To Set Positive Trend For Market Growth

Auto manufacturers encourage non-contact 3D magnetic sensors to replace potentiometers or optical systems that use traditional position-sensing techniques. These sensors prevent wear and contamination errors, save space, and ensure precise measurements in a high-temperature environment.

Manufacturers can use 3D magnetic sensing to optimize form factors throughout the vehicle, such as position sensors for gear sticks, pedals, and transmission moving parts. Suppliers such as STMicroelectronics and Elmos, for instance, are developing 3D gesture sensing to improve driver concentration and eliminate manual control of functions such as vehicle lighting and infotainment. Hence, the higher adoption of advanced technologies is a positive trend influencing the growth of the market.

Further, key market drivers that impact the automotive sensors market growth are growing demand for safety and comfort characteristics, new energy vehicles, connected vehicles, body electronics and upcoming autonomous vehicles, the rigorous regulatory framework. Moreover, this will add many new application/features scenarios to the charging, energy storage, power distribution, voltage conversion equipment, etc. Also, the rising purchases of such vehicles in North America and Europe and its rising vehicle production activities in South Africa will demand market growth in coming years.

Growth Factors

Increasing Demand for Pressure Sensors to Augment Growth

Modern vehicle restraint systems utilize side airbag pressure sensors to satisfy passenger car safety requirements. The pressure sensor is integrated into the vehicle's side doors and sends digital crash signals to the central airbag unit. Furthermore, the air pressure sensor improves engine efficiency by effectively controlling spark advances in gasoline and diesel engines. Hence, the market is expected to develop due to the rising use of pressure sensors in the engine and the vehicle's safety system.

Rising Growth of Autonomous Vehicles to Fuel Demand For Sensors

The autonomous abilities of commercially available vehicles are anticipated to develop rapidly over the next several years due to increasingly stringent regulations and safety tests (in particular, emergency brake assist) and growing awareness regarding vehicle safety. For instance, in developed countries, functions like cruise control and lane-keep assist are mandatory on all vehicles, and regulations for blind-spot monitoring, particularly in Europe.

These vehicles require Long-range radar sensors for features like adaptive cruise control and roughly two medium-range backward-facing radar sensors to enable blind spot detection. Furthermore, up to 12 ultrasonic sensors are required for features such as parking assistance. Thus, the usage of high-precision sensors is expected to increase as demand for autonomous driving features increases.

RESTRAINING FACTORS

High Cost and Limitations Under Bad Weather Conditions to Hinder Growth

Because of the small quantities produced it has been impossible to reduce the cost of sensors used in Advanced Driver Assistance System (ADAS) to target levels. Furthermore, most current sensors have a restricted signal bandwidth and measuring range, making it more difficult to distinguish between system noise and signals, such as road obstacles. Also, tracking moving things is even more challenging in less-than-ideal environments such as blizzards or rain. These factors are expected to hamper the market’s growth.

Automotive Sensors Market Segmentation Analysis

By Sensor Type Analysis

Position Sensors Held the Highest Market Share in 2023

The Position Sensor segment will account for 41.90% market share in 2026. Based on the type, the market is fragmented into speed, position, pressure, temperature, and others. Position sensors are used in vehicles to identify the steering wheel's position, pedals, manifold flap, and various actuators and valves. They can be used to detect and send data about the roof or seat position, the roof or door closure and activate the vehicle's essential functions accordingly. Hence, the position sensors segment is expected to dominate the automotive sensors market share over the forecast period due to the extensive range of applications.

Pressure sensors are a crucial part of automotive safety systems and engine operation. Airbag pressure sensors send digital crash signals that enable swift deployment of airbags, and air pressure sensors can effectively control spark advance that allows more excellent engine performance. These factors will help for the rise in growth for the segment.

The temperature sensors market segment is also predicted to show positive growth in the market. They are required to monitor transmission fluid temperature, exhaust gas temperature, engine oil temperature, fuel temperature, and coolant water temperature and ensure reliable vehicle engine operation over its durability.

By Application Type Analysis

ADAS Segment to Lead Market Owing to Rising Demand for Driving Assistance Features

Based on application, the market is segmented into powertrain, exhaust, chassis, ADAS, and others. ADAS sensors include LiDAR, cameras, and radar. Cameras and radars are mainly used in combination for level 1 and level 2 autonomous vehicles for safety-related applications. For instance, the New Car Assessment Programme (NCAP) awarded a five-star rating requires a high level of safety functions, fueling the growing demand for these radars and cameras.

Other ADAS sensors include ultrasonic, airbag, tire pressure, and rain, further increasing vehicle safety. Thus, these factors are expected to propel the growth of this segment over the projected period. In Chassis, these components monitor essential functions such as steering, acceleration, and braking. Greater focus on improving vehicle maneuverability and occupant safety are expected to boost adoption of these components in Chassis segment over the next few years.

Powertrain sensors optimize fuel consumption by monitoring vehicle parameters such as temperature and pressure and sending information to the engine control unit. Hence, these components can boost greater fuel efficiency. These are some factors that are responsible for a high share of the powertrain segment in the market. The powertrain segment accounted for a 24.98% market share in 2020. The segment will show low growth during the forecast period.

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Passenger Car Segment Held Largest Market Share in 2023

Based on vehicle type, the market is divided into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). The need for sensors in passenger cars has increased due to optimizing fuel consumption and the growing demand for personal mobility solutions.

The passenger car segment will account for 80.03% market share in 2026. Sensors used to monitor mass air flow, coolant, and oxygen assist the vehicle by controlling emissions rate, monitor temperature changes, and send signals to the engine control unit to adjust spark timing and deliver accurate fuel delivery. Thus, due to greater consumer demand for safety-oriented and environment-friendly vehicles, the passenger car segment is expected to hold the largest share of the market.

The light commercial vehicle segment accounted for 14.57% of the market. This segment will show a higher growth rate during the forecast period due to increased awareness about safety and comfort features and government regulation.

Heavy commercial vehicles currently hold a minimal share of 6.25% due to less awareness and high vehicle prices with advanced features such as sensors.

REGIONAL INSIGHTS

Asia Pacific Automotive Sensors Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America represents a technologically advanced and high-value market for automotive sensors, supported by early adoption of advanced driver assistance systems (ADAS), strong penetration of electric vehicles, and a well-established automotive OEM and Tier-1 supplier ecosystem. The region benefits from a mature regulatory environment that emphasizes vehicle safety, emissions reduction, and fuel efficiency, reinforcing the integration of sensors across powertrain, safety, and body electronics applications. Demand trends are increasingly shaped by consumer preference for connected, semi-autonomous, and electric vehicles, leading to higher sensor density per vehicle and sustained demand for image, pressure, temperature, and position sensors. The U.S. market is projected to reach USD 1.43 billion by 2026.

Europe holds a strong position in the global automotive sensors market, driven by stringent safety, environmental, and vehicle performance regulations. Regulatory mandates covering passenger and commercial vehicles, including requirements for tire pressure monitoring, driver monitoring, risky road user detection, and alert systems, are accelerating sensor adoption across multiple vehicle categories. The region’s focus on reducing road fatalities, combined with aggressive carbon emission targets and widespread electrification initiatives, continues to support steady demand growth. European OEMs’ emphasis on premium safety and efficiency features further contributes to consistent sensor integration rates. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 1.06 billion by 2026.

Asia Pacific is the largest and fastest-growing regional market, with a market size of USD 7.29 billion in 2026 projected to reach USD 12.91 billion by 2032, registering a CAGR of 9.3% over the forecast period. The region benefits from rising middle-class disposable incomes, expanding vehicle ownership, and significant cost advantages for OEMs, including low automotive production costs and the availability of low-cost labor. At the same time, increasing road accident fatalities have prompted governments to implement stricter safety and emission regulations. In India, for example, mandatory requirements for airbags, seat-belt reminders, alert systems, reverse parking sensors, and safety overrides for electronic systems have directly increased sensor penetration in both passenger vehicles and light commercial vehicles. These regulatory and demand-side dynamics are reinforcing Asia Pacific’s dominant market position.

The Japan market is projected to reach USD 1.1 billion by 2026, the China market is projected to reach USD 4.3 billion by 2026, and the India market is projected to reach USD 0.65 billion by 2026.

Latin America represents an emerging automotive sensors market, characterized by gradual recovery in vehicle production and rising adoption of safety and emission technologies. Regulatory frameworks across key markets in the region are progressively aligning with international safety and environmental standards, driving incremental demand for sensors related to braking, emissions control, and basic driver assistance functions. While cost sensitivity remains high, increasing awareness of vehicle safety and improving economic conditions are supporting steady growth in sensor adoption, particularly in passenger vehicles and light commercial segments.

The Middle East & Africa market remains comparatively smaller but shows long-term growth potential, supported by rising vehicle parc, infrastructure development, and gradual modernization of automotive safety regulations. Demand is primarily driven by imports of vehicles equipped with standard safety and comfort features, as well as increasing adoption of fleet and commercial vehicles in logistics, construction, and public transport. Although regulatory enforcement varies across countries, the growing focus on road safety, fuel efficiency, and vehicle durability under harsh operating conditions is expected to support incremental growth in automotive sensor demand across the region.

List of Key Companies in Automotive Sensors Market

Infineon Technologies AG, NXP Semiconductors, and Robert Bosch GMBH to Lead Market

STMicroelectronics, Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors are key major players in the global market. Over the past few years, there has been a rise in investment in advanced technologies. For instance, high-resolution sensors from companies such as NXP, Elmos, Infineon, and Allegro Microsystems are utilized in steer-by-wire systems. The steering sensor data can then be combined with other information such as the length of the journey and turn signals via a driver-awareness algorithm to alert the driver if the level of tiredness exceeds a particular threshold.

Driver tiredness accounts for nearly twenty percent of road accidents. Thus, sensor developers, particularly tier-one suppliers, are likely to increase R&D funding to improve safety-oriented sensors that offer high performance and lower power consumption to boost their commercial viability among automotive manufacturers.

LIST OF KEY COMPANIES PROFILED:

- Robert Bosch GmbH (Gerlingen, Germany)

- Infineon Technologies AG (Neubiberg, Germany)

- STMicroelectronics (Geneva, Switzerland)

- Continental AG (Hanover, Germany)

- Denso Corporation (Kariya, Japan)

- NXP Semiconductors (Eindhoven, Netherlands)

- Texas Instruments Incorporated (Dallas, U.S.)

- Allegro Microsystems, LLC (New Hampshire, U.S.)

- CTS Corporation (Illinois, U.S.)

- Elmos Semiconductor (Dortmund, Germany)

- Sensata Technologies (Attleboro, Massachusetts, U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In October 2023, Honeywell introduced innovative solutions to address EV battery fires. The announced that the its lithium-ion battery safety sensors help play a crucial role in detecting potential battery fires, which can protect drivers.

- In December 2022, Honeywell singed a strategic alliance with Nexceris developer of Li-ion Tamer® lithium-ion gas detection solutions, to help make electric vehicles (EVs) safer. Honeywell and Nexceris will co-develop sensor based solutions to help prevent conditions leading to thermal runaway in EV batteries, a phenomenon that causes extremely high temperatures within the battery cell and can result in a fire.

- In May 2022, Continental introduced new Sensors to Protect the Battery of Electrified Vehicles. Continental’s broad sensor portfolio is extended by sensors specifically designed for electro-mobility to support both road safety and electrification.

- In February 2023, CTS Corporation recently announced the acquisition of maglab AG, a privately held magnetic system design and current measurement solution provider. Maglab offers products designed for smart and fail-safe positions and current measurements for electric mobility, renewable energy, robotics, and automation. The company leverages magnetic material and sensor engineering experience to deliver solutions that fit customers’ unique applications.

- In February 2023, Continental announced that the company is expanding its sensor portfolio for the fast-growing electric car market by introducing a new innovative sensor. The high-speed inductive e-motor Rotor Position Sensor (eRPS) detects the actual position of the rotor in a synchronous electric machine, which helps to increase efficiency and allows smoother operations. Compared to existing resolver sensors, the eRPS is more compact and 40 percent lighter in weight.

REPORT COVERAGE

The automotive sensors market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, competitive landscape and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report delivers an in-depth market analysis of several factors that have contributed to its growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousand Units) |

|

Segmentation |

By Sensor Type

|

|

By Application Type

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 13.48 billion in 2026 and is projected to reach USD 26.61 billion by 2034.

In 2025, the market value in Asia Pacific stood at USD 6.78 billion.

The market is projected to grow at a CAGR of 8.90% and will exhibit steady growth during the forecast period (2026-2034).

The passenger car segment is expected to be the leading segment in this market during the forecast period.

Increasing stringency of emission and safety norms for vehicles is the key factor driving the markets growth.

STMicroelectronics, NXP Semiconductors, and Robert Bosch GmbH are the major players in the global market.

Asia Pacific held the largest share of the market in 2025.

Increasing adoption of driving assistance features such as parking assistance and emergency brake assist that utilize many sensors is expected to drive the adoption of these sensors over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us