Document Scanner Market Size, Share & Industry Analysis, By Type (High-speed Document Scanner, Portable Document Scanner, and Flatbed Document Scanner), By Application (Financial Institution, Government, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

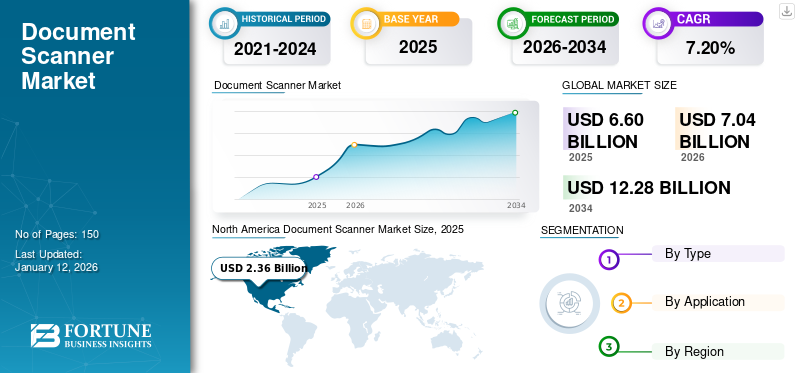

The global document scanner market size was valued at USD 6.60 billion in 2025. The market is projected to grow from USD 7.04 billion in 2026 to USD 12.28 billion by 2034, exhibiting a CAGR of 7.2% during the forecast period. North America dominated the global market with a share of 35.70% in 2025.

These scanners convert paper documents and text into digital data. Reduces the effort and time required to convert data from printed materials to digital data storage, such as the cloud. Various companies use these scanners to scan important documents to reduce costs and increase productivity. These scanners allow you to store and retrieve documents online, reducing storage costs, and increasing work efficiency. The utilization of document scanners in various industries is expected to boost the market.

The global COVID-19 pandemic have been unprecedented and disruptive, with the market experiencing higher-than-expected demand across all regions compared to pre-pandemic levels. As document scanner electronically copies the contents of a printed page and saves it as a text file on your computer. This feature helped to grow market in the pandemic. Small businesses use scanners to digitize legal documents, correspondence, business cards, and other printed materials to save time on data entry. Owing to the above-mentioned factors, the market has witnessed positive growth during the COVID-19 pandemic.

Document Scanner Market Trends

Cloud and AI Integration, along with the Development of Portable Scanners to Propel the Market Growth

Document scanners are increasingly integrated with cloud-based document management systems, enabling seamless storage, retrieval, and sharing of digitized documents. This trend allows for greater accessibility and collaboration among remote teams. With a direct internet connection, users can scan documents or images with a push of the buttons on the printer's control panel and then share scanned files to online cloud storage accounts without the need for a computer.

Cloud-based document management is emerging as a crucial solution for enterprises aiming to digitize and secure their important documents. With the rapid shift towards digitization, cloud computing presents a flexible and scalable platform to manage, store, and organize documents efficiently. AI and machine learning technologies are being utilized to automate document processing tasks, such as text recognition, classification, and data extraction. This leads to increased efficiency, accuracy, and speed in document workflows.

Download Free sample to learn more about this report.

Document Scanner Market Growth Factors

Surging Digitalization Initiatives Globally to Boost the Market Growth

Increasing government and corporate initiatives globally to digitize documents and records drive the demand for document scanners. This is especially prevalent in sectors, such as healthcare, government, and BFSI, as these sectors rely heavily on paper-based processes. For instance,

- The insurance industry is considered one of the most paper-intensive industries and deals with more than 100 million documents each year. In addition, one study revealed that the average 1,500-bed hospital prints more than 8 million pages every month.

According to the U.S. Chamber of Commerce Technology Engagement Center, the federal government of the U.S. uses 9,858 unique forms to access various services and processes over 106 billion forms every year. The scanners play a vital role in the process of digitalization by enabling the conversion of paper-based documents into digital format, which is essential for integrating paper documents into digital workflows and systems.

RESTRAINING FACTORS

Supply Chain Disruptions and Security Concerns to Hamper the Market Growth

The market relies on a complex global supply chain for sourcing components, manufacturing, and distribution. Disruptions such as natural disasters, trade disputes, or global pandemics can lead to delays in production, shortages of critical components, and logistical challenges in supply chain management. Document scanners contain various components, including sensors, imaging modules, motors, and electronics. Shortages or fluctuations in the availability of these components due to factors, such as high demand, supply chain disruptions, or geopolitical tensions can impact the production and availability of the scanners.

Document scanners, especially high-quality models with advanced features, can be expensive to purchase. This cost can be a barrier for small and medium-sized enterprises or organizations with limited budgets.

Document Scanner Market Segmentation Analysis

By Type Analysis

High-Speed Scanners to Dominate Market Owing to Increased Need for Paperless Workflows and Electronic Document

Based on type, the market is segmented into high-speed document scanner, portable document scanner, and flatbed document scanner.

Among these, high-speed scanners dominated the market with a share of 44.87% in 2026 and are expected to grow at the highest CAGR during the forecast period. As the need for high-speed document increased for scanner digitizes contracts, thick documents, small plans, diagrams, and even delicate antiques the market for high-speed documents also increased. These machines typically process legal-size paper or paper sizes 11 inches by 17 inches. Many companies in the market are launching these document scanners, which has increased the use of high-speed scanners. For instance,

- in October 2022, Digital Check Co., Ltd. introduced TellerScan TS250 and exhibited it at a joint booth with Globalis at Gitex Global 2022. This latest high-speed check scanner for the financial industry is aimed at teller use and remote capture of large deposits. The model is designed as a successor to the company's best-selling multi-feed device, the TellerScan TS240, which has sold thousands of units in the past.

Flatbed scanners will continue to grow as businesses and consumers become more environmentally conscious. The need for paperless workflows and electronic document management systems drives the adoption of flatbed scanners.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Usage of Document Scanner for financial services operations Drives the Financial Institution Segment Growth

Based on application, the market is divided into financial institution, government, and others (libraries, design studios, and archival facilities)

Among these, the financial institution segment dominated the market with a share of 43.07% in 2026 and is expected to grow at the highest CAGR during the forecast period. In many countries, such as India, paper is still used in many financial services operations. In numerous cases, organizations in this field are looking for approaches that handle dynamic, physically executed processes. This may lead to an increase in the global market during the forecast period. Various documents related to loan applications, account information, and transaction forms have to be managed by the staff of the BFSI department. As the number of documents increases, it becomes increasingly difficult for businesses to categorize and store important documents. This also increases the chances of forms being submitted or lost due to human error. Thus, document scanners help them maintain proper records, which can contribute to document scanner market growth.

The market is growing in government due to its efforts to digitize public services and improve administrative procedures. These scanner helps the government sector in digitizing documents, improve accessibility, reduce paperwork, and simplify government processes. Thus, the government will grow considerably in the upcoming years.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America Document Scanner Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.36 billion in 2025 and USD 2.55 billion in 2026. North America is expected to hold the highest document scanner market share owing to the rising penetration of core technologies, such as OCR (Optical Character Recognition), ICR (Intelligent Character Recognition), and the presence of technology giants in the region. Further, the regional growth due to the demand for efficient document management solutions, digitization trend, increasing adoption in government, businesses, and education sectors, along with advancements in scanning technology, fostering improved productivity and streamlined workflows. The U.S. market is projected to reach USD 1.99 billion by 2026.

Asia Pacific is expected to witness maximum growth in the global market during the forecast period. With economic development and increasing per capita income in emerging markets, especially in the Asia Pacific region, new potential opportunities are expected. This led to significant industrial growth and the expansion of the entire manufacturing sector. Increased investment by manufacturers in technology and research and development to produce innovative and effective technological devices is likely to create new market development prospects throughout the forecast period. The Japan market is projected to reach USD 0.43 billion by 2026. The China market is projected to reach USD 0.55 billion by 2026. The India market is projected to reach USD 0.2 billion by 2026. For instance,

- In June 2022, a new joint book was published focused on the technical and legislative tools governments are using to transition to paperless cross-border trade and improve the efficiency of import and export operations. During the event, the World Trade Organization, in collaboration with the United Nations Economic and Social Commission for Asia Pacific and the United Nations Commission on International Trade Law, announced "Paperless Across Borders.

The European market is growing considerably due to European businesses and governments' increased adoption of digital processes that necessitate efficient document scanning solutions. Emphasis on sustainability encourages companies to digitalize paper documents, leading to higher demand for document scanning solutions in European countries such as the U.K., Germany, France, and Benelux. The UK market is projected to reach USD 0.39 billion by 2026. The Germany market is projected to reach USD 0.38 billion by 2026.

South America and the Middle East & Africa will grow in the upcoming years as small and medium-sized enterprises increasingly invest in digital technology to streamline operations, reduce costs, and improve productivity. For instance,

- According to the article of the Brazilian Agency for Industrial Development (ABDI), Brazilian micro and small enterprises have made significant advancements in terms of digital maturity, with an average score of 48.25 in 2023.

Thus, the above factors are beneficial to the growth of the global document scanner market.

KEY INDUSTRY PLAYERS

Key Players Adopting Partnership Strategies to Strengthen their Market Positions

The prominent players in the market, such as Canon, Inc., Seiko Epson Corporation, HP, Inc., Brother Industries Ltd., and PFU Limited, are expected to dominate the market. These players are focused on offering scalable and multiple document scanner options to cater to the changing user requirements. Similarly, these players are adopting various strategies, such as product launches and partnerships, to continue their dominance in the upcoming years. For instance,

- February 2024: Seiko Epson Corporation unveiled two new document scanners, DS-C330 and DS-C490, in India. These scanners are highly suitable for compact spaces and handle diverse media types, such as 5mm thick booklets and passports.

List of Top Document Scanner Companies:

- Canon, Inc. (Japan)

- Seiko Epson Corporation (Japan)

- HP, Inc. (U.S.)

- Brother Industries, Ltd. (Japan)

- Xerox Corporation (U.S.)

- Plustek, Inc. (Taiwan)

- Kodak Alaris, Inc. (U.K.)

- PFU Limited (Ricoh Company, Ltd. (Japan)

- Avision, Inc. (Taiwan)

- Panasonic Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: PFU Limited announced two new high-performance production scanners, fi-8930 and RICOH fi-8950, in the U.S. These scanners boast an advanced image processing engine and clear Image Capture technology for high resolution and superior image quality.

- December 2023: Canon Marketing Philippines Inc. launched two compact scanners, imageFORMULA DR-M140II, and imageFORMULA DR-M1060II, for various sectors, such as BFSI, education, and government. These devices feature cutting-edge processing technology for clear images from faint text originals and are designed for up to 7,000 scans daily.

- March 2023: Brother Industries, Ltd. won "the 2023 Scanner Pick Awards" for its document scanners (ADS-4900W and ADS-4700W) awarded by Keypoint Intelligence, an intelligence organization in the U.S.

- January 2023: Kodak Alaris Inc. unveiled two new document scanners, The Kodak E1030, and E1040, for small and medium-sized enterprises (SMEs), branch offices, admin desks, and businesses with remote workers. These scanners are capable of scanning 40 pages per minute and can handle various types of pages, including hard cards.

- May 2022: HP Inc. announced the launch of the new HP ScanJet Pro, which includes HP’s advanced workflow scanner software. The ScanJet series consists of four new advanced scanners that simplify scanning for a better digital workplace experience.

REPORT COVERAGE

The study on the market includes prominent areas across the world to help the user get a better knowledge of the industry. Furthermore, the research provides insights into the most recent market trends and an analysis of technologies that are being adopted quickly across the world. It also emphasizes some of the growth-stimulating factors and restrictions, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.2% from 2025 to 2032 |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 12.28 billion by 2034.

In 2025, the market stood at USD 6.60 billion.

The market is projected to record a CAGR of 7.2% during the forecast period.

By type, the high-speed document scanner segment led the market.

Digitalization Initiatives across the globe to boost market growth

Canon, Inc., Seiko Epson Corporation, HP, Inc., Brother Industries Ltd., and PFU Limited are the top players in the market.

North America is expected to hold the highest market share.

By application, the financial institution is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us