Cloud Microservices Market Size, Share & Industry Analysis, By Component (Platform and Services), By Deployment Mode (Public, Private, and Hybrid), By Enterprise Type (Large Enterprises and SMEs), By End-User (IT and Telecommunications, BFSI, Retail and Consumer Goods, Healthcare, Education, Media and Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

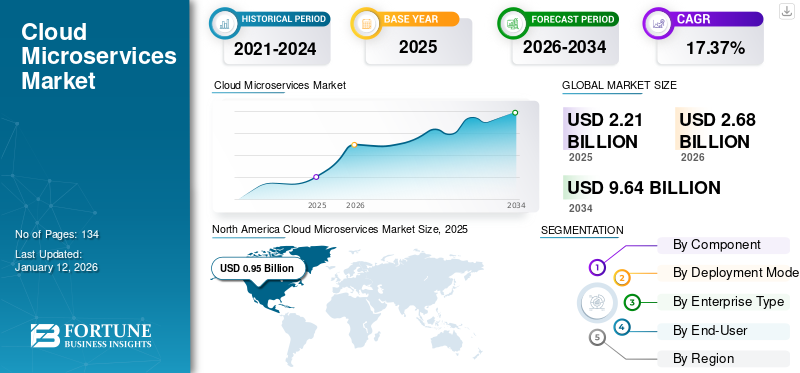

The global cloud microservices market size was valued at USD 2.21 billion in 2025. The market is projected to grow from USD 2.68 billion in 2026 to USD 9.64 billion by 2034, exhibiting a CAGR of 17.37% during the forecast period. North America dominated the global market with a share of 43.04% in 2025.

Microservices is a methodology for developing applications that are built on modular components or services. Each module is intended to support specific tasks or business objectives, using a direct and easily defined interface such as an Application Programming Interface (API) that refers to other sets of services. The microservices model enables a more decentralized approach to software development for developers.

The cloud microservices market growth can be attributed to several factors, such as the proliferation of microservices architecture, the rising need for secure, low-cost IT operations, and the growing recognition of containers and DevOps tools. With faster development cycles, scalable and agile systems, and improved productivity with reduced costs, the widespread adoption of microservices is helping organizations to streamline their web application development processes. In addition, there is considerable market potential for developing business strategies through partnerships and collaboration amongst the key players in the market. For instance,

- In April 2023, Sensedia, the world's largest supplier of API and microservices launched SPIN, a Global Partner Programme for technology, service, and distribution channel organizations seeking to extend their offer and opportunities.

The COVID-19 pandemic accelerated cloud adoption not only as a technological change but also as an operational model. For instance,

- According to O’Reilly’s Microservices Adoption in 2020, the success rate for the adoption of Microservices among enterprises was 92%.

To cope with the extraordinary growth in remote employees, enterprises are working toward a faster pace of cloud-based digital transformation that allows them to respond quickly to evolving market conditions. They were deploying cloud microservices to ensure business continuity during the crisis. For instance, according to Trading Platforms, Microsoft Teams which is based on microservices architecture saw an increase of 93% in daily active users in 2021 compared to 2020. Due to such an increase in cloud-based services for digitalization during COVID-19 pandemic, there has been an enormous need for microservices.

Cloud Microservices Market Trends

Adoption of Service Meshes and Serverless Architecture for Managing Microservices is a Key Trend

Service meshes have become more common in managing the complexity of microservices. A service mesh is a layer of specialized infrastructure within the microservices architecture, which serves to communicate between services. The use of service meshes has become more popular as the complexity of microservices architectures continues to sure in businesses.

- For instance, in March 2022, AuthenticID launched on-demand serverless identity microservices, available as AWS Lambda functions, offering ID document and facial biometric services for easy integration. The scalable solution supported up to one billion transactions per day, enabling businesses to adapt to changing industrial demands.

As most of the infrastructure is managed by a communication service provider, organizations can provide innovations. This model requires that organizations pay only for the resources they use. AWS Lambda is an instance of serverless architecture and is being deployed by many organizations. Developers can build, deploy, and run small, independent, and autonomous services using serverless architecture and microservices, making it simple for the cloud provider to scale and manage them.

Thus, the aforementioned factors are expected to be a trend over the forecast period.

Download Free sample to learn more about this report.

Cloud Microservices Market Growth Factors

Rise of Microservices Architecture by Enterprises for Eliminating Complexity to Enhance Market Growth

Microservices architecture has become a popular way to develop software applications among organizations. The microservices architecture consists in breaking an application down into smaller, independent services that are capable of developing, deploying, and scaling on their own instead of building monolithic applications.

Many companies have adopted microservices architecture and are making progress toward a multi cloud strategy, as they continue to rely on cloud solutions. This approach allows businesses to adapt their technology stack in ways that suit their specific needs, and this is often more cost effective than relying on a single cloud provider. For instance,

- According to a recent Solo.io survey in 2022, 85% of organizations are moving their applications to microservices architecture, and this rapid growth and adoption help to make microservices mainstream.

Thus, the aforementioned factors act as driving forces for the growth of the market.

RESTRAINING FACTORS

Managing Security Concerns and Monitoring Complexity to Hamper the Adoption of Microservices

Security and monitoring complexities present significant obstacles to the widespread adoption of cloud-based microservices. The distributed nature of microservices architecture increases the potential attack surface, as each service becomes a potential target. This requires the implementation of security measures for each service, which can be complex and resource-intensive. Furthermore, monitoring the performance and interactions of these services becomes challenging due to their large number and intricate dependencies.

Microservices face security threats such as data breaches, unauthorized access and denial-of-service attacks, which further highlight the importance of robust security measures. This complexity in security and monitoring impacts the overall performance and security of microservices and also adds to the overall cost of adopting and maintaining such architecture, especially for SMEs with limited resources.

Thus, lack of security of data restricts the market growth.

Cloud Microservices Market Segmentation Analysis

By Component Analysis

Rising Need for Scalable Environment to Increase the Demand for Services

The Platform segment is projected to dominate the market with a share of 61.35% in 2026. Based on component, the market is segmented into platform and services. The services segment is estimated to grow at a higher CAGR during the forecast period. Cloud microservices provide better control of resources and computing power, making it possible for users to scale each service on an independent basis according to their needs. The microservices architecture allows organizations to build more than independent services, in addition to establishing teams supporting each service and implementing a DevOps approach.

Key players have incorporated best practices to create scalable solutions and are helping companies with consulting services to implement those best practices. Users can create an adoption plan for microservices through consulting services. To migrate toward the microservices architecture, this roadmap allows them to select services based on their criticality.

By Deployment Mode Analysis

Cost Effective Strategies used in Hybrid Cloud Applications to Gain Traction in the Market

Based on deployment mode, the market is segmented into public, private, and hybrid.

The Public segment is expected to lead the market, contributing 40.29% globally in 2026. The hybrid segment is expected to grow at a higher growth rate during the forecast period. The growth is accredited due to the rising adoption of hybrid cloud across various end users. With a hybrid cloud, they can experiment with new products and business models more easily. The workload in the data center has grown as IT played a bigger role. It is costly to invest in the upgrading of computers and storage, but hybrid cloud applications can be cost-effective while driving market growth.

Also, to help tackle recurring business problems, organizations are increasingly using the hybrid cloud as a mainstream solution and deploying enterprise workload in production.

In a survey conducted by Microsoft in January 2022, 86% of respondents in the U.S. plan to increase their investment in hybrid cloud and multi cloud.

By Enterprise Type Analysis

High Demand of Cloud Microservices Consumption Model in SMEs to Aid Market Expansion

As per enterprise type, the market is bifurcated into large enterprises and SMEs.

The Large Enterprises segment will account for 62.21% market share in 2026. The SMEs segment is expected to significantly grow at a higher CAGR during the forecast period. SMEs are widely adopting the on-demand microservices consumption model which has transformed the IT landscape. The cost effectiveness, availability and mutability of cloud microservices make them an attractive option to SMEs with low budgets and non-conventional IT infrastructures. Moreover, investments in scalable application development are also boosting the cloud microservices platform demand. For instance,

- In August 2021, Elopage, a rapidly rising Software as a service (SaaS) platform and payment provider for entrepreneurs, enterprise businesses, inventors, and SMEs, announced that it completed its funding round of (USD 34.6 million), which enables them to be empowered at all stages of growth. This funding provides support to its all-in-one microservices platform for entrepreneurs.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Deployment of Automation Services by Cloud Microservices in Healthcare to Grow Market Share

Based on end-user, the market is categorized into BFSI, IT and telecommunications, retail and consumer goods, education, healthcare, media and entertainment, and others, which are adopting cloud microservices for improving their business.

The healthcare segment is expected to grow at the highest CAGR during the forecast period. The healthcare segment is largely driven by increasing demand for automation that enables rapid deployment of services. Moreover, the significant expansion of cloud microservices in healthcare is due to several advantages that contribute to reducing process complexity and the need for improved health service functionality. Additionally, companies are partnering to deliver the latest cloud native technologies. For instance,

- October 2022 - Capgemini announced a partnership with Microsoft to deliver a serverless and cloud native Azure based digital twin platform known as ReflectIoD. Also, it helps transform an organization's operational efficiency and maintenance effectiveness.

Thus, the rise in adoption of cloud, digital technology, and smart solutions in healthcare fuels the market growth.

REGIONAL INSIGHTS

Regionally, this market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Cloud Microservices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.95 billion in 2025 and USD 1.11 billion in 2026. As per the analysis, North America held a major cloud microservices market share due to the presence of key players in the region adopting advanced technologies. In addition, growing demand from North American companies is due in part to their adoption of microservices architecture within BFSI, E-commerce, and IT, which supports cost savings, increases flexibility, enhances operational efficiency, and improves scalability for information and data storage. In June 2022, Canadian company Telus acquired digital and in-person health company Lifeworks for USD 1.77 billion to strengthen its position as an employer-based health service provider for cloud-native applications. The U.S. market is expected to reach USD 0.72 billion by 2026.

Europe

The U.K. market is projected to reach USD 0.11 billion by 2026, while the Germany market is anticipated to reach USD 0.12 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow exponentially, with a strong demand for greater resilience and adaptability among businesses that could promote the adoption of cloud computing in the region. Across the region, to achieve real business value and resilience at a time of dynamic operating environments and distributed staff, customers are looking beyond their traditional digital transformation efforts toward cloud innovation as an internal strategy. Developing economies, such as India, Japan, and China, have made significant contributions in aiding the region's adoption of cloud microservices platforms. The Japan market is expected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.14 billion by 2026, and the India market is anticipated to reach USD 0.13 billion by 2026. For instance,

- May 2023 - By 2030, Amazon Web Services announced that it would invest USD 12.7 billion in cloud frameworks in India. It is intended to grow the demand for cloud services in the country.

List of Key Companies in Cloud Microservices Market

Market Players Announce Merger & Acquisition Strategies to Expand Reach

Prominent players operating in the global market focus on expanding their market share and global presence through merger & acquisition strategies. These companies focus on acquiring small and local firms to expand their business presence. Moreover, strategic partnerships and leading investments in cloud native technologies help increase the demand. Major players are adopting cloud decision frameworks and including best practices for cloud operations, which are leading them to scale up faster.

List of Key Companies Profiled:

- Amazon Web Services, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Salesforce Inc. (U.S.)

- F5, Inc (U.S.)

- Broadcom (U.S.)

- Software AG (Germany)

- Ksolves India Limited (India)

- Datadog (U.S.)

- WeaveWorks (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Marelli launched its Advantage and Lean platform at CES 2024, offering simplified software and hardware designs for cost-effective solutions. The platform, built on microservices architecture and cloud-based for flexible operations, included pre-developed systems such as LeanDisplay and LeanLight, showcasing reduced emissions and weight for entry-level vehicles.

- September 2023: Oracle expanded its banking cloud services with comprehensive microservices offerings, including virtual account management and real-time payment processing. These enhancements aimed to improve forecasting, transparency and liquidity control, enabling banking institutions to operate with innovation and agility.

- September 2023: Google Cloud and Apollo Hospitals expanded their partnership to enhance healthcare access in India through Apollo 24/7, offering medication delivery and online consultation. Using cloud technologies, including microservices, the collaboration aimed to enhance clinical outcomes and secure data management.

- September 2023: XYB partnered with Google Cloud to integrate generative AI and machine learning tools into its banking platform, reducing operational costs and enabling innovative financial product creation. Built on microservices architecture, the company launched financial services offering 172 possible services through its platform.

- September 2023: CrowdStrike acquired Bionic, enhancing its cloud-based application protection platform with comprehensive risk visibility and protection for microservices. This acquisition would help strengthen the company’s presence and set a new standard in cybersecurity.

- May 2023: Broadleaf Commerce partnered with Emax Electronics, a company of MEA retail giant Landmark Retail, for its e-commerce microservices. The Broadleaf Commerce platform was chosen by Landmark Retail for its API-first, Microservice-based, Headless, and Cloud native solution, which manages the complexities of the business using a single codebase and back-office administrative console.

- May 2023: F5, Inc. announced the ability to easily extend application and security services to one or more public cloud, hybrid deployment, native environment, Kubernetes and edge sites through multi cloud networking. At both the network and application levels, F5 distributed cloud services differ in connectivity and security.

REPORT COVERAGE

An Infographic Representation of Cloud Microservices Market

To get information on various segments, share your queries with us

The research report provides a detailed market analysis. It focuses on key aspects such as leading companies, software types, and leading software and services applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment Mode

By Enterprise Type

By End-User

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the market is projected to reach USD 9.64 billion by 2034.

In 2025, the market value stood at USD 2.21 billion.

The market is projected to grow at a CAGR of 17.37% over the forecast period.

The healthcare segment is likely to lead the market.

Rise of microservices architecture by enterprises in eliminating complexity to enhance market growth.

Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation, Salesforce Inc., F5, Inc, Broadcom, Software AG, Ksolves India Limited, Datadog, and WeaveWorks are the top players in the global market.

North America is expected to hold the highest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic