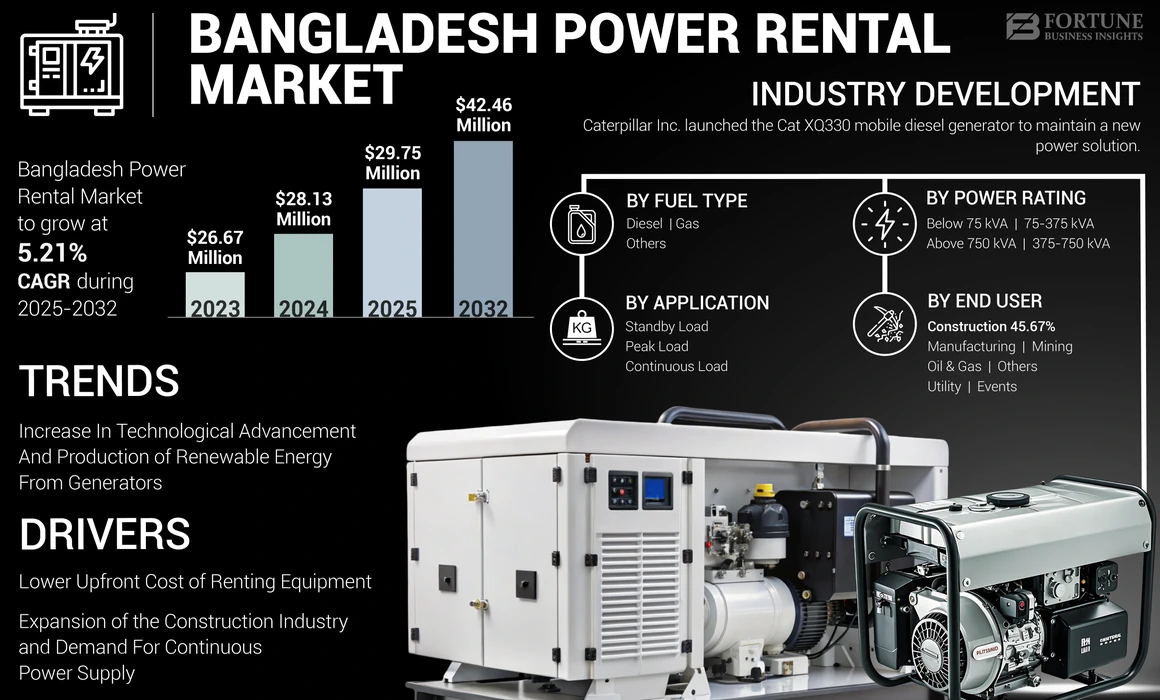

Bangladesh Power Rental Market Size, Share & COVID-19 Impact Analysis, By Power Rating (Below 75 kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA), By Fuel Type (Diesel, Gas, and Others), By Application (Continuous Load, Standby Load, and Peak Load), By End User (Mining, Construction, Manufacturing, Utility, Events, Oil & Gas, and Others), and Regional Forecast, 2025-2032

Bangladesh Power Rental Market Size

The Bangladesh power rental market size was valued at USD 28.13 million in 2024. The market is projected to grow from USD 29.75 million in 2025 to USD 42.46 million by 2032, exhibiting a CAGR of 5.21% during the forecast period.

Renting electricity, also known as rental power, has numerous advantages over purchased electricity devices. Bangladesh has experienced growth in its market due to increasing demand for temporary power solutions. Factors such as rapid industrialization, events, and the need for reliable electricity contribute to the market expansion. Rental generators are more effective than purchased generators because, among other things, they offer flexibility in the required power rating, have negligible maintenance and installation costs, are available at short notice, and have a lower initial cost in Bangladesh.

Power-on rental is generally preferred in areas with little grid infrastructure, which includes islands in the Asia Pacific and Latin America. The mining industry is one of the main consumers of rental electricity. Since, mining sites are not connected to the electricity grid, they draw electricity from temporarily rented generator sets for a certain period.

In the processing industry, there is a moderate need for rental generators to maintain the existing power system, e.g., In January 2021 Atlas Copco has launched the QAC 1350 TwinPower generator, designed to provide dependable power for substantial backup systems while complying with Stage V regulations., when additional power is needed during peak demand or when there is an outage for a short time. Therefore, the electricity rental market's growth depends heavily on sectors with weak electricity supply from the grids.

COVID-19 IMPACT

Supply Chain Disruptions Had a Negative Impact on the Market Growth

The global COVID-19 pandemic is an unprecedented event that the world reacted to and learned to deal with. As cases of the highly infectious COVID-19 grew globally, extraordinary measures were implemented to contain the infection and avoid a human catastrophe.

The power generation industry has been severely affected by the outburst of the COVID-19 outbreak. Power generation rental solutions are extensively used across different sectors to provide extra power to alleviate the chances of outages and maintain operations. The country-wide lockdown was imposed in Bangladesh on March 26th, 2020, which caused the closure and the suspension of production in the factories and disruptions of the supply chain in the energy sector, particularly impacting people. In addition, electricity demand dropped in many places in Bangladesh with confinement measures but steadily recovered as measures were gradually softened. Furthermore, Bangladesh have witnessed different national-level shutdowns of industrial, residential, and commercial operations to contain the spread of this viral infection.

Bangladesh Power Rental Market Trends

Increase in Technological Advancement and Production of Renewable Energy from Generators

Renewable energy installations have increased as the world moves toward cleaner and more sustainable energy sources. These installations, such as wind farms and solar arrays, often require temporary power solutions during construction and maintenance. Bangladesh Power Rental companies provide generators and other equipment to ensure uninterrupted energy production during these phases. As a sustainable solution to the energy crisis, a group of scientists has introduced a generator that generates electricity from water, and this technology will be introduced to Bangladesh in the near future. In times of energy crisis in the entire world, these generators are used for economic revival. The generator produces electricity from hydrogen after separating water into hydrogen and oxygen. Grid stability becomes crucial with the increasing adoption of intermittent renewable energy sources such as wind and solar. Bangladesh Power Rental companies in Bangladesh offer backup and grid stabilization services to manage fluctuations in the power supply, ensuring a consistent and reliable energy flow to the grid.

Various industries require temporary power solutions, including construction, oil & gas, events, and manufacturing. Bangladesh Power Rental services provide an efficient and cost-effective way to meet these demands. Industries often turn to rental solutions during peak demand periods or for projects in remote areas without power infrastructure.

Download Free sample to learn more about this report.

Bangladesh Power Rental Market Growth Factors

Lower Upfront Cost of Renting Equipment to Drive the Market Growth

The rising FDI inflow across Bangladesh has propelled the demand for equipment rental, owing to multiple factors such as the duration of use, project lengths, and financial situations.

Buying new equipment for construction or infrastructure projects could cause a heavy amount and high cost of ownership due to which customers or contractors generally prefer renting the desired, which implies less capital expenditure as the only cost which would be associated includes the cost of renting which would be much lower than owning the equipment which includes high upfront cost.

In addition, the upgradation and equipment upgrades are more feasible while renting the equipment as construction equipment, much like any piece of machinery, will require upgrades and updates over time to meet the industry standards. Moreover, the upgradation of this system can be expensive, especially when they are frequent. When maintaining equipment ownership, this extra expenditure adds up to the operating cost of equipment, whereas renting the equipment allows taking advantage of these upgrades and access to modern and technologically advanced equipment without paying the full cost.

Expansion of the Construction Industry and Demand For Continuous Power Supply to Drive the Market Growth

The failure in power generation equipment is due to rising faults in distribution lines & transmission, natural calamities, abrupt grid problems, and many other factors. These factors change the power supply in Bangladesh. Areas with low grid connectivity require more power supply, so rental generators are mainly used. Moreover, the major consumer of rental generators is the construction industry. Construction activity is growing in Bangladesh, and these projects require generators to provide large and small amounts of power. Construction activities are not long-lasting and are temporary, so the players in the construction industry prefer rental power to meet their daily energy demands. Conducting heavy lifting on construction site generally requires higher power rating generator sets. So generators having ratings above 750 KVA are highly used in the construction industry. Unanticipated power outages have significantly bolstered consumers' demand for reliable backup power sources in commercial and industrial sectors, propelling the adoption of Bangladesh power rental equipment. For instance, in October 2022, at least 130 million people in Bangladesh were left without power after a grid failure caused widespread blackouts. The abovementioned factors are expected to propel Bangladesh market growth.

RESTRAINING FACTORS

Various Environmental Carbon Emission Regulations May Hinder the Market Growth

Diesel generators are used for various applications, particularly in higher power ratings. When diesel is burnt and used in a generator, there is an emission of oxides of nitrogen, carbon mono oxides, and particulate matter. Bangladesh power rental companies must often invest in newer, low-emission equipment to comply with regulations. These eco-friendlier generators can be more expensive to purchase and maintain, increasing operational costs. In addition, meeting regulatory requirements can be complex and resource-intensive. Companies may need to allocate resources for monitoring emissions, reporting, and ensuring that their equipment adheres to emission limits. Some regulations may restrict or phase out the use of certain types of generators that are not environmentally friendly, reducing the range of available equipment for Bangladesh power rental companies.

Bangladesh Power Rental Market Segmentation Analysis

By Power Rating Analysis

750 kVA Segment Dominates the Market Due To the Critical Need for Emergency Power in Heavy-Duty Application

Based on power rating, the market is divided into below 75 kVA, 75-375 kVA, 375-750 kVA, and above 750 kVA.

Out of these, the above 750 kVA segment dominates the Bangladesh power rental market share. Over the forecast period, the segment is expected to lead due to the critical need for emergency power in heavy-duty applications.

The demand for 75-375 kVA generators is also rising across Bangladesh due to the increasing setup of small and large industrial organizations and rapidly increasing construction activities, propelling the segment market growth.

Multiple factors, such as easy maintenance, improved fuel efficiency optimization, reliable functions, low operational expense, and others, will allow the below 75 kVA segment to see promising growth in power rental industry.

By Fuel Type Analysis

Diesel Segment To Lead Owing to the Surplus Availability and Economical Pricing

This market is segmented into diesel, gas, and others according to fuel type.

The diesel segment is anticipated to lead the market during the forecast period. Diesel generators are widespread in construction, mining, oil and gas, and manufacturing sectors. There is a high demand for diesel generators because of the surplus availability and economical pricing.

On the other hand, gas generators have environment-friendly characteristics and are used mostly in cities of Bangladesh where there is good infrastructure for gas pipelines. The economy of Bangladesh is partially dependent on natural gas, the key indigenous energy source. Natural gas accounts for around 75% of the commercial energy consumption in Bangladesh. The potential of the market of gas generators is expected to grow significantly over the forecast period owing to the increasingly strict regulations and environmental policies in different regions.

In the others segment, there is a hybrid fuel model generator, which is also in demand but is not increasing rapidly.

By Application Analysis

Continuous Load Segment Is Dominating Due To Rapid Increase in Changing Infrastructure

This market is classified into continuous load, peak load, and standby load based on application.

The continuous load segment is anticipated to account for the maximum share in this market during the forecast period owing to growing developments in sectors that are not connected to the grid and need a twenty-four-hour supply of power.

Due to rapidly changing infrastructures in various verticals, especially to boost tourism activities, which require a specific base load power accessibility, the standby load segment is expected to grow rapidly.

By End-user Analysis

Construction Segment Is Dominating Due To Many Upcoming Infrastructure Development Projects

The market is segregated into construction, mining, utility, events, manufacturing, oil & gas, and others based on end user.

The construction segment is the leading segment in the Bangladesh power rental market. Due to many upcoming infrastructure development projects, the construction industry is gaining traction across Bangladesh and nearby cities. It is preferred by the players who are in the construction industry to avoid transportation and installation costs by using rental power solutions. Construction activities include the construction of commercial spaces, residential buildings, flyovers, and roads, among others. The growth in infrastructure development is expected to boost the growth of the construction industry, which in turn is anticipated to provide lucrative opportunities for the segment growth in the coming years.

Other segments such as mining, utility, events, manufacturing, and oil & gas are also growing significantly and propelling the market growth because of the increasing number of huge event activities and more networks of oil and gas in Bangladesh.

To know how our report can help streamline your business, Speak to Analyst

COUNTRY INSIGHTS

The generation and supply of sufficient electricity have always been an unsolved problem for Bangladesh. In 1991-92, the country's total installed capacity for electricity generation was 2,350 MW, while derated capacity was 1,719 MW. The installed capacity increased to 5,719 MW in 2008/09 and 8,819 MW in 2011/12, with the corresponding reduced capacity of 5,166 MW or 8,149 MW. However, the increase in production was not enough to meet the rapidly increasing demand for electricity, leading to sustained load shedding and the introduction of other demand measures management. In recent years, a severe energy crisis has forced the government to intervene in contractual agreements for cost-intensive interim solutions, such as rental electricity and small independent power generators (IPPs, mostly diesel or liquid fuel-based) in case of emergency.

Key Industry Players

Introduction Of New Efficient Products by the Key Market Players to Drive The Market Growth

The competitive landscape of the Bangladesh market reveals a market dominated by BanglaCAT, Rahimafrooz Energy Services Ltd, and Atlas Copco Bangladesh. An established brand image in the market with satisfied customer service has been one of the main factors that have helped these companies grow in recent years. This has also helped these companies gain a wider reach with different customers in different parts of the world. In addition, the introduction of new efficient products to keep up with the market has resulted in these companies having a diverse product portfolio and improving their sales performance.

LIST OF TOP BANGLADESH POWER RENTAL COMPANIES

- BanglaCAT (Bangladesh)

- Rahimafrooz Energy Services Ltd. (Bangladesh)

- Atlas Copco Bangladesh (Bangladesh)

- Energypac (Bangladesh)

- JARCON (Bangladesh)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: Caterpillar Inc. announced the introduction of the Cat XQ330 mobile diesel generator to maintain a new power solution for standby and prime power applications that meet EPA Tier 4 Final emission standards.

- September 2022: The government extended the contract of quick rental power plants for two more years. These plants are oil-based fuels and will increase the country's power division.

- January 2022: Caterpillar Inc. introduced the Cat G3516 Fast Response generator set, adding a 1.5 MW power node to its growing lineup of natural-gas power solutions offering market-leading load acceptance, transient response, and EPA certification for mission-critical applications.

REPORT COVERAGE

The market research presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the market research report. Furthermore, the report covers a detailed analysis of market segments, including applications and regions, helping our readers get a comprehensive Bangladesh industry overview.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.21% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Power Rating, By Fuel Type, By Application, and By End User |

|

Segmentation |

By Power Rating

|

|

By Fuel Type

|

|

|

By Application

|

|

|

By End User

|

Frequently Asked Questions

As per Fortune Business Insights, the Bangladesh market was valued at USD 28.13 million in 2024.

The Bangladesh market is projected to grow at a CAGR of 5.21% over the forecast period.

Based on application, continuous load segment to hold the dominating share in the Bangladesh market.

The Bangladesh market is expected to reach USD 42.46 million by 2032.

The key market drivers are the increase in technological advancement and renewable energy production from generators.

The top players in the market are BanglaCAT, Rahimafrooz Energy Services Ltd, and Atlas Copco Bangladesh, among other players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us