Central Nervous System Treatment Market Size, Share, Trends & Industry Analysis, By Disease Type (Neurovascular Diseases, Neurodegenerative Diseases, Mental Health, Infectious Diseases, and Others), By Drug Class (Immunomodulatory Drugs, Interferons, Decarboxylase Inhibitors, Dopamine Agonists, Antidepressants, Others) By Drug Type (Biologics and Non-biologics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), and Regional Forecast, 2026-2034

Central Nervous System Treatment Market Size & Share

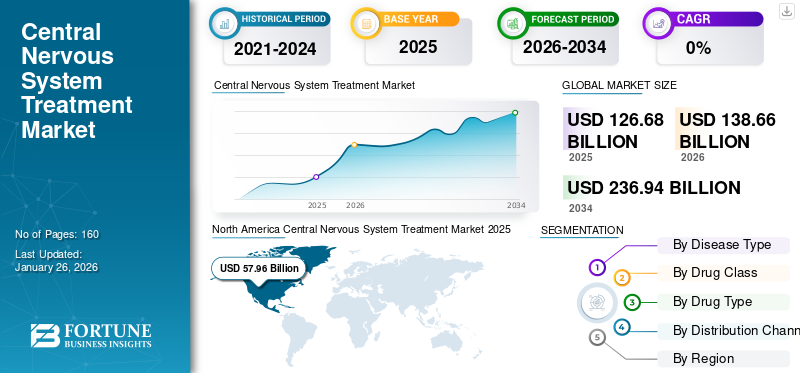

The central nervous system treatment market size was valued at USD 126.68 billion in 2025. The market is projected to grow from USD 138.66 billion in 2026 to USD 236.94 billion by 2034, at a CAGR of 6.93% in the 2026-2034 period. North America dominated the central nervous system treatment market with a market share of 45.70% in 2025. The global impact of COVID-19 has been unprecedented and staggering, with the central nervous system treatment witnessing a negative demand shock across all regions amid the pandemic. Based on our analysis, the market exhibited a decline of -4.2% in 2024. The sudden increase in CAGR is attributable to this market’s demand and growth returning to pre-pandemic levels once the pandemic is over.

The central nervous system (CNS) treatment market is projected to expand at an incredible growth rate. Over the past years, the world has witnessed a striking increase in neurological disorders' diagnosis rates. According to the Alzheimer's Association, around 6 million people in the U.S. are currently living with Alzheimer, and by 2050, the number of people suffering from the condition is projected to reach 13 million. Also, neurological disorders are exerting a huge economic burden on the healthcare system of various countries. The direct and indirect costs of treatment and management of these conditions is gradually increasing owing to the increasing prevalence. Alzheimer’s and other dementia’s cost around USD 355 billion in direct and indirect costs to the U.S. each year.

Increasing prevalence of neurological disorders, and increasing diagnosis rates in developed and emerging countries is presenting a large patient pool undergoing treatment. This is further supported by the emphasis of non-profit organizations, healthcare systems, and market player towards creating awareness regarding these conditions through campaigns, etc. These factors along with introduction of new generation of antipsychotic drugs by global and domestic players in the market is poised to drive the growth opportunities of the market during the forecast period.

COVID-19 Impact: Damaging Effect on Market Sales

The sudden outbreak of COVID-19 and the virus's consistent spread have significantly obstructed the supply chain of key CNS therapeutics in the market. The pharmaceutical companies that operate in the CNS market have focused their R&D expenditure and workforce towards the development of COVID-19 therapeutics and vaccines. This shift has led to an estimated USD 115.84 Billion sales drop in central nervous system treatment in 2024. Additionally, over-the-counter products such as anesthesia and products such as anesthesia have witnessed an increased dip in revenue growth owed to lower demand from respective end-users. However, the market is estimated to stabilize and showcase astounding growth in 2025 attributable to market growth returning to the pre-pandemic level.

Global Central Nervous System Treatment Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 126.68 billion

- 2026 Market Size: USD 138.66 billion

- 2034 Forecast Market Size: USD 236.94 billion

- CAGR: 6.93% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.70% share in 2025. This is driven by the strong presence of key players, higher access to CNS disorder treatments, and active engagement from government agencies such as the U.S. FDA in providing regulatory guidance.

- By Disease Type: Neurodegenerative diseases held the largest market share. The segment's growth is fueled by rising sales of drugs for multiple sclerosis and Alzheimer’s disease, driven by the increasing prevalence of these neurological disorders and significant R&D investments in potential drug candidates.

Key Country Highlights:

- Japan: The market is driven by an increasing geriatric population, evolving healthcare infrastructure, and a strong presence of biosimilar and over-the-counter medication manufacturing, which enhances treatment accessibility. Strategic licensing agreements, such as Corbus Pharmaceuticals' deal with Kaken for a new drug, are also key growth factors.

- United States: The market is propelled by a high and growing prevalence of neurological conditions, with around 6 million people living with Alzheimer's. The country also faces a significant economic burden from these diseases, with treatment and care costs for Alzheimer's exceeding USD 305 billion annually, which drives the demand for effective therapies.

- China: As part of the fastest-growing Asia Pacific region, China's market is expanding due to a rising geriatric population, improving healthcare infrastructure, and an increasing prevalence of neurological disorders that require effective and accessible treatments.

- Europe: The market is advanced by favorable reimbursement policies and high access to treatment through public healthcare systems, such as the NHS in the U.K. The region is also a key hub for new product launches due to its highly recognized regulatory approval process.

CENTRAL NERVOUS SYSTEM TREATMENT MARKET LATEST TRENDS

Download Free sample to learn more about this report.

Mergers, Acquisitions, and Partnerships are Key Trends Exhibited by Market

One of the significant trends that the market exhibits are mergers, acquisitions, and partnerships. Predominant companies in the market involved in innovating central nervous system treatment drugs have entered into distribution and developmental agreements with fellow competitors. For instance, in February 2024, Biogen agreed with Sangamo Therapeutics to innovate gene therapy drugs for various neurological diseases. Such strategic steps taken by key companies operating in the CNS therapeutics market will significantly improve the prospects of the industry.

DRIVING FACTORS

Growing Geriatric Population and Associated Neurological Disorders to Fuel Product Demand

Worldwide, there is a rapid increase in the prevalence and incidence of neurological disorders such as multiple sclerosis, Alzheimer’s, Parkinson’s, among others. According to Public Health England, the number of individuals with multiple sclerosis has increased to over 131,000 in the U.K. for the year 2025. This increase is set to remarkably influence the growth of the market in the coming years.

On the other hand, Alzheimer’s disease is also witnessing an increase in prevalence in countries with a growing geriatric population. For instance, according to the Alzheimer's Association, more than five million individuals are affected by Alzheimer’s disease, and this number is set to rise to 14 million by 2050. Also, the organization reports that the treatment and care for Alzheimer’s cost the U.S. government over USD 305 billion in 2024.

Promising Pipeline Drugs to Create New Growth Prospects

Prospective product launches for treating neurological disorders are anticipated to propel market growth over the forecast duration. These upcoming launches are expected to increase access to treatment in developing countries.

For instance, Lenabasum is currently in Phase 3 clinical trial to evaluate safety and efficacy in the treatment of diffuse cutaneous systemic sclerosis by Corbus Pharmaceuticals Inc. The molecule is set to launch globally by 2024. Also, In January 2019, Corbus Pharmaceuticals Inc. entered into a licensing agreement with Kaken for the commercialization of Lenabasum in Japan. These factors are projected to propel market growth in the coming years.

RESTRAINING FACTORS

Time-Consuming Approval Process and Stringent Regulatory Framework to Restrain Market Growth

Central nervous system treatment therapeutic research and development require a higher amount of investment than other therapeutic disease areas. Since the therapeutics developed for central nervous system treatment had to cross the blood-brain barriers, it requires a longer developmental and approval process. The market also faces challenges in patient recruitment and higher cost per approval in the entire pharmaceutical industry.

Moreover, an adverse occurrence with the use of these drugs is also a major factor that is anticipated to hinder the global central nervous system treatment market growth. For instance, in 2025, the U.S. FDA issued a warning notifying that the use of Gilenya in relapsing multiple sclerosis patients could lead to severe disability if the medication is stopped. These issues could restrain the market growth during the forecast period.

CENTRAL NERVOUS SYSTEM TREATMENT MARKET SEGMENTATION ANALYSIS

By Disease Type Analysis

Demand for Multiple Sclerosis Drugs to Help Proliferate Market Growth

Based on disease segment type, the global CNS therapeutics market is classified as neurovascular diseases, neurodegenerative diseases, mental health, infectious diseases, and others. Neurodegenerative diseases dominated the market with a share of 47.08% in 2026, owing to the growing sales for multiple sclerosis as well as Alzheimer’s disease drugs due to the rising prevalence of neurological disorders.

Additionally, growing R&D investments with an aim to develop potential drug candidate for the treatment of multiple sclerosis, Alzheimer’s etc. is another factor contributing to the rapid expansion of the market. For instance, in October 2020, Dyno Therapeutics and Roche announced a collaborative license agreement to use Dyno’s CapsidMap platform for the development of next-generation adeno-associated virus (AAV) vectors for gene therapies for CNS disorders and liver-directed therapies for both Roche and Spark Therapeutics, (a member of the Roche Group) product portfolio.

Furthermore, rising cases of mental health disorders among the population owing to increased stress levels, anxiety, and unhealthy diet are also leading to a growing demand for CNS therapeutics. Due to the emergence of COVID-19, mental health disorders have taken a steep climb among the population worldwide, therefore, increasing the sales of antidepressants, analgesics, and others.

By Drug Class Analysis

Immunomodulators Dominated Market Owed to Higher Sales Revenue

Based on the drug class, the market is divided into immunomodulators, interferons, decarboxylase inhibitors, dopamine agonists, antidepressants, analgesics, and other central nervous treatment drugs. The majority of the share 52.08% was captured by immunomodulators in 2026. The major factor driving immunomodulators in the market is the constant innovation and development of therapeutic molecules to treat disease indications.

- For instance, in August 2020, Novartis received U.S. FDA approval for Kesimpta indicated against relapsing forms of multiple sclerosis. Combined with this, the drug class segment is witnessing an increase in partnerships and R&D.

Interferons have followed the lead in terms of market revenue for the year 2020. The increasing incidence and prevalence of neurological disorders are expected to predominantly influence the segments' growth. According to the World Health Organization (WHO) (2019), globally, around 50 million individuals have epilepsy. Besides, antidepressants are estimated to witness considerable growth owing to growing awareness regarding mental health in developing nations.

By Drug Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Launch of Novel Non-Biologics has Triggered Strong Growth

Based on drug type, the global market has been segmented into biologics and non-biologics. The non-biologics segment dominated the global market with a share of 69.05% in 2026. The dominance is attributable to the lesser imposition of regulations by the regulatory body than that of the biologics for approval.

Additionally, Biogen’s Tecfidera has the highest sales as it is largely prescribed worldwide in the non-biologics segment for treatment against multiple sclerosis. In addition, the rising prevalence of neurological diseases, strong government support, and favorable health reimbursement are key factors driving the growth of the non-biologics segment during the forecast period.

Moreover, factors such as the presence of potential pipeline candidates and government support in the development and approval of the biologic CNS drugs are expected to foster the growth of the biologics segment.

By Distribution Channel Analysis

Increasing Sales of Prescription-based Drugs to Support Hospital Pharmacy Segment

Based on the distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacy segment captured the lion’s share worldwide attributable to the higher rising preference of treatment from hospitals and more significant sales revenue of prescription drugs from the distribution channel.

The retail pharmacy segment also garners importance in the market because of the increasing access to prescription drugs and discounts offered by retail pharmacy giants. Besides, online pharmacies are projected to witness a lucrative CAGR during the forecast period due to the internet's penetration in emerging countries.

REGIONAL INSIGHTS

North America Central Nervous System Treatment Market 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 57.96 billion in 2025 and USD 63.13 billion in 2026. The dominance of this region in the CNS therapeutics market is attributable to the strong presence of key players in the region combined with higher access to the treatment of CNS disorders. Combined with this, government agencies such as the U.S. FDA are constantly engaging in informing the public and healthcare professionals regarding the treatment and regulatory guidelines for managing CNS diseases. The U.S. market is projected to reach USD 58.25 billion by 2026.

- For instance, in 2025, the U.S. FDA issued a draft guidance document for the development of drugs for the treatment of Alzheimer’s disease.

Europe followed the lead by generating the second largest revenue in the market for the year 2024. This is owed to the favorable reimbursement policies and largest access to treatment through public healthcare providers such as the National Health Service (NHS) of the U.K. Combined with this, the European regulatory approval is also one of the highly recognized approvals by major companies making it one of the most lucrative regions for product launches. The UK market is projected to reach USD 4.98 billion by 2026, while the Germany market is projected to reach USD 7.51 billion by 2026.

The countries of Asia Pacific are anticipated to showcase stellar CAGR attributed to factors such as the increasing geriatric population, evolving healthcare infrastructure, a larger presence of biosimilar/over-the-counter medication manufacturing countries, and the rising prevalence of neurological disorders. The Japan market is projected to reach USD 9.04 billion by 2026, the China market is projected to reach USD 5.99 billion by 2026, and the India market is projected to reach USD 3.16 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

On the flip side, Latin America, and the Middle East and Africa are projected to showcase reasonably slower market growth rates due to the lack of product approvals in the region combined with weaker product penetration.

KEY INDUSTRY PLAYERS

Major Companies Focus on Strong Presence in Emerging Countries Through Partnerships

The market is fragmented due to the presence of various companies aiming at central nervous system therapeutics. Robust pipeline and strategic distribution agreements have enabled companies to hold a strong position in the market.

Biogen dominates the market, with the company’s crucial molecules generating significant revenue in the year 2020. Other players operating in the market are Johnson and Johnson Services, Inc., Pfizer Inc., RF. Hoffman-La Roche Ltd., Novartis AG, Sanofi, Teva Pharmaceutical Industries, Otsuka Holdings, among others.

LIST OF TOP CENTRAL NERVOUS SYSTEM TREATMENT COMPANIES:

- Biogen (Massachusetts, U.S.)

- Pfizer Inc. (New York, U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Basel, Switzerland)

- Johnson & Johnson Services, Inc. (New Jersey, U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (Paris, France)

- Otsuka Holdings (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2021 – Johnson & Johnson received U.S. FDA approval for the launch of Ponvory as a daily oral drug for treatment against multiple sclerosis.

- May 2020 – Neurocrine announced that the company would be delaying the launch of Ongentysis, a drug indicated to treat Parkinson’s disease owing to challenges experienced by the ongoing global pandemic.

REPORT COVERAGE

The global market research report provides a detailed central nervous system treatment market analysis. It focuses on key aspects such as leading companies, drug class type, and distribution channel. Besides this, it offers insights into the market trends and highlights new product launches, key industry developments, and pipeline analysis. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the developed market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Disease Type

|

|

By Drug Class

|

|

|

By Drug Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 126.68 billion in 2025 and is projected to reach USD 236.94 billion by 2034.

In 2025, the North American market size stood at USD 57.96 billion.

Registering a CAGR of 6.93%, the market will exhibit healthy growth in the forecast period (2026-2034).

The neurodegenerative diseases segment is expected to lead this market during the forecast period.

The increasing prevalence of neurological diseases is the key factor driving the growth of the market.

Biogen, Roche, Johnson and Johnson Services, Inc., and Novartis AG are the global market players.

North America dominated the market in terms of share in 2025.

Asia Pacific region exhibited the highest growth during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us