Bone Growth Stimulator Market Size, Share, By Product (Bone Growth Stimulation Devices [Electrical Bone Growth Stimulators {Capacitive Coupling Devices, Combined Magnetic Field Devices (CMF), & Pulsed Electromagnetic Field Devices (PEMF)}, Implantable Bone Growth Stimulators, Ultrasonic Bone Growth Stimulators], Bone Morphogenetic Proteins (BMP), and Platelet-Derived Growth Factor (PDGF)) By Application (Spinal Fusion, Maxillofacial & Dental, Nonunion & Union Bone Fractures, and Others) & By End-user (Hospitals & ASCs, Speciality Clinics, Home Care and Others) & Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

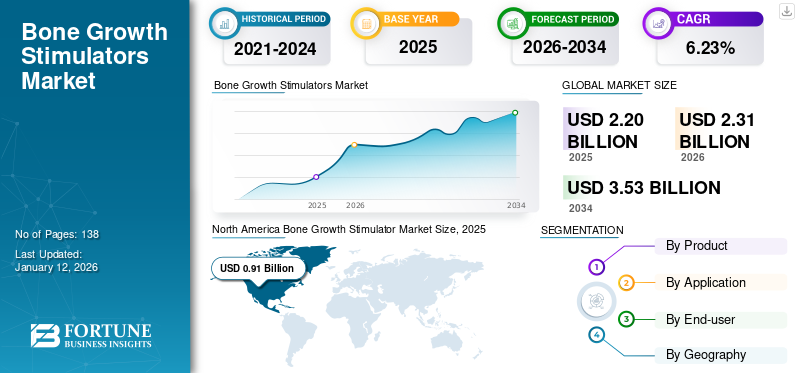

The global bone growth stimulator market size was valued at USD 2.2 billion in 2025 and is projected to grow from USD 2.31 billion in 2026 to USD 3.53 billion by 2034, exhibiting a CAGR of 6.23% during the forecast period. North America dominated the bone growth stimulators market with a market share of 41.09% in 2025.

Bone growth stimulators are used to enhance the healing of bone fractures and spinal injuries. The demand for these stimulators in sports injuries and other orthopedic surgeries has increased significantly. Therefore, the increasing prevalence of these injuries and orthopedic surgeries has fueled market growth.

- For instance, as per the data published by Springer Nature in 2023, around 500-100 adults per 100,000 people aged 50 and above get fractures annually in Asia Pacific countries.

Moreover, other factors, such as the rising prevalence of osteoporosis and the increasing focus of the market players on new product development, have fueled the global bone growth stimulators market.

The market experienced a revenue decline amid the COVID-19 pandemic due to lockdown restrictions that limited the availability of these products globally. However, in 2021 and 2022, the market experienced significant growth due to the increased burden of untreated patients suffering from spinal cord injuries and osteoporosis. Henceforth, the market is estimated to grow steadily over the forecast period.

GLOBAL BONE GROWTH STIMULATOR MARKET OVERVIEW

Market Size:

- 2025 Value: USD 2.2 Billion

- 2026 Value: USD 2.31 Billion

- 2034 Forecast Value (with CAGR): USD 3.53 Billion (CAGR of 6.23%)

Market Share:

- Regional Leader: North America (41.09% in 2025)

- Fastest-Growing Region: Asia Pacific

- End-User Leader: Hospitals

Industry Trends:

- Increasing Shift in Patients' Preference Towards Non-invasive Bone Growth Stimulators

- Growing Use of Pulsed Electromagnetic Field (PEMF) Technology

- Rise in Strategic Collaborations and Product Launches by Key Players

Driving Factors:

- Increasing Prevalence of Bone-Related Disorders such as Osteoporosis

- Growing Number of Orthopedic Surgeries and Trauma Cases

- Increasing R&D Activities and Product Launches

- Rising Awareness Regarding Advanced Non-invasive Therapies

- Technological Advancements in Bone Stimulation Devices

Bone Growth Stimulator Market Trends

Increasing Shift in Patients’ Preference Towards Non-invasive Bone Growth Stimulators

The increasing preference and adoption of noninvasive bone growth stimulators are the latest trends witnessed over the past few years. Noninvasive stimulators use magnetic, ultrasonic signals, or electrical fields to stimulate osteogenesis in conjunction with spinal fusion or fracture fixation. The device is applied over the location of a fracture for a period of time during the entire treatment procedure. Companies marketing such devices include Zimmer Biomet, Orthofix, Theragen, and DJO.

- For instance, in August 2022, Theragen, a biologics company, announced that it received the U.S. Patent for its ActaStim-S Spine Fusion Bone Growth Stimulator system.

These medical devices use pulsed electromagnetic fields (PEMF) at a low level designed to augment and activate the body's natural healing process, offering patients a non-invasive and safe treatment option for promoting postoperative spinal fusion..

North America Bone Growth Stimulator Market Size, 2021-2034 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Bone Growth Stimulator Market Growth Factors

Increasing Prevalence of Bone-Related Disorders has been Fueling the Market Growth

The increasing occurrence of bone diseases worldwide is one of the major factors supporting the usage of such stimulators, thus augmenting the market growth. Osteoporosis is one of the leading causes of fractures worldwide.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in 2021, in the U.S., osteoporosis was prevalent in 12.6% of the population aged 50 and above from 2017 to 2018, impacting around 19.6% of females aged 50 and above. Moreover, this proportion was 4.4% for men in the same age group.

The growing prevalence of osteoporosis has been increasing the cases of bone fractures, which has been fueling the demand for these stimulators for rapid healing. Furthermore, increasing diagnosis of such conditions, coupled with the rapid development of technologically advanced products for efficient treatment, is also anticipated to fuel the market growth. Also, the increasing number of oral and maxillofacial surgeries across the globe will further support the market growth.

Increasing R&D Activities Coupled with a Growing Number of Product Launches to Support Bone Growth Stimulator Market Growth

The prevalence of bone-related disorders has been increasing significantly. Market players have been focusing on developing new products to fulfil the increasing demand for effective treatment.

- For instance, Encore Medical, L.P., has been working on CMF Bone Stimulation to study its safety and efficacy in treating ankle fractures. The company’s bone healing stimulator, OL1000, is a non-invasive treatment indicated for closed, unstable ankle fractures.

Moreover, the market players have also been focusing on expanding applications for which their products are indicated.

- For instance, Orthofix Inc. has been working on a clinical trial to study the safety and efficacy of its product, CervicalStim Device, in cervical fusion patients who have undergone cervical fusion surgeries.

The launch of the pipeline products and increased emphasis on the market players' expansion of their product applications have been fueling bone growth stimulators market growth.

RESTRAINING FACTORS

Product Recalls Due to Certain Complications is Hampering the Market Growth

Demand for bone healing stimulators has been increasing significantly due to the increasing prevalence of bone-related disorders. However, risk factors associated with these products have been hampering its adoption.

- For instance, as of 2018, Zimmer Biomet had to recall its 1,360 bone growth and spinal fusion stimulators due to the limited availability of validation to ensure that these products had no bacterial or chemical residue.

Such risk factors associated with these products’ use and product recalls hamper the adoption of these products as patients are inclined towards alternate options, such as skin grafting, stem cell therapy, and hyperbaric oxygen therapy.

Bone Growth Stimulator Market Segmentation Analysis

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Bone Growth Stimulation Devices Segment Projected to Dominate in Forthcoming Years

The bone growth stimulation devices segment accounted for a dominant share of 51.95% the global market in 2026. The increasing focus of researchers to develop novel non-invasive stimulating devices has further surged demand for these products. For instance, in March 2019, DJO, announced the successful result of the Oregon Health & Science University’s independent study of patients undergoing lumbar fusions using non-invasive electrical stimulation devices.

Platelet-Derived Growth Factor (PDGF) segment is expected to witness a comparatively higher growth rate across the forecast period. Growing incidence of fractures and trauma incidences has led to higher demand for these products. Hence, manufacturers are constantly trying to develop and market PDGF-based therapies across the globe, thereby supporting market growth.

By Application Analysis

Spinal Fusion Segment to Hold Largest Share

Among applications, the spinal fusion segment dominated the market with a share of 33.33% in 2026. High shares of the segment are primarily due to the large number of patient pools undergoing spinal fusion surgeries across the globe. Moreover, the high price of the procedure coupled with the increasing volume of surgeries is the major factors supporting the lucrative shares of the segment across the analysis time frame. For instance, as per the data published by Frontiers Media S.A. in 2022, around 313 million surgeries are performed annually globally, and 500,000 lumbar spine surgeries are performed in the U.S. annually.

The non-union and union bone fractures segment, on the other hand, is estimated to witness a significant growth rate across the forecast period. High growth is primarily due to the increasing incidence of fractures and trauma cases worldwide. Growing incidence of sports injuries and road accidents are leading to increased cases of fractures, thus augmenting segmental growth.

By End-user Analysis

Hospitals to Remain Dominant Across the Forecast Period

In terms of end-users, the hospital segment dominated the global market with a share of 57.58% in 2026. The dominance is due to a high number of patient visits and many orthopaedic procedures being conducted in hospital facilities. The huge numbers of hospitals on a global scale, including the developed and developing markets. The indispensability of government hospitals in terms of subsidized care in a number of markets, especially in the emerging markets, is the cause of the segment's dominance. For instance, as per the American Hospital Association, in 2022, the total number of hospitals in the U.S. was around 6,120, with the number of staffed hospital beds around 916,752.

The specialty clinics segment is anticipated to register the highest CAGR for numerous factors. One of the key market trends in the developed markets is the growth of specialty clinics, where the care revolves around specific medical specialties such as orthopedics. Since the treatment and management of bone fractures require specialized care, this is anticipated to contribute to the growth of the segment in the forecast period.

REGIONAL INSIGHTS

North America

North America Bone Growth Stimulator Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America held the dominant share and stood at USD 0.91 billion in 2025. The Increasing healthcare expenditures, growing prevalence, and incidences of associated bone disorders that require the administration of bone growth stimulators are the major factors supporting regional dominance. Furthermore, robust procedural volumes pertaining to orthopedic conditions will significantly contribute to this region's high shares. The U.S. market is projected to reach USD 0.77 billion by 2026.

Europe

The market in Europe is projected to register a considerable market size throughout the study period. Strong and emerging companies such as Bioventus and Orthofix Holdings, Inc are expected to contribute to the region's dominance coupled with the strong procedural volumes in the region for various types of orthopedic conditions. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Asia Pacific

The industry in Asia Pacific is anticipated to witness lucrative growth during the forecast period. Lucrative development of the region is due to the rising prevalence of bone diseases in the region. The strong potential patient pool coupled with the under-penetration of the market is expected to offer lucrative growth opportunities for the bone stimulators companies to expand in the region and thus augment regional growth. The Japan market is projected to reach USD 0.04 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Market in Latin America and Middle East & Africa is anticipated to grow at a moderate rate owing to the gradual adoption of the novel bone growth stimulators and increasing usage of non-invasive stimulation devices. However, comparatively limited healthcare infrastructure is expected to restrict the market growth up to a certain extent despite the strong potential patient population in these regions.

List of Key Companies in Bone Growth Stimulator Market

Zimmer Biomet and Orthofix Holdings, Inc. to lead the Market

Zimmer Biomet and Orthofix Holdings, Inc. account for the majority of the share in the global market mainly due to the diversified product portfolio of Zimmer Biomet and new product approvals received by Orthofix Holdings, Inc. Orthofix Holdings, Inc. received both FDA and CE approval for CervicalStim and SpinalStim bone stimulators, which is estimated to strengthen the company’s position in the global market. Other players operating in the market are Stryker, Medtronic, Bioventus, DJO, LLC., and a few others. These companies operate in a highly competitive landscape.

LIST OF KEY COMPANIES PROFILED:

- Orthofix Medical Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Bioventus (U.S.)

- Medtronic (Ireland)

- DJO, LLC (U.S)

- Arthrex, Inc. (U.S.)

- Terumo Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - Orthofix Medical Inc. announced the new data that supported the safety and efficacy of PEMF Stimulation in Lumbar Spine Fusion Procedures indicated for patients with the risk of pseudarthrosis.

- October 2021 – Bioventus completed the acquisition of Misonix, a regenerative medicine and minimally invasive ultrasonic technology therapeutics provider. This acquisition would help the company to enhance its offerings for bone growth stimulators and products.

- April 2021 - Orthofix Medical Inc. and IGEA S.p.A. signed an agreement to commercialize IGEA S.p.A.’s cartilage, bone, and soft tissue stimulation product portfolio in the U.S. and Canada.

- March 2021 - Bioventus LLC announced the acquisition of Bioness, Inc. This acquisition will enable Bioventus LLC to expand its bone growth therapy product portfolio.

- November 2020 - DJO, LLC. announced the acquisition of the bone growth stimulation device business from OrthoLogic Corporation for USD 93.0 million.

REPORT COVERAGE

An Infographic Representation of Bone Growth Stimulators Market

To get information on various segments, share your queries with us

The market report provides a thorough analysis of the industry. It focuses on key aspects, such as leading companies, products, applications, and end-user. Also, the report offers insights into the market trends, impact of COVID-19, and the prevalence of bone diseases, among other key insights. Moreover, the report encompasses several factors driving the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.23% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global bone growth stimulator market size was valued at USD 2.2 billion in 2025 & is projected to grow from USD 2.31 billion in 2026 to USD 3.53 billion by 2034.

North America dominated the bone growth stimulators market with a market share of 41.09% in 2025.

The market will exhibit steady growth at a CAGR of 6.23% during the forecast period (2026-2034).

Bone growth stimulators are primarily used in spinal fusion surgeries, maxillofacial & dental procedures, and the treatment of nonunion & union bone fractures.

Key factors include the increasing prevalence of bone diseases, rising R&D activities, a growing number of product launches, and the demand for non-invasive treatment options.

Major companies include Zimmer Biomet and Orthofix Holdings, Inc., among others.

Asia Pacific is predicted to grow at a higher CAGR of around 6.2% over the projected period, driven by factors such as a large and aging population, improving healthcare infrastructure, and increasing awareness about advanced medical technologies.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic