Cloud Storage Market Size, Share & Industry Analysis, By Type (Private, Public, and Hybrid), By Component (Storage Model (Object Storage, File Storage, and Block Storage) and Services), By Enterprise Type (SMEs and Large Enterprises), By Vertical (BFSI, IT and Telecommunication, Government and Public Sector, Manufacturing, Healthcare and Life Sciences, Retail and Consumer Goods, Media and Entertainment, and Others), and Regional Forecast, 2026-2034

Cloud Storage Market Size

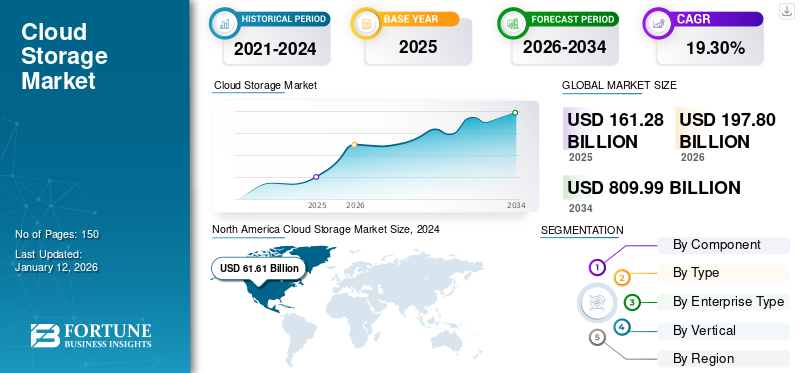

The global cloud storage market size was valued at USD 161.28 billion in 2025 and is projected to grow from USD 197.8 billion in 2026 to USD 809.99 billion by 2034, exhibiting a CAGR of 19.30% during the forecast period. North America dominated the global market with a share of 46.40% in 2025. Additionally, the U.S. cloud storage market is predicted to grow significantly, reaching an estimated value of USD 4,776.8 million by 2032.

In the market study, we have considered cloud storage solutions offered by market players, such as Amazon Web Services Inc.'s Amazon Simple Storage Service (S3) object storage, file storage including the Amazon Elastic File System, Amazon FXs for Windows File Server, Amazon FXs for Lustre, and Amazon Elastic Block Storage. Similarly, Oracle Corporation's file, block and object storage, archive storage, flash local storage and storage gateway, Google LLC's Filestore, Cloud archival storage, persistent disk, local SSD block storage, and cloud object storage.

The growth of the cloud storage is driven by several factors, such as the growing volume of unstructured data and increased demand for advanced technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), analytics, automation, and others. Cloud storage stores and manages data on the internet and can be delivered on-demand as per the pay-and-use model. Also, cloud-based storage provides global scalability, agility, remote access, and durability to data storage.

In June 2020, as per LogicMonitor's Cloud 2025 survey respondents, 95% of the IT workload will be on the cloud in the next five years. This factor indicates that the market is likely to showcase remarkable growth in the coming years. Also, the global market witnessed significant growth during the COVID-19 pandemic.

Market players are providing storage services to businesses to manage their remote employees. For instance, in April 2022, Amazon launched the EC2 Console where users can automatically attach the Amazon EFS file system to new Amazon EC2 instances created from the Configure storage section.

The impact of the COVID-19 pandemic resulted in considerably high market growth. The market's growth is attributed to the significant adoption of storage services owing to increasing virtual work and the growing volume of data. The market observed a significant growth rate of 13.7% in 2020 compared to 9.3% in 2019.

Cloud-based solutions enable employees to collaborate and stay connected as firms move toward a remote work environment. The COVID-19 pandemic accelerated the adoption of cloud storage with the increased use of collaboration and conferencing applications by the remote workforce.

Cloud Storage Market Trends

Market players are providing storage services to businesses to manage their remote employees. For instance, in April 2022, Amazon launched the EC2 Console where users can automatically attach the Amazon EFS file system to new Amazon EC2 instances created from the Configure storage section.

The impact of the COVID-19 pandemic resulted in considerably high market growth. The market's growth is attributed to the significant adoption of storage services owing to increasing virtual work and the growing volume of data. The market observed a significant growth rate of 13.7% in 2020 compared to 9.3% in 2019.

Cloud-based solutions enable employees to collaborate and stay connected as firms move toward a remote work environment. The COVID-19 pandemic accelerated the adoption of cloud storage with the increased use of collaboration and conferencing applications by the remote workforce.

Rising Use of Social Media and Analytical Platforms to Propel Market Growth

Cloud analytics creates ample opportunities for cloud providers due to the increasing demand for analytical insights for decision-making in various industries. The demand for additional data storage to support a massive data volume is growing exponentially due to the substantial computing power. Enterprises leverage platforms and deliver advanced storage technologies with more accessibility and flexibility.

Similarly, social media analytics encouraged end-users to adopt cloud-based automated data storage services to provide real-time improved customer experience. For instance, in October 2020, Facebook LLC partnered with a cloud service provider, Backblaze. The partnership focused on transferring social media videos and images over the cloud-based encrypted storage to maintain security and privacy. These technological trends are expected to fuel the market size in the coming years.

Growing Adoption of Multi Cloud Storage Fuels Market Growth

Organizations are increasingly adopting multi-cloud storage strategies, utilizing multiple cloud providers to meet different needs, such as cost optimization, geographic diversity, and specialized services. This approach helps mitigate vendor lock-in, improves resilience, and enables organizations to leverage the strengths of different cloud providers for specific workloads.

Furthermore, many organizations are adopting hybrid cloud storage solutions, which combine on-premises infrastructure with public and private cloud storage resources. This approach allows organizations to leverage the scalability and flexibility of the cloud, while maintaining control over sensitive data and applications that require local storage.

Download Free sample to learn more about this report.

Cloud Storage Market Growth Factors

Exponential Growth in Data Volumes to Surge Demand for New Storage Capacity

Remote sensing, the adoption of Internet of Things (IoT), and improved video quality due to the use of 4K or 8K resolution cameras have resulted in the collection of large amounts of data. As a result, demand for cloud-based storage and networking technology is increasing. Similarly, the growing use of Artificial Intelligence (AI) is projected to increase the storage demand to improve data security.

For example, in February 2021, NextBillion AI, a California-based start-up, collaborated with Google Cloud to improve time-to-market solutions using cloud SQL and storage. The partnership aims to offer data protection and 99% uptime for NextBillion artificial intelligence clients.

Additionally, connected devices and autonomous systems, such as self-driving cars are likely to drive the adoption of cloud computing services, including data storage for providing real-time assistance.

For instance, in February 2021, Ford Motor Company, a connected car manufacturer, partnered with Google Cloud to improve customers’ experience with connected vehicles. The company is moving toward digitalization with automatic and driverless cars. Ford aims to offer an enhanced experience by implementing machine learning, automation, and cloud across its vehicles. Such factors are expected to drive the market toward a higher growth trajectory.

RESTRAINING FACTORS

Stringent Laws and Regulations Associated with Privacy and Data Security May Impede Market Growth

Data privacy and confidentiality are the most vital elements of the cloud storage ecosystem. The stringent government laws and regulations on using the cloud are expected to restrict the market growth. For example, the Government of India made a provision in the Information Technology Act 2000. According to the provision, any unlawful activities related to the computing models/transactions consisting of confidential data or information will be subjected to a penalty. These rules and regulations enforced by governments are likely to hamper the market growth.

As the data resides outside the company's infrastructure, it is apparent that the company may loss control over its data. Even though the concerns are largely psychological and hypothetical due to the lack of awareness of cloud services, especially in developing and underdeveloped countries, consumers may have genuine concerns regarding the service provider's capability and operational processes. Privacy and security concerns are projected to act as barriers to adopting cloud-based storage.

Cloud Storage Market Segmentation Analysis

By Component Analysis

High Data Security Feature to Augment Storage Models Growth

Companies offer various storage models including file, object, and block storage and services in the market. The storage models segment, which includes block storage, object storage, and file storage, held the maximum market share in 2022. The block storage segment is expected to hold a major market with a share of 68.00% in 2026. due to increased demand for reliable and high-performance storage.

The file storage segment is anticipated to record the highest CAGR owing to its increased storage capacity. For instance, in February 2021, Nasuni Corporation, a file cloud data storage provider, collaborated with Google Cloud. The increased demand for enterprise file storage played a vital role in the partnership.

Storage models help organizations tackle fundamental requirements, such as availability, data security, and durability. These factors are projected to drive the adoption of cloud-based data storage models among enterprises.

At the same time, services such as training, installation, support, maintenance, and others help maintain connectivity and data flow, which is expected to drive their demand in the coming years.

By Type Analysis

Public Cloud Segment to Dominate Market Owing to Rising User Spending

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud deployment. The public cloud segment accounted a major market share contributing 63.71% globally in 2026, due to growing public cloud spending. The growing end-user spending on the public cloud will accelerate the segment’s growth in the coming years. The private cloud segment is expected to exhibit steady growth during the forecast period owing to improved security and protection of confidential data.

The hybrid cloud segment is projected to gain sturdy growth due to increased demand for hybrid deployment as enterprises can benefit from both private and public deployments. Thus, the surge in demand for hybrid cloud storage due to data security, flexibility, and agility will likely foster the segment’s growth. Organizations will rely on multiple public clouds, private cloud legacy platforms, and on-premises models to fulfill the infrastructure needs. Hybrid multi-cloud provides control and visibility over the infrastructure, which helps users access and secure files. These factors are expected to increase the demand for hybrid cloud-based storage.

By Enterprise Type Analysis

Growing Need for Cost-Effective Data Storage Solutions to Drive Demand for Cloud Across SMEs

Large enterprises and small and medium sized enterprises are deploying cloud storage for managing the data. The large enterprises segment accounted for a maximum revenue contributing 70.30% globally in 2026, due to the increased demand for cloud-based storage to manage large amounts of remote workforce and data.

The growing adoption of infrastructure as a service, software as a service, and platform as a service by organizations to manage the virtual work during the COVID-19 pandemic accelerated the demand for cloud-based storage. For instance, in February 2022, as per the EY-Nasscom cloud survey, 67% of the large organizations accelerated cloud adoption, while 38% of small organizations embarked on their cloud journey.

The small and medium enterprises segment is expected to showcase a higher growth rate in forecast year. According to Flexera 2021 State of the Cloud Report, 86% of respondents stated that small and medium-sized enterprises adopted the cloud higher than planned during COVID-19, which is likely to drive the market growth.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Digitalization to Drive Demand for Cloud in BFSI Industry

By vertical, the market is split into banking, financial services and insurance (BFSI), healthcare & life science, IT & telecommunication, manufacturing, government & public sector, media & entertainment, retail & consumer goods, and others.

The BFSI industry segment is set to gain traction with a share of 22.22% in 2026, owing to the digitalization of banking financial services and insurance services, such as online banking, mobile wallets, digital payment, net banking, and others. This factor drives the demand for secure storage models. The market players are offering secure storage solutions to the banking and financial institutions, which is expected to surge the partnerships and collaborations between cloud providers and financial service providers. For instance, in February 2021, Global Financial Services partnered with Google Cloud. The collaboration aimed to tackle data and security threats of its banking infrastructure using an AI-based platform.

The healthcare & life sciences segment is anticipated to showcase a remarkable growth rate. Cloud services help get real-time health data insights and minimize the IT complexities with storage solutions. The patient's data stored in the cloud can be accessed from anywhere and at any time. Besides, the growing adoption of advanced technologies, such as virtual reality and augmented reality in healthcare generates a huge volume of data per day. Thus, digitalization in the healthcare & life science industry creates a demand for scalable data storage. The market players are focusing on introducing cloud-based services to the healthcare industry to improve the productivity of healthcare professionals.

For instance, in November 2022, Change Healthcare transitioned to cloud-based storage and imaging. Such a growing introduction of advanced services is expected to drive the market growth across this industry.

The surge in demand for video streaming and Over-The-Top (OTT) services accelerated the adoption of cloud-based storage services across telecom service providers. Similarly, the government & public sector, manufacturing, and retail & consumer goods, among other industries, are actively investing in cloud-based data management services and software, which is expected to fuel the market growth in these industries.

REGIONAL INSIGHTS

The market is studied across regions including North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is studied across countries.

North America

North America Cloud Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated maximum revenue in 2022. The U.S. holds a major part of the global cloud storage market share due to the presence of major cloud providers and a large number of data centers. North America dominated the global market in 2025, with a market size of USD 74.79 billion. Furthermore, the growing adoption of smart home devices, connected devices, video streaming services, and digital payments generates heaps of data every day. These huge volumes of data create the demand for cloud storage across the U.S. The U.S. market is projected to reach USD 39.51 billion by 2026.

Canada is expected to record the highest CAGR during the forecast period owing to growing investment by organizations in implementing cloud-based services and solutions. According to a January 2021 CDW Cloud Report, more than half of enterprises (52%) in Canada have already made a plan on making investments in cloud-based infrastructure and services to ensure consistent service delivery. COVID-19, which forced many enterprises to recognize the drawbacks of on-site solutions and data centers, fueled the adoption.

South America

To know how our report can help streamline your business, Speak to Analyst

South America is expected to witness steady growth owing to growing investment by Brazil, Argentina, Chile, and Columbia governments to improve digitalization across the countries. The COVID-19 pandemic surged the adoption of digital technologies, smartphones, and digital banking across the region.

For instance, in October 2020, Mastercard stated that 40 million people from Latin America opened bank accounts amid the pandemic. Furthermore, in October 2020, IT spending in Latin America was expected to grow by 7.7% in 2021, and the IT industry rose by 5.5% in 2020. These factors are anticipated to propel the market growth. The UK market is projected to reach USD 7.6 billion by 2026, and the Germany market is projected to reach USD 6.68 billion by 2026.

Europe

Europe is likely to gain a significant market share due to government initiatives to fuel cloud adoption across organizations and governments. In December 2021, as per Eurostat, 68% of the European Union enterprises used cloud computing services to store files, and 42% of the enterprises used cloud computing across the organization.

Besides, 75% of enterprises in Sweden and Finland adopted cloud computing in 2021. The increased adoption of cloud computing across Nordics is expected to create new opportunities for the European cloud storage market growth in the coming years.

Middle East and Africa

The Middle East and Africa are projected to show potential market growth in the coming years owing to growing investment by cloud providers to establish data centers across these regions. For instance, Oracle Corporation launched the cloud region in Saudi Arabia in 2021, Abu Dhabi in 2022, and Dubai and Jeddah in 2020. Similarly, the rising smartphone penetration and improved network connectivity across the region are expected to foster the market growth.

Asia Pacific

Asia Pacific is anticipated to showcase the highest growth rate during the forecast period. The growing investment by developing economies, such as India, Japan, Singapore, South Korea, and others will contribute to the market growth. The government initiatives to drive digital transformation across the countries will fuel the adoption of cloud technology across the region. The Japan market is projected to reach USD 9.62 billion by 2026, the China market is projected to reach USD 12.65 billion by 2026, and the India market is projected to reach USD 8.32 billion by 2026.

For instance, in July 2021, the Deloitte report 'The imperative cloud Asia Pacific's unmissable opportunity’, stated that public cloud spending stood at USD 19.45 billion in 2020, which is expected to rise to USD 67.64 billion by 2024 in China. It also stated that the total annual spending in Asia Pacific on public cloud is expected to reach USD 116.06 billion in 2024 from USD 43.14 billion in 2020.

Asia Pacific countries are undergoing significant digital transformation across various industries, including finance, manufacturing, healthcare, and retail. Cloud storage plays a crucial role in enabling digital transformation by providing scalable, cost-effective storage solutions that support data-intensive applications, collaboration tools, and analytic platforms. These factors are expected to fuel the demand for cloud-based storage across the Asia Pacific countries.

Key Industry Players

Key Market Players to Enhance their Product Offerings and Adopt Partnership Strategies to Achieve Organizational Goals

Being a fragmented market, key market players, such as Amazon Web Services, IBM Corporation, Oracle Corporation, Alibaba Group Holding Limited, VMware Inc., and Microsoft Corporation are focusing on enhancing their product offerings. By enhancing their product lines, these companies are trying to increase their revenue share. Also, it is likely to enable them to take advantage of the market opportunities across different sectors. Strategic partnerships are likely to promote the business expansion of market players. For instance,

- March 2023: IBM entered a collaboration agreement with Wasabi. This collaboration aimed to allow businesses to drive data innovation across a hybrid cloud environment.

- June 2022: Reliance Industries collaborated with DigiBoxx to meet the cloud consolidation needs and developed cloud storage solutions.

LIST OF TOP CLOUD STORAGE COMPANIES:

- Alibaba Group Holding Limited (China)

- Amazon Web Services (U.S.)

- Dell Technologies Inc. (U.S.)

- Dropbox (U.S.)

- Google, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- VMware, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Hitachi Vantara launched Hitachi Virtual Storage Platform One, a hybrid cloud data platform. This platform allows businesses to store their structured and unstructured data, and enables them to run on different applications whether on cloud or on-premises.

- July 2023 – DigiBoxx launched a novel data storage solution named Megh3 for individuals and enterprises. This solution will provide customers with a quick and easy storage solution at attractive pricing.

- April 2023 – HPE launched new file, block, disaster, recovery, and backup data services to help customers reduce cost & complexity, eliminate data silos, and improve performance.

- December 2022 – Vmware introduced Vmware Cloud Flex Storage, a managed cloud storage service, to help its customers be in charge of the performance they can expect and costs, which was explained on its blog.

- July 2022 – Dell Technologies launched a software-driven modern storage solution in its storage portfolio to drive multi-cloud flexibility, cyber resiliency, and automation. This solution will help businesses derive critical insights to grow in the digital era.

- May 2022 – Dell Technologies and Snowflake entered a go-to-market partnership that combines Dell's storage system with Snowflake’s cloud data technology.

REPORT COVERAGE

The report highlights leading regions globally for offering a better understanding of the market to the user. Furthermore, it provides insights into the market outlook with the latest industry growth trends and analyzes technologies deployed at a rapid pace at the global level. The report further offers some drivers and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.30% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Type

By Enterprise Type

By Vertical

By Region

|

Frequently Asked Questions

As per Fortune Business Insights, the market value stood at USD 161.28 billion in 2025.

Fortune Business Insights says that the market value is expected to reach USD 809.99 billion by 2034.

A 19.30% CAGR will be observed in the market during the forecast period of 2026-2034.

Within verticals, the BFSI segment is expected to lead the market during the forecast period.

Exponential growth in data volumes is the key market driver.

Amazon Web Services, Inc., VMware, Inc., IBM Corporation, Microsoft Corporation, and Dell, Inc. are some of the top companies in the market.

North America is expected to hold a major market share during the forecast period due to the presence of various key players.

North America accounted for USD 74.79 billion in terms of revenue in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us