Cannabis Market Size, Share & COVID-19 Impact Analysis, By Type (Flowers/Buds and Concentrates), By Application (Medical, Recreational (Edibles and Topicals), and Industrial Hemp) By Component (THC-Dominant, Balanced THC & CBD, and CBD Dominant), and Regional Forecast, 2023-2030

KEY MARKET INSIGHTS

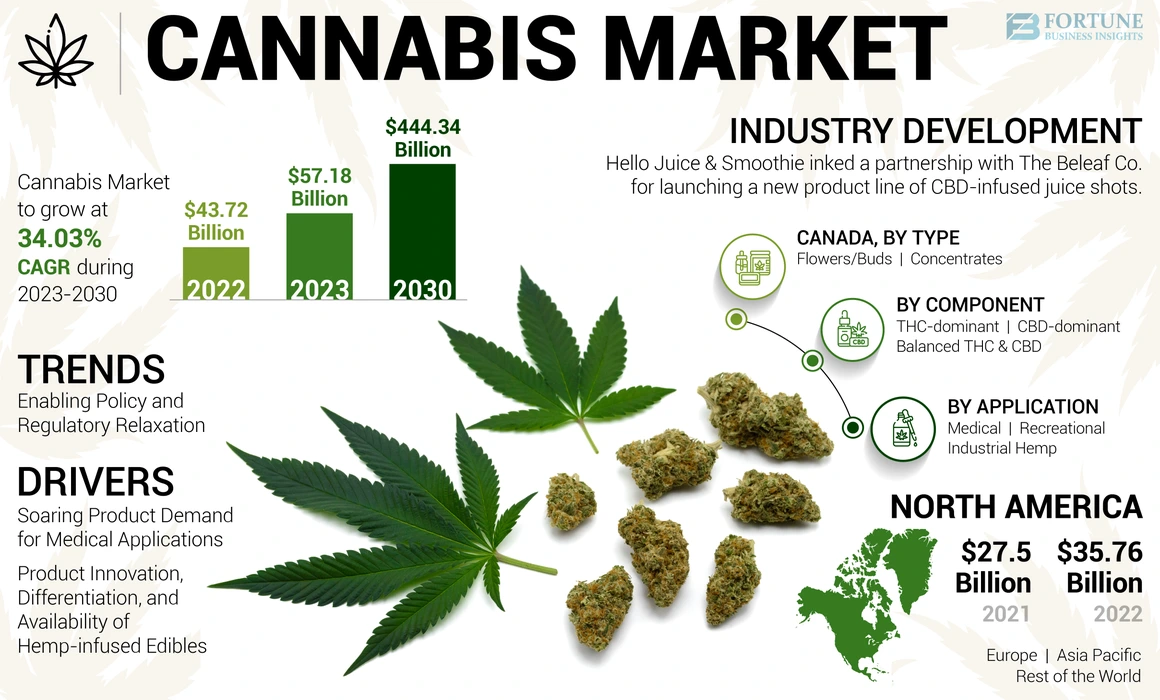

The global cannabis market size was valued at USD 43.72 billion in 2022 and is projected to grow from USD 57.18 billion in 2023 to USD 444.34 billion by 2030, exhibiting a CAGR of 34.03% during the forecast period. North America dominated the cannabis marijuana market with a market share of 81.79% in 2022. Moreover, the cannabis market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 428.22 billion by 2032, driven by increasing legalization of medical and recreational cannabis in different states of the U.S.

Cannabis is a genus of flowering plant and its use dates back thousands of years, with consumption based on recognized and accepted therapeutic and medicinal benefits. The social and spiritual utilization of it is also well-documented. C. sativa, indica, and ruderalis are three dominant species. Most varieties grown today are hybrids that exhibit features of two or more of these principal species.

Moreover, marijuana legalization is gaining momentum across the globe. This momentum is driven primarily by the increasing recognition that the product may have a range of legitimate medicinal benefits and therapeutic applications. It is the most widely cultivated, trafficked, and consumed drug worldwide, according to the United Nations Office on Drugs and Crime (UNODC). For instance, in June 2022, the government of Thailand decriminalized the cultivation, distribution, marketing, and consumption of all the parts of the cannabis plant. The decriminalization led to the highlight of the medical benefits of marijuana and pushed the economy of the country by using cannabis and hemp as cash crops.

GLOBAL CANNABIS MARIJUANA MARKET OVERVIEW

Market Size & Forecast:

- 2022 Market Size: USD 43.72 billion

- 2023 Market Size: USD 57.18 billion

- 2030 Forecast Market Size: USD 444.34 billion

- CAGR: 34.03% from 2023–2030

Market Share:

- North America dominated the cannabis marijuana market with an 81.79% share in 2022, led by widespread legalization of medical and recreational cannabis in various U.S. states.

- The U.S. cannabis market is projected to reach USD 428.22 billion by 2032, supported by rising demand, product innovation, and increasing state-level legalization.

Key Country Highlights:

- United States: State-level legalization for both medical and recreational use, the Infrastructure Investment and Jobs Act’s indirect support through relaxed regulations, and consumer adoption of edibles and concentrates fuel growth.

- Canada: A leading role in global legalization has enhanced production and export capabilities, supporting domestic and international market expansion.

- Thailand: Decriminalization of all cannabis parts in 2022 has positioned it as a regional cannabis hub and economic driver via hemp and cannabis-based cash crops.

- Germany: Strong push for medical marijuana and progressive healthcare policies are driving demand and shaping EU regulations.

- Israel: Pioneering medical cannabis research and innovation continue to support both domestic use and exports.

- Mexico: Legislative movement toward legalization for recreational use is expected to open significant growth opportunities.

COVID-19 IMPACT

Increased Consumption of Medical and In-house Cannabis amid COVID-19 to Boost Market Growth

Behaviours related to marijuana use may not be severely disrupted during prolonged periods of social isolation amid the COVID-19 pandemic outbreak, leading to its persistent demand throughout the pandemic. Many states declared that medical marijuana is permissible and medical marijuana dispensaries were declared an important business. Others, such as California, Oregon, and Colorado states in the U.S., have allowed dispensaries and recreational stores to remain open despite their stay-at-home orders. As concerns about COVID-19 increased and countries began implementing lockdown measures, consumers stocked up their products in Europe. The value of products sold through Cannazon, a marketplace for hemp products, reached approximately USD 5.04 million between January and March 2020, representing a volume of 1.6 metric tonnes. A similar increase in sales was seen in the U.S., with consumers also stocking up in anticipation of government-mandated shelters. Thus, the rise in stockpiling and positive demand among consumers and an increase in regions recognizing the product as essential for recreation and medicine are anticipated to further propel the cannabis market growth in the upcoming years.

CANNABIS MARIJUANA MARKET TRENDS

Download Free sample to learn more about this report.

Enabling Policy and Regulatory Relaxation to Support the Market Growth

The coronavirus pandemic provided opportunities to support the industry and relax regulations. For instance, in June 2021, the Cannabis Regulation Act (CRA) created a comprehensive licensing, taxing, and regulatory enforcement structure for the adult use of cannabis in New Mexico, the U.S. The act would be administered by the Cannabis Control Division (CCD). According to the act, adults aged 21 and over can possess up to 16 grams of extract, 2 ounces of flower, 800 mg infused edibles, and six mature plants.

However, a growing number of jurisdictions have established legal frameworks for the non-medicinal use of adults, including social, religious, and cultural purposes. Furthermore, formalizing activities related to the product's cultivation, production, and trade in a (legally regulated) legal marijuana market will facilitate access to information and increased consumption among consumers, which is expected to provide opportunities for the market in the upcoming years.

CANNABIS MARIJUANA MARKET GROWTH FACTORS

Product Innovation, Differentiation, and Availability of Hemp-infused Edibles to Drive Market Growth

C. Sativa consumer product companies and retailers are rapidly evolving to meet the needs of the "mainstream" marijuana consumer. The consumers are no longer limited to smoking flowers with joints, pipes or bongs, but have their choice of an increasing variety of products, including concentrates, infused products, and topicals. The COVID-19-related concerns drove consumers toward newly developed substitutes such as edibles and other infused products. Consuming the product by inhalation allows THC to enter the lungs and enter the bloodstream rapidly, causing the user to experience the associated mind-altering effects much more quickly than ingesting an edible product. Advancements in scientific development and product innovation have begun to overcome the drawbacks of edibles such as the inconsistent effect of marijuana after consumption. Newer forms of infusion products include topical or sublingual products designed to be absorbed under the tongue or through the skin.

Candies, chocolates, and beverages remain popular hemp-based edibles in the market. The onset of euphoric "high" effect by such edibles takes one to two hours, but the effect lasts longer than that resulting from inhaling smoke or vapor. Nonetheless, product innovation and packaging-related modifications are expected to play a pivotal role in boosting the sales sentiments of edibles and are projected to grow at the fastest rate during the forecast period.

Rising Product Demand for Medical Applications to Augment Industry Expansion

Medical hemp has gained a lot of attention across the globe in recent years. The use and acceptance of medical C. Sativa continue to grow, as evidenced by an increasing number of countries and states permitting its use for specific medical indications. Countries such as Germany, Finland, Israel, and Canada have taken bold steps in allowing medical marijuana use owing to its therapeutic benefits. Additionally, the recreational use of marijuanahas been legalized in more than 30 states in the U.S. In California and Florida, mainstream doctors have successfully used the product to treat AIDS, anorexia, arthritis, and cancer. The ongoing research and clinical trials for several marijuana-based medications are expected to fuel the market growth over the forthcoming years.

RESTRAINING FACTORS

Regulations Related to the Use of Hemp in Various Countries to Impede the Market Growth

Marijuana is nominally identified and authorized for medical use in certain areas of North America, Africa, Australia, Europe, and South America. But it is still prohibited in most Middle Eastern and Asian countries. In Asian countries such as Japan, India, and Korea, the law prohibits the product's consumption, possession, purchase, or sale and is treated as a criminal act. Thus, the legal landscape of the products in these regions is expected to hinder the market from achieving its full growth potential. Furthermore, side effects such as cognitive impairment associated with its use as a medicine are also expected to restrain market growth.

CANNABIS MARIJUANA MARKET SEGMENTATION ANALYSIS

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Flowers/Buds Segment to Dominate Driven by Rising Consumption

By type, the market is subdivided into concentrates and flowers/buds. The flowers/buds segment is touted to dominate the market with an appreciable valuation and is anticipated to exhibit remarkable growth over the forecast period.

Marijuana flower, or "bud," is a widely popular consumable product in the world market. A "bud" usually contains approximately 15% -30 % of THC, about 0.1%-1% of CBD, and presumed levels of other cannabinoids. The boiling temperatures of Cannabinoids are lower than the temperature at which flower burns. The same concept is used in vaporizers, which are becoming extensively popular across the globe.

Concentrates (primarily including CO2 oil, butane hash oil or "BHO," shatter, wax, live resin, budder, kief, ice water hash, and rosin) are set to witness exponential growth in the global (legal) market. This is owing to the favourable demand dynamics, huge consumer base, and higher availability and penetration of marijuana products, especially among the Western markets. Concentrates are also observing more significant consumer acceptance due to the general belief that vaporizing or ingesting concentrates is a healthier consumption method than smoking. Moreover, the level of THC that provides a euphoric "high" in concentrates can exceed 80% in concentrates. Such products have achieved diverse flavour profiles and formulations and offer enhanced convenience and a discreet consumption experience.

By Application Analysis

Recreational Marijuana to Emerge as the Leading Application Sector Owing to Mind-Altering Effect

The growing trend of marijuana legalization and decriminalization worldwide is a significant driver for the global recreational cannabis market. In the past decade, there has been a notable shift in public opinion and policy surrounding marijuana, resulting in the legalization of its recreational use in various countries and states. Canada, Thailand, Uruguay, and several states in the U.S. are among those that have legalized recreational marijuana, creating a significant market for marijuana products and paving the way for further legalization efforts in other regions. Additionally, governments recognize the economic benefits of a regulated marijuana market, including substantial tax revenues, business growth, and job opportunities, which have been compelling drivers for cannabis legalization. Furthermore, the growing demand for recreational cannabis led to new entrants in the market. For instance, in May 2023, Heritage Cannabis Holdings Corp., a Canada-based company, announced its entry into the recreational market in New York with the launch of RAD-branded vape and concentrate products.

Topicals represent a minimal share of the product application - lotions, lubricants, creams, and others. These are generally infused with ingredients providing relief for muscle soreness, inflammation, headaches, and cramping. The growing usage of marijuana in cosmetics and skin pathology applications is likely to propel its market demand.

The medical marijuana segment is expected to grow at a significant CAGR in the forecast period. Medicinal applications include the incorporation of cannabinoids or cannabinoid-like compounds in pharmaceutical products, as per market trends. Sativex, Marinol, and Cesamet are some of the well-known hemp-based drugs. Some of the documented and practised applications of the product in the medical sector are for the treatment of chronic pain, multiple sclerosis, treatment-resistant epilepsy, and others. The health and wellness trend resonating in the global marketplace has facilitated the medical marijuana market growth and the utilization of cannabidiol (CBD) in particular. A growing body of research indicates the potential benefits of CBD in treating various illnesses, including chronic pain, anxiety, epilepsy, and cancer.

By Component Analysis

THC-dominant Hold a Significant Share Due to the Robust Consumer Demand for their Psychoactive Effects and Recreational Experiences

THC (Delta-9-Tetrahydrocannabinol) is the primary chemical compound responsible for the product’s euphoric effects and is majorly used for recreational activities. Most cannabis varieties are THC-dominant as it is the most abundant cannabinoid. The THC-dominant product usually contains 10% to 30% Delta-9-Tetrahydrocannabinol. The compound provides a range of feelings from desirable relaxation to less-than-pleasant sensations such as paranoia and anxiety.

Furthermore, THC has some potential uses in treating conditions such as glaucoma, low appetite, muscle spasticity, and others. With THC now legalized in various regions and growing consumption of cannabis-infused food and beverages, manufacturers have developed innovative products in the market. For instance, in February 2023, Harpoon Brewery, an employee-owned American brewery, launched its First THC-based beverage named Rec. Weed.

The CBD-dominant segment is expected to grow at a high CAGR in the forecast period. It is a non-intoxicating compound and is popularly used in various medical applications such as seizures, anxiety, and pain.

REGIONAL INSIGHTS

North America Cannabis Market Size, 2022 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Market to Hold Major Share Attributed to the Widespread Use of Marijuana and Marijuana-infused Products

North America dominated the market in 2022 and was valued at USD 35.76 billion. Recreational legalization in the U.S. began in 2012, with Colorado and Washington becoming the first two states to legalize its recreational use. As of May 2022, Nineteen states, two territories, and the District of Columbia have legalized it for recreational purposes. In the U.S., all state medical hemp laws recognized it as a form of therapy or medicine for conditions such as Alzheimer's disease, anorexia, arthritis, chronic pain, epilepsy, post-traumatic stress disorder, and even cancer. Canada has recently emerged as a flag-bearer country by playing a leading role in global marijuana legalization. Furthermore, its growers in the U.S. have increased significantly, thereby fueling its consumption and uses. This is projected to increase its sales and opens up new revenue channels for companies in the region.

Europe is the second-largest market owing to the growing use of medical cannabis and progressive legislation. In European countries, medical marijuana is effective in trials. It is being used legally in medical settings to treat conditions ranging from cancer to appetite stimulants in patients with AIDS-related syndrome. Additionally, the product demand is expected to increase rapidly due to changes in government policy. In many countries, the relevant legislation is recent. According to the European Monitoring Centre for Drugs and Drug Addiction, no national government in Europe supports the legalization of cannabis or its products' sale for recreational use. The growing medicinal use of the product in countries is expected to boost sales in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to witness substantial growth due to the rapidly changing government policies and legalization of cannabis in several Asian countries. The consumption of marijuana and hemp is projected to grow in Thailand owing to its legalization of marijuana cultivation, which can positively impact the regional market growth. Furthermore, the growing research in the pharmaceutical industry is expected to show the potential for the medical capabilities of cannabis in the region.

KEY INDUSTRY PLAYERS

Partnership and Expansion by Leading Players to Significantly Aid Market Growth

The global market remains highly competitive and robustly dynamic - new partnerships and expansions are underway as the wave of legalization spreads gradually across the globe. Recreational consumption is also expected to attain multi-faceted patterns among younger consumers, taking higher risks for trying out different forms and versions of the product. Thus, the robustly expanding popularity of recreational utilization is creating a shift from flowers/buds to more processed formats such as edibles, oils, and topical products. Key players in the market have appropriately reciprocated this. For instance, in August 2021, Tilary Inc., a global pioneer in the research, production, and distribution, announced the launch of medicinal hemp edibles in varieties of chocolates and soft chewing gums rich in THC and CBD. The new Tilray brand offers a wide range of medicinal marijuana products, including whole flowers, oils, vaporizers, and pre-rolls designed for the health and wellness of the patient.

List of Top Cannabis Marijuana Companies:

- Aurora Cannabis Inc. (Canada)

- Tilary, Inc. (Canada)

- Canopy Growth Corporation (Canada)

- CannTrust Holdings Inc. (Canada)

- VIVO Cannabis Inc. (Canada)

- Cronos Group Inc. (Canada)

- Jazz Pharmaceuticals (Ireland)

- OrganiGram Holdings (Canada)

- Lexaria Corp. (Canada)

- ABcann Medicinals, Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 - Toast, a multi-state-operating brand, partnered with the Nirvana Group, a premier diversified cannabis company. The partnership would bring innovative new offerings to patients and consumers in Oklahoma and New Mexico.

- April 2023 - Hello Juice & Smoothie, a local juice and smoothie shop in the U.S., collaborated with The Beleaf Co. to launch a new product line of CBD-infused juice shots.

- April 2023 - PharmaCielo, a Canadian cultivator and producer of dried flower and medicinal-grade cannabis extracts, partnered with CANNPRISMA - PHARMA, a Portuguese Contract Manufacturing Organization. The deal was focused on supplying high-quality EU-GMP1-certified medicinal cannabis flowers to the European market.

- May 2022 - Canopy Growth Corporation introduced new flavors for its cannabis-infused carbonated drinks. The two new flavors were orange and grape.

- March 2021 – In Mexico, lawmakers passed a bill to legalize the use of recreational marijuana. This is a turning point for the country amid challenges faced due to drugs, and the country has the potential to become the largest global market for cannabis. The step would permit adults in the country to not only smoke marijuana but also to grow a limited number of cannabis plants at home with legal permits. Moreover, it will also grant cannabis licenses to the plant cultivators and manufacturers for selling the crop.

REPORT COVERAGE

The report provides qualitative and quantitative insights into the cannabis industry and a detailed analysis of the cannabis market size and growth rate for all possible segments. The market is segmented by type, application, and geography. Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights provided in the report are the overview of related markets, recent hemp industry developments such as mergers and acquisitions, the regulatory scenario in key countries, and key industry trends.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2030 |

|

Base Year |

2022 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023-2030 |

|

Historical Period |

2019-2021 |

|

Growth Rate |

CAGR of 34.03% from 2023 to 2030 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Component

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the value of the market was USD 43.72 billion in 2022 and is projected to reach USD 444.34 billion by 2030.

Growing at a CAGR of 34.03%, the market will exhibit steady growth during the forecast period (2023-2030).

Based on type, the cannabis flower/bud segment is expected to be the leading segment in the global market during the forecast period.

The robust popularity of recreational hemp is the key factor fueling the market growth.

Aurora Cannabis, Canopy Growth Corporation, and Tilary Inc. are a few of the key players in the market.

North America is expected to hold the highest share in the global market over the forecast period.

The edible segment of recreational marijuana is expected to grow at the fastest pace during the projected period.

Enabling policy and regulatory relaxation across the globe is a key trend in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us