Cardiac Biomarkers Market Size, Share & Industry Analysis, By Indication (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, and Others), By Biomarker (Troponin, Creatine kinase-MB (CK-MB), B-type Natriuretic Peptide (BNP), Myoglobin, and Others), By End User (Hospitals, and Specialty Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

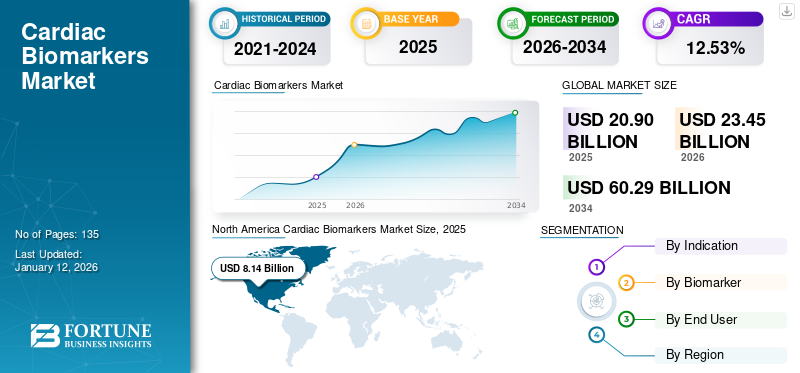

The global cardiac biomarkers market size was valued at USD 20.9 billion in 2025. The market is projected to grow from USD 23.45 billion in 2026 to USD 60.29 billion by 2034, exhibiting a CAGR of 12.53% during the forecast period. North America dominated the cardiac biomarkers market with a market share of 38.94% in 2025.

This type of biomarkers are certain endogenous substances including enzymes, hormones, and proteins, which are released into the blood during specific cardiovascular conditions indicating the abnormality of the cardiac functioning. Healthcare providers are now focusing on the detection of these specific markers, to identify and diagnose critical cardiac conditions, including myocardial infarction, heart attack, and acute coronary syndrome (ACS) or other conditions. Various tests have been developed by market players to accurately and timely detect the presence of these biomarkers, which have been instrumental in early diagnosis of cardiovascular conditions.

According to the World Heart Federation, Harvard University studies, along with other sources, individuals with pre-existing medical conditions, such as diabetes, heart disease, among others are more vulnerable to the novel coronavirus. Also, patients with pre-existing heart disease suffering from COVID-19 are more prone to high risks of heart attack or develop congestive heart failure. A more unusual condition called myocarditis has been observed in COVID-19 patients being admitted in emergency departments globally. Additionally, the National Health Commission (NHC) of China demonstrated that 35.0% of the total patients diagnosed with COVID-19 (sample size of 46,248) were suffering from hypertension and 17.0% were suffering from coronary heart disease. This has led to an increase in demand and adoption of cardiac biomarkers tests in patients suffering from COVID-19.

However, there has been a significant drop in the number of patients visiting in the emergency departments globally, during the current outbreak of COVID-19 pandemic. According to an article published by The New York Times, there has been 40.0% to 60.0% reduction in admissions in patients suffering from heart attack during March and April 2020. Additionally, various cardiologists in Spanish hospitals reported around 40.0% reduction in admissions of patients in emergency departments for conditions including strokes, and heart attacks. The significant decline in the number of patients admitted is anticipated to have significant decline in the number of cardiac biomarker tests performed which is projected to impact the global industry in 2020.

Cardiac Biomarkers Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 20.9 billion

- 2026 Market Size: USD 23.45 billion

- 2034 Forecast Market Size: USD 60.29 billion

- CAGR: 12.53% from 2026–2034

Market Share:

- North America dominated the cardiac biomarkers market with a 38.94% share in 2025, driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and adoption of cutting-edge biomarker tests.

- By biomarker type, troponin holds the largest share due to its widespread use in diagnosing myocardial infarction and acute coronary syndrome.

Key Country Highlights:

- Japan: Demand is supported by an increasing elderly population, rising cardiovascular disease prevalence, and government initiatives to improve cardiac diagnostics.

- United States: Market growth is driven by high incidence of cardiovascular diseases, supportive reimbursement policies, and increased use of rapid and point-of-care cardiac biomarker tests.

- China: Growth fueled by expanding healthcare infrastructure, rising awareness, and technological advancements in biomarker testing, alongside increasing cases of cardiovascular conditions.

- Europe: Increasing prevalence of acute coronary syndrome and myocardial infarction, combined with improved healthcare access and innovation adoption, is accelerating market growth.

MARKET TRENDS

Download Free sample to learn more about this report.

Adoption of Point-of-Care Biomarker Tests to Boost Market Growth

Rising prevalence of cardiovascular disorders is one of the major factors expected to increase the demand for rapid and POC cardiac biomarkers testing. Key market players are investing in the development of rapid biomarker test kits hence expected to drive the market growth. The point care test offers clinical benefits including reduced diagnosis time in comparison to the traditional laboratory-based tests. For instance, in March 2017, F. Hoffmann-La Roche AG received FDA clearance to Elecsys Troponin T (TnT) Gen 5 Stat blood test for diagnosis of myocardial infarction. The test provides results in 9 minutes, shortening the time to diagnosis by almost 3 hours when compared with Roche’s conventional TnT test. There is a gradual shift in the adoption of rapid POC tests for detection of this type of biomarkers in emerging and developed countries.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases to Drive the Market

The burden of cardiovascular diseases (CVDs) is rising globally, owing to numerous factors such as smoking, diabetes, obesity, and lifestyle changes. According to the National Centre for Health Statistics, coronary artery diseases (CAD) account for 1 in 4 deaths in the U.S. annually. According to, Centers for Disease Control and Prevention, around 1.5 million cases of myocardial infarctions are registered annually in the United States. Additionally, according to Patient Platform Limited, around 103,000 people in the United Kingdom suffer from myocardial infarction each year. Rising prevalence of cardiovascular disorders is one the major factor anticipated to drive the market growth during the forecast period.

Additionally, according to the current scenario of 2020, coronavirus disease 2019 (COVID-19) has affected more than 129 countries globally. The impact of COVID-19 on patients suffering from cardiovascular disorder is high and patients suffering from COVID-19 are anticipated to trigger certain cardiovascular disorders such as heart failure, acute coronary syndrome, and among others. According to an article published by NCBI in March 2020, states that although COVID-19 affects the respiratory tract and other related organs, it has a huge impact on cardiovascular disorders. Additionally, according to various studies from China including 1,527 patients with COVID-19, 16.4% reported co-morbid conditions. Out of this 9.7%, 16.4% and 17.1% of patients reported diabetes, cardio-cerebrovascular diseases, and hypertension respectively. This has laid down makeshift reforms and protocols, to test COVID-19 patients with biomarkers, and other tests in healthcare settings globally. These are some of the factors anticipated to trigger the use of biomarker testing globally, hence driving the market growth.

Introduction of Novel Biomarker Tests to Drive the Market

Robust research and development on cardiovascular interventions and the introduction of rapid and novel biomarker tests is anticipated to drive the market growth during the forecast period of 2025-2032. Key market players are investing in the research and development of novel biomarkers for the diagnosis, prognosis, and predictive analysis of cardiovascular disorders.

In July 2019, Siemens received the U.S. Food and Drug Administration (FDA) approval for high-sensitivity troponin I assays (TnIH) to aid early diagnosis of myocardial infarctions. Additionally, in September 2019, Abbott received U.S. Food and Drug Administration (FDA) approval for its ARCHITECT STAT High Sensitivity Troponin-I blood test. The test is designed to detect heart attacks in quick time, and more accurately than contemporary troponin tests. The introduction of such novel tests for detection of these biomarkers is anticipated to propel the demand for these tests, and subsequently drive the growth rate of the market during the forecast period.

MARKET RESTRAINT

Lack of Availability of POC Testing Kits and delayed Test Results Anticipated to Hamper the Market Growth

Despite the rising prevalence of cardiovascular disease and the use of this type of biomarkers for diagnosis and treatment, there are certain factors hindering the growth of the market. The time period required to obtain results from certain biomarker tests is relatively higher and lead to several further complications such as misdiagnosis. For instance, Increased CK-MB can usually be detected in a patient with a heart attack about 3-6 hours after the onset of chest pain. The duration of results for evaluating these conditions with the use of laboratory-based biomarkers tests is relatively high. This has limited the uptake of cardiac biomarkers for diagnosis of acute conditions, and has compelled healthcare providers towards alternative diagnostic methods.

SEGMENTATION

By Indication Analysis

To know how our report can help streamline your business, Speak to Analyst

Acute Coronary Syndrome Segment is anticipated to grow at faster pace during the forecast period

Based on indication, the cardiac biomarkers market is segmented into myocardial infarction, congestive heart failure, acute coronary syndrome, and others. The acute coronary syndrome segment dominated the indication segment with a share of 55.74% in 2026. Rising prevalence of the acute coronary syndrome is propelling demand for these biomarkers. This is one of the major factors anticipated to drive the growth of the segment in the market. The myocardial infarction is anticipated accounted to the second-largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period of 2025-2032.

By Biomarker Analysis

Troponin Dominated the Biomarker Segment

In terms of biomarkers, the market is segmented into troponin, creatine kinase, b-type natriuretic peptide (BNP), myoglobin, and others. The troponin segment is estimated to grow at a significant CAGR during the forecast period with a market share of 50.26% in 2026, due to high preference among end-users. The troponin test is performed for the diagnosis of myocardial infarction, acute coronary syndrome, and among others. The rising prevalence of the myocardial infarction and acute coronary syndrome is one the major factor anticipated to propel the demand of the troponin test during the forecast period. Creatine Kinase segment is anticipated to grow at a significant CAGR during the forecast period of 2026-2034.

By End User Analysis

Higher Adoption of Cardiac Biomarkers by Hospitals to Enable Dominance of the Segment

Rising healthcare expenditure and the development of new hospitals in developing countries are some of the major factors attributable to the dominance of the hospitals segment. Increasing prevalence of cardiovascular disorders and COVID-19 is also one of the additional factors anticipated to propel the growth of the hospital segments with market share of 52.32% in 2026. A rapidly developing hospital infrastructure in emerging countries, and clinical laboratories being an integral part of large hospitals, have been instrumental in higher adoption of cardiac biomarkers tests globally. These factors combined with adequate reimbursement policies for inpatient admissions in emerging countries are driving the growth of the hospitals segment in the market.

However, increasing specialty clinics and a number of ambulatory surgical centers in developed countries is anticipated to drive the growth of the specialty clinics at significant CAGR during the forecast period of 2026-2034.

REGIONAL ANALYSIS

North America Cardiac Biomarkers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 8.14 billion in 2025. North America is expected to hold a major market share due to the rising prevalence of cardiovascular diseases. For instance, according to the American College of Cardiology Foundation an estimated 1.05 million patients were suffering from coronary disorders in the United States alone, in 2019. This is presenting a large pool requiring diagnostic procedures, fueling the demand for cardiac biomarkers in North America. The U.S. market is projected to reach USD 8.29 billion by 2026.

Europe

Europe is anticipated to grow at a faster pace owing to due to rising prevalence of acute coronary syndrome and myocardial infarction leading to an increase in demand for these biomarkers. The UK market is projected to reach USD 1 billion by 2026, while the Germany market is projected to reach USD 1.87 billion by 2026.

Asia Pacific

Asia Pacific, on the other hand, is anticipated to grow at a significant CAGR due to the introduction of technologically advanced cardiac biomarkers, and developing healthcare infrastructure leading to higher adoption of these tests in countries including China, and India. The Japan market is projected to reach USD 1.18 billion by 2026, the China market is projected to reach USD 1.57 billion by 2026, and the India market is projected to reach USD 0.82 billion by 2026.

Latin America and Middle East & Africa

Latin America and Middle East & Africa are anticipated to grow at a moderate rate due to slower adoption of technologically advanced solutions and lack of awareness among the population towards tests for cardiac biomarkers.

KEY INDUSTRY PLAYERS

F. Hoffmann-La Roche AG, Abbott and Siemens AG are some of the leading market players

The market is highly fragmented. In 2019, F. Hoffmann-La Roche AG, Abbott, and Siemens AG were among the top market players accounting for more than 30.0% share of the market. The competitive landscape consists of large, mid-size, and small companies that have developed different types of biomarkers to target various indications. Key market players are focused on achieving growth through the development of innovative product designs & new tests and inclined towards the specificity of the tests based on detection of cardiac biomarkers.

LIST OF KEY PLAYERS PROFILED:

- F. Hoffmann-La Roche AG

- Abbott

- Siemens AG

- Creative Diagnostics

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Others

KEY INDUSTRY DEVELOPMENTS:

- April 2021 – F. Hoffmann-La Roche Ltd announced the launch of five new applications for their key cardiac biomarkers in combination with their Elecsys technology. These biomarkers have been proved to be successful managing cardiovascular diseases and can help clinicians to diagnose heart attacks and manage heart failures in patients.

- April 2021 –Siemens AG. announced that they received CE Mark approval for their point-of-care Atellica VTLiPatient-Side Immunoassay Analyzer, a high sensitivity troponin I test. The approved device detects protein biomarkers for acute myocardial infraction.

REPORT COVERAGE

The cardiac biomarkers market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, biomarker types, and leading applications of the biomarkers. Besides this, the report offers insights into the market, current cardiac biomarkers market trends, the impact of COVID-19 on cardiovascular disorders and highlights the key industry developments. In addition, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Indication

|

|

By Biomarker

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 20.9 billion in 2025 and is projected to reach USD 60.29 billion by 2034.

In 2025, the market value stood at USD 20.9 billion.

Growing at a CAGR of 12.53%, the market will exhibit steady growth in the forecast period (2026-2034).

Troponin segment is expected to be the leading segment in this market during the forecast period.

Rising prevalence of cardiovascular diseases and introduction of POC cardiac biomarkers tests are some of the major factors anticipated to drive the market.

F. Hoffmann-La Roche AG, Abbott and Siemens AG., are some of the leading player in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us