Dentures Market Size, Share & Industry Analysis, By Type (Complete and Partial), By Usage (Removable and Fixed), By End-User (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

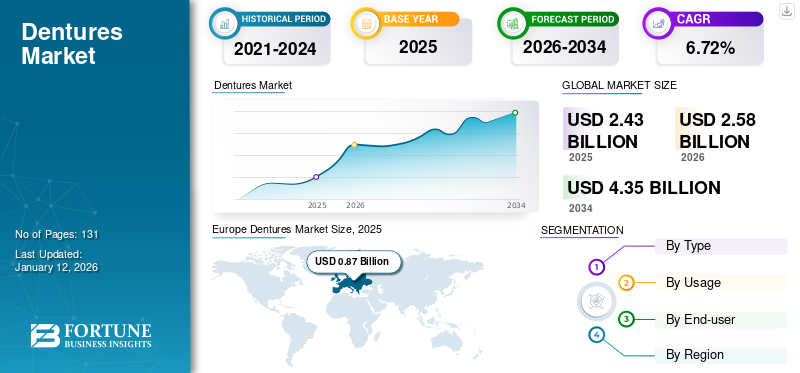

The global dentures market size was valued at USD 2.43 billion in 2025. The market is projected to grow from USD 2.58 billion in 2026 to USD 4.35 billion by 2034, exhibiting a CAGR of 6.72% during the forecast period. Europe dominated the dentures market with a market share of 35.71% in 2025. Moreover, the U.S. dentures market size is projected to grow significantly, reaching an estimated value of USD 1.29 billion by 2032, driven by increasing awareness regarding dental services and product diversity, coupled with emerging indications.

Dentures are removable dental prosthetics designed to replace missing teeth and surrounding tissues. They come in two main types including complete, which replace all teeth in a jaw, and partial, which fill in gaps between the existing teeth. These products improve the chewing ability, speech clarity, and facial appearance, enhancing the quality of life for individuals with missing teeth. Advanced products are often made from durable materials and customized to fit comfortably and securely in the mouth. These products are composed from pink acrylic, which stimulates the appearance of gums, and the teeth are made of ceramic or plastic. Moreover, the increase in the periodontal diseases and edentulism are expected to propel the demand for these products across the globe.

- For instance, according to the American College of Prosthodontists, more than 36 million Americans do not have any teeth, and 120 million people in the U.S. are missing at least one tooth. These numbers are anticipated to rise in the next two decades, and around 15% of the edentulous population has artificial teeth made each year.

Furthermore, technological advancements in these products manufacturing by using 3D printers also is expected to drive the market growth. In February 2023, Desktop Health announced stronger formulation of its Flexcera resin for 3D printing gingiva, Flexcera Base Ultra+, which is used to fabricate full and partial removable products.

In 2020, during the COVID-19 pandemic, the market was negatively impacted due to the cancellation of non-emergency dental procedures in several countries. Furthermore, due to lockdown restrictions, many elective surgeries were postponed in various regions around the world resulting in a reduced demand for these products. The market is projected to witness steady growth prospects in the forecast period of 2024-2032.

Global Dentures Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.43 billion

- 2026 Market Size: USD 2.58 billion

- 2034 Forecast Market Size: USD 4.35 billion

- CAGR: 6.72% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 35.71% share in 2025. This leadership is driven by increasing awareness of dental services, product diversity, and significant public spending on dental care services in countries across the region.

- By Type: The complete dentures segment held the largest market share in 2024. Its dominance is attributed to the needs of a growing aging population requiring comprehensive tooth replacement solutions, coupled with advancements in denture materials and techniques that improve both functionality and aesthetics.

Key Country Highlights:

- Japan: The market is driven by a rapidly aging population, which leads to a significant demand for dentures as partial and complete tooth loss is more prevalent among the elderly.

- United States: The market is fueled by a very large edentulous population, with over 36 million Americans having no teeth. Growth is also supported by high dental care expenditure and increasing awareness of available dental services.

- China: Demand is propelled by a high prevalence of edentulism and a substantial aging population that requires effective and accessible tooth replacement solutions.

- Europe: As the market leader, growth is supported by high awareness, strong government investment in dental care, and technological advancements from regional players, such as the introduction of new digital denture systems and milling units.

Dentures Market Trends

Growing Trend of Cosmetic/Aesthetic Dentistry Identified as Significant Global Dentures Market Trends

In the recent years, people have prioritized their appearance and smile aesthetics; there has been a surge in the demand for dental procedures aimed at improving the overall appearance of teeth and gums.

These products play a crucial role in restoring a natural-looking smile for individuals with missing teeth or tooth irregularities. Modern denture materials and techniques allow for the creation of dentures that closely resemble natural teeth, providing patients with aesthetically restorative solution.

Moreover, advancements in the denture technology have enabled the customization of these products to meet each patient's unique aesthetic preferences, including considerations such as tooth color, shape, and alignment. The customization ensures that these products not only restore oral function but also blend seamlessly with the patient's natural dentition, enhancing overall facial aesthetics and boosting confidence.

Various manufacturers are increasingly focusing on developing innovative denture solutions that cater to the aesthetic needs and preferences of patients, further fueling market expansion.

- For instance, in February 2023, Stratasys Ltd launched the first monolithic, full-color 3D printed permanent dentures solution, TrueDent. This FDA-approved product is made especially for the fabrication of dental appliances.

Download Free sample to learn more about this report.

Dentures Market Growth Factors

Increase in the Utilization of Digital Dentures is Expected to Drive the Market Growth

Digital dentures involve the use of advanced technology, such as CAD/CAM to design and fabricate dentures with exceptional precision and customization. Digitally manufactured products are precisely produce to the individual's oral anatomy, resulting in a more comfortable and natural-feeling fit. Additionally, the digital design process allows for greater customization in terms of tooth shape, size, and arrangement, enabling patients to achieve optimal aesthetics and function.

- For instance, in February 2024, Desktop Metal, Inc. announced the launch of Flexcera Base Ultra+ Dental Resin for the manufacturing of 3D printed dentures.

Furthermore, these digital products streamline the production process, reducing the time and labor involved in fabricating products compared to traditional methods. This efficiency is poised to augment the global dentures market growth.

The key players operating in the market are focusing on developing using digital dentistry due to create advanced denture. Moreover, various players focus on strategic partnerships in order to expand its product portfolio. These strategic initiatives taken by market players are expected to propel the market growth during the forecast timeframe.

- For instance, in September 2021, Dentsply Sirona launched four Lucitone Digital Print Denture System. These systems are expected to use in the production of nearly all full arch denture types, thereby propelling the demand of the products.

Such adoption of digital dentistry in manufacturing dentures is anticipated to drive the growth of the market in the long run.

Rising Geriatric Population Anticipated to Boost Market Development

The geriatric population is more susceptible to tooth loss due to factors such as periodontal disease, decay, and wear and tear over time. The growing number of elderly individuals seeking dental treatment to address tooth loss creates a substantial demand for these products as a viable solution for restoring oral function and aesthetics.

- For instance, as per the data published by the World Health Organization (WHO) in October 2022, the proportion of individuals over 60 years is expected to increased nearly from 12.0% in 2015 to 22.0% in 2025.

Moreover, advancements in denture materials, technologies, and techniques have improved the comfort, fit, and appearance of these products, making them more appealing and effective for older adults. As a result, the adoption of these products among the geriatric population is expected to continue to rise, further driving market development.

RESTRAINING FACTORS

High Costs Associated with Products in Developing Nations to Hinder the Market Growth

The growing demand for dental prosthetics driven by factors such as increasing awareness of oral health and rising prevalence of dental disorders. However, the high price of denture options is expected to limit the accessibility for a significant portion of the population, thereby hampering the growth of the market.

- For instance, premium heat-cured artificial teeth typically retail for approximately USD 2,000 to USD 4,000 per unit or around USD 4,000 to USD 8,000 or higher for a full set. These products within this price bracket are typically tailored entirely to meet the specific needs of the patient.

In these emerging regions, where healthcare expenditures may be constrained and insurance coverage for dental procedures limited, the affordability of denture products becomes a barrier to adoption. Many individuals may opt for cheaper alternatives or forego treatment altogether due to financial constraints, thereby restricting the potential growth of the market.

Such high cost of these products and limited insurance coverage in developing nations is expected to limit the growth of the market.

Dentures Market Segmentation Analysis

By Type Analysis

Complete Segment Dominated in 2024 Due to Requirement Of Comprehensive Tooth Replacement Solutions

According to type, the dentures market is classified into complete and partial.

In 2026, the complete segment held the largest market with a share of 35.71%. The growth is attributed to several factors, including the aging population requiring comprehensive tooth replacement solutions, advancements in denture materials, and techniques improving functionality and aesthetics, and increased awareness of dental health.

- Furthermore, according to an article published by NCBI in April 2020, the overall prevalence of edentulism was and 9.0% in China and 16.3% in India

The partial segment is expected to grow comparatively higher CAGR during the forecast timeframe. The segmental growth due to the growing cases of tooth loss and growing the demand for partial product types. As more people seek reliable solutions for partial tooth replacement, the demand for partial dentures continues to surge. Additionally, innovations in materials and techniques are further driving this growth, offering patients more aesthetically pleasing and durable options for restoring their smiles and oral functions.

For instance, as per Global Oral Health Status Report published by World Health Organization (WHO), in 2019, there were 513,829,451 dental caries cases across the world, in which upper-middle income countries had large number of cases.

To know how our report can help streamline your business, Speak to Analyst

By Usage Analysis

Increasing Number of Dental Procedures Boosted the Removable Segment Growth

Based on usage, the market is segmented into fixed and removable.

The removable segment held the dominating market with a share of 81.22% in 2026. The segmental growth is attributed to advancements in technology, heightened awareness of oral health, and the affordability of removable denture options. As individuals seek cost-effective and convenient solutions for tooth replacement, the demand for removable dentures continues to surge, driving substantial growth in this segment over the past period. Furthermore, strategic initiatives taken by companies to produce novel product is also primarily driving the market during the forecast period.

For instance, in December 2023, Zahn Dental announced its exclusive distribution of Myerson’s newly launched Trusana Premium Denture System. The system is comprised of the Trusana Premium 3D Denture Base Resin, Trusana Premium 3D Tooth Resin, and Trusana Bond Denture Adhesive. The three products work together to create a premium denture with optimal physical properties and esthetics for dental laboratories.

The fixed segment is expected to experience significant growth during the forecast period. This growth can be attributed to the increasing adoption of fixed products, driven by the limitations associated with removable ones. These limitations include restrictions on consuming certain types of food due to limited mastication ability and the challenging cleaning process of removable types. Furthermore, these products provide a natural appearance, help maintain facial structure, and prevent further bone loss resulting from missing teeth.

By End-user Analysis

Higher Dental Procedural Volume at Solo Practices Aided the Segment Growth

Based on end-user, the market is classified into DSO/group practices, solo practices, and others.

In 2026, the solo practices segment held the largest dentures market share contributing 62.30% globally, due to the significant presence of dentists operating within these facilities. Moreover, the increase in the number of dental and orthodontic clinics across Europe and the U.S. is driving up the volume of procedures performed, thus fueling growth in this segment during the forecast period. Furthermore, growing concerns over the dental health is increasing visits to the dental facilities. For instance, according to CDC, in the U.S., around 64.1% of the adults above aged 18 visited the dental clinics in 2022.

The DSO/group practices segment is anticipated to register a higher CAGR during 2025-2032.

The segment's growth during the forecast period will be significantly driven by the increasing adoption of advanced digital technologies, such as 3D printing, in dental facilities for designing and manufacturing customized products. Furthermore, the rising number of such dental facilities to provide preventive and restorative dental services across various regions globally is anticipated for the segmental growth.

Other segments include, healthcare facilities, such as hospitals and community healthcare center. This segment held the significant share and expected to grow at moderate CAGR during the forecast period.

REGIONAL INSIGHTS

On the basis of region, the global market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe Dentures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 0.87 billion in 2025 and USD 0.91 billion in 2026.The increasing awareness regarding dental services and product diversity, coupled with emerging indications. These factors will fuel market growth during the study period. Moreover, Europe market offers significant growth potential, attracting investments from manufacturing companies, and prompting the adoption of strategies. Major market players' technological advancements have stimulated demand for dental care products across various age groups. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

- For instance, The National Health Service (NHS) in England allocates approximately USD 4.8 billion each year for both primary and secondary dental care services. Additionally, more than 1 million patients avail themselves of dental services through the NHS in England on a weekly basis.

In North America, the region is expected to secure the second-largest share in the regional market. This is attributed to increasing healthcare expenditures, well-established healthcare infrastructure, and a significant population suffering from edentulism.Moreover, the rise in the dental expenditure in the U.S. is also driving the growth of the market. Dental care expenditure in the U.S. has increased from USD 163.0 billion in 2019 to USD 165.0 billion in 2022, an 1.2% increase in this period. The U.S. market is projected to reach USD 0.86 billion by 2026.

The market in Asia Pacific is estimated to grow at the highest CAGR due to growing awareness among the population about the various benefits associated with these products. Additionally, factors such as the increasing geriatric population, higher incidence of periodontal diseases, rising disposable income, and greater utilization of dental services are anticipated to drive market growth in the region.

For instance, according to the Asia Pacific Report on Population Ageing 2023, the number of people aged 60 years or older residing in Asia is around 697 million. This number is projected to double 2050. There is a significant demand for these products among the elderly population, especially in countries like India, China, and Japan, where partial and complete tooth loss is more prevalent. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.15 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

In the Middle East & Africa and Latin America regions, the growth prospects are propelled by increasing expenditures on qualified dental services and the presence of a large number of dentists.

List of Key Companies in Dentures Market

Growing Number of Acquisitions to Boost Market Growth

The market's competitive landscape is fragmented, with key players such as Dentsply Sirona and Zimmer Biomet holding substantial shares as of 2024. These leading companies concentrate on research and development of dental products and strategically acquiring other businesses to bolster their market presence.

- For instance, in February 2022, Zimmer Biomet Holdings, Inc. launched, a new overdenture attachment system, known as OverdenSURE in Europe and North America.

- Additionally, in January 2021, Dentsply Sirona acquired Datum Dental, Ltd. Datum Dental has innovative dental regeneration products in its product portfolio.

Such acquisitions will significantly enhance their portfolio of innovative products in the dentistry segment. Other players, such as Ivoclar Vivadent, SHOFU INC., and others, continuously developing new products to strengthen their footprints in emerging regions.

LIST OF KEY COMPANIES PROFILED:

- Dentsply Sirona (U.S.)

- Zimmer Biomet (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- SHOFU INC. (Japan)

- Modern Dental Group Limited (China)

- JH Dental Care (India)

- VITA Zahnfabrik (Germany)

- Mitsui Chemicals Inc (Kulzer GmbH) (Germany)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Dentsply Sirona introduced Lucitone Digital Print Denture System for the manufacturing of digital dentures using Primeprint Solution.

- December 2023 – Myerson launched Trusana 3D Premium Denture System which is exclusively being distributed by Zahn Dental.

- February 2023 - vhf camfacture AG announced that it had been certified as an Ivoclar Authorized Milling Partner for the Ivotion Denture System. With this, the company can now manufacture monolithic full dentures.

- November 2022 - Global Dental Science, LLC and Renew, LLC signed a partnership agreement for the supply of AvaDent. This product is the latter company’s fixed-removable, full arch implant-supported dentures.

- March 2022 - Amann Girrbach AG introduced Ceramill Motion 3, a new milling unit to conveniently fabricate dentures with more digitalization. It is designed for dry and wet operation.

REPORT COVERAGE

An Infographic Representation of Dentures Market

To get information on various segments, share your queries with us

The dentures market report provides a detailed of the advanced product, the prevalence of dental disorders and key countries. Additionally, it includes key industry developments such as mergers, partnerships, & acquisitions, and an overview of reimbursement scenarios for surgical procedures. In addition to the aforementioned factors, the report also consists various factors that have contributed to the growth of the market along with the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.72% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Usage

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.43 billion in 2025 and is projected to reach USD 4.35 billion by 2034.

In 2025, Europe stood at USD 0.87 billion.

Growing at a CAGR of 6.72%, the market will exhibit steady growth during the forecast period.

The complete segment is expected to be the leading segment in this market during the forecast period.

The rising incidence of periodontal diseases and the aging population are major factors driving market growth.

Dentsply Sirona and Zimmer Biomet are some of the major players in the global market.

Europe dominated the market in 2024.

Penetration of digital technologies in the dental industry, such as digital scanners, CAD/CAM machines, and 3D printing technologies, has been employed to design and manufacture these products and is expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic