Concrete Cutting Market Size, Share & COVID-19 Impact Analysis, By Product Type (Equipment and Attachment), By Attachment Application (Wheel Loader, Skid Steer, and Excavators), By Payload Capacity for Attachment Application (Less than 1 Ton, 1-5 Ton, 5-15 Ton, 15-20 Ton, and More than 20 Ton), By End Use Vertical (Demolition and Refurbishment), and By Sales Channel (OEM and Aftermarket), Regional Forecast, 2026-2034

Concrete Cutting Market Size

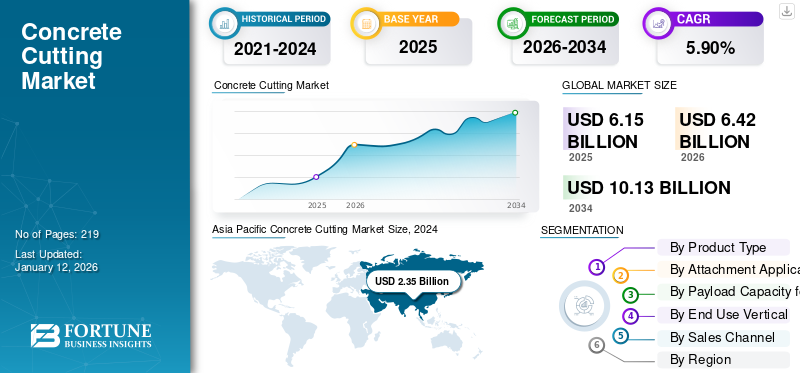

The global concrete cutting market size was valued at USD 6.15 billion in 2025 and is projected to grow from USD 6.42 billion in 2026 to USD 10.13 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. Asia Pacific dominated the global market with a share of 40.00% in 2025. The concrete cutting market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.78 Billion by 2032, driven by the technological advancements and adoption of diamond cutting tools.

Concrete cutting machines are the tools that used for road maintenance and construction. The main function of the cut road surface. It can be used for demolition as well as refurbishment applications. Wall saws, floor saws, walk-behind push, handheld cut-off saws, circular saws, and hydraulic chainsaws are some of the equipment used while construction sectors. It can be used to cut bricks, stones, construction, slabs, walls, masonry, and asphalt. The market comprises of the sales generated from equipment and the attachment which can be assembled into various equipment such as handheld cut, walk-behind push, wheel loader, skid steer, and excavators. The attachment providers are considered aftermarket service providers.

Global Concrete Cutting Market Overview

Market Size:

- 2025 Value: USD 6.15 billion

- 2026 Value: USD 6.42 billion

- 2034 Forecast Value: USD 10.13 billion

- CAGR: 5.90% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific leads the global market, driven by extensive infrastructure development.

- Product Segment Leader: Equipment segment dominates due to increased usage of handheld and walk-behind systems.

- End-Use/Application Leader: Refurbishment segment holds the largest share as renovation activities rise worldwide.

- Sales Channel Leader: OEM sales channel leads, owing to advantages like high precision, time savings, and low noise.

Industry Trends:

- Growing integration of automated and diamond-blade cutting technology for enhanced efficiency and safety.

- Increasing use of smart, IoT-enabled cutting tools for predictive maintenance and performance tracking.

- Customization of equipment for urban construction and demolition tasks, focusing on speed and minimal environmental disruption.

Driving Factors:

- Expansion of infrastructure and refurbishment projects globally, especially in urban centers.

- Rising demand for accurate and controlled cutting in complex construction environments.

- Stringent regulations on dust, vibration, and noise driving adoption of advanced equipment.

- Industry push toward reducing project timelines and improving cutting precision.

Apart from this, the overall concrete operation involves the players that are core OEMs, OEMs that provide equipment and aftermarket services, and other local aftermarket services.

The infrastructure sector majorly includes bridges, roads, power, dams, and urban infrastructure. Infrastructural development is a key driver of the economic growth of any country. Therefore, government and private institutions are investing heavily in infrastructure projects in order to support economic growth and development. For instance, according to the Global Infrastructure Hub, the investment by the Indonesia government in the construction sector grew by 30.2% in 2022 as compared to 2020. Such an investment in infrastructure development drives the demand for this equipment. In addition, advances in edge-cutting technology have made the process safer by reducing the risk of accidents and injuries. New equipment designs, such as diamond saw blades and wire saws can cut the concrete with less dust and noise, reducing the risk of respiratory problems and hearing loss. For instance, iQ Power tools make use of cyclonic vacuum system to manufacture their products which enables the equipment to absorb 99.5% of the dust created. Such factors drive the growth of the market.

COVID-19 IMPACT

Halt on Construction-Related Activities Due to COVID-19 Pandemic Restrained Market Growth

The pandemic put a halt on construction-related activities and demolition activities and also led to supply chain problems. This resulted in a drop in the net sales generated by companies operating in the market. For instance, the net sales of Atlas Copco AB decreased by 5.2% from 2019 to 2020. Such a drop in the net sales of companies reduced the net sales of machines.

Moreover, after the post-COVID-19 pandemic, manufacturers are focusing more on reducing carbon emissions generated from machines used in the concrete cutting industry and construction applications. Further, the rising spending in construction-related activities, which consists of demolition as well as refurbishment projects subsequently increased the demand for the products, driving the growth of the market.

For instance, as per Atradius, the construction industry in Japan witnessed a growth of 4% in 2024 as compared to 2021. Such a growth in the construction sector is expected to uplift the demand for concrete cutters in the coming years.

Concrete Cutting Market Trends

Growing Trend of Using Diamond Blades for Masonry Cutting to Trigger the Market Growth

Major players such as Husqvarna Group, Stihl Group, and Tyrolit are introducing new technologically advanced concrete discs and blades on the market to strengthen their industry footings. For instance, in April 2025, Husqvarna Group introduced a new Ulti-Grit diamond blades to cut concrete, masonry, and walls. The blade is designed with new technological advancements and having features such as high cutting speeds, long durable, and able to precise cutting. In addition to their durability, diamond blades also provide faster and smoother cutting performance. The sharp edges of the embedded diamonds allow the blade to make precise cuts with minimal chipping or cracking, resulting in accurate cuts.

Download Free sample to learn more about this report.

Concrete Cutting Market Growth Factors

Rising Infrastructure-Related Activities to Drive the Market Growth

The infrastructure sector majorly includes bridges, roads, power, dams, and urban infrastructure. Infrastructural development is a key driver of the economic growth of any country. Therefore, government and private institutions are investing heavily in infrastructure projects in order to support economic growth and development. The machines are largely used in these infrastructure projects. For instance, the U.S. government’s investment in infrastructural development is projected to grow by 9.4% from 2021 to 2024. Therefore, as these projects continue to increase the demand for cutters, this is expected to escalate the diamond blades demand. In such a way, all these factors increase the global concrete cutting market share.

RESTRAINING FACTORS

High Cost of Maintenance and Procurement Costs to Restraint the Market Growth

Concrete cutting can be expensive, making it challenging for individuals or businesses that need this equipment to justify the initial investment. In addition, it requires regular maintenance to ensure that it remains in good working condition and performs effectively, increasing the maintenance cost. Around USD 4.75 and USD 7.5 per foot are required to cut concrete during construction operations. Around USD 600 to USD 1,000 is required for demolition activities per slab. As a result, many businesses and individuals may explore other alternative options, such as renting and buying used cutters, which may affect new equipment sales, hindering the global concrete cutting market growth.

Concrete Cutting Market Segmentation Analysis

By Product Type Analysis

Equipment Segment Dominates the Market due to Rising Construction Related Activities

Based on product type, the market is segmented into equipment and attachment. The equipment segment holds a dominating share in the market and the attachment segment is estimated to expand with the highest CAGR during the analysis period.

The equipment segment dominated the market accounting for 63.55% market share in 2026, owing to a rise investment in both residential and commercial construction activities. Such an investment in infrastructure project, subsequently boost the demand for such equipment, drives the market growth.

The attachment segment is expected to grow with potential growth during the forecast period. This is owing to major players offering attachment, diamond, and drill bits to the market.

To know how our report can help streamline your business, Speak to Analyst

By Attachment Application Analysis

Excavators to Dominate the Market on Account of Surging Demand from Commercial Construction Sector

Based on the attachment application, the market is segmented into wheel loader, skid steer, and excavators.

Excavator segment accounts for a dominating share in the market and is slated to expand with the highest CAGR during the analysis period. The dominance is attributed to features such as high efficiency and capability to break solid rock which drives the growth of the global market.

The skid steer segment is projected to grow with CAGR of 4.8% over the study period. The surge is due to major players offering blades, diamond blades, and circular discs to the market. Additionally, attachments enabled with skid steer are designed to cut flat surfaces, as well as cut concrete pipes, drainage pipes, and light poles.

The wheel loader segment is set to exhibit moderate growth during the forecast period. This is owing to strong demand from renovation and demolition construction sector. Such factor drive the growth of market.

By Payload Capacity for Attachment Application Analysis

Less than 1 Ton Segment to Lead with the Highest CAGR Owing to Strong Product Portfolio of Manufacturers

Based on payload capacity for attachment application, the market is segmented into less than 1 ton, 5-15 ton, 15-20 ton, and more than 20 ton.

The less than 1 ton segment is poised to grow with the highest CAGR of 5.4% over the projected period. This type of attachment applications are largely adopted in residential and multi-home building constructions.

In addition, 15-20 tons of attachment application segment is projected to grow with potential growth during the forecast period. It is owing to rising demand for small as well as medium construction sector. The attachment is used for tractors and excavators. Additionally, it is used for both demolition as well as renovation activities.

The growth in new construction renovation activities and demolition activities across the globe enhances the demand for more than 20 tons of attachment applications, which drives the growth of the market.

By End Use Vertical Analysis

Refurbishment Segment Dominates the Market Due to Increasing Government Investment in New Residential and Commercial Infrastructure

Based on end use vertical, the market is classified into demolition and refurbishment. The refurbishment segment dominates the market and the demolition segment is projected to grow with the highest CAGR over the analysis period.

The refurbishment segment is projected to dominate the market with a share of 52.34% in 2026. This is due to rising government investments in the construction of new residential and commercial buildings and government mandates to renovate old buildings. This is expected to propel the demand for concrete cutters, propelling industry growth.

For instance, in 2021, according to financial budget of U.S., the government planned to invest around USD 2,000 billion for the new commercial as well as industrial infrastructure buildings. Also, this investment was done for constructing 20,000 miles of roads, and 10,000 new bridges.

The demolition segment is anticipated to exhibit a significant CAGR of 5.7% during the forecast period. This is due to the increasing count of demolition projects and favorable government investments.

By Sales Channel Analysis

OEM to Dominate the Global Market Due to Benefits Associated with Equipment

Based on sales channel, the market is segmented into OEM and aftermarket.

The OEM segment is expected to lead the market, contributing 66.82% globally in 2026. This is due to the presence of major players such as Makita Corporation, Stanley Black & Decker Inc, and iQ Power Tools, and others, which engaged in offering new products to the market. Along with, these products having advantages such as faster operation, high dimensional tolerance, low noise level, accuracy cuts, and save time of operations.

The aftermarket segment is projected to grow with a moderate growth over the study period. Major players are offering attachment and aftermarket services required for concrete cutters deployed in the construction of residential and commercial construction buildings.

REGIONAL INSIGHTS

The market report covers an in-depth analysis of five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Concrete Cutting Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 2.46 billion in 2025 and USD 2.58 billion in 2026. This is due to the presence of numerous pivotal regional players, increasing government investments in infrastructure development, spending on new construction, and demolition activities across India, China, Japan, and others. For instance, according to the Financial Budget of Australia, in 2024, the Australian government planned to invest around USD 13.4 billion on the construction of residential as well as non-residential activities. Also, strong network of new OEM players as well as aftermarket service providers available in the Asian market, contributes to the potential share in the market.

The Japan market is projected to reach USD 0.28 billion by 2026, the China market is projected to reach USD 1.49 billion by 2026, and the India market is projected to reach USD 0.42 billion by 2026.

China to Exhibit Fastest Growth Impelled by Increasing Construction-Related Activities

Major players are adopting new product development, product launch, acquisition, and business expansion as key developmental strategies to intensify the market competition across China. For instance, in 2020, Metabo Professional Tool Solutions, a subsidiary of HI-Koki Co Ltd, based in China, offered diamond cutting blades as attachments for handheld cut-off machines as well as walk-behind push machines. These blades have features such as a maximum speed of work 80 m/s, high torque capacity, and are used for cutting asphalt, and bricks. Such product developments by key players are expected to drive the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

North America region is anticipated to exhibit substantial growth during the forecast period. This is owing to government investment in infrastructure development and the strong presence of key players across the U.S., Canada, and Mexico. For instance, as per the World Bank Group, in 2024, the U.S. accounted for 6.3% of the GDP contribution generated from the construction sector. Such a growth in the investment in the construction sector propelled the North America concrete cutting market growth. The U.S. market is projected to reach USD 1.31 billion by 2026.

The Europe region is projected to exhibit substantial growth over the forecast period. This is owing to growth in the tourism sector, investment in the residential and commercial sector development, and the presence of key players across Germany, France, and the U.K., among others, which boost the growth of the market. Also, increasing awareness regarding the benefits associated with a concrete chain saw, floor saw, and wall saw among the European population and government authority increased the adoption of these machines in construction-related activities. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.59 billion by 2026.

South America and the Middle East & Africa regions are expected to exhibit a decent growth considering rising government investments for residential and commercial developments and increasing disposable income of end users. Additionally, the growth in the tourism sector coupled with more visits in these regions is set to propel the demand for the product, impelling the market growth.

KEY INDUSTRY PLAYERS

Key Players Adopted Key Development Strategies to Strengthen the Competitive Landscape

Major players such as Stihl Group, Husqvarna Group, and others are adopting product development, product launch, merger, joint venture, and developmental and business expansion strategies to intensify the industry competition and also to increase their geographical reach. For instance, in January 2023, DEWALT, a Stanley Black & Decker brand announced that it will launch several new products supporting the concrete and masonry construction industry at the world of Concrete trade show in Vegas. Such factors are expected to drive the growth of the global market over the forecast period.

List of Top Concrete Cutting Companies:LIST OF KEY COMPANIES PROFILED:

- Abortech (Australia)

- Atlas Copco (Sweden)

- Cedima GmbH (Germany)

- Hilti Corporation (Liechtenstein)

- Husqvarna Group (Sweden)

- iQ Power Tools (U.S.)

- Makita Corporation (Japan)

- Stanley Black & Decker Inc (U.S.)

- Stihl Group (Germany)

- Tyrolit (Austria)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Tyrolit announced the acquisition of Turkish Egeli Egesan that manufactures grinding tools for several applications to strengthen its global abrasive market position. The main aim of the acquisition was to improve the product portfolio of concrete cutters.

- August 2024: The construction division of Husqvarna Group acquired privately owned Heger that manufactures diamond tools and equipment for construction and stone industries.

- April 2024: The construction division of Husqvarna Group collaborated with AABTools, a supplier of industrial equipment and tools in the UAE, as part of their growth strategy.

- February 2024: Stihl, a German manufacturer of chainsaw power tools and forestry machinery, acquired Danish robotics company TinyMobileRobots.

- April 2020: Hilti acquired U.S. based Concrete Sensors, an IoT concrete testing startup, to better understand concrete curing process and initiate digital transformation within the industry.

REPORT COVERAGE

The research report covers a detailed analysis of the market on the basis of product type, attachment application, end use vertical, sales channel, and payload capacity for attachment application. It provides information about leading players and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and key applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, By Attachment Application, By Payload Capacity for Attachment Application, By End Use Vertical, By Sales Channel, and By Region |

|

By Product Type

|

|

|

|

By Attachment Application

|

|

|

By Payload Capacity for Attachment Application

|

|

|

By End Use Vertical

|

|

|

By Sales Channel

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the market was valued at USD 6.15 billion in 2025.

According to Fortune Business Insights, the market is expected to reach USD 10.13 billion by 2034.

The global market is estimated to have a remarkable CAGR of 5.90% over the forecast period.

The Asia Pacific region is expected to hold a major market share. The region stood at USD 2.46 billion in 2025.

Within the product type segment, the equipment segment is expected to lead the market during the forecast period.

An increasing investment in the residential and commercial development and the growth of the tourism sector are expected to drive the growth of the market.

Stihl Group, Husqvarna Group, Makita Corporation, and Hilti Corporation are some of the top companies operating in the global market.

The OEM segment is expected to drive the market.

The refurbishment segment is estimated to dominate the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us