Countertop Market Size, Share & COVID-19 Impact Analysis, By Material Type (Natural Stone, Engineered Stone, Concrete, Solid Surfaces, Plastic Laminate, Ceramic, and Wood), By Construction Activity (New Construction and Renovation), By Application (Kitchen, Bathroom, and Others), By End User (Residential and Commercial), and Regional Forecast, 2026-2034

Countertop Market Size

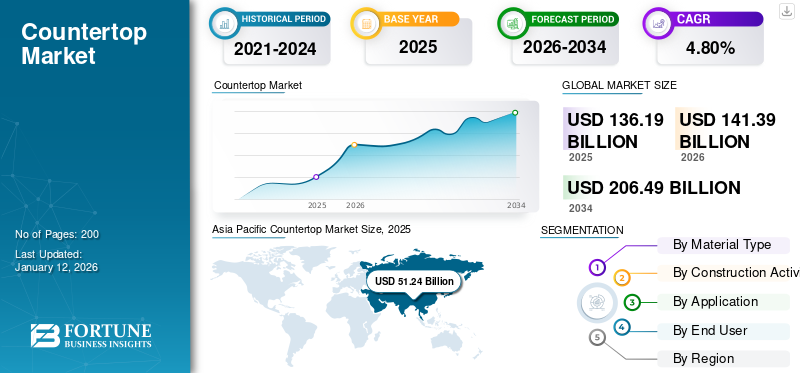

The global countertop market size was valued at USD 136.19 billion in 2025. The market is projected to grow from USD 141.39 billion in 2026 to USD 206.49 billion by 2034, exhibiting a CAGR of 4.80% during the forecast period. Asia Pacific dominated the global market with a share of 37.60% in 2025. The countertop market in the U.S. is projected to grow significantly, reaching an estimated value of USD 33.82 billion by 2032, driven by the extensive installation Of pipelines to improve energy infrastructure across regions.

A worktop is a basic utility in kitchens, laboratories, retails, bathrooms, and workrooms supported by the cabinets. Work platforms are constructed using various materials according to their functionality, durability, aesthetics, and needs such as built-in appliances for relative applications. Worktop products being multi-purpose platforms and owing to their expansive utilities are expected to produce voluminous revenue over the forecast period.

Global Countertop Market Overview

Market Size:

- 2025 Value: USD 136.19 billion

- 2026 Value: USD 141.39 billion

- 2034 Forecast Value: USD 206.49 billion

- CAGR: 4.80% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific led the market in 2025 with 37.60% share, driven by urbanization and rising residential construction.

- Material Leader: The natural stone segment is expected to lead during the forecast period, followed by engineered stone, concrete, solid surfaces, laminate, and wood.

- Application Leader: Kitchen counters dominate usage, followed by bathroom and other countertop applications.

- End-User Leader: Residential segment holds the major share, fueled by growing demand for modern kitchens and remodeling trends.

Industry Trends:

- Growing popularity of designer and high-end materials (e.g. quartz, honed granite, composite surfaces) for aesthetics and durability.

- Rise in modular kitchen design and customized countertop solutions tailored to user lifestyle and interiors.

- Demand for cleaner, non-porous surfaces and easy-to-maintain materials; eco-friendly composites and reclaimed wood gaining traction.

Driving Factors:

- Increase in housing construction and home renovation globally, particularly in emerging economies.

- Rising disposable incomes and consumer preference for premium, durable surfaces in kitchens and bathrooms.

- Technological innovation in countertop materials and manufacturing, including engineered quartz and eco-friendly composites.

- Expansion of cabinet and interior design industries influencing countertop demand in residential and commercial sectors.

Latest technological implementations in the construction industry have surged the demand for modern worktops that can be fitted over cabinets and low-height furniture. Advanced tools, mobile applications, heavy equipment, robots, drones, and 3D printing are being deployed in the construction industry to achieve the goal of supplying advanced and innovative functionality products across the globe. For instance, in November 2019, the National Kitchen and Bath Association invested USD 147 billion for the premier kitchen and bath aesthetic cabinetry platform and other interiors.

Quartz is one of the major engineered stones made from crystalline silica and used for constructing kitchen cabinetry as it is able to lever more pressure with longer durability. The National Institute for Occupational Safety and Health (NIOSH) conducted a study to understand the usage of crystalline silica stone (Quartz stone) and take preventive measures to control its usage as it causes respiratory diseases. An engineered stone such as granite on an average contains 72% crystalline silica by weight, making it the most durable stone for constructing these products.

The COVID-19 pandemic negatively impacted the global market owing to halted construction activities from residential and commercial sectors. Also, lack of human labor, raw material disruption, and halted transportation of building materials negatively impacted the market growth. According to the European construction equipment industry (CECE), the COVID-19 pandemic extensively impacted around 60% of the European construction equipment industry. Such a loss negatively affected the market growth during the COVID-19 pandemic.

Current countertop industry trends include cabinetry construction materials such as rust-free concrete, tactile and leather surfaces materials, reclaimed wood, and eco-friendly composite stone and non-porous laminates. Moreover, the customer-driven marketing strategies followed by the major players are becoming the key growth factor for the kitchen countertops in the near future. For example, in October 2020, Caesarstone introduced new types of concrete material in its Metropolitan Collection such as Airy Concrete 4044 and Cloudburst Concrete 4011 that have airy visual textures with softened edges. The solutions are suitable for workroom platforms, kitchen, and bathroom.

With the help of advanced cabinetry construction materials, it is possible to cater to the demand for various business segments effectively and efficiently. Customers’ demand for trendy designs to make their kitchen, bathrooms, or workrooms aesthetically modern with hyper-functionality is propelling the overall demand for designer products.

Countertop Market Trends

Emergence of Honed Finished Quartz to be a Major Trend

The emergence of advanced materials such as quartz is driving the market growth. Quartz is the strongest, durable, and non-porous material, which is primarily used in the cabinetry construction industry. According to the International Interior Design Association, quartz is stated as the most relevant and reliable worktop construction material, supporting its adoption for major interior designing work. Honed quartz offers a sleek and contemporary appearance that appeals to many homeowners, designers, and architects. Its matte finish provides a softer, more subdued look compared to polished surfaces, making it ideal for modern and minimalist designs. This product is relatively easy to clean and maintain. Its non-porous surface resists bacteria and mold growth, making it hygienic for use in kitchens and bathrooms. Routine cleaning with mild soap and water is usually sufficient to keep honed quartz surfaces looking pristine.

Download Free sample to learn more about this report.

Countertop Market Growth Factors

Rising Investments in Refurbishing and Remodeling Building Construction Infrastructure to Drive Market Growth

Worktop plays an important role in residential and commercial sectors with its expanding applications such as modular kitchen and decorative shelves for toiletries in luxury bathrooms. Countertop manufacturers are focusing on the production of various types of materials due to the rising demand for engineered and natural stone in new building construction. Construction firms across the globe are investing in refurbishing the existing building, boosting the demand for work platforms. Moreover, deterioration of buildings is being observed across Asia Pacific, Europe, and North America due to climatic changes and increasing pollution. Refurbishing and remodeling of the existing buildings surges the demand for natural stone, engineered stone, concrete, laminates, eco-friendly composite stone and nonporous laminates for constructing kitchen, bathroom, retail, and laboratory platforms.

Furthermore, the Global Buildings Performance Network (GBPN) pioneers in reducing the energy used for refurbishing the existing buildings. According to GBPN, a standard refurbishment project saves up to 20%-30% of energy, which reduces the deterioration rate of the building. In commercial spaces. These products are utilized across a wide range of applications in retail stores, hotels and restaurants, and research laboratories. The building material of these products depends on the application as per the need such as higher durability rate and weight bearing capacity. Therefore, the rising demand for countertops while renovating and decorating the residential constructions is increasing the global market size.

Increasing Demand for Durable Laminate Countertop Material to Boost Market Growth

International Surface Fabricators Associations (ISFA) is the only association that has published standards for both solid surfaces and quartz fabrication. This association represents fabricators from 13 different countries, adhering to ISFA’s code of ethics and fabrication standards, leveraging the demand for construction materials. Aesthetic cabinetry materials play a vital role in driving the global countertop market share expansion.

RESTRAINING FACTORS

Harmful Radiations from Granite and the High Purchasing Cost of Natural Stone to Hamper Industry Growth

Several types of materials are used to make countertops, including granite, marble, quartz, slate, and artificial materials. Granite's durability and decorative aesthetic is making it the most preferred choice among home and building construction contractors. However, the harmful radiations from the granite are hampering the market growth. Granite contains veins of naturally occurring radioactive elements, such as thorium and uranium, along with their radioactive decay. Uranium and thorium eventually decay into radon, an odorless, colorless, and radioactive gas that may cause lung cancer.

Moreover, the naturally occurring radioactive elements in granite can emit small amounts of gamma and beta radiation, hampering the product adoption. To ensure safety, government authorities across the globe have implemented some rules and regulations regarding the granite radiation levels. For instance, the Environment Protection Agency (EPA) has set the safety threshold for radon gas levels in the home at four epicures to lessen the effect of harmful radiations from the granite integrated in the house. It poses a similar risk of lung cancer as half a pack of cigarettes. Therefore, harmful radiations from the natural granite stone would hinder the market growth over the forecast period. The market players are also focused on expanding the manufacturing opportunities in the forthcoming years.

Countertop Market Segmentation Analysis

By Material Type Analysis

Natural Stone Segment to Depict Lucrative Growth Owing to Increase in Imports

Based on material type, the market is segmented into natural stone, engineered stone, concrete, solid surfaces, plastic laminate, ceramic, and wood.

The natural stone segment is estimated to hold a major market with a share of 34.42% in 2026. It is owing to the increased imports of natural stones by the developed and developing economies including China, India, Egypt, and Thailand. Traditionally, natural stones are utilized in residential applications such as kitchen cabinetry. Along with that, these stones are fabricated by all public and non-public manufacturers. Granite is a widely utilized natural stone for products attributed to its heat resistance capability and less affection by regular wear and tear. It has become a first choice for commercial as well as residential applications in virtue of aesthetics, low maintenance, and durability. Moreover, the edges of granite products offer creative style and shapes, making it favorable amongst end users for customized offerings.

The ceramic segment is expected to exhibit a substantial CAGR during the forecast period. It is owing to the quality that ceramic brings in case of installation in hotels and restaurants, washroom areas, and kitchen cabinetry. Moreover, the improved manufacturing process over the years has increased the demand for ceramic products over its substitutes.

Furthermore, the plastic laminate segment is expected to exhibit steady growth attributed to low cost per square feet for kitchen applications. Plastic laminate is a non-porous material with fairly tough and durable properties, making it stain resistant and easy-to-clean. Engineered stone material includes glass and quartz. Quartz material has superior tensile strength and durability as it is fabricated by mixing approximately 90% ground natural quartz with polymer resin. It is also fabricated through quarried slabs of stone that makes it almost impossible to break. In the current scenario, it is one of the most preferred materials, owing to its low maintenance cost and versatile options including customized fabrication with natural and synthetic materials such as resins, polymers, and more.

Global Countertop Market Share, By Material Type, 2026

To get more information on the regional analysis of this market, Download Free sample

By Construction Activity Analysis

New Construction Segment to Exhibit Appreciable Growth owing to Investment in Building Structures

Based on construction activity, the market is segmented into new construction and renovation.

The new construction segment dominates the market contributing 74.88% globally in 2026 and is expected to grow at the highest CAGR of 4.3% during the forecast period. This is due to increasing government spending on construction of new residential and commercial buildings. For instance, according to Statistics Canada, the government’s investment in infrastructure development increased by 19.3% and reached up to USD 218.2 billion from 2020 to 2021.

The renovation segment is expected to grow at a CAGR of 3.3% during the forecast period. This is on account of increasing government investment in renovation activities along with rising disposable income of end users. For instance, as per statistics from Eurostat, around 250 million new home and building renovation activities will be carried out by the end of 2050. These factors are anticipated to propel the market growth over the forecast period.

By Application Analysis

Kitchen Segment Dominates the Market Owing to Increasing Product Adoption in Residential and Commercial Applications

Based on application, the market is classified into kitchen, bathroom, and others.

The kitchen segment dominates the market accounting for 66.13% market share in 2026 and is expected to grow exhibiting the highest CAGR of 4.2% over the forecast period. This is due to an increase in kitchen remodeling activities. Granite and natural stones are materials that are largely adopted in kitchen countertops. These materials are used in kitchen applications as they are robust, durable, resistant to cracking, heat resistant, and scratch free.

The bathroom segment is growing at a decent growth rate over the study period. This is due to the increasing preference for spacious and multiple bathrooms from residential and commercial sectors, driving the market growth. Also, increasing disposable income of end users and rising public interest in residence and bathroom interiors are driving the demand for bathroom vanities. Such aforementioned factors are expected to drive the growth of the market.

By End User Analysis

Residential Segment to Exhibit Significant Growth Impelled by Rising Modular Kitchen Demand

Based on end user, the market is trifurcated into residential and commercial.

The Residential segment dominates the market contributing 57.62% globally in 2026 The residential segment has showcased the highest demand for the products for kitchen and washrooms and this trend is expected to continue over the forthcoming years as the demand for modular kitchens is rising. The kitchen cabinetry manufacturers are mostly focusing on developing robust and aesthetic products to meet the necessities of customers. Manufacturers tend to focus on granite material for kitchen cabinetry platforms, owing to its low material cost and availability of colors and textures. Quartz is the other material with longer shelf life feasible for residential kitchen platforms. This, in turn, is expected to be the key factor driving the market growth.

Commercial spaces cover a wide range of places with the application of these systems and their specific needs. The commercial segment is further classified into research laboratories, retail, hotels/restaurants, and others. Research laboratories require chemical resistant platforms such as phenolic resin, epoxy resin, stainless steel, chemical resistant laminate, high quality, and high-pressure laminate. These types of chemical-resistant resins form strong and durable cabinetry material along with decorative surfaces.

REGIONAL INSIGHTS

Asia Pacific Countertop Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 51.24 billion in 2025 and USD 53.65 billion in 2026. Asia Pacific is projected to showcase the highest growth and dominate the global market amongst all the regions. Emerging economies, such as China, India, and Japan, would contribute to the largest market share as these countries are expecting urbanization and commercialization at a faster pace. China is the leading country with an increasing demand for residential as well as commercial engineered quartz worktops. This would drive the overall regional cabinetry construction growth. According to the Federation of Indian Granite & Stone Industry (FIGSI), India is in the 4th position in natural stone trade with 15% of natural stone reserve, which is approximately about 46 billion cubic meters. The recent emergence of COVID-19 pandemic has increased the market uncertainty and volatility, imposing a complete production shutdown in India and China. The Japan market is valued at USD 12.67 billion by 2026 and the India market is valued at USD 9.75 billion by 2026.

Growth in Tourism in China to Drive Market Growth

Robust development of the tourism industry in China can be identified as one of the prominent factors driving the market growth at a noteworthy pace. The government authorities are keen toward streamlining tourism sector and revitalize its operations to reinforce the number of foreign tourists within the country. The authorities are seriously looking to allow visa free policies and trying to simplify payment and travel procedures for foreign nationals. The efforts to strengthen tourism is estimate to provide vital growth for the application of these products in the commercial sector.

China is also the second most populated country in the world. In the recent past, China witnessed an unforeseen growth in the GDP which subsequently increased the disposable income of the general population and boosted the trend of kitchen renovation and installation of modular countertop in residential spaces. The China market is valued at USD 12.79 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is projected to emerge in the manufacturing sector during the forecast period. The prompt adoption of advanced engineered materials by many organizations across the region is expected to drive the platform construction materials growth in North America. The U.S. is anticipated to exhibit the highest growth rate of 7.4% over the study period with an increasing demand for plastic laminates in the near future. Increasing demand for natural stone, engineered stone, and solid surfaces would be driving the worktop market growth in this region. The COVID-19 pandemic has led to the volatility in the stock market across the region and has an adverse impact on stock prices and trading volumes for manufacturers. Moreover, trade volumes are expected to fall steeper in sectors with complex value chains, particularly in the natural stone products. The U.S. market is valued at USD 25.46 billion by 2026.

Furthermore, Europe, the Middle East & Africa, and Latin America are projected to show steady market growth with respect to the demand for work platforms in these regions. Cabinetry manufacturers are establishing their presence in these regions to enhance the market growth. These regions are drastically affected by the COVID-19 pandemic and it has brought the regional economies down. This will impact almost all the sectors including construction, mining, and others. Hence, reduction in the capacity of the manufacturers to produce high-quantity products would subsequently impact the market growth. The UK market is valued at USD 6.29 billion by 2026, while the Germany market is valued at USD 7.5 billion by 2026.

However, in 2020, all the regions were expected to exhibit slow growth rate for a considerable period. It was owing to the sudden shutdown of fabricating industries across China, India, Vietnam, the U.S., Italy, and the other countries due to the COVID-19 pandemic impact across the globe.

KEY INDUSTRY PLAYERS

Prominent Players Ensure to Strengthen their Position by Providing Work Surface Solutions to Customers

DuPont de Nemours Inc. is developing its customer base for its brand named Corian, under which it provides solid surfaces that increase the customers’ customized needs by enhancing the quality of services provided by the company. This is expected to boost the growth of the Corian brand under the solid surfaces business segment.

Masco Corporation is an active manufacturer of kitchen and bath cabinetry products and solutions with 20 product lines and 300 styles and patterns. It provides custom-based cabinetry products to fit the customers’ needs with high-quality and stylish work platforms. It caters to the demand through its dealers and distributors throughout North America and across the globe, thereby driving the global market.

List of Top Countertop Companies:

- ARISTECH SURFACES LLC (U.S.)

- Caesarstone (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Formica Group (U.S.)

- Masco Corporation (U.S.)

- Panolam Industries International Inc (U.S.)

- Silestone (U.S.)

- STRASSER Steine GmbH (Austria)

- Vicostone (Vietnam)

- Wilsonart LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Caesarstone announced launch of its multi material product portfolio and has introduced quartz and outdoor quartz material for their products. Introduction of these products will provide more diverse product portfolio for the company increasing its traction amongst the customers.

- March 2023: Silex Holdings which operates as a subsidiary organization of RJD Green Inc. has ventured into a non-binding MoU (Memorandum of Understanding). The acquisition will positively drive the operations of the company in terms of market size and regional supply chain network.

- December 2021: Cambria USA opened a new manufacturing facility in Minnesota, U.S. The new facility was aimed at improving the production capacity of the new countertop.

- November 2022: Wilsonart LLC signed a partnership with U.S.-based Rugby ABP, which deals in surfaces and architectural building products. The basic aim of the partnership is the improvement of the product portfolio of countertop products and to supply products to diversified locations.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report covers a detailed analysis of the material type, construction activity, application, and end users of the market. It provides information about leading players and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material Type, Construction Activity, Application, End User, and Region |

|

Segmentation |

By Material Type

By Construction Activity

By Application

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the value of the global market was USD 136.19 billion in 2025.

The market is projected to reach USD 206.49 billion by 2034.

The market is projected to grow at a CAGR of 4.80%, exhibiting moderate growth during the forecast period (2026-2034).

Asia Pacific dominated the countertop market with a market share of 37.60% in 2025.

The natural stone segment is anticipated to lead the market during the forecast period.

Refurbishing and Remodeling Building Construction Infrastructure sector to drive the market.

Panolam Industries International Inc (U.S.), Silestone (U.S.), STRASSER Steine GmbH (Austria), Vicostone (Vietnam), Wilsonart LLC. (U.S.) are the top companies in the market.

Emergence of Honed Finished Quartz to be a Major Trend

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us