Data Center Cooling Market Size, Share & Industry Analysis, By Product (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Unit, Chillers, and Others), By Data Center Type (Large Scale, Medium Scale, and Small Scale), By Cooling Technique (Room Based Cooling, Rack Based Cooling, and Row Based Cooling), By Industry (BFSI, IT and Telecom, Manufacturing, Retail, Healthcare, Energy and Utilities, and Others) and Regional Forecast, 2026-2034

Data Center Cooling Market Analysis - 2034

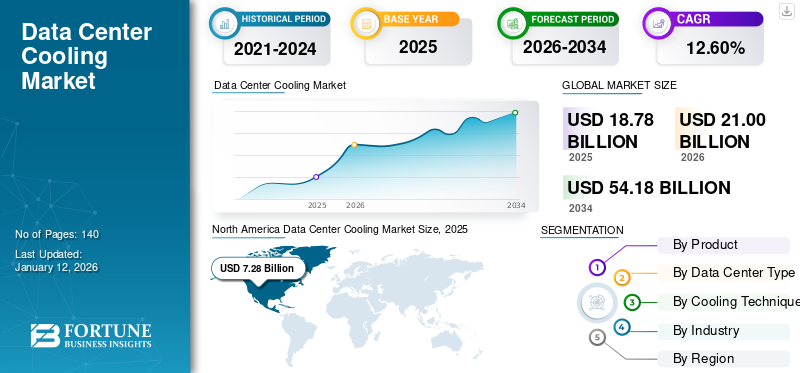

The global data center cooling market size was valued at USD 18.78 billion in 2025 and is projected to grow from USD 21 billion in 2026 to USD 54.18 billion by 2034, exhibiting a CAGR of 12.60% during the forecast period. The North America dominated global market with a share of 38.70% in 2025.

Data center cooling involves the systems and solutions aimed at keeping data centers' temperature, humidity, and airflow levels at their optimum, thereby guaranteeing the stable operation of servers, storage, and network devices. Such solutions are important in avoiding overheating, maximizing energy efficiency, and ensuring continuous IT operations. The market is seeing fast growth, led by growing hyper scale data center demand, growth of cloud services, deployment of edge computing, and rising deployments of AI and high-performance workloads, which are demanding sophisticated thermal management. Moreover, the drive toward environmentally friendly data centers and more stringent sustainability legislation is driving innovation for liquid cooling, free cooling, and modular cooling systems.

Additionally, the market is dominated by a number of established players including Schneider Electric, Vertiv Holdings Co., and STULZ GmbH. Ongoing innovations in energy-efficient cooling technologies, strategic alliances with hyperscale operators, and global expansion of service and support networks have allowed these players to keep a solid position in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Hyperscale & Cloud Data Centers to Propel Market Growth

The major driver for the data center cooling market growth is the growing deployment of hyperscale data centers and cloud computing services globally. Growing demand for digital transformation, artificial intelligence, big data analysis, and streaming services is generating a spate of IT load density, thereby pushing the demand for enhanced and efficient cooling systems. Energy-efficient cooling systems are a must to minimize downtime, optimize performance, and achieve aggressive sustainability targets.

Additionally, the widespread embracement of edge computing and AI workloads with increased heat densities further accelerates the demand for sophisticated cooling technologies.

- For example, in 2024, Amazon Web Services (AWS) reportedly planned to double its data center capacity in Virginia and Ohio with a special emphasis on implementing leading-edge liquid cooling technology for AI workloads.

MARKET RESTRAINTS

High Energy Consumption & Capital Investment Requirements to Restrict Market Expansion

One of the most impactful limitations for the market is the expense of operating and acquiring advanced cooling systems. Systems such as immersion cooling and direct-to-chip liquid cooling, though highly efficient, are in the form of capital outlays, require specialized infrastructure, and have high maintenance charges as opposed to traditional air-based cooling systems.

Also, the heavy energy use of older cooling systems continues to be a problem as it poses questions about sustainability and capital expense. Tighter government regulations on carbon output and power utilization effectiveness (PUE) are compelling operators to retire and replace, which can hinder uptake for small and mid-size data centers.

- For example, the United States Department of Energy highlighted that cooling can account for 30–40% of a data center's total energy budget, which complicates cost-efficient scaling.

MARKET OPPORTUNITIES

Rise of Green Data Centers and Innovative Cooling Technologies to Unlock New Growth Opportunity

The shift to sustainable and energy-efficient infrastructure is pushing market opportunity. Free cooling, liquid cooling, and modular cooling systems are being invested in by operators more often as they look to meet net-zero targets. In addition, the use of AI and digital twins for real-time thermal monitoring is opening up opportunities for vendors to offer smart, adaptive data center cooling solutions.

In addition, governments and businesses are backing mass investment in green hyperscale campuses, further boosting demand for green cooling solutions.

- For example, Microsoft in 2024 revealed the development of a hydrogen-fueled clean data center in Sweden to be built with next-generation liquid immersion cooling to achieve carbon neutrality.

DATA CENTER COOLING MARKET TRENDS

Shift Toward Liquid Cooling and Immersion Cooling is a Major Market Trend

While traditional CRAC (computer room air conditioning) units and air cooling dominate, there is a clear trend toward liquid-based cooling technologies to handle the increasing heat loads of AI and HPC (high-performance computing) systems. Immersion cooling is specifically gaining attention due to its ability to significantly reduce PUE and improve rack density.

This trend is being driven by hyperscale cloud providers, colocation operators, as well as enterprises seeking to optimize performance while reducing carbon footprints.

- For instance, Google deployed AI-optimized liquid cooling systems in its data centers in 2023 to support large-scale AI workloads, reducing overall cooling energy consumption by over 30%.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

High Demand for Air Handling Units Contributed to Segmental Growth

On the basis of product, the market is segmented into air conditioners, precision air conditioners, liquid cooling, air handling units (AHUs), chillers, and others.

To know how our report can help streamline your business, Speak to Analyst

The air handling unit (AHU) segment captured the highest data center cooling market share in 2026, accounting for 26.62% of the total market share. Such systems find extensive deployment in medium- to large-scale data centers owing to the ability they possess to regulate airflow, temperature, and humidity levels across server rooms. Their scalability, energy efficiency, and feasibility to both traditional and newest cooling solutions further increase their adoption.

Aside from this, air handling units are often mounted with advanced controls, free cooling systems, and economizers, thus they are energy efficient and energy efficiency regulation compliant. This has led AHUs to become the most desired product by hyperscale operators and colocation providers.

- Vertiv Holdings Co. and STULZ GmbH are some of the dominant players providing sophisticated AHU solutions developed especially for hyperscale and high-density workloads.

By Data Center Type

Rising Adoption of Edge & SME Infrastructure Propelled Dominance of Small-Scale Data Centers

On the basis of data center type, the market is segmented into small scale, medium scale, and large scale.

The small-scale data center segment held the largest share of the data center cooling market in 2026, accounting for 36.14% of the total market share. Regional enterprises, SMEs, as well as edge computing operators majorly use these data centers in order to meet their localized data processing requirements. Their lower capital needs, ease of deployment, and applicability to emerging markets have driven their mass adoption. The deep emphasis on edge computing and increasing need for regionalized storage of data have added to the dominance of this segment.

- For instance, some telecom operators in North America and Asia Pacific are increasing their networks of small-scale and modular edge data center operations to enable 5G and IoT use cases.

The big scale data center segment is expected to register the highest growth rate of 13.3% during the forecast period. This is due to the growing investments by hyperscale cloud providers, colocation firms, and internet giants to support increasing AI, big data, and cloud service workloads.

By Industry

Rising Digitalization & Cloud Adoption Strengthened IT & Telecom Segment Leadership

Segmented by industry, the market is split into BFSI, IT & telecom, manufacturing, retail, healthcare, energy & utilities, and others.

The IT & telecom segment captured the majority of the data-center cooling market in 2024. This is due to increased dependency on cloud services, hyperscale facility rapid growth, and 5G infrastructure integration that necessitates high-quality cooling systems to handle large computing loads. The segment keeps growing as telcos and cloud players optimize their networks to support growing demand for data-hungry applications such as video streaming, AI, and IoT.

- For instance, in 2024, Google Cloud and Microsoft Azure announced new data center builds in Asia and North America, significantly spending on next-gen liquid cooling technologies to support higher rack densities.

The retail segment is anticipated to expand at a highest CAGR of 14.7% over the forecast period, majorly driven by rapid digitalization, surging of e-commerce transactions, as well as growing investments in large-scale data centers in order to support omnichannel retail operations.

Data Center Cooling Market Regional Outlook

Geographically, the market for data center cooling is divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

NORTH AMERICA

North America Data Center Cooling Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America led the market, with the market size valued at USD 7.28 billion in 2025 and increasing to USD 8.1 billion in 2026, maintaining its leading position. North America is underpinned by hyperscale presence of operators including Amazon Web Services, Google, and Microsoft, as well as early embracement of liquid and immersion cooling systems. Sustainability-oriented programs and robust investment pipelines in the U.S. continue to propel growth. By 2026, the U.S. market is expected to be valued at USD 5.26 billion.

- For example, in 2024, Meta revealed a new hyperscale data center campus in Indiana developed with next-generation liquid cooling systems to accommodate AI workloads.

ASIA PACIFIC

Asia Pacific is slated to attain the highest CAGR over the forecast period, thus emerging as the most vibrant region in the global environment. Growing digital economies, enormous cloud service uptake, and China, India, and Southeast Asian governments-sponsored 5G and smart city initiatives are the primary growth drivers. Asia Pacific is estimated to grow to USD 3.64 billion by 2025, while Japan market is projected to reach USD 0.92 billion by 2026, the China market is projected to reach USD 1.43 billion by 2026, and the India market is projected to reach USD 0.9 billion by 2026.

EUROPE

Europe is also expected to capture the second-largest market share, fueled by rigorous Europe Union energy efficiency regulations, growing colocation needs, and massive digital infrastructure investments in Germany, the U.K., and the Nordics. European markets are expected to reach USD 5.00 billion by 2025, with Germany and the U.K. being at the forefront of regional adoption of green efficient cooling solutions. The UK market is projected to reach USD 2.1 billion by 2026, while the Germany market is projected to reach USD 1.23 billion by 2026.

SOUTH AMERICA & MIDDLE EAST & AFRICA

South America and the Middle East & Africa are also projected to develop steadily in the next few years. The South America market is expected to increase to USD 1.06 billion by 2025, attributed by Brazil's burgeoning colocation and fintech sectors. In the Middle East & Africa region, GCC countries will lead the regional growth and the market is expected to grow to USD 1.80 billion by 2025 with the help of government-initiated digital transformation initiatives and growing investment in regional data centers.

COMPETITIVE LANDSCAPE

Key Industry Players

Comprehensive Cooling Portfolios and Global Service Networks Enable Market Leadership

The global data-center cooling market has a moderately consolidated nature with a number of well-established multinational companies together with an increasing number of specialized technology vendors. Top players are concentrating on innovation in energy-efficient and green cooling solutions, collaboration with hyperscale operators, and enhancing service capabilities in important regions.

Some of the major players in the market include Schneider Electric, Vertiv Holdings Co., and STULZ GmbH. Their large product offerings for air handling units, precision air conditioners, liquid cooling, and modular solutions, along with their strong global distribution and service channels, have enabled these industry players to achieve leading market shares.

In addition to this, Daikin Industries Ltd., Rittal GmbH & Co. KG, Johnson Controls International plc, and Mitsubishi Electric Corporation are some other key players. They are investing heavily in R&D, green technologies, and strategic partnerships with data center constructors to bolster their position. Emerging entrants and smaller companies are also entering the market with specialized liquid cooling and immersion cooling techniques, further heightening competition.

LIST OF KEY DATA CENTER COOLING COMPANIES PROFILED

- Daikin Industries, Ltd. (Japan)

- Johnson Controls (U.S.)

- Schneider Electric (France)

- Asetek Inc. (Denmark)

- Thermal Care (U.S.)

- Vertiv Group Corp. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Danfoss (Denmark)

- Airedale International Air Conditioning Ltd. (U.K.)

- STULZ Air Technology Systems, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Brookfield Asset Management moved into AI infrastructure, investing heavily in liquid cooling and GPU-oriented "in-the-box" systems, and got a USD 10 billion data center campus JV in Sweden.

- July 2025: Vertiv Holdings signed to buy Great Lakes Data Racks & Cabinets for USD 200 million, looking to bolster its AI and edge computing infrastructure solutions.

- July 2025: Gates Industrial, Generac, and Honeywell among U.S. industrial companies increased efforts in data center cooling pump and hybrid cooling control offerings, riding the wave of AI-driven hyperscaler demand.

- February 2025: Schneider Electric, a data center cooling company acquired Motivair Corporation to enhance its data center liquid cooling market position by providing more extensive cooling solutions.

REPORT COVERAGE

The market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Data Center Type

|

|

|

By Cooling Technique

|

|

|

By Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 18.78 billion in 2025 and is projected to reach USD 54.18 billion by 2034.

In 2025, the market value stood at USD 7.28 billion.

The market is expected to exhibit a CAGR of 12.60% during the forecast period of 2026-2034.

The air handling unit segment led the market by product.

Growing demand for hyperscale & cloud data centers is key factors driving the market.

Daikin Industries, Ltd., Johnson Controls, Schneider Electric, Asetek Inc., Vertiv Group Corp. (U.S.), are some of the prominent players in the market.

North America dominated the data center cooling industry in 2025.

Energy efficiency, increasing hyperscale and AI-based workloads, increasing sustainability regulations, and increasing demands for advanced cooling in edge and cloud data centers are the key drivers that are likely to promote product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us