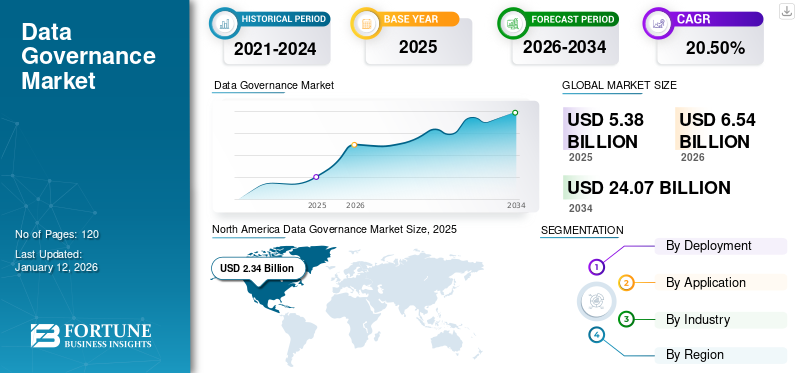

Data Governance Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Application (Audit Management, Incident Management, Compliance Management, and Risk Management), By Industry (BFSI, Healthcare, Government, Retail & Consumer Goods, IT & Telecom, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global data governance market size was valued at USD 5.38 billion in 2025. The market is projected to grow from USD 5.38 billion in 2026 to USD 24.07 billion by 2034, exhibiting a CAGR of 20.50% during the forecast period. North America dominated the global market with a share of 43.50% in 2025.

Managing data has become an essential aspect for businesses and individuals in the digital world. Organizations have started various programs to extract value from the data they collect so that the data is used for better decision making. Improving data quality is the leading benefit that organizations receive from data governance programs. Organizations that invest in governance solutions are realizing the significance of the added value from their programs, starting with progress toward increasing data quality and trust.

The volume of data is expected to reach 180 zettabytes by 2025, which is 3x more than that generated in 2020. As the volume of data increases, the demand for data governance also increases. The COVID-19 pandemic also played a significant role in the increased data usage. Enterprises in various industries, especially telecommunication companies across various countries, witnessed a surge in data usage as the governments imposed lockdowns. Also, due to the pandemic, a huge number of employees started working from home by connecting remotely. This increased the demand for data-related governance solutions for managing the data efficiently.

According to a survey by Komprise, around 68% of enterprises spend nearly 30% of their IT budget on data storage, management, and protection. Businesses are applying a governance framework to define the management of data right from collection to deletion, and help maximize the value and minimize the risk. Moreover, the market growth is driven by the growing integration of Artificial Intelligence in data governance solutions. For instance, in November 2023, Privacera declared that Privacera AI Governance (PAIG), a comprehensive AI data governance solution, now incorporates Amazon Web Services for Foundation Models (FMs) on security that are used for Generative Artificial Intelligence.

Also, according to the 2024 State of Data Security Report by Immuta, around 88% of data leaders stated that data security is expected to become an even higher priority by 2025, ahead of AI. While AI is trending among data professionals across every sector, security, trust, and compliance are still ranking in important organizational priorities.

Data Governance Market Trends

Emergence of Data Democratization is Driving Market Growth

Data democratization is gaining popularity as data consumption has surged among nontechnical users. According to industry experts, the demand for data will grow in the next three years among nontechnical users. As data democratization is gaining popularity, the demand for governance is increasing for data security, privacy, and compliance requirements. Data democratization is important to businesses as it ensures an effective and efficient method of providing data to all users, regardless of technical expertise. This eliminates the frustration of requesting access, sorting information, or contacting IT help.

Data governance has a built-in nature to control access to data. Data democratization aims to offer more access to many data users across the organization. Organizations need to review their governance framework so that it is associated with democratization but does not overprovision. It is crucial throughout the entire process of democratizing data, from collecting, accessing, storing, and interpreting data. The solution acts as an enabler and guide for data democratization. Therefore, the emergence of data democratization is driving the market growth.

For instance, in May 2023, Informatica launched expanded data governance, data engineering, and MDM capabilities in its data management cloud platform and improved the system’s AI engine with GenAI functionality. The company’s CLAIRE AI engine simplifies how enterprises manage, process, and analyze data, fostering greater data democratization with extended self-service capabilities.

Download Free sample to learn more about this report.

Data Governance Market Growth Factors

Increase in Amount of Big Data to Fuel Demand for Data Governance Solutions

The market is experiencing a notable surge primarily due to a remarkable increase in the volume of big data due to the rapid digitization of businesses and the global economy. With the shift toward digital operations, organizations are generating and collecting vast amounts of data, including customer information, financial transactions, operational metrics, and others. In particular, industries, such as e-commerce, entertainment, finance, healthcare, and manufacturing are witnessing an explosion in data production. For instance, according to Zippia, in 2022, the amount of data generated and stored reached 94 zettabytes, indicating a significant surge in data creation and consumption since the onset of the COVID-19 pandemic. This growth can be attributed to the increased remote work and greater home entertainment use during this period. The growing importance of data analytics for gaining insights, optimizing operations, and making informed decisions has led to a substantial increase in the volume of data collected, thereby boosting the demand for governance solutions. For instance, in December 2022, the Institute of Big Data Governance (iBDG) and Hong Kong Science and Technology Parks Corporation (HKSTP) partnered to drive cross-industry big data governance in Hong Kong. iBDG (non-profit platform) aimed to develop Hong Kong as an international data hub and accelerate good self-governance for the big data industry.

Moreover, the ever-increasing online presence of individuals, extensive use of social media platforms, and expansion of mobile devices have contributed to the surge in data. Individuals' digital footprint and interactions in the virtual world result in massive data streams, including text, images, videos, and other user-generated data, highlighting the importance of adopting advanced governance solutions. In response to this big data surge, businesses are seeking advanced governance solutions to securely and efficiently manage and analyze this information.

As companies strive to derive insights and create value from big data, the demand for governance solutions is expected to remain robust.

RESTRAINING FACTORS

Changing Format of Regulatory Policies and Data Address Validation & Lack of Awareness to Hamper Market Growth

The regulatory policies are continuously evolving and organizations are navigating through a maze of regulations, including HIPAA, GDPR, and more. The challenge lies in understanding and adhering to these regulations as data privacy, quality, and complexity of regulatory policies leads to confusion, potential breaches, and legal liabilities, further hindering the market growth.

Furthermore, a fundamental challenge is a lack of awareness about the governance solutions that restricts the market growth. Organizations resist data governance initiatives as they often fight with well-established data silos, making it difficult to create a unified governance framework. Identifying data owners is essential for governance, but organizations struggle to outline the data owner's responsibility. This leads to misunderstanding and impedes effective governance, which is expected to restrict the market growth.

Data Governance Market Segmentation Analysis

By Deployment Analysis

Cloud-based Solution to Prioritize Compliance & Regulation, Fueling Cloud Segment Growth

By deployment,The Cloud segment is anticipated to hold a dominant market share of 23.41% in 2026. the market is bifurcated into on-premises and cloud. The cloud segment is expected to witness the highest CAGR during the forecast period. Cloud-based solutions highlight the significance of data privacy and ethical practices. Also, a cloud-based solution ensures that organizations comply with several regulations, including HIPPA, GDPR, and others,. These solutions offer robust security measures, thereby establishing a strong base for data protection.

For instance, in March 2023, Immuta partnered with Interago to help Norwegian enterprises speed up data access across all major cloud platforms.

The on-premises segment dominated the market in 2024 as on-premises solutions help organizations in deploying software, infrastructure, and data management systems within their physical premises. This traditional approach helps organizations have direct control over their hardware and software.

By Application Analysis

Adoption of Governance Solutions for Compliance Management to Drive Compliance Management Segment Growth

By application, The Compliance Management segment is anticipated to hold a dominant market share of 23.41% in 2026. the market is classified into audit management, incident management, compliance management, and risk management. The compliance management segment is estimated to witness the highest CAGR during the forecast period. Compliance management is essential for adhering to industry-specific regulations and data privacy laws, and compliance management mitigates legal risk and fosters trust among partners and customers.

The risk management segment generated the maximum market revenue share in 2024 as risk management identifies potential risks associated with the data and aims to mitigate these risks and prevent data-related issues.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Data Breaches in Healthcare Industry to Propel Healthcare Segment Growth

Based on industry, the market is segmented into BFSI, healthcare, government, retail & consumer goods, IT & telecom, and others. The healthcare segment is expected to record the highest CAGR owing to increasing data breaches in the healthcare industry. Data breaches in healthcare continue to significantly impact the sector's growth, even as more firms implement updated security solutions to keep up with the flood of new cyber threats. This factor is creating the need for governance solutions.

The BFS segment is anticipated to hold a dominant market share of 23.59% in 2026. The BFSI segment holds the maximum market share as governance solutions help the sector optimize its effectiveness and innovation. The solution helps banks enable lineage mapping that traces the origin, transformation, and movement of data throughout its lifecycle and ensures that banks maintain a clear audit trail of data assets.

REGIONAL INSIGHTS

Our report studies the market across five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Data Governance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.34 billion in 2025 and USD 2.78 billion in 2026, owing to the increasing amount of user-generated data among various regional industries. Adoption of governance solutions is increasing in highly regulated industries, including retail and healthcare, as these industries are bound by strict regulations to disclose the stock of materials as they use, record, and report raw materials and finished goods data to avoid legal consequences. The U.S. market is projected to reach USD 2.28 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is experiencing growth in the volume of unstructured data across enterprises, and this data is being stored in on-premises devices or in the cloud environment. The adoption of IoT devices is also increasing in the region, creating massive amounts of data. Also, the adoption of digital payments is surging, resulting in the generation of huge amounts of data daily that enterprises need to process, thereby propelling the demand for governance solutions. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.40 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026.

Europe is witnessing substantial growth as the European Union introduced the Data Act and specific regulations for connected devices. As a huge volume of data is being generated through connected devices, the European Union plans to utilize this data for productive use to benefit companies and the society. As the European government regulates technology, enterprises in the region are investing in digitalization. According to European Bank Investment, around 46% of enterprises claimed that they are taking steps toward digitalization, which is surging the demand for data governance in the region. According to an Immuta InfoBrief 2022 report, 87% of European C-Suite executives are aiming to become data-driven intelligent organizations in the next three to four years. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.20 billion by 2026.

South America and the Middle East & Africa markets are experiencing significant growth as the governments in various countries aim to build digital infrastructure. This is expected to generate massive amounts of data, thereby surging the regional market growth.

Key Industry Players

Key Players Launch New Products to Strengthen Market Position and Drive Market Growth

Major players, including Collibra, SAP SE, IBM Corporation, and others operating in the data governance market, are actively developing advanced solutions to cater to customer demands. They are also focusing on enhancing their existing product portfolios to deliver flexible solutions with unique attributes. Furthermore, these organizations are proactively pursuing collaborations, mergers & acquisitions, and partnerships to bolster their product offerings.

List of Top Data Governance Companies:

- Alation (U.S.)

- Infogix (U.S.)

- Collibra (Belgium)

- SAP (Germany)

- OneTrust (U.S.)

- Ataccama (Canada)

- Erwin(U.S.)

- Syniti (U.S.)

- Data.World (U.S.)

- Solix (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Digital Glyde partnered with Decube to transform the data landscape and ensure the quality of AI initiatives. The partnership offers improved observability and data governance, driving businesses to unlock opportunities in their AI investments.

- February 2024: Perforce acquired Delphix to add the Enterprise Data Management Software to its DevOps offerings. The platform enables governance, scalable automation, and compliance of data across enterprises throughout the application lifecycle.

- February 2024: Securiti launched its AI Security and Governance solution, marking its entry in the AI governance space. The tool provides customers with a combination of AI risk ratings, AI model discovery, AI tool mapping, organizational data, and AI security & privacy controls.

- January 2024: Satori joined the Snowflake Horizon Partner Ecosystem to give its joint clients additional features by utilizing the power of both platforms to accelerate data governance. Snowflake customers using Satori can improve their data governance function with continuous sensitive data discovery and unified security policies.

- January 2024: Databricks launched the Data Intelligence Platform for Communications for network service providers and telecommunication carriers. The platform combines data governance, data sharing, and data management with generative AI and Machine Learning (ML) tools.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Industry

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 24.07 billion by 2034.

In 2025, the market was valued at USD 5.38 billion.

The market is projected to record a CAGR of 20.50% during the forecast period.

By application, the compliance management segment is expected to be the highest growing segment in the market.

Increase in the amount of big data is expected to fuel the demand for data governance solutions.

Collibra, SAP, Alation, Syniti, and OneTrust are the top players in the market.

North America held the highest market share.

By industry, the healthcare segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us