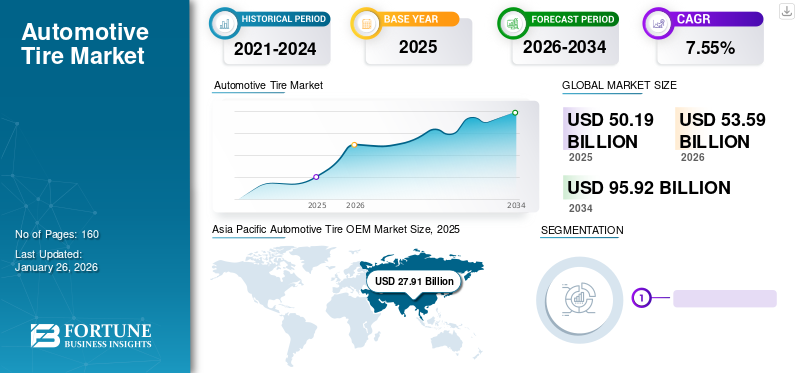

Automotive Tire OEM Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), By Rim Size (13”-15”, 16”-18”, 19”-21”, and Above 21”), By Design (Radial and Bias), By Tire Type (Tubeless and Tube), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global automotive tire OEM market size was valued at USD 50.19 billion in 2025 and is projected to grow from USD 53.59 billion in 2026 to USD 95.92 billion by 2034, exhibiting a CAGR of 7.55% over the forecast period. Asia Pacific dominated the global market with a share of 55.61% in 2025.

Automotive tires are original tires equipped with vehicles offered by Original Equipment Manufacturers (OEMs). These tires are specified by the vehicle manufacturer and are initially fitted to the vehicle. The vehicle manufacturer works with tire companies to choose a tire that meets performance requirements such as high fuel efficiency, longevity, and balanced ride noise for their brand-new vehicle.

Global Automotive Tire Market Overview

Market Size:

- 2025 Value: USD 50.19 billion

- 2026 Value: USD 53.59 billion

- 2034 Forecast Value: USD 95.92 billion, with a CAGR of 7.55% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific dominated the market share in 2025, led by growing vehicle sales and robust manufacturing activity in China and India.

- Vehicle Type Leader: Passenger cars accounted for the highest share in 2023 due to increased global production and demand.

- Fastest-Growing Segment: The run-flat tire segment is projected to expand rapidly, supported by rising consumer demand for safety-enhanced, high-performance vehicles.

Industry Trends:

- Smart & Sustainable Tire Development: Manufacturers are focusing on fuel-efficient, eco-friendly materials and incorporating sensor technologies.

- TPMS & Digital Monitoring: Tire Pressure Monitoring Systems and RFID technology are increasingly adopted to enhance safety and vehicle tracking.

- EV-Compatible Tires: Custom tire designs for electric vehicles are emerging to support unique performance requirements like high torque and quiet operation.

- Retread Tire Adoption: Growing popularity of retreaded tires in the commercial segment due to cost-effectiveness and sustainability focus.

Driving Factors:

- Automotive Production Growth: Rising output of passenger and commercial vehicles globally drives tire demand.

- Aftermarket Expansion: Increased replacement cycles due to aging vehicles and higher average miles driven.

- Infrastructure Development: Expansion of road networks, particularly in emerging economies, supports tire market growth.

- Online Tire Sales: The rise of e-commerce platforms is improving accessibility and consumer reach.

- Regulatory Standards: Government mandates related to tire safety are pushing innovation and product upgrades.

The overall growth in vehicle sales, particularly in emerging markets, drives the demand for OEM tires. As more vehicles are produced and sold globally, there is a proportional increase in the demand for tires. Shifts in automotive industry trends, such as the increasing demand for electric vehicles (EVs), autonomous vehicles, and connected cars, can impact the OEM tire market. For instance, EVs often require tires with specific characteristics to support their unique performance requirements, such as low rolling resistance for improved range.

The rising production and sales of passenger and light commercial vehicles globally are anticipated to propel the automotive tire OEM market growth. As more people purchase vehicles, a greater demand for high-performance automobiles exists. Increasing vehicle production and high demand for passenger cars worldwide are anticipated to boost market growth over the forecast period. According to the data published by European Automobile Manufacturers Association (ACEA), over 68 million passenger cars were manufactured globally in 2022, an increase of 7.9% from a year earlier. The rapid growth of the automotive industry is also supporting the market growth. Growing awareness of environmental issues and sustainability concerns may prompt automakers to prioritize eco-friendly materials and manufacturing processes in OEM tire production. Sustainability initiatives could drive the demand for tires made from renewable or recycled materials.

Automotive Tire OEM Market Trends

Growing Demand for Airless and Non-Pneumatic Tires Set a Positive Trend in the Market

Aesthetic design, high performance, durability, and cost-effectiveness are some of the customers' primary concerns. The demand for high performance tires is increasing with the rising concern of customers using conventional tires. This is encouraging automotive tire OEMs to focus on top-end technological development and production of high-caliber products.

Advanced and high-performance tires can substantially improve the in-vehicle convenience of customers. These tires are generally airless, non-pneumatic, and cannot be punctured, providing a firm grip on roads and performing well on wet roads and during high-speed traveling. They have a smaller surface contact area than conventional tires, and it helps increase the vehicle’s fuel efficiency.

Through continued technological innovation, automotive tire OEM players are developing safer, quieter, and improved passenger car and light truck radial tires with improved eco-friendliness and cutting-edge technology. The automotive tire OEM players are also focusing on manufacturing Electric Vehicle (EV) tiers to boost product competitiveness at a higher level. For instance, in February 2023, Goodyear introduced an EV tire, RangeMax RSD, compatible with EV and gas- or diesel-powered vehicles for regional fleets. The energy-efficient tire is equipped to handle the higher load capacities of EVs, designed to deliver lower rolling resistance irrespective of the drivetrain.

Download Free sample to learn more about this report.

Automotive Tire OEM Market Growth Factors

Growing Demand for Passenger Cars and Light Duty Vehicles is Accelerating the Market Growth

Increasing vehicle sales and production is anticipated to boost the market over the forecast period. The growing demand for passenger cars and light-duty commercial vehicles, especially in countries including China, Japan, and India, will increase tire demand over the forecast period. According to the China Association of Automobile Manufacturers report, sales of passenger vehicles witnessed robust expansion; over 1.05 million such vehicles were sold in China in March 2023, an increase of 20.4% from the previous month. The rebounding vehicle sales post-COVID-19 pandemic will catalyze market development.

Advancements in tire manufacturing technology, such as intelligent tires with built-in sensors, to reduce overall driving costs across all fleets are creating growth opportunities for the market players. Prominent players of automotive tire OEM, including Continental and Hankook are investing in technologies that will enable safer driving and vehicle management based on the data provided by the tire. Intelligent tires monitor accurate pressure and temperature readings from sensors in the tire's inner liner. For instance, in February 2023, Continental Tires launched new ContiConnect Live cloud-based solutions to assist fleets in real-time, intelligent digital tire monitoring of all vehicles in the fleet. Continental tire sensors collect data inside the tires and forward it to a telematics unit. This information can be used for truck and trailer monitoring or stand-alone trailer monitoring.

RESTRAINING FACTORS

Fluctuating Raw Material Prices May Restrain the Market Growth

Fluctuating raw material prices can disrupt the supply chain, leading to production delays, inventory shortages, and increased lead times. Such disruptions can hamper the ability of OEMs to meet the customer demand for new vehicles, thereby impacting tire sales and overall market growth. Tire manufacturers operate within thin profit margins and unexpected increases in raw material prices can squeeze profitability. This can lead to reduced investments in research and development, innovation, and expansion initiatives that are essential for driving market growth.

High development cost is one of the factors that can restrain the market of automotive tire OEM. Developing tires that meet the specific requirements of automakers can be expensive, especially for smaller manufacturers that may not have the resources to compete with the larger companies. Tire manufacturers must comply with various environmental regulations, including safety and environmental standards. These requirements lead to higher costs and complexity in developing and producing automotive tires.

Automotive Tire OEM Market Segmentation Analysis

By Vehicle Type Analysis

Passenger Car Segment is anticipated to Lead Owing to Rising Demand from Developing Countries

The market has been categorized into light commercial vehicle, heavy commercial vehicle, and passenger car, by vehicle type.

The passenger car segment dominated a major market with a share of 58.73% in 2026. Growing demand for passenger cars from developing countries such as India, China, and Indonesia, amid the rise in the purchasing power of consumers, will also propel the growth of the passenger cars segment in the region over the forecast period.

The light commercial vehicle segment is anticipated to be the fastest-growing segment, with a CAGR of over 7.4% over the forecast period. The rapid boom of the e-commerce industry has propelled the demand for light-duty vehicles. The Light-duty vehicles continue to move in an upward trajectory buoyed by public investment in logistics & transportation, and construction. This has led to the wider adoption of light-duty vans propelling the demand for commercial-grade tires for these fleets.

To know how our report can help streamline your business, Speak to Analyst

By Rim Size Analysis

16’’-18’’ Rim Size to Dominate the Market Owing to Growing Demand for Passenger Cars

The market is categorized into 13”-15”, 16”-18”, 19”-21”, and above 21” by rim size. The 16”-18” segment dominated with a market with a share of 30.83% in 2026. This rim size is primarily used in passenger cars. The growing production of passenger cars has propelled the demand for 16”-18” rim-size tires.

Rim size 13”-15” is anticipated to register a CAGR of 8.8% over the forecast period. This reflects the growing demand for small cars for urban fleets and the growing popularity of shared transportation, where higher-occupancy vehicles such as buses may be less preferred in the post-pandemic period.

Tire rim size 19”-21” is anticipated to grow significantly owing to their wider usage in light commercial vehicles and SUVs. The positive market statistics can be attributed to its low maintenance cost, operating cost, and better fuel efficiency.

By Design Analysis

Radial Held a Considerable Market Share Owing to Better Traction and Lower Fuel Consumption

Based on design, the market is segmented into radial and bias. The radial tire held a leading market with a share of 80.80% in 2026. A radial tire is expected to show significant growth over the forecast period owing to the strength and flexibility of the tire. Radial tire absorbs the bumps, impacts, and shocks, providing better comfort to the operator with a better ride. The tread and sidewall of the radial tire function independently. Radial tires transfer more power from the machine to the ground, thus helping to lower fuel consumption and higher productivity. The radial tire provides lesser ground compaction and damage to the vehicle. These factors will lead to an increase in sales of the radial tire among the passenger vehicle segment.

The bias tires segment is anticipated to grow slower over the forecast period. Bias tires are used on heavy construction owing to their stronger sidewalls, reducing the chances of tire damage when driving across rough terrain. They are designed to have less flexibility than radial, which can lead to reduced traction, increased wheel slippage, and provide a smaller footprint resulting in additional compaction. Due to these factors, the bias tire segment's growth is much less in the passenger vehicle segment. In contrast, it is steady in the commercial vehicle segment over the forecast period.

By Tire Type Analysis

Tubeless Leads the Market due to Higher Performance and Better Resistance to Heat

Based on tire type, the market is segmented into tube and tubeless.

The tubeless segment is expected to dominate the market with a share of 77.08% in 2026. The tubeless tire has no tube inside the tire like a tube tire. Air is trapped between the tires and the rim itself with the use of the airtight seal. Due to the high speed of a passenger vehicle, the temperature inside the tire gets higher, leading to an increase in pressure on the tire tube, causing the tire to burst. But the radial tire is without a tube, has high resistance to heat, and is suited to hold air much more than a thinner tube. These factors further drive the market for tubeless tires in passenger cars over the forecast period.

The tube segment is expected to grow significantly over the forecast period. Commercial vehicles are used for the transportation of heavy loads. Considering the capability to withstand heavy loads, a tube tire is generally used in commercial vehicles. This factor will propel the growth of the tube tire in the commercial vehicle segment.

REGIONAL INSIGHTS

Asia Pacific Automotive Tire OEM Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific to Dominate the Market due to Rising Production of Vehicles in the Region

Asia Pacific

Asia Pacific dominated the automotive tire OEM market share amid rapidly growing domestic consumption, availability of cheap labor, raw materials, large population, and evolving standards. Asia Pacific dominated the global market in 2025, with a market size of USD 19.51billion. China is anticipated to dominate the region due to the tire industry's huge investment. The Chinese tire industry is the world’s largest in terms of volume. According to the China Rubber Industry Association Tire Branch report, the 38 major member companies produced over 500 million tires in 2021, an increase of 11.28% as compared to 2020. The Japan market is projected to reach USD 4.64 billion by 2026, the China market is projected to reach USD 15.48 billion by 2026, and the India market is projected to reach USD 3.8 billion by 2026.

Moreover, the rise of the middle-class group has pushed automobile demand to an all-time high, creating a growing market for all kinds of tires. Technological innovation and high investments in R&D by key players may help to maintain dominance of the Asia Pacific region during the forecast period. China is expected to hold the largest market share in the Asia Pacific region amid huge sales of advanced tires such as airless tires, 3D print tires, and puncture-proof tires.

North America

The North America automotive tire OEM market is anticipated to grow significantly with a CAGR over the forecast period owing to robust demand for passenger cars and light-duty vehicles. Moreover, major market players GoodYear, Cooper Tire, Michelin, Continental, and Michelin have contributed to the region’s growth by expanding their product portfolio and investment in tire technologies. Moreover, the ever-growing demand for premium cars and compact SUVs has played a major role in the automotive tire OEM industry. The U.S. market is projected to reach USD 9.61 billion by 2026.

The rest of the world

The rest of the world would witness considerable market growth as companies such as Bridgestone, Sumitomo, and Continental actively invest in countries including Africa and Brazil. For instance, in November 2022, Bridgestone announced an investment of over USD 190 million to expand its tire manufacturing plant located in Costa Rica. This investment is in addition to over USD 60 million planned for 2022-2026. The company will be investing more than USD 250 million for five years. Moreover, rising disposable income, public infrastructure investment, and tire industry investment will drive regional market growth over the forecast period. The UK market is projected to reach USD 0.51 billion by 2026, and the Germany market is projected to reach USD 1.82 billion by 2026.

List of Key Companies in Automotive Tire OEM Market

Companies are Focusing on Mergers & Acquisitions and Partnerships to Gain a Competitive Edge in the Market

The companies are focusing on cost-reduction strategies, strategic partnerships, mergers, and acquisitions to enhance their product offerings. They are highly focused on using sustainable raw materials to create new tires, reduce their carbon footprint, and strengthen their global market position. For instance, in April 2023, Bridgestone developed tires using 75% recycled and renewable materials, including natural rubber, recycled plastic bottles, and recycled steel for electric SUVs and crossover vehicles.

List of Key Companies Profiled:

- Bridgestone Corporation (Japan)

- Michelin (France)

- Continental AG (Germany)

- Goodyear Tire and Rubber Company (U.S.)

- Sumitomo Rubber Industries (Japan)

- Hankook (South Korea)

- Pirelli (Italy)

- Yokohama Rubber Company (Japan)

- Toyo Tires (Japan)

- Giti Tire (Singapore)

- Maxxis (Taiwan)

- ZC Rubber (China)

- MRF Tires (India)

- Apollo Tyres (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023- Sumitomo Rubber Industries collaborated with Global Data Service Organization for Tyres and Automotive Components (GDSO) to enhance individual tire identification and management systems to enhance tire traceability. The tire manufacturer will also design a database enabling users to access data on the company's tires using RFID technology.

- October 2022 – Hankook Tire launched Smart iON AU06+, the first Truck and Bus Radial tire in its iON product portfolio for premium EVs in the Korean market. The Smart iON AU06+ is the latest addition to its iON tire family, which includes winter and summer tires for passenger EVs.

- September 2022 – Michelin launched Defender 2 tires for passenger cars and Crossover Utility Vehicles (CUVs) featuring an 80,000-mile warranty with an expansion into 19” and 20” rim sizes. The tire is designed to handle the extra weight and torque of small SUVs, minivans, and electric vehicles.

- July 2021 – Pirelli launched its first high-load index tire for electric or hybrid cars and SUVs. The tire is designed to support the weight of new vehicles equipped with batteries. It is designed to provide high driving comfort and low rolling resistance.

- June 2021 – The Goodyear Tire & Rubber Company acquired Cooper Tire & Rubber Company to strengthen its market position in the global tire industry. The combined company will offer broader options across the value spectrum to strengthen its customer base.

REPORT COVERAGE

The research report provides market analysis of automotive tire OEM and focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

An Infographic Representation of Automotive Tire Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.55% from 2026 to 2034 |

|

Unit |

Value (USD Billion) Volume (Thousand Units) |

|

Segmentation |

By Vehicle Type

|

|

By Rim Size

|

|

|

By Design

|

|

|

By Tire Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 50.19 billion in 2025.

The market is likely to grow at a CAGR of 7.55% over the forecast period (2026-2034).

Tubeless segment is expected to lead the market due to its improved puncture resistance.

Some of the top players in the market are Bridgestone, Michelin, Sumitomo, and Hankook.

Asia Pacific dominated the market in size in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic