Biochar Market Size, Share & Industry Analysis, By Technology (Pyrolysis and Gasification), By Application (Farming, Livestock, Power Generation, and Others), and Regional Forecast, 2026-2034

Biochar Market Size

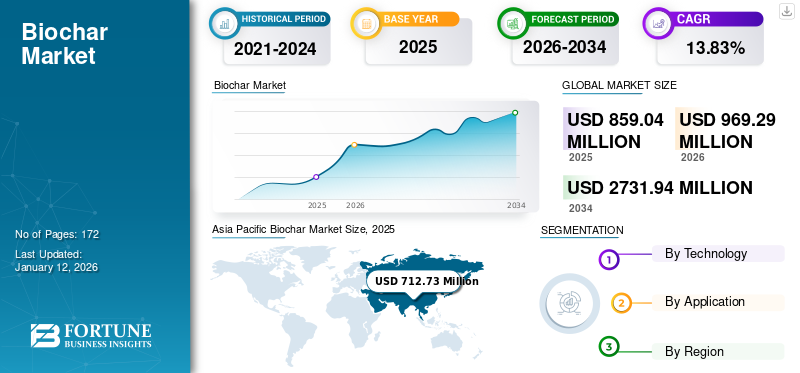

The global biochar market size was valued at USD 859.04 million in 2025. The market growth is projected to grow from USD 969.29 million in 2026 to USD 2,731.94 million by 2034, exhibiting a CAGR of 13.83% during the forecast period. Asia Pacific dominated the global market with a share of 82.97% in 2025. The biochar market in the U.S. is projected to grow significantly, reaching an estimated value of USD 43.61 million by 2032, driven by the federal and state renewable energy mandates and the push toward combating GHG emissions.

Biochar is a charcoal-like material produced from plant materials, such as grass and agricultural and forest residues, that decompose at high temperatures, often during renewable energy production. During the process, the physical and chemical properties of the plant material change into a highly porous, stable, and carbon-rich material. Pyrolysis is widely known as the manufacturing process of producing charcoal from wood. Gasification is a basic process in which organic carbonaceous materials are converted into carbon monoxide and carbon dioxide at high temperatures with oxygen and steam. The demand for biochar is rising owing to growing trends of carbon credits and rising adoption sustainable agriculture practices across farming activities are the driving factors for the market growth.

Global Biochar Market Overview

Market Size:

- 2025 Value: USD 859.04 million

- 2026 Estimate: USD 969.29 million

- 2034 Forecast Value: USD 2,731.94 million, with a CAGR of 13.83% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific dominated the global biochar market with an 82.97% share in 2025

- Fastest‑Growing Region: Asia Pacific remains the fastest-growing region, driven by agricultural innovation, soil remediation efforts, and supportive government programs in countries like India and China

- End‑User Leader: The Farming (agricultural) application segment held the largest share in 2026, due to biochar’s utility in enhancing soil fertility, water retention, and crop yield

Industry Trends:

- Carbon credits & climate‑smart agriculture: Biochar is increasingly utilized in carbon credit schemes as a tool for permanent carbon sequestration

- Dominance of pyrolysis technology: Pyrolysis is the preferred production process over gasification, as it yields high-quality, stable biochar with consistent carbon retention

- Integration with renewable‑energy systems: Biochar production is aligning more with biomass-based energy and biorefinery initiatives, supporting circular economy goals

- Post‑COVID recovery: Market growth reaccelerated following pandemic disruptions, as investment in agricultural tech and environmental sustainability renewed

Driving Factors:

- Surging adoption of sustainable agriculture practices, with farmers leveraging biochar to improve soil structure, nutrient retention, and yield performance

- Carbon sequestration potential, positioning biochar as a viable strategy for climate mitigation—enabling carbon credit revenue streams

- Strong regional momentum in Asia Pacific, fueled by large-scale agriculture, government support, and soil health initiatives

- Preference for pyrolysis technology, which produces consistent, high-grade biochar suited for agricultural and environmental applications

- Synergy with renewable energy value chains, as biochar manufacturing aligns with biomass utilization, carbon capture, and circular economy models

The outbreak of COVID-19 across the globe has led to a slowdown in the expansion of the global market. The halt in the operation of various industries due to the disturbance in the supply chain and imposition of lockdown has led to the downfall of the economy of several countries. This also had a negative impact on biomass plants worldwide, which further restricted the growth of the market.

Biochar Market Trends

Rising Trend of Carbon Credits is Propelling the Market Growth

Biochar carbon credits are credits that constitute persistent carbon sequestration. This permanent sequestration, also referred to as drawdown or removal, varies from reduction credits or avoidance as it physically traps carbon in a stable form for a longer time.

For instance, in March 2024, Microsoft buys 95,000 tons of carbon capture credits from a Mexican biochar plant. It has agreed to a six purchasing deal with The Next 150 and its General Biochar Systems business unit, which runs the biochar plant near the city of Guanajuato.

In addition, in July 2023, North America’s largest plant was announced along the north shore of the Saint Lawrence River in Port-Cartier, Quebec, Canada. A group of Canadian and French companies, including Groupe Rémabec, SUEZ, and Airex Energy, are investing ~USD 59 to 60 million to construct North America’s biggest biochar production plant. This initiative underlines the rising worldwide acknowledgment of biochar’s ability to enhance soil and sequester carbon. By sequestering carbon, biochar will generate guaranteed, certified carbon credits. Moreover, biochar production can generate Carbon Dioxide Removal (CDR) carbon credits. These credits can be traded or sold, generating a second revenue stream for biochar manufacturers and motivating further carbon sequestration attempts.

Download Free sample to learn more about this report.

Biochar Market Growth Factors

Surging Adoption of Sustainable Agriculture Practices to Lead the Market Growth

The adoption of sustainable agriculture practices across farming activities is expected to drive the global market. Sustainable agriculture practices include a wide range of methods and techniques for meeting the current and future demand for food while ensuring a healthy environment and ecosystem. The integration of biochar as a sustainable farming method for promoting crop yield has resulted in the expansion of the global biochar market growth.

In addition, biochar enhances soil structure, water retention, and nutrient availability, promoting optimal conditions for plant growth. Moreover, the rising initiatives, schemes, and subsidies by the government and different organizations for the promotion of sustainable practices in agriculture would also support market growth. For instance;

- In December 2023, a task force of companies including Mars, McCain Foods, McDonald's, Mondelez International, PepsiCo, and Waitrose announced a plan to make regenerative farming financially viable and scalable, exploring implementation projects in India, the U.K., and the U.S.

- In March 2024, The Agriculture Department and Nuziveedu Seeds gave 200 metric tons of Biochar to farmers of Erravelli village in Markook Mandal. Nuziveedu’s Biochar, a carbon-rich soil amendment produced from cow dung and maize shanks. Its innovative production process imbues the Biochar with unusual characteristics, comprising enhanced soil aeration, nutrient capacity, and improved moisture retention.

Rising Waste Management is Driving the Market Growth

In recent years, pyrolysis of biochar has gained significant traction as a sustainable method for waste management and soil enhancement. This innovative technology provides numerous advantages that extend beyond conventional waste disposal methods. As an option for rapid incineration or slow decomposition, converting biomass waste into biochar results in a product that is extremely valuable for enhancing the soil.

Biochar is mainly produced from biomass waste materials, which are suitable for production. It includes crop residues, such as field and processing residues, food and forest waste, and animal manure. Abundant agricultural, municipal, and forest biomass are burned, due to which a large amount of CO2 and methane is released, which pollute surface and local ground water.

If solid waste is not treated properly, it could negatively impact the environment as the global accumulation of agricultural waste is around 2 billion tons in a year, whereas forest waste accounts for about 0.2 billion tons, municipal waste for about 1.7 billion tons, and industrial waste for 9.1 billion tons. The usage of biomass-related solutions globally is increasing, owing to the increasing prices of primary fuel for energy production. The global demand for biochar as a fuel is increasing significantly due to the high industrial and commercial demand. Moreover, the easy availability of biomass sources and low production cost have led to its higher consumption in the industrial sector.

RESTRAINING FACTORS

Lack of Knowledge Concerning the Manufacturing Process of Products to Hamper Market Growth

Biomass is used as the feedstock in the pyrolysis reactor, which has a set heating and gas flow rate, residence duration, and temperature. Following that, the biomass-residue product can be created. There are certain by-products of this process, such as gas and bio-oil. However, when the product is applied to agricultural land, several prior research identified the following drawbacks: loss of land due to erosion, soil compaction during the application, risk of contamination, removal of crop residues, and reduction in worm life rates; these factors are creating a negative impact on the environment and could affect the market.

Many farmers and industries in regions such as South America, Africa, and some parts of Asia-Pacific regions have limited awareness regarding the useful application and production of biochar. Due to the lack of education and outreach efforts by government organizations, the potential of biochar hasn’t reached to the core users and manufacturers, which has further led to the limited production and application of biochar in the global market.

Lack of knowledge of the sustainable char manufacturing process will continue to be one of the major constraints limiting this product's development and potential consumption. The lack of effective technology for low-emission char synthesis, particularly for distant or mobile production, has hampered the market value. The high cost of such products and underlying structural constraints, such as a shortage of finance for producers, an immature carbon market, and shorter timescales for mining land restoration bonds, continue to impede the market growth. While the commercialization of this product is still in its early stages, this hard-to-sell product's lack of consistency and standardization impedes market expansion.

Biochar Market Segmentation Analysis

By Technology Analysis

Pyrolysis Segment Holds the Dominant Market Share Owing to its Inexpensive and Convenient Aspects

Based on the technology, the market has been bifurcated into gasification and pyrolysis.

Pyrolysis is likely to dominate the market due to its widespread adoption, as it is cost-effective, convenient, and capable of processing a wide range of feedstocks, accounting for an 86.71% market share in 2026. This technology helps to avoid greenhouse gas emissions. This drives the growth in the pyrolysis technology segment over the forecast period.

The gasification segment is expected to show significant growth during the forecast period. This technology produces smaller quantities of such char in a directly heated, air-introduced reaction vessel. Market demand and acceptance of this technology are increasing as it produces lower levels of air pollutants. However, this method is slightly less efficient than others.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Farming Segment Holds the Dominant Share due to its Extensive Use in Agriculture for Fertilizer

Based on application, this market is segmented into farming, livestock, power generation, and others.

The farming segment is likely to dominate the market with a share of 40.91% in 2026. Such charcoal is used extensively in agriculture for fertilizer as it helps to increase the natural rates of carbon in the soil and improves the quality of the soil. It also helps reduce agricultural waste and lowers greenhouse gas emissions from the soil. Farmers are increasingly using such char globally, driving the growth in the agriculture segment during the forecast period.

The power generation segment is expected to grow significantly over the forecast period. Governments in different parts of the world have encouraged the generation of energy from such coal as it reduces carbon emissions from different sectors, such as agriculture, forestry, and others.

REGIONAL INSIGHTS

By geography, the market is studied across North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Biochar Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant share of the global market, with the regional market valued at USD 712.73 million in 2025. The region's potential for soil improvement and carbon sequestration is the main driver behind this sector. In addition, the region's tremendous economic and agricultural development has contributed to the market expansion. In the Asia Pacific region, China is the leading producer of such char. The China market is projected to reach USD 552.37 Million by 2026. The region addresses crop residue disposal, soil pollution, quality degradation, slash-and-burn, and greenhouse gas emissions. As a result, agricultural waste from this product and the use of this product as a soil conditioner in farmland are driving growth in this region to overcome these problems.

According to Nature Communication, the widespread application of zero-emission technologies (NETs) is essential to achieve CO2 reduction and renewable energy goals to meet the Paris Agreement goals of cost-effectively reducing global temperature rise to 2°C or possibly limiting 1.5°C. Reductions in total GHG emissions could reach up to 8620 MtCO2eq by 2050 if a “moderate” scenario calls for charcoal processing 73% of crop residues with BIPP in the short term (2020-2030) and then coordinating deployment with BECCS beyond 2030.

In addition, there has been rising interest in biochar from developing nations such as India. For instance, as of March 2024, the government of India has set up a task force to investigate the utilization of biochar in steel manufacturing as part of its attempt to decrease carbon emissions in the steel sector.

North America

North America is the second largest market for biochar globally and is expected to expand significantly due to growing demand for organic food and high meat consumption. The sector's growth has been supported by many local and large manufacturers operating on a national and global basis. The U.S. market is projected to reach USD 99.21 Million by 2026. According to the U.S. Biochar Initiative (USBI), the domestic char production represented by the survey participants ranges from 35,000 to 70,000 tons annually.

Europe

Europe is also projected to grow steadily in the forecast period due to the rising adoption of biochar in agriculture, driven by an increasing awareness of its benefits in improving soil fertility, improving water retention, and mitigating climate change through carbon sequestration. European countries, particularly those with strong commitments to sustainable agriculture and environmental conservation, have implemented policies and incentives encouraging the use of biochar, further enhancing the market growth. The Germany market is projected to reach USD 17.01 Million by 2026. For instance, as of January 2024, the Irish BioEnergy Association (IrBEA) hails the recognition of Bioenergy with Carbon Capture and Storage (BECCS) and Biochar in Ireland’s Biochar Climate Action Plan 2024.

Rest of the World

Rest of the World consisting the Middle East & Africa and Latin America will grow in the coming years owing to the prevalence of region's vast agricultural landscapes in the South America and African regions including large-scale crop cultivation and livestock farming, which creates an opportunity for the utilization of biochar. For instance, in November 2023, BIOSORRA launched one of the largest biochar manufacturing sites, Thika, in Kiambu County, Kenya. Thus, the companies have become one of the first scalable biochar alliances in the East Africa region with a shared goal of agriculture and sustainability, among others.

In addition, as of December 2023, NetZero and the World Bank unit promote biochar in African farming. NetZero, a French start-up mastering the large-scale execution of biochar in the tropics, announced the strategic collaboration agreement with the International Finance Corporation (IFC), aiming to increase NetZero’s unique model in African agriculture supply chains.

KEY INDUSTRY PLAYERS

Key Participants are Focusing on Enhancing Their Product Capacities to Gain a Competitive Edge

The market for biochar is highly fragmented, with the presence of numerous players. Chardust Ltd, Aries Clean Energy, Airex Energy, and Farm2Energy are the leading players with a strong presence across different countries. Their operational plants' success will help them acquire contracts and gain a market share in the coming years. In June 2022, Airex Energy became a technology group partner in the BDO Zone Strategic Alliance, which comprises some of the top companies in the bioenergy sector. This alliance plays a crucial role in mitigating risks associated with the development of biobased projects in BDO Zones.

The other key industrial wood pellet market players are Oregon Biochar Solutions, Carbonis GMBH, Chargrow, Charline, and SAFI ORGANICS. The competition among top players in the market is very high as they are targeting to expand across regions. The one with unique offerings in technology, portfolio, design, efficiency, and more will capture the maximum end-user attention.

LIST OF TOP BIOCHAR COMPANIES:

- Airex Energy (Canada)

- Carbonis GmbH & Co. KG (Germany)

- Carbon Gold Ltd (U.K.)

- Farm2Energy (India)

- Oregon Biochar Solutions (U.S.)

- CharGrow LLC (U.S.)

- Chardust Ltd (Kenya)

- Safi Organics (Kenya)

- Charline Gmbh (Austria)

- Cookswell Jikos (Kenya)

- Aries Clean Energy (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023- Carbonfuture, in partnership with the Bolivia-based Exomad Green Concepción project, announced an agreement with Microsoft to deliver more than 32,000 tonnes of carbon dioxide removal credits. This agreement is a part of Microsft’s ongoing efforts to achieve carbon negativity by 2030 and eliminate all past emissions by 2050.

- December 2022 - Farm Hannong, a green bio and agricultural technology unit of LG Chem, launched a joint project to accelerate the commercialization of biochar. The company will showcase the effectiveness of biochar on crops, such as rice, cannabis, garlic, and chili pepper.

- July 2022 - NetZero, the French start-up in long-term carbon removal in the tropics, announced the beginning of the construction of the first industrial biochar production plant in Brazil, which is also the first biochar production plant in Latin America.

- June 2022 - Airex Energy became a technology group partner in the BDO Zone Strategic Alliance, which comprises some of the top companies in the bioenergy sector. This alliance plays a crucial role in mitigating risks associated with the development of biobased projects in BDO Zones.

- June 2021 - Airex Energy and SUEZ Group partnered to provide solutions to regions and industries on their path toward carbon neutrality. The two groups' expertise will enable them to industrialize the recovery of biomass residues into biochar (a stable form of organic carbon), which is essential to urban and agricultural soil resilience, vitality, and fertility.

REPORT COVERAGE

The market report provides a detailed analysis of the biochar market share and focuses on key aspects such as leading companies, types, and system applications. Besides this, the report offers insights into market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.83% from 2026 to 2034 |

|

Unit |

Value (USD Million) and Volume (Tons) |

|

Segmentation |

By Technology, By Application, and By Region |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 859.04 million in 2025.

The global market is projected to grow at a CAGR of 13.83% during the forecast period.

The Asia Pacific market size stood at USD 712.73 million in 2025.

Based on the application, the farming segment holds the dominating share in the global market.

The global market size is expected to reach USD 2,731.94 million by 2034.

Surging adoption of sustainable agriculture practices to drive market growth

The top players in the market are Chardust Ltd, Aries Clean Energy, and Airex Energy, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us