Cable Tray Market Size, Share & Industry Analysis, By Material (Steel, Aluminum, and Stainless Steel), By Type (Ladder, Solid Bottom, Trough, Channel, Wire Mesh, and Single Rail), By End-User (Power, Construction, Manufacturing, IT and Telecom, and Others), Regional Forecast, 2026-2034

Cable Tray Market

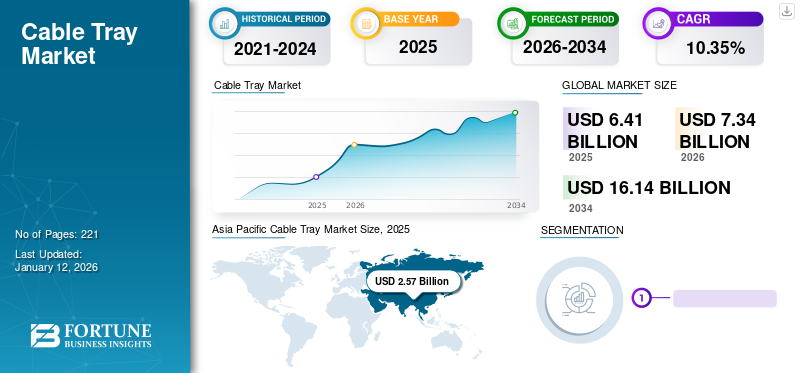

The global cable tray market size was valued at USD 6.41 billion in 2025. The market is projected to grow from USD 7.34 billion in 2026 to USD 16.14 billion by 2034, exhibiting a CAGR of 10.35% during the forecast period. Asia Pacific dominated the global market with a share of 40.02% in 2025.

The trays are essential for cable managing, organizing cables, and conserving the infrastructure carrying electricity. It provides wiring simplicity, system design flexibility, and lower installation cost to the consumer. Almost all types of cables are sorted and maintained with the help of cable trays as an option to open wiring systems or electrical conduits.

Due to lockdowns and government restrictions on mobility and workforce, many construction projects and power plant installations, which use a huge cable tray, were delayed. The delays have led to decreased demand. In addition, the pandemic put a halt on global supply chains, resulting in shortages and price increases for equipment and materials needed for the trays. According to the World Bank, the global construction sector contracted by 3.1% in 2020.

Cable Tray Market Trends

Rapid Growth in the Use of Digital Technologies is a Major Trend in the Market

The swift growth of digital technologies might continue to propel the requirement for more digital infrastructure, such as data centers, and the demand for advanced warehousing and distribution centers to back e-commerce. There is a need for products such as metal framing and racking structures, electrical cable & cable management such as cable trays that are majorly utilized in the construction of renovated and new buildings, renewable power systems, infrastructure, warehouses, data centers, and to connect electric vehicle charging stations to the electrical grid. For instance, in January 2023, the government of Maharashtra, India, stated at the World Economic Forum in Davos, Switzerland, that it inked a memorandum of understanding with two companies to construct two data centers in Pune for USD 3.9 billion.

Cable trays provide a safe and organized way to support complex wiring systems, protect them from potential damage, and ensure efficient operation. As the world continues to shift towards smart technologies and sustainable practices, the demand for cable trays in these sectors is expected to grow.

Download Free sample to learn more about this report.

Cable Tray Market Growth Factors

Growth in Construction Industry and Emphasis on Safety in Organizations to Surge Cable Tray Demand

The construction industry has rapidly expanded lately, especially in emerging countries such as China, Brazil, India, and others. The rise in population growth, urbanization, and disposable income has fueled construction activities. These constitute the development of infrastructure such as roads, constructing new buildings, bridges, and others. With the growth of construction activities, there is a rising electrical and communication wiring systems demand. These trays are fundamental parts to support these wiring systems, making them a significant component of any construction project. Therefore, the cable tray market growth is due to the rising demand for trays in the construction industry.

According to the International Trade Administration and the U.S. Department of Commerce, China’s 14th Five-Year Plan focused on new infrastructure developments in urbanization, energy, transportation, and water systems. China is expected to invest USD 1.49 trillion in new infrastructure during the 14th Five-Year Plan period (2021-2025). In contrast to traditional infrastructure such as water protection, roads & railways, the “new infrastructure” implies critical facilities based on information technologies such as industrial internet, the Internet of Things, AI, and 5G.

Shift Toward the Renewable Energy Sources to Drive the Market Growth

In recent years, renewable energy sources have been adopted in several regions due to their applications. Multiple sources, such as wind, hydroelectric power, and solar, require strong network sources. Cable tray plays an important role in the network building by the wiring systems.

The recent shift toward renewable sources is a major driver for the cable tray market. In addition, challenging remote areas, such as offshore wind farms, require a lot of cable tray systems to manage the network. Such renewable projects are backing the cable tray market, which will most probably continue growing in the coming years.

- In February 2023, Howrah Electrical Division of Eastern Railway issued a tender for installing a 2.2 MW on-grid solar rooftop. The tender is also for designing and supplying an on-grid connected solar PV plant without battery backup, complete with mono/polycrystalline silicon solar cells connected in series, fire-resistant DC cables, and fire-resistant AC cables via suitable cable trays.

RESTRAINING FACTORS

High Costs for Setting up Cable Tray Systems and Availability of Alternative Products May Hinder Market Growth

Cable tray systems need fitting tools, skilled labor, accurate measurement, specialized installation techniques, and others. The installation of such systems needs additional materials, such as elbow fittings, brackets, wall mounts, fasteners, and supports, which add to the system's total cost.

Additionally, nuclear plants, construction sites, and huge projects need specific time, tools, and labor to install can slow down the construction schedule and lead to supplementary system costs. Furthermore, the replacement and maintenance of such systems can also be cost-effective, as worn-out components or damage must be changed, and the entire system may be tested frequently. It becomes very problematic to inspect and detect the damaged cables, where cable trays are also involved and can amplify the time needed for the installation again, thereby hampering the market growth.

The imperative considerations for trays are their confrontation with fire, the possibility of ignition, and the spread of cable fire between adjacent trays. This is also associated with the cable materials, extra equipment, layout of the trays, area ventilation system, and fire protection system.

Cable Tray Market Segmentation Analysis

By Material Analysis

Ability to Withstand Harsh Environmental Conditions to Propel the Demand for Aluminum-based Trays

Based on material, the market is segmented into steel, aluminum, and stainless steel. The aluminum segment dominates the market with a share of 75.88% in 2026 and is expected to register notable growth over the forecast period. The trays are majorly utilized for their durability, corrosion resistance, and other properties. In addition, it can also withstand harsh environmental conditions, such as mining environments, electrical cogeneration facilities, and oil & gas plants, making them ideal choices for indoor and outdoor applications.

Steel is one of the fastest-growing segments in the region, driven by several advantages over other materials. Factors, such as durability and adaptability to the environment make it ideal for cable tray manufacturing.

By Type Analysis

Rising Application of Wire Mesh Tray in Data Centers to Drive the Demand

By type, The Ladder segment is forecast to represent 69.51% of total market share in 2026. the market is divided into ladder, solid bottom, trough, channel, wire mesh, and single rail. The wire mesh segment is expected to be the fastest-growing segment during the forecast period. The product is sorted, lightweight, strong, and easy to install in any environment, making it a cost-effective and durable solution for cable management. Wire mesh trays also deliver good ventilation and are ideal for utilization in environments where heat dissipation is important, such as data centers and other commercial applications.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Construction Sector in Developing Regions to Propel Segmental Expansion

Based on end-user, the market is divided into power, construction, manufacturing, IT and telecom, and others. The construction segment garnered the highest share in the market in 2022. This is attributed to the growing construction sector, especially in developing regions. The construction sector utilizes these tray systems for channeling wiring and electrical cables in residential buildings, bridges, and tunnels, offering an economical and long-lasting solution for cable management.

Further, the IT and telecom segment is expected to be the fastest-growing end-user segment. This is due to the rising trend of digitalization and the expansion of e-commerce which is leading to the growth of IT spaces such as data centers. As per the National Association of Software and Service Companies, the revenue of the Indian IT industry reached USD 227 billion in FY22. In addition, as per the India Brand Equity Foundation, in February 2020, Amazon secured environmental clearance for the construction of data centers in Hyderabad. The construction cost USD 1.6 billion.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Cable Tray Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.57 billion in 2025 and USD 2.99 billion in 2026. This is owing to factors such as the growing construction industry in the region. The increasing investment in construction and infrastructure development in developing economies, such as China, India, and Southeast Asia, is growing the requirement for cable management systems. The Japan market is projected to reach USD 0.58 billion by 2026. The China market is projected to reach USD 0.84 billion by 2026. The India market is projected to reach USD 0.56 billion by 2026.

North America also accounts for a significant market share due to increasing demand from the IT and telecom sectors. The growing renewable energy sector also contributes to the growing market in North America. The Middle East & Africa region is expected to witness significant growth during the forecast period. As the population in the region grows and economies continue to develop, there is a rising demand for energy infrastructure such as power plants, substations, and transmission lines. This is consequently expected to surge the demand in the coming years. The U.S. market is projected to reach USD 1.43 billion by 2026.

Several factors, such as the rising infrastructure development, increasing demand for dependable and efficient power distribution systems, and the requirement for effective and safe cable management solutions in various industries, are expected to drive the market in Latin America.

Cable trays are a significant part of the power distribution systems, offering support and protection for cables. With the rising demand for renewable energy and the development of smart grids in Europe, the demand is anticipated to rise further from the power industry.The UK market is projected to reach USD 0.15 billion by 2026. The Germany market is projected to reach USD 0.2 billion by 2026.

List of Key Companies in Cable Tray Market

ABB is among the Major Players due to its Product Portfolio and Geographical Presence

ABB produces various cable tray systems, such as perforated trays, cable ladders, channel trays, and struts, at their production facilities in Canada and Saudi Arabia. With a wide range of products and local manufacturing and distribution capabilities, ABB efficiently meets customer demands and promptly responds to project timelines across different regions. Whether it is a new project or refurbishing the existing facilities, the company offers dependable and durable support for all customers’ cabling requirements.

List of Key Companies Profiled:

- Atkore International Group Inc. (U.S.)

- Hubbell Incorporated (U.S.)

- ABB (Switzerland)

- Eaton (Ireland)

- Legrand (France)

- MP Husky Cable Tray & Cable Bus (U.S.)

- OBO BETTERMANN GmbH & Co. KG (Germany)

- Basor (Spain)

- Niedax MonoSystems, Inc. (U.S.)

- Snake Tray (U.S.)

- WIREMAID USA (U.S.)

- Oglænd System Group (Norway)

- Techline Mfg. (U.S.)

- Chatsworth Products (U.S.)

- Panduit (U.S.)

- nVent (U.S.)

- SUPERFAB INC (India)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: igus, a manufacturer of high-performance polymers, launched the world's first motor cable intended for cable trays and energy chains with UL approval, presenting a four-year functional guarantee. The CF33.UL motor cable allows seamless cable laying from the energy chain to the cable tray without a plug connection.

- January 2023: Snake Tray launched the Snake Tray 801 Series Mega Snake Cable Tray, which is better than all other wire basket trays. It is stronger than a steel ladder but infinitely more versatile and greatly reduces installation costs.

- October 2022: Snake Tray launched a new rail mount cable dropout for the mega snake cable tray. The side-mounted cable dropout offers ultimate support for the high-capacity data center cable runs without compromising with the product.

- May 2022: Atkore Inc. acquired the assets of Talon Products, LLC. It is a supplier of non-metallic, injection-molded cable cleats for power distribution utilization.

- April 2021: Atkore launched a welded wire mesh management system named EAGLE BASKET. It is one of the industry's toughest welded wire mesh management systems. EAGLE BASKET is manufactured in the U.S. with superior-quality steel wires creating a 2" x 4" mesh cable basket to manage and route the rising number of cables required to keep an operation running.

REPORT COVERAGE

The market research report provides a detailed market research analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends, competitive landscape, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Cable Tray Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.35% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market was USD 6.41 billion in 2025.

The global market is projected to grow at a CAGR of 10.35% over the forecast period.

The Asia Pacific market size stood at USD 2.57 billion in 2025.

Based on end-user, the construction segment holds the dominating share in the global market.

The global market size is expected to reach USD 16.14 billion by 2034

The increasing demand for electricity due to rapid construction and urbanization is a key driver of the market.

ABB, Atkore International, and Eaton are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic