Autonomous Cars Market Size, Share & Industry Analysis, By Type (Fully Autonomous and Semi-Autonomous), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

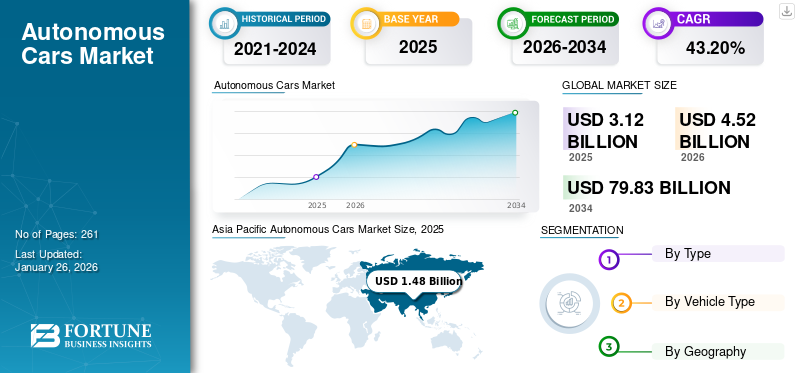

The global autonomous car market size was valued at USD 3.12 billion in 2025. The market is projected to grow from USD 4.52 billion in 2026 to USD 79.83 billion by 2034, exhibiting a CAGR of 43.20% during the forecast period. Asia Pacific dominated the global market with a share of 47.42% in 2025.

An autonomous car is a driverless car, also known as a self-driving car. The autonomous industry is involved in developing, producing, and commercializing vehicles equipped with advanced technologies that allow them to navigate and work without human intervention. These vehicles often have sensors, cameras, radar, Lidar (Light Detection and Ranging), GPS (Global Positioning System), and sophisticated software algorithms that perceive their surroundings, make decisions, and control the vehicle's movements.

Download Free sample to learn more about this report.

Global Autonomous Cars Market Overview

Market Size:

- 2025 Value: USD 3.12 billion

- 2026 Value: USD 4.52 billion

- 2034 Value: USD 79.83 billion, with a CAGR of 43.20% from (2026–2034).

Market Share:

- Asia Pacific accounted for the largest share in 2025, representing approximately 47.42% of global revenue

- By vehicle type, passenger cars dominate the market, significantly outpacing commercial vehicle adoption

Industry Trends:

- The emergence of the CASE framework (Connected, Autonomous, Shared, Electric vehicles) is reshaping industry dynamics, with growing emphasis on electrified and shared mobility models

- Rapid deployment of ADAS technologies—such as adaptive cruise control, parking assist, and collision avoidance systems—is accelerating adoption in semi-autonomous vehicles

- Major OEMs and tier‑one players (e.g., Waymo, Tesla) are investing heavily in sensor fusion platforms (LiDAR, radar, cameras) and advanced perception AI to advance toward full autonomy

Driving Factors:

- Escalating global focus on road safety and accident reduction is pushing demand for higher levels of driving automation

- Advances in AI technologies, sensor accuracy, high-definition mapping, and V2X connectivity are enhancing reliability and driving broader acceptance of autonomous systems

- The post‑pandemic recovery in semiconductor production and automotive supply chains is enabling scale-up of autonomous vehicle manufacturing

Autonomous cars are equipped with communication technologies that enable them to interact with other vehicles (V2V communication) and infrastructure (V2I communication), enhancing safety and efficiency on the road.

The COVID-19 Pandemic-induced semiconductor chip shortage impacted unevenly across various industries. Autonomous vehicles rely on various electronic systems and technologies, such as automated driving systems, control units, battery management systems, sensors, LiDAR, and others. All these systems are essential and mandatory for autonomous vehicles' efficient and safe working. Therefore, interruptions in the availability of semiconductor chips also affected the launch of autonomous cars, further hampering the market growth.

Autonomous Cars Market Trends

Increasing Demand for Automated Energy-efficient Vehicles to Favor Growth

The rising adoption of emission-free, fuel-efficient, or energy-efficient vehicles is one of the ongoing trends in the market. The imposition of stringent emission norms has influenced automakers to develop new generation clean energy vehicles such as fuel cell electric vehicles, battery electric vehicles, and others. Additionally, rising fossil fuel prices due to limited availability are also surging the demand for energy-efficient vehicles, such as electric cars, as an alternative to conventional fossil fuel-powered vehicles.

These vehicles are equipped with a significant level of autonomy and advanced technologies to run the vehicle; hence, they provide improved efficiency through efficient driving and optimized energy consumption. Therefore, increasing demand for highly efficient clean energy autonomous vehicles among the populace worldwide is driving the market growth. Additionally, to cater to the increasing demand for these autonomous vehicles, manufacturers are focused on partnering with autonomous cars technology developers.

Nearly all the leading automakers are actively investing in autonomous technology for its early adoption in their automobiles. For instance, in January 2021, Hyundai revealed they are in talks with Apple to reduce high manufacturing costs in developing Apple’s Autonomous car. Moreover, Alphabet’s self-driving car company Waymo partnered with Chinese automaker Geely to create a fleet of all-electric, self-driving cars. Similarly, other leading automakers have also established strategic partnerships with autonomous vehicle technology startups. Therefore, this rising investment trend of automakers investing in autonomous technology to grab early revenue growth opportunities in the market is anticipated to boost market growth in the near future.

Autonomous Cars Market Growth Factors

Rising Demand for Advanced Automotive Safety to Drive Market Growth

An increasing number of road accidents worldwide due to human error or lack of safety features in automotive is surging the demand for autonomous vehicles. Autonomous vehicles with advanced safety technologies such as parking assistance systems, blind spot detection systems, adaptive cruise control, and others benefit in this situation. According to the U.S. Department of Transportation (DOT), nearly 32 fatalities occur every day in the U.S. in drunk and driving car crashes, which is one fatality in every 45 minutes.

As per the 2020 annual traffic crash data released by the U.S. DOT’s National Highway Traffic Safety Administration, in 2020, nearly 38,824 lives were lost in traffic crashes across the U.S. According to the World Health Organization, road accidents are the most significant reason of death for young adults and children aged 5 to 29. Self-driving vehicles have various advantages over traditional vehicles as they are outfitted with modern LiDAR, radar, cameras, sensors, and other advanced technologies for safe driverless operation. Therefore, increasing demand and development of autonomous vehicles to avoid car crashes caused by human error is anticipated to boost the market growth during the forecast period.

Additionally, automakers are focused on developing driverless cars and related technologies that will allow the automobile to become a partner in a drive-by, continuously monitoring the vehicle’s surroundings and taking control of the car in various situations to avoid crashes that occur due to human errors and lack of safety features. All these factors are anticipated to influence market growth in the near future.

RESTRAINING FACTORS

High Complexity and R&D Cost in Adoption of Self-driving Cars to Restrain Growth

Autonomous vehicles consist of over 40 sensors, including LiDAR, RADAR, and cameras that assist in the efficient functioning of the vehicle. These sensors are highly expensive, and their functioning depends on the type of software and hardware used during operational activities. This further increases the cost of the overall system. For instance, the cost of automotive LiDAR is as high as USD 50,000, which adds up to the cost of a vehicle.

Thus, the production and adoption of autonomous vehicles necessitate large investments due to the high cost of components. Furthermore, due to the high cost and complexity of autonomous vehicle technology, the availability of level-4 and level-5 autonomous vehicles for analysis and testing is negligible. Moreover, the design and development of software that is utilized in autonomous vehicles are highly challenging, and the use of level-4 autonomous vehicles is not only capital-intensive but also subject to regulatory compliance.

A fully autonomous car needs to analyze massive quantities of sensor data, which is approximately 100 times greater than that of the data analyzed by the most advanced automobiles available in the market. The complexity of software used in autonomous vehicles is increasing at an exponential rate, with several Deep Neural Networks (DNNs) concurrently operating as part of the software stack. All these factors make self-driving cars expensive and complex to develop, further restraining the market growth.

Autonomous Cars Market Segmentation Analysis

By Type Analysis

Technology Advancement in Self-driving Cars to Drive Semi-autonomous Segment Growth

Based on type, the market is segmented into fully autonomous and semi-autonomous.

Semi-autonomous dominated the market with a share of 93.32% in 2026 and is also expected to remain dominant during the forecast period. Almost all the new-generation vehicles available in the market consist of semi-autonomous technology for efficient driving. Therefore, the soaring adoption of semi-autonomous type of cars with features, such as ADAS, autopilot, automated vehicle braking and parking systems, and others, is likely to fuel the segment's growth during the forecast period.

The fully autonomous segment accounted for the fastest-growing segment in the market, with a high CAGR. Increasing demand for autonomous vehicles to reduce car crashes, improve road safety by zero human interactions, and eliminate human errors is anticipated to drive the segment growth during the forecast period. Rapid technological advancement in the automotive sector for fully autonomous and emerging new trends in self-driven cars are expected to grow and offer lucrative opportunities for the growth of the fully autonomous segment.

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Safety Concerns and High Productivity to Drive Passenger Cars Segment Growth

Based on vehicle type, the market is split into passenger cars and commercial vehicles.

Passenger cars segment holds the largest market with a share of 92.21% in 2026. People prefer private transport to avoid overburdened public transport. Additionally, increasing demand for passenger cars after the pandemic to maintain social distancing drives the segment growth. Moreover, increasing demand for SUVs with a significant level of autonomy drives the market growth.

Commercial vehicles segment accounts for the fastest-growing segment in the market. Commercial vehicles have mostly fixed paths, and the distance traveled is more than passenger cars, which can create fatigue for drivers. Vehicle autonomy systems will be more suitable in such situations, preventing accidents. Therefore, increasing demand for autonomous commercial vehicles among logistics and transport companies is likely to drive segment growth.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Autonomous Cars Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest autonomous cars market with a size of USD 1.48 Billion in 2025. The region has witnessed heavy growth in adopting autonomous vehicles due to the demand for road safety, efficient traffic flow, compelling transit features, and avoiding road accidents. Increasing demand for transportation efficiency and road safety coupled with efficient traffic flow is anticipated to drive the market growth. Companies in the Asia Pacific region are partnering and collaborating to accelerate the development and commercialization of autonomous vehicles; this development drives the market growth during the forecast period. The Japan market is projected to reach USD 0.15 Billion by 2026, the China market is projected to reach USD 0.64 Billion by 2026, and the India market is projected to reach USD 0.4 Billion by 2026.

Europe

The Europe region holds the second-largest market share in 2025. The region is focused on improving its position in the market by providing early regularization to the adoption of autonomous vehicles. Many European countries have aimed to deploy fully autonomous vehicles and vehicles on the road. This will create heavy demand for autonomous vehicles in Europe, fueling the market growth. The UK market is projected to reach USD 0.34 Billion by 2026, while the Germany market is projected to reach USD 0.44 Billion by 2026.

North America

The North America region holds a considerable share of the market in 2025. The region is focused on the regularization of the use of autonomous vehicles with specific requirements. Governments are initiating programs and funding to provide safe, autonomous vehicle deployment. Various government initiatives for promoting the use of autonomous vehicles by providing funding and introducing programs for research and development for the testing of autonomous vehicles are anticipated for the market's growth. The U.S. market is projected to reach USD 0.31 Billion by 2026.

Rest of the World

The Rest of the World market accounted for a decent share of the market in 2025. The region is focused on adapting advanced transportation technologies. Rapid infrastructural developments and the growing adoption of newer transit technology in countries, such as Brazil, Argentina, South Africa, the UAE, and Saudi Arabia, among others, are providing a positive outlook for the growth of the market.

List of Key Companies in Autonomous Cars Market

With Development in Autonomous Cars, AutoX is the Leading Player in the Market

AutoX is a leading driverless technology startup backed up by Alibaba. The company specializes in building hardware and software-integrated technology for driverless autonomous cars. In January 2021, AutoX launched a commercial autonomous car system in Shenzhen, China and became one of the first driverless technology companies globally to provide fully driverless mobility services with no safety driver behind the wheel. The company has been continuously expanding and developing its driverless technology. In 2021, the company built a specially dedicated production facility to ramp up autonomous cars production.

LIST OF KEY COMPANIES PROFILED:

- Tesla (U.S.)

- Cruise LLC (U.S.)

- Uber Technologies (U.S.)

- Lyft, Inc. (U.S.)

- WAYMO (U.S.)

- Aptiv (Ireland)

- Baidu (China)

- Didi Chuxing (China)

- Zoox (U.S.)

- AutoX Inc. (U.S.)

- Nuro Inc. (U.S.)

- Volkswagen AG (Germany)

- Lumotive LLC (U.S.)

- Pony.ai (U.S.)

- Robert Bosch GmbH (Germany)

- Autoliv (Sweden)

- Mercedes Benz AG (Germany)

- BYD Company Ltd. (China)

- Ford Motor Company (U.S.)

- Volvo (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- In December 2023, Mercedes-Benz announced that the company received approval from regulators in California and Nevada to utilize turquoise-colored exterior marker lights on vehicles equipped with its Drive Pilot SAE Level 3 automated driving feature. The lights, integrated into test vehicles, are designed to alert other road users that a vehicle is operating in autonomous mode.

- In April 2023, DiDi announced that the company is developing its self-driving taxis and plans to roll them out in 2025 on its ride-hailing service. DiDi also introduced two pieces of hardware focused on autonomous driving. The company was first co-developed with Chinese technology firm Benewake and is called DiDi Beiyao Beta LiDAR.

- In May 2022, Volkswagen’s software business CARIAD announced a deal with Qualcomm for self-driving technology up to level 4. The partnership will enable Volkswagen to use Qualcomm’s system on a chip (SOC), which has been developed explicitly for autonomous vehicles, across all its brands. Based on Qualcomm’s Snapdragon Ride Platform, Cariad has developed up to level 4 autonomous driving function.

- In January 2022, Nuro launched its third-generation delivery vehicle named Nuro. The company claimed it to be the most advanced autonomous flagship delivery vehicle. It was designed to carry more deliveries, nearly double the capacity of the previous model. It will also feature customizable and temperature-controlled storage.

- In January 2022, Volvo introduced the autonomous driving feature Ride Pilot to its customers in California. Ride Pilot will be accessible as an add-on subscription on the company’s upcoming fully electric models. The autonomous driving software company Zeneact with the help of Volvo Cars’ team of developers along with developers of Luminar has developed this software. The set-up consists of sensors, including Luminar’s cutting-edge Iris LiDAR sensor, which works with the developed software.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, and vehicle type. Besides this, the report offers insights into the market trends and highlights key automotive industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 43.20% from 2026 to 2034 |

|

Unit |

Value & Volume (USD Billion & Units) |

|

Segmentation |

By Type

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 4.52 billion in 2026 and is estimated to reach USD 79.83 billion by 2034.

Throughout the forecast period of 2026-2034, the market is expected to register a growth rate of (CAGR) 43.20%

Rising demand for advanced automotive safety is expected to drive the global market growth.

Asia Pacific dominated the global market with a share of 47.42% in 2025.

The passenger car segment holds the largest share of the market.

Waymo, Mobileye, and Tesla are the major players in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us