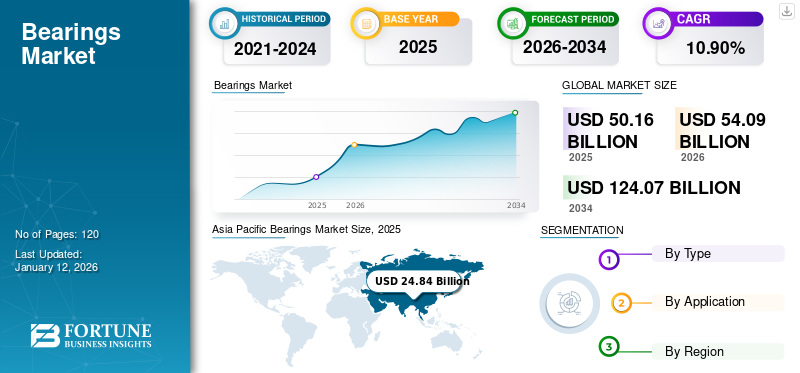

Bearings Market Size, Share & Industry Analysis, By Type (Ball Bearings, Roller Bearings, Plain Bearings, and Others), By Application (Automotive, Industrial Machinery, Aerospace & Defense, and Others), and Regional Forecast, 2026–2034

Bearings Market Size

The global bearings market size was valued at USD 50.16 billion in 2025. The market is projected to grow from USD 54.09 billion in 2026 to USD 124.07 billion by 2034, exhibiting a CAGR of 10.90% during the forecast period. The Asia Pacific dominated global market with a share of 49.50% in 2025.

Bearings are components used to enable motion between two parts and minimize friction in machines. They are used in automotive, industrial machines, consumer appliances, aerospace and defense, and construction machinery. Bearings with high performance are designed to withstand extreme conditions and demanding environments. These components provide exceptional heavy machinery and critical systems where precision and performance are paramount. Bearings are also used in machine tools, automobiles, wind turbines, gearboxes, aerospace, heavy machinery, motors, generators, and other industrial machinery.

In addition to high-performance bearings, the industry also produces specialized bearings tailored for specific applications. These specialized products include thrust bearings for handling axial loads, radial bearings for supporting radial loads, spherical roller bearings for accommodating misalignment, and many others. Each specialized bearing is engineered to deliver optimal performance and longevity in its intended use case.

Rising industrial production and increasing investment in robotics bring strong opportunities and boost bearings market share. Growing automation in manufacturing facilities and gradual greening of industrial production further enhance market growth during the forecast period. According to the United Nations Industrial Development Organization (UNIDO), motor vehicles and other transport equipment showcased the highest growth rate in 2023. Advanced technologies, such as Computer-Aided Design (CAD) and simulation, enable manufacturers to develop highly efficient and reliable bearings. Manufacturing companies are investing in new product launches with an expanded range of applications across industries.

As many industries faced shutdowns and reduced operations due to the COVID-19 pandemic, the demand for bearings declined in the automotive, aerospace, and industrial machinery sectors. This downturn in demand resulted from reduced production and restricted movement of goods.

Bearings Market Trends

Growth in Robotics and Electric Vehicles to Boost Bearings Market Growth

Electric vehicle sales increased by 18% in 2023 as sales reached a total of 14 million units, according to the International Energy Agency. Similarly, strong growth prospects are observed in industrial robot installations owing to the increasing adoption of automation across industries. For instance, according to the International Federation of Robotics, around 553,052 industrial robots were installed across factories in 2023, with 73% of the total robots deployed in Asia. Bearings play a crucial role in electric vehicles and robots by improving reliability, overall efficiency, and performance. These components enable high rotational accuracy and smooth functioning of electric vehicles and robots across the industry.

Download Free sample to learn more about this report.

Bearings Market Growth Factors

High Demand for Precision Bearings across Diverse Industries Boost Market Growth

Growing trends in automation across manufacturing and industrial processes are a few of the key factors increasing demand for precision bearings. They are specialized components designed to provide high accuracy, reliability, and performance levels in various industries. Precision bearings in automobile and heavy engineering industries provide benefits such as accurate and smooth rotation, reduce energy consumption, and enhance overall performance. The increased focus on healthcare infrastructure and medical equipment production increased the demand for specialized bearings used in ventilators, diagnostic devices, and medical machinery. Moreover, the rising popularity of e-commerce and online platforms during the pandemic drove the demand for bearings in logistics and material handling systems. Manufacturers in this industry had to navigate supply chain disruptions, ensuring a steady flow of raw materials and components to meet customer demands.

Technological advancements and a greater emphasis on sustainability have also led to the development of more fuel-efficient and environment-friendly aircraft. Growing aviation and healthcare sectors to surge the demand for machines in aerospace and medical devices. The bearings market growth is attributed to the notable rise in demand for small single-aisle aircraft and helicopters from emerging economies. Moreover, the growth of e-commerce and the need for efficient logistics solutions have created a demand for smaller aircraft and helicopters to support last-mile delivery and transportation of goods in remote areas. High demand for precision bearings in these industries is anticipated to expand market growth. As automation becomes more prevalent, the need for precise movement, reduced downtime, and improved productivity becomes paramount. Precision bearings provide the reliability and accuracy required by automated machinery and robotics, making them essential components in these systems.

RESTRAINING FACTORS

High Manufacturing Cost and Fluctuating Raw Material Prices to Impact Demand for Bearings

Fluctuations in raw material costs directly affect the production costs of bearings, making it challenging for manufacturers to maintain stable pricing and profit margins. Manufacturers may also face difficulty sourcing consistent and high-quality raw materials at affordable prices, leading to supply chain disruptions. High maintenance costs may discourage potential customers from investing in high-quality bearings, leading to lower demand and hindered market growth. Collaborations between manufacturers and suppliers can also help stabilize raw material costs and improve overall efficiency in the industry. The bearing market faces significant challenges due to fluctuations in raw material costs and trade tariffs, hindering growth.

Bearings Market Segmentation Analysis

By Type Analysis

Ball Bearings to Dominate Market as Result of its Wide Industry Applications

By type, the market is segmented into ball bearings, roller bearings, plain bearings, and others. Ball bearings are further sub-segmented into self-aligning ball bearings, deep groove bearings, angular contact bearings, and others, including thrust ball bearings, accounting for a 41.71% market share in 2026. The roller bearing is further classified into cylindrical roller bearing, tapered roller bearing, spherical roller bearing, and others that include needle roller bearing. Plain bearing is bifurcated into journal plain bearing, linear plain bearing, thrust plain bearing, and others that include mounted bearings. The others segment includes slewing bearing and magnetic bearing. Ball bearings cater to the highest revenue market share due to their wide industry application.

Ball bearings are used in automotive, aerospace, consumer electronics, and other industrial machines such as lathes and machine tools. They are also available at lower cost and are highly durable for end-use industries with good wear resistance. Ball bearings have a wide range of industrial applications in mining, petroleum production, mixing equipment, and electric motors.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Industry Holds Highest Market Share Due to Increasing Demand from Electric Vehicles

By application, the market is segmented into automotive, industrial machinery, aerospace & defense, and others. The others segment includes consumer appliances and the energy sector. The automotive segment has the highest revenue market with a share of 40.01% in 2026 among all industry sectors.

Consumer demand for electric vehicles and growing demand for bearings in the aftermarket is anticipated to further boost market demand. Bearings in automotive vehicles aid in minimizing friction and heavy load-bearing capacity. Rapid growth in the automotive industry and sound investment decisions in sustainable mobility solutions are expected to surge the market demand for bearings.

The aerospace and defense sector is set to witness the highest growth during the forecast period as a result of rapid growth in the aviation sector.

REGIONAL INSIGHTS

By region, the market is further classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Bearings Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is anticipated to dominate the market share as a result of the adoption of automation and the Internet of Things.

Government initiatives and supportive energy policies are further surging the demand for energy-efficient bearings. Increasing demand for machines and rapid growth in automobile production are a few of the prominent factors surging the market demand for bearings. Rapid industrialization and high-end technologies to drive the bearings market growth in the region. Industrial machine demand is growing across several developing countries in the region. The Japan market is projected to reach USD 5.41 billion by 2026, and the India market is projected to reach USD 3.65 billion by 2026. For instance, Germany’s machine tools export to Malaysia rose by 51% in 2020. Similar heavy trade-offs and dynamic growth across developing nations in the Asia Pacific are surging the market demand for bearings. Asia Pacific, due to rising construction activities, increasing investment in machinery, and advanced manufacturing facilities, is expected to experience the highest growth rate.

China is forecast to cater to the highest market share in Asia Pacific due to the rising investment in the manufacturing sector. The China market is projected to reach USD 11.65 billion by 2026. China’s investment in the manufacturing sector and double-digit growth trend to surge the market demand for bearings. Advanced manufacturing facilities and demand for efficient manufacturing operations is anticipated to boost the market across the country. Additionally, the Chinese government has implemented favorable policies to encourage the establishment and growth of automotive manufacturing and precision engineering industries. These policies aim to attract investment, promote technological advancements, and enhance the overall competitiveness of this industry. China has been actively expanding its manufacturing clusters and industrial infrastructure, creating a conducive environment for the development of this industry. Considerable efforts have been made to establish well-connected production facilities and manufacturing hubs nationwide.

To know how our report can help streamline your business, Speak to Analyst

North America

North America to cater second highest revenue market share as a result of the growing automotive and wind energy sector. Rising industrialization and machinery demand across manufacturing sectors to further expand the market for bearings. The market is anticipated to grow fast as a result of high demand for precision bearings. Also, technological advancements such as Industry 4.0, automation, and the Internet of Things (IoT) are driving the adoption of advanced machinery and equipment. The U.S. market is projected to reach USD 9.79 billion by 2026.

Europe

Bearings application is increasing in energy systems, aerospace & defense, construction, and infrastructure sectors generating strong demand for new designs and material-based bearings. The automotive and food & beverages sectors are generating heavy demand for bearings and bearing products, with the presence of leading automobile manufacturers in Europe. Moreover, the region is also set to have the highest CAGR during the forecast period, owing to enormous R&D and manufacturing facilities. The UK market is projected to reach USD 1.68 billion by 2026, while the Germany market is projected to reach USD 2.3 billion by 2026.

Middle East & Africa and Latin America

The moderate growth in the Middle East & Africa and Latin America can be attributed to the decreased implementation of new technologies and lack of skilled labor necessary for developing and manufacturing industrial goods.

KEY INDUSTRY PLAYERS

Heavy Investment in New Product Launch and Increasing Merger and Acquisition to Upsurge Market Presence

The bearing market is moderately fragmented across the global region owing to a considerable number of market participants. Prominent players in the market are consistently focusing on new product launches to minimize production costs and environmental impact. Manufacturing companies are focused on providing bearings with a wide range of industry applications, such as turning, grinding, and milling. Mergers and expansion strategies to further boost the market presence of key players in the market. Several companies in the market are engaging in strategic partnerships and acquisitions with small and medium-scale enterprises to expand their global presence.

List of Top Bearings Companies:

- NSK Ltd (Japan)

- Nachi-Fujikoshi Corp (Japan)

- Myopic GmbH (Germany)

- LYC Bearings Corporation (China)

- Luoyang Huigong Bearings Technology Co., Ltd. (China)

- Koyo (Jtekt Corporation) (Japan)

- ISB Industries (Italy)

- NTN Corporation (Japan)

- SKF (Sweden)

- The Timken Company (U.S.)

- THB Bearings (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: RBC Bearing Incorporated, which deals with engineered precision bearings and components, introduced the acquisition of Specline, Inc. for commercial and defense aerospace markets.

- November 2022: The Timken Company announced the acquisition of GGB Bearings to expand its product offerings across diverse geographic markets and industry applications.

- August 2022: SKF introduced a new hybrid deep groove ball bearing aimed at high-speed applications such as railways, traction motors, and others.

- June 2022: NTN Corporation developed a new sensor-based integrated bearing, also known as a Talking Bearing that wirelessly transfers information on temperature, vibration, and speed.

- March 2022: Koyo Corporation, a leading bearings manufacturing company, rebranded all its products under the name of JTEKT Corporation. This business strategy will assist its customers in accessing all bearing products under a single brand name.

- September 2021: SKF launched its new line of spherical roller bearings in the North American region. The new spherical roller bearings have superior lubrication and enhanced bearing service life.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 124.07 billion by 2034.

In 2025, the market was valued at USD 50.16 billion.

The market is projected to grow at a CAGR of 10.90% during the forecast period of 2026-2034.

Ball bearing caters the highest market share owing to its wide range of applications.

Heavy demand for precision bearings fuel market growth.

SKF, NSK, and NTN Corporation are a few of the prominent market players across diverse geographies.

Aerospace & defense segment to experience the highest growth rate during the forecast period

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us