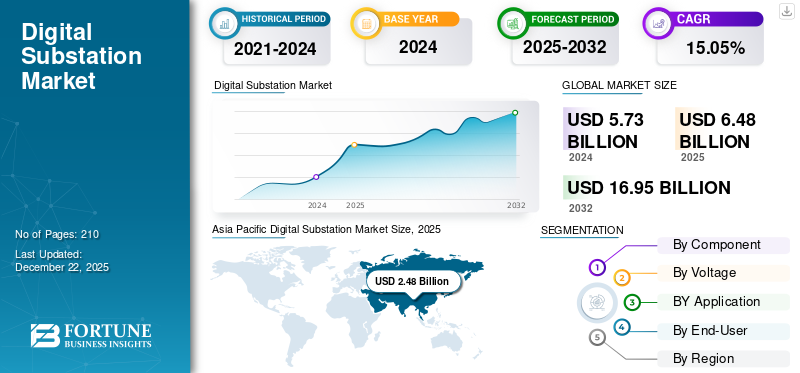

Digital Substation Market Size, Share & Industry Analysis, By Component (Hardware, Communication Network, and Others), By Voltage (Low (Upto 220 KV), Medium (220-550 KV), and High (Above 550 KV)), By Application (Transmission Substation and Distribution Substation), By End-User (Utility, Transportation, and Commercial & Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global digital substation market size was valued at USD 6.48 billion in 2025. The market is projected to grow from USD 7.37 billion in 2026 to USD 22.61 billion by 2034, exhibiting a CAGR of 15.05% during the forecast period. Asia Pacific dominated the global market with a share of 38.34% in 2025.

A digital substation is a contemporary development of electrical substations that uses digital technology and communication networks to operate power distribution equipment. For asset management, including remote control, real-time monitoring, and predictive maintenance, it makes use of sensors, Intelligent Electronic Devices (IEDs), and other digital technology.

High Voltage (HV) cables are in great demand due to the growing need to update power grids for the integration of renewable energy sources and the broad use of IEC 61850 communication standards, which guarantees smooth compatibility between substation devices.

Renewable sources such as wind and solar are increasingly variable. Digital substations with IoT, AI and real time analytics help integrate these seamlessly into the grid. Investments in smart grids especially in rapidly urbanizing regions are driving upgrades to digital substations to support two way communication, distributed energy, and grid flexibility.

Hitachi is a global leader in this market with an extensive product line. The company emphasizes cutting-edge technologies that integrate advanced automation, communication, and digital protection systems.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Enhanced Grid Reliability and Resilience through Advanced Monitoring and Control is Driving Demand

The use of digital substations is increasing as they significantly improve grid resilience and dependability. Real-time monitoring of critical equipment characteristics, advanced fault detection, and automated restoration features are made possible to accomplish this resilience and dependability. Utilities are able to promptly address and fix possible issues before they create major disruptions due to this thorough control.

In order to meet the increased demand for modernization and to improve grid stability through sophisticated monitoring and control, governments and businesses across the world are working together to develop digital substations. For example, in April 2020, ABB installed the first 500 kV digital substation in South America at the São Goncalo solar photovoltaic (PV) project owned by Enel Green Power in Piaui, Brazil. In addition to being the first digital substation of its sort to operate at this voltage globally, this represents a major advancement in the delivery of emission-free electricity from the biggest solar PV plant in South America to Brazil's 500 kilovolt (kV) transmission network.

Integration of Renewable Energy Sources and Distributed Generation Propelling Market Growth

Traditional substations lack the potential to manage the fluctuating and two-way power flows inherent in these sources. With advanced monitoring, control, and communication systems, digital substations offer the flexibility and resilience needed to handle the intricacies of a grid that is becoming more and more reliant on renewable energy. By optimizing power flow, enhancing grid stability, and quickly addressing fluctuations brought on by intermittent renewable generation, these cutting-edge substations help operators sustain a decentralized energy infrastructure and enable a smooth transition to a cleaner energy in the future.

In January 2022, Hitachi Energy secured a dependable power supply in East Java, Indonesia, by installing a 150kV digital substation at PT PerU.S.haan Listrik Negara. Connecting the expansive 200-hectare Sidoarjo Industrial Estate to PLN's power grid, this 1.5-hectare substation, the first and largest digital substation in East Java, ensures steady electricity for the estate's several significant manufacturing enterprises. The design of the substation will also make it easier to integrate renewable energy sources, which will further enable decarbonization and have a good effect on the East Java Province's economic growth, according to Hitachi.

MARKET RESTRAINTS

High Initial Investment Costs Expected to Hamper Market Progression

Digital substation deployment is significantly hampered by high upfront costs, especially for smaller utilities with tighter budgets. These expenses include software platforms, communication networks such as fiber optics, and sophisticated digital equipment including IEDs. It might be difficult and costly to retrofit these control systems with the current infrastructure. Adoption in other areas is slowed by the expense of special training for staff, which further raises the financial burden. Therefore, the digital substation market growth is anticipated to be hampered by these limitations.

MARKET OPPORTUNITIES

Demand for Grid Modernization in Developing Economies is Expected to Create Market Growth Opportunities

Rapid development and urbanization in developing nations to create a significant potential for the digital substation market due to its rising need for grid upgrades. These areas are installing cutting-edge digital substations without the constraints of upgrading older systems, since they frequently lack established grid infrastructure. By avoiding legacy limits and facilitating the implementation of state-of-the-art technology, this program improves efficiency, dependability, and responsiveness to growing energy demands.

In order to promote digital transformation in Egypt's utility industry and support vital infrastructure and economic growth, GE Digital and Hassan Allam Utilities announced in a press release that they had formed a strategic agreement in November 2023.

MARKET CHALLENGES

Interoperability and Cybersecurity Threats for Systems Expected to Challenge Market Growth

Digital substations provide improved monitoring and control capabilities, but they also create new cybersecurity risks. They are vulnerable to cyberattacks because of their networked infrastructure, which depends on software-driven controls and communication networks. These assaults can compromise critical data, interfere with grid operations, and even cause bodily injury. To protect digital substations from these threats, it is essential to have robust cybersecurity defenses, including firewalls, intrusion detection systems, encryption, and regular security assessments.

DIGITAL SUBSTATION MARKET TRENDS

Increasing Adoption of Cloud-Based Solutions for Data Management and Remote Monitoring

Cloud-based solutions for data management, analysis, and remote supervision are becoming increasingly popular in the digital substation sector. These cloud platforms offer benefits such as increased scalability, reduced expenses, and simpler data access. In order to identify patterns, foresee future issues, and increase grid efficiency, utilities are using these technologies to store and analyze the massive data streams from digital substations. Cloud platforms also make it possible to remotely monitor and control digital substations, which gives utilities the ability to manage assets better and respond quickly to grid changes.

For instance, in March 2025, Hitachi Ltd. and Cisco announced a collaboration to use digitization to transform substation control and protection. This change entails switching from conventional copper cables to fiber optic Ethernet, boosting throughout to permit for more important substation data, and drastically lowering installation & maintenance costs and complexity through simpler wiring.

IMPACT OF COVID-19

The COVID-19 pandemic negatively impacted the market due to supply chain disruptions, which caused delays in manufacturing and project deployments. Deployment and expansion were severely impeded in the short term by lack of labor, supply chain disruptions that affected the availability of vital components including communication equipment and Intelligent Electronic Devices (IEDs), and project delays brought on by lockdowns. However, the pandemic also drew attention to the need for improved grid resilience and remote monitoring capabilities, which had a positive impact on long-term adoption as utilities analyzed the beneficial digital substations for facilitating remote operation, better diagnostics, and quicker reaction times to grid disruptions under trying conditions.

SEGMENTATION ANALYSIS

By Component

Hardware Component Dominates as it Enables Fundamental Data Acquisition and Control of Digital Systems

Based on component, the market is segmented into hardware, communication network, and others.

Hardware holds the major market share 61.14% in 2026 as the use of advanced sensors and IEDs for real-time data capture from the grid facilitates predictive maintenance and enhances grid stability, thus boosting market expansion. Moreover, the demand is boosted by the modernization of aging infrastructure with digital technologies to improve monitoring, control, and protection.

For communication networks, the demand is driven by the need for reliable and secure communication networks, such as hardware fiber optic communication networks and ethernet switches, for seamless data transfer between IEDs and control centers. Moreover, the adherence to strict cybersecurity regulations and protocols intensifies this demand.

Others mostly include software, services, and other components. Demand for this segment is driven by the growing need for software solutions such as SCADA systems, asset management tools, and advanced analytics platforms that enable efficient operations and predictive maintenance. The increasing complexity of digital substations drives demand for specialized services including installation, commissioning, and integration.

By Voltage

220-650 KV Dominates as it Supports Long-Distance Power Transmission and Grid Interconnections

Based on voltage, the market is segmented into low (upto 220 KV), medium (220-550 KV), and high (above 550 KV).

The medium voltage range (220-550 KV) dominates the market contributing 57.60% globally in 2026 because it facilitates grid interconnections and long-distance power transmission, which increases grid stability and power exchange. The demand for this voltage category is further driven by significant investment in modernizing transmission infrastructure with cutting-edge digital technology, especially in countries where the demand for energy is rising.

The low voltage (up to 220 KV) category is used to aid industrial facilities, distribution networks, and also in integration projects of renewable energy sources. It is used to provide smart grid features, optimize energy management, and increase grid resilience. As the use of renewable energy grows, these applications are expanding rapidly.

High voltage (over 550 KV) is essential for grid connectivity and large-scale, long-distance transmission. Investments in interregional power transfer projects and ultra-high-voltage transmission lines fuel the growing use of high-voltage digital substations. The demand for digital solutions is further fueled by the requirement for improved monitoring and control capabilities to ensure the stability and dependability of these vast grids.

By Application

Transmission Substation Dominates Due to High Demand for Automation and Monitoring in Transmission Sector

Based on application, the market is segmented into transmission substation and distribution substation.

The overall market share of transmission substations with a share of 66.53% in 2026 was higher owing to the criticality and high cost of the equipment used. Digital technology adoption is fueled by the requirement for sophisticated monitoring, control, and protection systems in transmission networks in order to guarantee grid stability and dependability at high voltage levels.

Demand for distribution substations is fueled by the significant growth of smart grids, the expansion of distributed power generation, and the requirement for more effective power delivery to final customers. Better voltage regulation, load management, and integration of renewable energy sources are made possible by digital substations in distribution networks, which boost the local grid's resilience and efficiency.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Utility Sector leads Due to Its Widespread Network in Transmission and Distribution Sector

Based on end-user, the market is segmented into utility, transportation, and commercial & industrial.

Utility is the dominating segment in the market with share 73.51% in 2026. The utility is the main end-user of digital substations as it maintains grid efficiency and dependability, and it is also one of the main adopters of digital substation technology. Investments in this industry are also being boosted by government regulations, aging infrastructure, and the requirement to incorporate renewable energy sources such as wind and solar. In line with their purpose, digital substations assist utilities in increasing operating efficiency, decreasing outages, and improving grid monitoring.

The electrification of transportation, such as metros, airports, and railroads, is raising demand for digital substations to guarantee a steady supply of electricity. Superior power distribution, control, and monitoring are made possible by digital technologies, which are essential for safe and effective operation, particularly as the use of electric vehicles increases.

The Commercial & Industrial (C&I) segment is expected to grow considerably over the forecast period. The need for improved power quality, energy economy, and operational resilience drives the growing demand for digital substations in this market. Data centers, manufacturing facilities, and other industries with vital equipment are adopting digital technology more frequently in an effort to meet power quality standards, cut down on downtime, and save energy expenses.

DIGITAL SUBSTATION MARKET REGIONAL OUTLOOK

The digital substation market share has been studied across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Grid Modernization and Increasing Data Centre Demand Drive Market in North America

Digital substations in North America are primarily driven by the growing need to update antiquated grid infrastructure and increase resilience to extreme weather. In order to improve grid visibility and speed up power restoration during outages, utilities in the area are making significant investments in digital technologies. Demand in the area is also being driven by the growing integration of data centers and renewable energy sources, supporting distributed generation, and controlling variable power flows.

In November 2022, Digital Realty and ComEd opened a new power substation at Digital Realty's data center campus in Franklin Park, Chicago. The four-acre substation, which is part of the Digital Realty property, will help the campus grow further.

U.S.

Cybersecurity Concerns and Governmental Support for Grid Resilience to Boost the U.S. Market

The U.S. is concentrating on fortifying its cybersecurity defenses and electrical grid. With the help of federal financing and regulatory encouragement, digital technologies including Advanced Metering Infrastructure (AMI) and remote monitoring systems are being used to update the substation infrastructure.

In November 2023, One Energy Enterprises' plug-and-play, fully digital substation in Findlay, Ohio, was commercially put into service after completing testing and energization. A 30 MVA transformer with Hitachi Energy's Coresense M10 real-time dissolved gas analyzer and condition monitoring system is part of the transmission-voltage substation. The U.S. market is projected to reach USD 1.71 billion by 2026.

Europe

Sustainable Energy Goals Driving Demand for Digital Substation Deployment in Europe

Europe's stringent environmental regulations are driving the expansion of digital substations and demand for renewable energy. The region's pursuit of a low-carbon energy system depends on these substations for controlling variable renewable energy sources and maximizing grid performance. The EU's emphasis on smart grids and cross-border energy trading further promotes digital substations.

In January 2025, UK Power Networks installed the U.K.'s first digital electricity substation in Maidstone, Kent, enabling it to communicate with other sites and optimize power distribution by sharing electricity where it is needed most during peak demand. This is the first substation to be upgraded with advanced communication technology that will pave the way for more distributed generators to connect to the network across the South East of England. The UK market is projected to reach USD 0.31 billion by 2026, while the Germany market is projected to reach USD 0.38 billion by 2026.

Asia Pacific

Asia Pacific Digital Substation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Need to Support Urbanization and Industrial Expansion Influencing Digital Substation Market

The current electricity infrastructure in the Asia Pacific region is under stress due to growing industrialization and energy consumption. Therefore, digital substations are essentially enhancing grid performance, reducing transmission losses, and ensuring a steady power supply which is crucial for economic development. The market's growth is also significantly influenced by government initiatives aimed at improving the power system and increasing energy security.

In June 2024, BHEL commissioned India's first digital substation, incorporating Indigenous 420kV Fiber Optical Current Transformers (FOCTs) and IEC61850-compliant Intelligent Electronic Devices (IEDs). This achievement is supported by BHEL's ultra-high voltage laboratory, a globally renowned facility that ensures the quality and reliability of its advanced transmission products. The Japan market is projected to reach USD 0.19 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

China

Government’s Focus on Power Grid Expansion and Smart Grid Technologies Boosting Demand for Digital Substations

China's market for digital substations is primarily driven by the government's huge investments in updating and enlarging the country's electrical grid. The government is focusing on smart grid technologies, renewable energy integration, and increased grid resilience, all of which need the use of digital substation technology. In November 2023, State Grid Corporation of China announced plans for significant investment in smart grid technologies, including digital substations, to support the country's energy transition. China market is projected to reach USD 2.11 billion by 2026.

Latin America

Increasing Demand for Electricity and Integration of Renewables to Drive Market Growth

The electrical infrastructure in Latin America is being updated to satisfy the growing demands of industry and urbanization for electricity. In this transition, digital substations are essential because they increase grid stability, reduce outages, and facilitate the use of renewable energy sources.

Middle East & Africa

Development of Energy Security is Driving Regional Market

Due to the region's increased industrialization and growing energy demand, digital substations are becoming more and more popular in the Middle East & Africa. As governments place a higher priority on updating antiquated grid infrastructure, enhancing energy security, and diversifying energy sources, these technologies are also increasingly indispensable. The deployment of digital substations is ultimately being driven by the need to improve grid efficiency and dependability in the face of difficult environmental circumstances. The first entirely digital high-voltage substation in Africa was put into service in November 2021 by General Electric (GE) Renewable Energy's Grid Solutions. It is situated in Thiès, Senegal, close to Dakar, the country's capital.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Competitive Landscape Driven by Innovation and Established Players

Globally, Hitachi Energy, GE Vernova, Siemens, Honeywell, and Eaton are some of the major players in the market. Due to the presence of these established players and some new companies, the digital substation market witnesses strong competition focusing on research and development to enhance their product offerings and gain a competitive edge. Moreover, key players are prioritizing innovative products and strategic alliances. Competition stems from the demand for advanced solutions, improved grid dependability, and adherence to changing industry regulations.

Some other key players in the market include Schneider Electric, NR Electric, Emerson Electric, and others. Some of the emerging and regional players are focusing on scalable, modular substation designs for regional demands and requirements. For instance, in March 2025, Schneider Electric re-launched the upgraded PowerLogic T500, which is the next-generation Sage offer successor, designed to satisfy the demanding needs of contemporary utility markets, especially in the U.S. These launch was reintroduced along with the one digital grid platform of the company.

List of Key Digital Substation Companies Profiled

- ABB (Switzerland)

- Siemens (Germany)

- GE Vernova (U.S.)

- Schneider Electric (France)

- Eaton Corporation (Ireland)

- Hitachi Energy (Japan)

- NR Electric Co. Ltd.(China)

- Cisco Systems Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Toshiba Energy Systems & Solutions (Japan)

- Belden Inc. (U.S.)

- SATEC Ltd. (Israel)

- Powell Industries (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: The Lanang Substation, the 30th distribution substation overall and its sixth entirely digital facility, was opened by Davao Light and Power Co., Inc. to support power service in the quickly growing Lanang district. The substation's cutting-edge technology encourages sustainable energy habits and offers greater dependability.

- January 2024: Hitachi Energy unveiled the SAM600 3.0 Process Interface Unit (PIU), the most recent development in its digital substation technology. Transmission utilities can speed up the switch to digital substations with the aid of this cutting-edge gadget. The SAM600 3.0 is a one-box, modular solution that combines the capabilities of three different units to serve as a unit for merging.

- May 2022: ABB India expanded its factory in Vadodara, Gujarat, dedicated to manufacturing digital substation products and digital systems; the new facility, situated within ABB India's largest manufacturing campus, will serve both domestic and international markets in over 50 countries.

- May 2021: ABB and UK Power Networks (UKPN) partnered on a new digital substation protection and control project that will help the power grid integrate more renewable energy sources. Using 5G telecommunications to facilitate communication between medium voltage substations across UKPN's network, the project intends to use ABB's technology to deploy a software-defined wide area protection system.

- January 2020: Siemens and CenterPoint Energy collaborated to increase grid resilience by installing a SIPROTEC digital substation with Electromagnetic Pulse (EMP) mitigation at a CenterPoint Energy substation. This shielded substation control house provides an affordable way to guarantee grid operational continuity by guarding against EMP and other threats.

Investment Analysis and Opportunities

- Globally, government and utility key players are collaborating and investing to modernize aging grid infrastructure with smart grid technologies, such as digital substations, advanced power equipment, and upgraded systems. Moreover, investment in transmission and distribution infrastructure includes digitalization, which eventually is expected to create demand for digital substations in both developing and developed economies.

- In 2024, a group of 39 prominent utility companies that serve more than 327 million consumers across the world, which are also members of the Utilities for Net Zero Alliance (UNEZA) alliance, announced their commitments to invest more than USD 116 billion yearly in grid infrastructure. Global power grid infrastructure upgrades and clean electricity generation are the intended uses of this investment. Nearly 48% of this significant investment will be used to update transmission and distribution infrastructure, as the firms aim to increase their renewable energy portfolios by 2.6x by 2030.

REPORT COVERAGE

The global digital substation market report delivers a detailed insight into the market and focuses on key aspects such as the leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.05% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Voltage

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 6.48 billion in 2025.

The market is likely to grow at a CAGR of 15.05% over the forecast period (2026-2034).

The market size of Asia Pacific stood at USD 2.48 billion in 2025.

Enhanced grid reliability and resilience through advanced monitoring and control, along with the integration of renewable energy sources and distributed generation, are the key factors driving the market growth.

Some of the top players in the market are ABB, Siemens, Schneider Electric, and others.

The global market size is expected to reach USD 22.61 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us