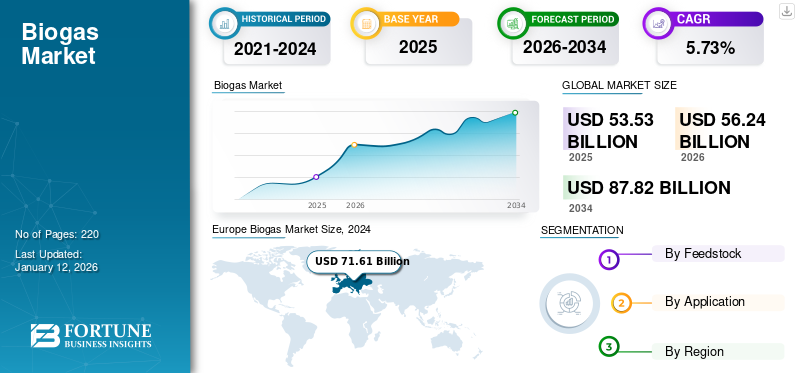

Biogas Market Size, Share & Industry Analysis, By Feedstock (Organic Residue & Wastes {Biowaste, Municipal & Sewage, Agricultural Waste, and Others}, and Energy Crops), By Application (Electricity Generation, Heating, Combined Heat and Power, and Others), and Regional Forecast, 2026-2034

Biogas Market Size

The global biogas market size was USD 53.53 billion in 2025 and is expected to grow from USD 56.24 billion in 2026 to USD 87.82 billion by 2034 at a CAGR of 5.73% during the forecast period. Europe dominated the global market with a share of 48.66% in 2025. The Biogas market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.73 billion by 2032.

This gas is a mixture of gases produced from raw materials such as agricultural waste, manure, municipal waste, plant material, sewage, green waste, or food waste. It primarily contains carbon dioxide and methane and little amount of water vapors and supplied compounds. This gas is burnt in the presence of oxygen, which releases energy. This energy is used for different purposes, such as generating electricity, cooking food, transportation, and heating. Rising concerns about environmental safety and increased demand for clean energy are the factors driving the growth of the market.

Several restrictions on travel, work, and industry due to the COVID-19 pandemic led to the discard of uncountable barrels of oil and trillions of cubic meters of gas from the global energy system in 2020. European countries, such as Spain, the U.K., Italy, Germany, and France; and China in Asia Pacific are the major shareholders of the global market. Conversely, these countries have undergone various regional and national level shutdowns of residential, commercial, and industrial operations to contain the spread of this viral infection. Various bioenergy projects across the globe are facing major problems due to this pandemic. Components, raw materials, and manpower shortages have greatly impacted project development, resulting in delays. In March 2020, Strabag, one of the key players in this market, halted its operations due to the COVID-19 pandemic.

The U.S. Energy Information Administration (EIA) estimates that biomass would be used to generate 27.3 billion kilowatt-hours (kWh) of electricity in 2020, down from 28.8 billion kWh in 2019.

Biogas Market Trends

Several Countries are Accepting the Paris Climate Change Agreement

Many countries are coming forward and showing conviction in the Paris Climate Change Agreement. The agreement insists the countries increase their renewable energy consumption. Biogas is one of the major low-cost renewable energy sources that help the countries to minimize GHG emissions and implement the Kyoto Protocol agreements. Hence numerous countries have made a considerable investment in this form of energy.

Download Free sample to learn more about this report.

Biogas Market Growth Factors

Rising Environmental Concerns to Positively Impact Market Growth

The rising carbon and greenhouse gasses have been a concern for the global countries. To mitigate this, governments of different countries have been taking numerous steps, such as increasing renewable energy in the energy mix, decarbonizing the automotive industry, and producing biogas. For instance, in March 2021, the Canadian government announced funding of around USD 116,800 to the Canadian Biogas Association (CBA) to accelerate sustainable agricultural development. Biogas production helps in reducing greenhouse gas emissions by capturing methane that would otherwise be released into the atmosphere from organic waste. Additionally, the production of biogas encourages the use of agricultural residues and livestock manure as feedstock, providing farmers with an additional revenue stream while helping manage waste from farming operations.

High Demand for Upgraded Biogas Will Augment Market Growth

The shortage of conventional fossil fuel coupled with environmental degradation is one of the major global problems. The use of renewable energy is expected to help overcome these problems. This gas plays a crucial role in forming a sustainable society and reducing dependency on oil. This gas includes the high content of methane, which is further upgraded into biomethane. Biomethane has the same properties as natural gas and can be used as a renewable fuel for natural gas vehicles.

According to the International Renewable Energy Agency (IRENA), this gas as a vehicle fuel can reduce greenhouse gas emissions by about 60% to 80% compared to fossil-based fuels. Presently, in Germany, around 150 filling stations offer 100% biomethane. Thus, increasing the production of automobiles is projected to boost the demand for biomethane.

RESTRAINING FACTORS

Huge Capital Investment for Biogas Plants Setup May Hinder Market Growth

Biogas plants require high capital investment. The plant requires the land in acres. Also, the cost of equipment, feedstock materials, engineering, and labor is also high. The process of feedstock buying, storing, and sorting are challenging and costly. Moreover, the operation of plants and the sale & distribution of this gas are also costly. Hence, high capital investment for plants setup and operation may hinder market growth.

Biogas Market Segmentation Analysis

By Feedstock Analysis

Organic Residue & Wastes Is Primarily Used For Production

The market is distributed into organic residue & wastes and energy crops on the basis of feedstock. Organic residue & wastes are further trifurcated into biowaste, municipal & sewage, agricultural waste, and others. The organic residue & wastes segment dominated the global market with share in 75.05% 2026. Agricultural waste includes organic waste generated in any farming-related activities. As per Global Bioenergy Statistics, 3–14% of the total energy supply globally can be fulfilled by the energy generated from agricultural waste.

According to the World Bioenergy Association (WBA), globally, more than 1.6 billion tonnes of food is lost every year. Suppose all accessible food waste is collected and recycled by the anaerobic digestion process. In that case, it has the potential to generate around 880 to 1100 TWh of energy, which can be used as electricity and heat.

Energy crops are projected to show significant growth during the forecast period. In the U.S., numerous states such as Minnesota, North Dakota, Iowa, Illinois, Nebraska, and Arkansas have high availability of crop residues from corn, wheat, and soybean, which can all be digested for the production of this gas.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Electricity Generation Application Dominated the Market Share

The market can be segmented into electricity generation with a share of 50.96% in 2026, heating, combined heat and power (CHP), and others on the basis of application. Electricity demand is growing continuously owing to enhanced living standards and electrification of transportation. The heating segment is projected to gain more traction during the forecast period. In the updated Renewable Energy Directive (RED), the member states need to achieve a target to increase renewable energy in heating and cooling by 1.3% points/year, which would open up doors for heating applications.

The other segment includes the transportation segment. Implementation of environmental protection regulations globally is enhancing the demand for alternate fuels. In Germany, around 900 natural gas filling stations are available for more than 100,000 natural gas vehicles. Of those, 150 stations offer 100% biomethane, and over 300 filling stations offer mixtures from biomethane and natural gas.

REGIONAL INSIGHTS

The global market has been studied geographically across five major regions, such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America. The major biogas market share was held by Europe in 2024. Europe currently produces around 2 billion cubic meters (bcm) of biogas per year. Recently in Renewable Energy Directive II (RED II), the overall EU target for Renewable Energy Sources (RES) consumption by 2030 has been raised to 32%. Germany, U.K., Spain, Italy, and Sweden are the key countries for bio-based energy. Germany is the major producer across the globe, with more than 10,000 plants operating in the country.

The UK market is projected to reach USD 3.67 billion by 2026, and the Germany market is projected to reach USD 13.84 billion by 2026.

The Asia Pacific market is expected to gain more traction during the forecast period. Developing economies such as India and China are implementing strong regulations to lower their carbon footprint, which is a crucial factor driving the biogas market growth. According to the Indian ministry, 1.45 lakh metric tons of waste were generated per day in India. Only 53 percent of waste was processed under the Swachh Bharat Mission (SBM), a flagship program of the Prime Minister. The Centre aims to attain 100% scientific management of solid waste, and make the country Open-Defecation Free.

The China market is projected to reach USD 4.22 billion by 2026, and the India market is projected to reach USD 19.34 billion by 2026.

North America has been a significant region for the global market. The U.S. has more than 2,200 plants in all 50 states, i.e., 253 anaerobic digesters on farms, 1,269 water resource recovery facilities, 68 stand-alone systems that digest food waste, and 652 landfill gas projects. The U.S. market is projected to reach USD 4.58 billion by 2026.

Europe Biogas Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Key Industry Players

Key Players to focus on Increasing Production Capacities

The global biogas market is extremely fragmented due to the presence of abundant regional and international players. Numerous players across the globe are progressively contributing in organic & inorganic developments to strengthen their market position. Most companies are focusing on enhancing their production capabilities by introducing new or expanding the existing plants. For instance, in May 2020, Weltec Biopower built a plant in Veria, Greece. The main investor of the project is the largest abattoirs for cows and pigs in Greece. In February 2020, Brightmark Energy company announced to expand its Western New York dairy biogas project. The ‘Yellowjacket’ project would extract methane from 265,000 gallons of dairy manure per day and convert it into renewable natural gas and other valuable by-products.

LIST OF KEY COMPANIES PROFILED:

- Future Biogas Limited (U.K.)

- Air Liquide (France)

- PlanET Biogas Global GmbH (Germany)

- WELTEC BIOPOWER GmbH (Germany)

- Scandinavian Biogas Fuels International AB (Sweden)

- EnviTec Biogas AG (Germany)

- Ameresco (U.S.)

- Quantum Green (India)

- AB HOLDING SPA (Italy)

- RENERGON International AG (Switzerland)

- StormFisher (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2020 – Ductor, a Finnish Swiss biotech company, is building three combined biofertilizer-bio-gas facilities in northern Poland. The new facilities will be built in Poland's Zachodniopomorskie region. Two of the new plants have installed capacity of 0.5MW, and the third will be 1MW.

- June 2020 –Gasum, a Nordic energy company, announced that they would open a liquefied natural gas (LNG) and LBG filling station near Arlanda Airport in Stockholm. The station is Gasum’s first in the Stockholm area.

- October 2019 – Mazoon Dairy Company (MDC) opened a biogas plant in Oman. The plant is part of MDC’s strategy to use waste to energy to enhance waste management efficiency. This is the first time a dairy company in the region has adopted clean technology on such a scale.

REPORT COVERAGE

The market research reports provide a detailed analysis of the global biogas industry and focus on key aspects such as leading companies and leading feedstock, and the application of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historic Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Million Cubic Meters) |

|

Growth Rate |

CAGR of 5.73% from 2026-2034 |

|

Segmentation |

By Feedstock

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the global market was USD 53.53 billion in 2025.

The global market is projected to grow at a CAGR of 5.73% over the forecast period.

The market size of Europe stood at USD 26.05 billion in 2025.

Based on the application, the electricity generation segment is holding the dominant share in the market.

The global market size is anticipated to reach USD 87.82 billion by 2034.

Based on feedstock, the organic residue & wastes segment is holding the dominating share in the market.

Rising concerns about environmental safety and increased demand for clean energy are the factors driving the growth of the market.

The top players in the market are EnviTec Biogas AG, Air Liquide, Ameresco, and StormFisher, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us