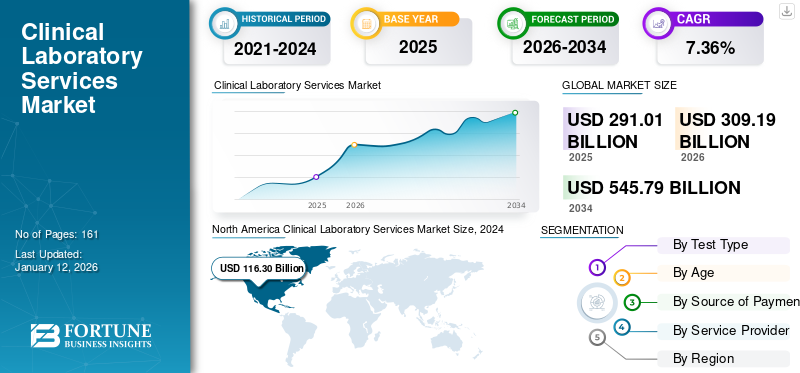

Clinical Laboratory Services Market Size, Share & Industry Analysis, By Test Type (Clinical Chemistry, Hematology, Genetic Testing, Microbiology & Cytology, and Others), By Age (Pediatric and Adult), By Source of Payment (Public, Private, and Out of Pocket), By Service Provider (Hospital-based Laboratories, Stand-alone Laboratories, Clinic-based Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global clinical laboratory services market size was valued at USD 291.01 billion in 2025. The market is projected to grow from USD 309.19 billion in 2026 to USD 545.79 billion by 2034, exhibiting a CAGR of 7.36% during the forecast period. North America dominated the clinical laboratory services market with a market share of 42.56% in 2025.

Clinical laboratories are healthcare facilities where tests are conducted on clinical specimens to derive information regarding patients’ health for diagnosis, treatment, and disease prevention. These labs also offer emergency response assistance, research support, and training for new lab staff. The prevalence of chronic conditions and growing geriatric population are promoting the use of lab-based solutions.

- For instance, according to a report by the International Monetary Fund in July 2023, during the period between 2000 and 2050, the global share of people aged 80 years and above was 5.0% of the total population share. Such a high geriatric population is augmenting the growth of the market.

Moreover, the increasing awareness of the importance of clinical tests and growing healthcare expenditure are expected to drive market growth during the forecast period. In addition, growth in strategic initiatives implemented by key players to offer advanced services and the introduction of innovative testing products are expected to favor the market growth during the forecast period. In 2020, the COVID-19 pandemic had a positive impact on the global market due to a rise in the demand for clinical diagnostics and laboratory testing. However, in 2022, a decrease in the number of COVID-19 tests and patient visits to clinical laboratories and hospital labs led to a decline in the market’s growth. The market experienced a negative impact in 2023 too and is expected to normalize in 2024. The market is anticipated to witness steady growth during the forecast period.

Global Clinical Laboratory Services Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 291.01 billion

- 2026 Market Size: USD 309.19 billion

- 2034 Forecast Market Size: USD 545.79 billion

- CAGR: 7.36% from 2026–2034

Market Share:

- Region: North America dominated the market with a 42.56% share in 2025. The region's growth is driven by high healthcare expenditure, strong demand for clinical tests for chronic diseases, and the integration of advanced technologies such as AI and Big Data for diagnostics.

- By Test Type: The Clinical Chemistry segment held the largest market share in 2024. Its dominance is attributed to the high prevalence of diabetes, thyroid, and hormonal disorders, coupled with the wide availability of at-home clinical testing services and a high volume of biochemistry test procedures.

Key Country Highlights:

- Japan: As a part of the rapidly aging Asia Pacific population, the market is driven by the increasing need for diagnostic services. The region has over 630 million people aged 60 or above, a number projected to reach 1.3 billion by 2050, increasing the prevalence of chronic diseases.

- United States: The market is propelled by a high number of genetic tests (over 129,000 provided as of 2022) and strong demand for diagnostics for chronic conditions. However, the industry also faces a significant challenge with a shortage of 20,000 to 25,000 laboratory technologists.

- China: As a key country in the fastest-growing Asia Pacific region, the market benefits from a rising geriatric population, an increasing prevalence of chronic diseases, and a growing focus on preventive healthcare, which boosts the demand for laboratory services.

- Europe: Market growth is supported by improved healthcare facilities and high adoption of clinical testing for timely diagnosis. Strong government support through health insurance coverage is a key driver, with countries like England performing around 500 million biochemistry tests annually.

Clinical Laboratory Services Market Trends

Rising Focus of Companies on Developing Automated Clinical Laboratories is the Major Trend

The growing emphasis and initiatives by key players in terms of the development of automated clinical labs is one of the most prominent global clinical laboratory services market trends. As pressure has risen to decrease healthcare costs over the last decade, laboratories rely on developing automatic machinery to maintain profitability. Moreover, lab automation provides advantages such as the replacement of manual and repetitive tasks, an increase in throughput, and an improvement in the quality of the results. Such advantages are expected to boost the demand for lab automation and propel the market growth in the coming years.

- For instance, in April 2023, Flow Robotics announced the launch of a new sample traceable device, ScanID, that offers both 1D and 2D scanning on one device and can scan an entire row of sample tubes in one go. The device optimizes sample traceability and reduces pre-analytical phase errors, further enhancing the patient’s clinical diagnosis and treatment.

Several key companies are also emphasizing the launch of new and advanced diagnostic tests to expand clinical laboratory services globally. Thus, the growing technological advancements by the service providers and the rising introduction of advanced devices by prominent players are leading to the high adoption of these services, bolstering the market expansion.

Download Free sample to learn more about this report.

Clinical Laboratory Services Market Growth Factors

Rising Occurrence of Chronic Disorders to Propel the Market Growth

The global market is witnessing the mounting incidence of chronic disorders such as sickle cell disease, cystic fibrosis, autoimmune diseases such as rheumatoid arthritis and celiac disease, and several forms of cancer, including breast cancer. The factors contributing to the upsurge in the occurrence of such disorders include the increasing geriatric population, tobacco consumption and exposure, physical inactivity, and poor lifestyle. In addition, the increasing number of chronic diseases is projected to boost the number of hospitalizations and clinical laboratory tests. These factors are expected to contribute to the growth of the market during the forecast period.

- For instance, according to a journal published by Elsevier B.V. in May 2022, approximately 162,428 people are estimated to be living with cystic fibrosis across 94 countries globally, and 57,076 patients remain undiagnosed. Such a rise in prevalence is expected to increase the demand for clinical laboratory tests during the forecast period.

Moreover, the rise in the occurrence of chronic disorders has further increased the number of medical practitioner-prescribed clinical laboratory tests and hospitalizations.

- For instance, according to a National Center for Biotechnology Information (NCBI) article in April 2023, the genetic testing registry data was analysed for 2012 to 2022. It was found that a total of 129,624 and 197,779 genetic tests were provided in the U.S. and globally as of November 2022, respectively, which included updated versions of earlier existing genetic tests. Thus, these above-mentioned factors are expected to propel the demand for clinical services.

Increasing Healthcare Expenditure by Government and Public-Private Partnerships to Impel Market Expansion

One of the significant factors propelling the market growth is the rising healthcare expenditure by the government. In order to combat the increasing demand for clinical laboratory diagnosis and services and for easy availability and accessibility to citizens without financial hardship, the government bodies of different countries are focusing on increasing their healthcare expenditures.

- For instance, according to a report published by the Ministry of Health and Family Welfare in April 2023, in India, the share of government health expenditures in total healthcare expenditures increased from 29.0% in 2014-2015 to 41.4% in 2019-2020.

In terms of the growing demand for clinical laboratory testing, public-private partnerships are expected to play a crucial role in expanding the medical laboratory services' reach. The private-public partnerships provide lucrative advantages, which include highly scalable outcomes to strengthen a nation’s capacities to build technical skills, develop innovations, and map the prevalence of the chronic diseases. Such a rise in public and private partnerships coupled with increased government healthcare expenditures is expected to boost the clinical laboratory services market growth.

RESTRAINING FACTORS

Shortage of Clinical Lab Personnel May Hamper the Market Growth

The lack of clinical lab personnel, especially in emerging countries, is one of the key hindrances to the market expansion. The market is further anticipated to be hampered by the inadequacy of equipment and a lack of skilled healthcare professionals.

- For instance, according to an article published by Clinical Lab Products (CLP) in September 2022, in the clinical laboratory services industry, there is a shortage of 20,000 to 25,000 laboratory technologists, with roughly 335,000 professionals currently employed across the U.S. There has been a shortfall of about 7.0% technologists in laboratory settings across the U.S. Such shortage of laboratory technicians is expected to restrain the market growth in the coming years.

In addition, resource-poor settings for diagnosis, such as the limited supply of equipment, poor staffing and monitoring, poorly equipped laboratory materials and personnel, and avoidance of good lab protocols during critical tests, may hinder the growth of the market in emerging regions.

Clinical Laboratory Services Market Segmentation Analysis

By Test Type Analysis

Clinical Chemistry Segment Dominated Due to Growing Prevalence of Diabetes

On the basis of test type, the market is divided into hematology, clinical chemistry, microbiology & cytology, genetic testing, and others. The clinical chemistry segment accounted for the largest clinical laboratory services market with a share of 32.78% in 2026. The segment growth can be attributed to the high prevalence of diabetes, thyroid, and hormonal disorders coupled with the availability of at-home clinical lab testing services, providing easy access to diagnostic procedures. An increasing number of biochemistry test procedures is further expected to impel the segment growth.

- For instance, according to an article published by the University of Reading in October 2021, around 95.0% of clinical pathways rely on patients having access to efficient, timely, and cost-effective pathological services, and 500.0 million biochemistry tests are carried out every year in England.

The hematology segment held the second-highest position in the global market in 2024. The segment growth can be attributed to the rising patient population suffering from hemophilia, blood-clotting disorders, and leukemia, coupled with the surging number of hematology tests conducted in hospitals.

The genetic testing segment gained a substantial market share in 2024. The segment’s growth can be credited to the rising number of patients suffering from genetic disorders in various countries and increasing number of hospitalizations. Moreover, the introduction of new laboratories to study genome variations in the Middle Eastern countries is expected to propel the segment’s growth. In July 2024, Lifenity Group launched the integrated clinical pathology & genomic laboratory in the Middle East. This state-of-the-art laboratory is dedicated to studying the profound impact that genome variations have on a person’s susceptibility to diseases, as well as the development and progression of diseases.

The microbiology & cytology and others segment is anticipated to grow significantly during the forecast period due to rising cases of infectious diseases and launches of clinical lab tests by various key players to meet patient demands.

To know how our report can help streamline your business, Speak to Analyst

By Age Analysis

Adult Segment Dominated Due to Growing Geriatric Population Suffering From Chronic Disorders

In terms of age, the global market is divided into adult and pediatric. The adult segment held the major share in the global market with a share of 82.81% in 2026. The segment growth can be ascribed to the upsurge in the geriatric population suffering from chronic disorders across the globe. The rising adoption of advanced clinical laboratory tests among adults is further expected to propel the segment growth.

- For instance, in July 2022, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) published a report stating that Asia Pacific has over 630.0 million people aged 60 or above, representing 60% of the world’s older population. This number is projected to increase to 1.3 billion by 2050.

The pediatric segment occupied a substantial market share in 2024 owing to the growing incidence of genetic disorders in children coupled with favorable public health insurance policies for children in several countries such as the U.S., Germany, and others.

By Source of Payment Analysis

Favorable Reimbursement Policies by the Government to Drive the Public Segment Growth

By source of payment, the market is divided into private, public, and out of pocket. The public segment held the dominant share in the market with a share of 63.00% in 2026. The increasing healthcare expenditure by the government, coupled with improving reimbursement policies are expected to boost segment growth during the forecast period.

- For instance, according to an article published by The Wilson Center in 2022, approximately 70.9% of Mexicans are covered by public healthcare as per the 2020 census.

The private and out-of-pocket segments held a significant share of the market in 2024.These segments are expected to grow due to the patients’ increasing disposable income and growing awareness about early diagnosis among the population. Moreover, the rising strategic activities by key market players to provide advanced patient care through their diagnostic laboratories are expected to boost the private segment’s growth.

- For instance, in January 2021, American Hospital Dubai, a Middle East healthcare provider and Mayo Clinic Laboratories entered a strategic partnership to advance patient care through enhanced laboratory diagnostics. Such strategic partnerships are anticipated to increase the visits in laboratories, increasing the payment through private insurance.

By Service Provider Analysis

Hospital-based Laboratories Held the Dominant Share Due to Growing Demand for Clinical Services

In terms of service provider, the global market is classified into stand-alone laboratories, clinic-based laboratories, hospital-based laboratories, and others. The hospital-based laboratories segment accounted for the dominant share in the market with a share of 53.40% in 2026. The segment growth can be credited to the rising number of hospital labs, increasing technological advancements in automated clinic labs, surging number of patient visits to hospitals for testing, and growing demand for clinical laboratory services.

- For instance, in January 2021, Clinisys launched a laboratory information management system meant for genomic laboratories in the U.K. The product has been successfully deployed at Poitiers University Hospital in France and would be introduced into seven additional laboratories across the region.

The stand-alone laboratories segment exhibited leading CAGR during the forecast period 2024-2032. The stand-alone laboratories segment is expected to grow due to strategic activities by numerous vital players to introduce new laboratories and provide easy access to diagnostic care services.

- For instance, in May 2024, BD (Becton, Dickinson, and Company) collaborated with Sehgal Path Lab and launched its Center of Excellence (CoE) in Flow Cytometry for clinical research in Mumbai, India.

The clinic-based laboratories segment is projected to register moderate CAGR during forecast period. The emergence of clinic-based laboratories coupled with the rising demand for clinical laboratory services and research initiatives in developed countries are major factors behind the clinic-based laboratories segment expansion.

REGIONAL INSIGHTS

Based on region, the global market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

North America Clinical Laboratory Services Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market, valued at USD 123.86 billion, dominated the global market in 2025. The high healthcare expenditure and growing demand for clinical laboratory tests for regular body check-ups and other long-term disorders, such as cancer, arthritis, and heart diseases are the major factors behind the region’s dominance. Similarly, integration of advanced technologies, such as Big Data Engines and Artificial Intelligence (AI) for easy diagnosis is propelling the regional market growth.

- For instance, according to a report published by the Journal of the American Heart Association (JAHA), approximately 55.0% to 98.0% of older adults aged 60 years and over have at least two chronic diseases. Ischemic heart disease is among the most prevalent individual chronic illnesses.

Europe held a moderate share in the global market due to improved healthcare facilities and high adoption of clinical laboratory testing for the on-time diagnosis of life-threatening diseases. The strong support by the government in terms of health insurance coverage is further bolstering the regional growth.

The Asia Pacific market is projected to record the maximum CAGR during the forecast period. Rise in the aging population and increase in the prevalence of chronic diseases will enhance the service demand in the region. The growing focus of prominent players on the regional expansion of their clinical laboratories and launches of advanced testing solutions is expected to drive the market growth in the region.

Moreover, the growth of Latin America and the Middle East & Africa markets can be ascribed to the improving healthcare infrastructure, surge in healthcare expenditure, and growing awareness regarding preventive care.

- In March 2022, GC Labs announced the new lab testing service agreement with two partners Bio Lab in Bahrain and Biotrust in Cambodia. This strategic partnership increased its sales and expanded footprint in the Middle East and African region. GC Labs has strengthened its presence globally by collaborating with 12 partners in 10 different countries, mainly covering Asia and the Middle East. Such developments continue to create new business opportunities to gain a strong position in the market.

List of Key Companies in Clinical Laboratory Services Market

Prominent Market Players Dominated Due to Expanded Service Offerings

The competitive landscape of the global market reflects a highly fragmented structure. It comprises innumerable global and regional players. Prominent players such as Laboratory Corporation of America, Eurofins Scientific, and Quest Diagnostics Incorporated dominated the global market in 2023. Their dominance can be ascribed to their strong services portfolio and a robust presence in the U.S. and Europe markets. Some other factors behind these companies’ established market presence include a more extensive customer base, several clinical laboratories, and innovative test launches.

- For instance, in December 2022, Laboratory Corporation of America opened a more extensive anatomic pathology and histology (APH) laboratory in Los Angeles. This new launch expanded the company’s global central laboratory capabilities.

ARUP Laboratories, Sonic Healthcare Limited, NeoGenomics Laboratories, Inc., and Illumina, Inc. are some other prominent players operating in the market. The prominence is due to their increasing strategic initiatives to expand their brand presence. Other players, such as DDRC SRL Diagnostics (SRL Diagnostics), Charles River Laboratories, and Metropolis Healthcare Limited India, are focusing on increasing their geographical presence in key regions and diversifying their services portfolio, which is expected to strengthen their market position.

LIST OF KEY COMPANIES PROFILED:

- Laboratory Corporation of America (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Illumina, Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- DDRC SRL Diagnostics (SRL Diagnostics) (India)

- UNILABS (A.P. Moller Holding A/S) (Switzerland)

- NeoGenomics Laboratories, Inc. (U.S.)

- ARUP Laboratories (U.S.)

- Sonic Healthcare Limited (Australia)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Atalan added TriCore to its network. It is an independent, not-for-profit clinical laboratory that provides more than 2,900 full-service, state-of-the-art laboratory tests to healthcare professionals and their patients. Additionally, it provides analytics and research services to support healthcare and scientific organizations worldwide.

- October 2023: Froedtert Health, Wisconsin Diagnostic Laboratories (WDL), and HealthEco launched Atalan together. It is a technology-based clinical partnership providing doctors and medical centres with unprecedented access to a vetted network of the foremost clinical laboratories in the U.S.

- August 2023: Redcliffe Labs partnered with Abbott India to launch Clinical Decision Support (CDS), also known as AlinIQ. It is powered by advanced technologies, such as Big Data Engines and Artificial Intelligence (AI).

- April 2023: SRL Diagnostics announced the acquisition of Lifeline laboratories to expand its presence in the Indian pathology market.

- April 2023: Quest Diagnostics announced the acquisition of Haystack Oncology to enhance the focus on early-stage oncology testing to aid in the early and accurate detection of residual or recurring cancer.

- March 2023: NeoGenomics Laboratories, Inc. announced the expansion of their Next-Generation Sequencing (NGS) portfolio with the commercial availability of multiple tests, including Neo Comprehensive for solid tumor cancers.

REPORT COVERAGE

An Infographic Representation of Clinical Laboratory Services Market

To get information on various segments, share your queries with us

The report encompasses a complete analysis of the market. It highlights vital aspects such as test type, age, source of payment, service provider, and geography. It also provides insights into market dynamics, the prevalence of chronic diseases, overview on accreditation bodies for laboratories, prominent players, and COVID-19 impact on the market. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.36% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Test Type

|

|

By Age

|

|

|

By Source of Payment

|

|

|

By Service Provider

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 309.19 billion in 2026 and is estimated to reach USD 545.79 billion by 2034.

The market is projected to record a CAGR of 7.36% during the forecast period.

The market value of North America was USD 123.86 billion in 2025.

Based on test type, the clinical chemistry segment dominates the global market.

North America held a dominant share of the global market in 2025.

The rising prevalence of chronic disordersis driving the global market growth.

Laboratory Corporation of America, Quest Diagnostics Incorporated, and Eurofins Scientific are some of the top players in the market.

The major contributing factors to the adoption of these services are increasing disease prevalence and a surge in strategic initiatives by key players to offer advanced offerings.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic