Dry Type Transformer Market Size, Share & Industry Analysis, By Technology (Cast Resin, Vacuum Pressure Impregnated), By Phase (Single-Phase, Three-Phase), By Rating (Less than 5 MV, 5 MVA to 30 MVA, More than 30 MVA), By Installation (Outdoor, Indoor), By Application (Industries, Inner-City Substations, Indoor and Underground Substations, Renewable Generation, Others) and Regional Forecast, 2026-2034

Dry Type Transformer Market Size

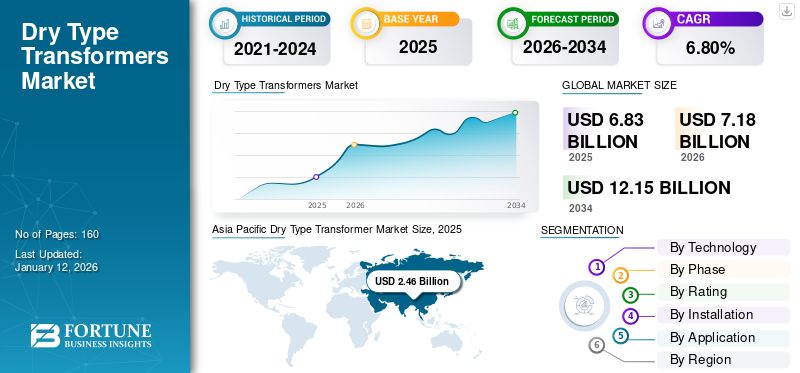

The global dry type transformer market size was valued at USD 6.83 billion in 2025 and is projected to grow from USD 7.18 billion in 2026 to USD 12.15 billion by 2034, exhibiting a CAGR of 6.80% during the forecast period. Asia Pacific dominated the global market with a share of 36.02% in 2025. The dry type transformer market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.64 billion by 2032, driven by the focus on renewable energy integration and grid modernization.

A dry-type transformer is an electrical transformer that uses solid insulation materials, such as epoxy resin and fiberglass to insulate the windings and core, thereby eliminating the need for liquid dielectric materials, such as oil. These transformers are designed to provide electrical isolation and voltage transformation in various applications. They are called "dry-type" as they do not rely on a liquid coolant or insulating oil for their operation. Instead, they dissipate heat generated during operation through natural convection or forced air circulation. Dry-type transformers are known for their environmental friendliness, fire resistance, and suitability for a wide range of indoor and outdoor installations. There are two types of transformers which come in different phases, such as single phase and three phase which have various uses and applications. These factors are expected to boost the market growth in the coming years.

The COVID-19 pandemic disrupted the global supply chains, causing delays in the production and delivery of electrical equipment, including dry type transformers. Manufacturers faced challenges in sourcing materials and components, which led to production slowdowns and increased costs. Many manufacturers relied on a complex network of suppliers and sub-suppliers to source materials and components necessary for building these transformers. Many factories across the globe temporarily shut down or reduced their production capacity to comply with lockdowns, social distancing measures, and workforce shortages. This led to delays in the supply of critical components. With disruptions in the supply of important materials and components, manufacturers of these transformers faced challenges in maintaining their production schedules. This resulted in production delays and potential backlogs.

Dry Type Transformer Market Trends

Increasing Adoption of Renewable Energy to Propel Market Growth

The increasing adoption of renewable energy sources has had a positive impact on the market for dry type transformers. Renewable energy sources, such as wind and solar power often require transformers to step up voltage levels for efficient electricity distribution and transmission. Dry type transformers are commonly used in these applications due to their environmental friendliness and safety features, making them a preferred choice in renewable energy projects.

For instance, In October 2022 Hitachi Energy India Limited (Hitachi Energy) has received an order from NTPC Renewable Energy Limited (NTPC REL) to supply power transformers for its upcoming 4.75 GW renewable energy park in Gujarat. This is part of India's largest solar park, spread over 72,600 hectares in Kutch. This will increase the adoption of renewable energy.

Latest Innovations in Transformers and Its Components to Propel Market Growth

Manufacturers are focusing on enhancing the efficiency of dry type transformers. This involves the use of advanced materials, better core designs, and improved winding techniques to reduce energy losses and make them more attractive to energy-conscious customers. New features, such as use of fire-resistant materials are making transformers safer and more reliable, creating more demand for them and accelerating the market growth.

For instance, In June 2023 Hitachi showcased its latest innovations in transformer insulation and components, offered interactive sessions with experts, and hosted a product launch of the latest addition to its implementation portfolio.

Download Free sample to learn more about this report.

Dry Type Transformer Market Growth Factors

Increasing Demand for Electricity to Drive the Dry Type Transformer Market Growth

As the global population continues to increase, especially in urban areas, the demand for electricity rises. Urbanization leads to the development of residential, commercial, and industrial infrastructure, all of which require reliable electricity supply. Dry type transformers play an important role in effectively distributing electricity in these urban environments. Industrialization is a major driver of electricity demand. Industries, such as manufacturing, mining, and construction, need substantial amounts of electricity to power their operations. As countries undergo economic development and industrialize further, the demand for electricity increases, thereby driving the demand for transformers, comprising dry type transformers, to ensure efficient power distribution.

Thus, the increasing demand for electricity, driven by factors, such as population growth, urbanization, industrialization, technological advancements, renewable energy integration, and infrastructure renewal, is a key driver for the growth of the dry type transformer market. As per the latest update in December 2023 by the U.S. Energy Information Administration, the U.S. electricity consumption in 2022 was about 3.2% higher than in 2021. In 2022, retail electricity sales to the residential sector were about 2.6% higher than in 2021, and retail electricity sales to businesses were about 4.7% higher than in 2021. Thus, the increasing demand for electricity drives the dry type transformer market growth.

Upgrade of Aging Power Distribution and Transmission Infrastructure to Accelerate Market Development

Modernization of the ageing power distribution and transmission systems is expected to drive the growth of the market. This trend is increasing due to the rising domestic electricity demand and rapid industrialization, which has led to the expansion of distribution and transmission networks. The increasing demand for modernized and intelligent power distribution infrastructure will likely create numerous market opportunities. In addition, using the vacuum pressure impregnation technology increases the penetration of transformers in moisture-prone areas, which is expected to increase the product demand.

For example, Canada and the U.S. have quite an old infrastructure of transmission lines that are over 50 years old. To cater to the rising electricity demand, Canada needs to upgrade its existing infrastructure while substantially increasing the capacity of the grid. By 2050, the total investment is expected to reach more than USD 1.1 trillion.

RESTRAINING FACTORS

High Initial Costs to Hinder Market Growth

One of the primary challenges associated with these transformers is their higher upfront cost as compared to that of oil-filled transformers. It requires specialized insulation materials to ensure proper electrical insulation and thermal performance. These materials are often more expensive than the oil and paper insulation used in oil-filled transformers. The design and construction of these transformers can be more complex than those of their oil-filled counterparts. These transformers may include features, such as epoxy resin casting or Vacuum Pressure Impregnation (VPI), which require precision engineering and specialized manufacturing processes.

Dry Type Transformer Market Segmentation Analysis

By Rating Analysis

Development of Advanced Rotary Bit Technologies Drove the Use of 5 MVA to 30 MVA Dry Type Transformers

Based on rating, the market is segmented into less than 5 MVA, 5 MVA to 30 MVA, and above 30 MVA.

The 5 MVA to 30 MVA segment held a larger market share in 2023. The development of advanced rotary bit technologies propelled their adoption in the mining industry. Manufacturers are introducing innovations, such as improved cutting structures, enhanced materials, and better designs to make rotary bits more effective and efficient for mining applications. Rotary bits can offer higher drilling speeds and better penetration rates in certain geological formations. Mining companies may opt for these bits to increase productivity and reduce overall drilling costs.

By Installation Analysis

Due to the Initiation of Advanced Product Design Indoor Transformer Will enhance the market share of this segment

Based on the Installation the market is segmented into Indoor and Outdoor. The Indoor type segment is leading the global market with a share of 62.40% in 2026. Indoor types are specifically designed to be installed indoors, typically in enclosed spaces, such as utility rooms, substations, or industrial buildings. They are constructed to be compact and often have features, such as noise reduction to minimize the impact of background noise on the indoor environment. Indoor transformers do not require additional protective enclosures or housing as they are designed for a controlled and sheltered environment.

On the other hand, the outdoor transformers are designed for installations in open-air environments where they are exposed to weather conditions, such as rain, snow, and sunlight.

By Phase Analysis

Expansion of Long and Medium Route Transmission Systems to Propel Demand for Three-Phase Transformer

Based on phase, the market is segmented into single and three phases.

A three-phase has three primary and three secondary windings, accommodating three AC waveforms with a 120-degree phase difference between them. It is estimated that the three-phase type segment will dominate the market due to widespread migration of people to the suburbs and favorable government norms related to expanding long-distance and medium-range transmission networks. In addition, the ongoing demand for electricity, driven by the increasing tendency of energy suppliers to expand the electricity network infrastructure, will boost the segment’s progress. The three-phase segment accounting for 54.46% market share in 2026

A single-phase transformer has two primary and two secondary windings, allowing it to handle a single Alternating Current (AC) waveform. Single-phase transformers are commonly used in residential and light commercial settings for applications, such as lighting, appliances, and small machinery.

By Application Analysis

Demand for Dry Type Transformers to Rise in Industries Due to Growing Use in Oil & Gas Sector

Based on application, the market is divided into industries, inner-city substations, indoor & underground substations, renewable energy generation, and others. The industries segment is the largest segment with a share of 30.50% in 2026, due to the product’s widespread use in oil & gas, chemical, shipping, railway, renewable energy generation, and other fields. Transformers are crucial for oil and gas plants to maintain a stable and dependable power supply, which is necessary for safe and efficient operations. In addition, major manufacturers in this industry are focusing on supplying specialized transformers that are suitable for various applications.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Cast Resin Segment Is Projected To Dominate The Market Owing to Its Use in Various Applications

Based on technology, the market is bifurcated into cast resin and vacuum pressure impregnation technologies.

The cast resin segment holds the largest market with a share of 70.33% in 2026. The cast resin transformer technology segment is expected to experience a significant spike as this technology is majorly used in areas, such as general buildings, wind turbines, industrial plants, solar parks, and commercial areas, including airports and railway stations. In this type of transformer, the current-carrying part consists of a core, and the windings are encapsulated inside in a liquid resin cast.

Furthermore, the vacuum pressure impregnation technology segment is expected to record a significant CAGR during the forecast period. The segment’s growth is due to various factors, such as no risk of explosion or fire, no leaking liquids, and excellent mechanical strength.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Dry Type Transformer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific holds a significant share of the global market with a dominating weightage. Due to the rising electricity demand adjoined by the replacement of conventional electrical grid lines, the region will project high demand for the product. In addition, increasing investment in the electrical infrastructure will augment the market growth. For instance, in January 2023, PATRIZIA infrastructure is projecting between USD 500 million and USD 1 billion for its new flagship APAC-focused sustainable infrastructure fund. The Japan market is projected to reach USD 0.26 billion by 2026, the China market is projected to reach USD 0.36 billion by 2026, and the India market is projected to reach USD 0.86 billion by 2026.

North America

North America is another major market owing to the rising demand for restructuring and refurbishing the conventional grid infrastructure supported by the digitalization of power utilities. The U.S. market is projected to reach USD 1.72 billion by 2026.

Europe

Europe places a high emphasis on energy efficiency and environmental sustainability, it an attractive choice. Germany, France, and the U.K. are significant markets, with growth driven by industrial automation and renewable energy integration. The UK market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

Latin America

Latin America exhibits a potential growth with investments in infrastructure and power generation projects. Brazil, Mexico, and Argentina are key markets, with an increasing focus on energy efficiency and safety standards. Stringent emission standards and regulations will also promote the use of environmentally friendly transformers.

Middle East & Africa

The Middle East & Africa regions see growth in the adoption of these transformers, driven by expanding utility and industrial sectors.

Key Industry Players

ABB to Fortify Its Market Position by Introducing Hybrid Products

The global market is highly competitive, with multiple players active across different distribution channels. Industry participants are emphasizing the introduction of new hybrid transformers equipped with new technologies to increase customer reach. Additionally, they are entering merger and acquisition deals to expand their technological horizons.

For example, ABB, one of the world's leading technology companies, is introducing hybrid equipped with new technologies to expand its presence in the industrial sector. In November 2018, the company introduced a vacuum-moulded coil transformer, the most technologically advanced design for extreme/harsh conditions. In addition, the product was manufactured and designed to offer flexibility for specific requirements and make optimal use of space. These transformers are suitable for catering to the strict parameters of an electrical system and designed for an almost maintenance-free process.

LIST OF TOP DRY TYPE TRANSFORMER COMPANIES:

- Schneider Electric (France)

- Hammond Power Solution (Canada)

- Schneider Electric (France)

- Siemens (Germany)

- Eaton (Ireland)

- Crompton Greaves Consumer Electricals Limited (India)

- GE (U.S.)

- Hyosung Heavy Industries (South Korea)

- Kirloskar Electric Co. Ltd. (India)

- Voltamp Transformer Limited (India)

- ABB (Switzerland)

- Bharat Heavy Electricals Limited (India)

- Fuji Electric Co., Ltd. (Japan)

- Hanley Energy (Ireland)

- Tbea Co. Ltd. (China)

- Virginia Transformer Corp. (U.S.)

- KOTSONS (India)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 - Advanced Materials experts from Huntsman worked with TBEA Group, a global leader in the production of power transmission and distribution equipment with an annual transformer capacity of 260 million kVA, on an Outdoor Dry Type Transformer (DDT). DDT claims to have the largest capacity and highest voltage in the world. It passed the final test and was officially put into operation at the end of April.

- January 2023 – Trafo Power Solutions specially developed dry-type transformers with protection class (IP) enable the use of dry-type transformers outdoors despite high levels of dust and moisture.

- April 2022 - Hitachi Energy developed and supplied a unique Vacuum Cast Coil (VCC) dry type transformer specifically designed for floating offshore wind turbines. This transformer is a compact, moisture-proof solution that is best suited for operation even with heavy and frequent vibrations.

- December 2021 – Jiangshan Scotech Electrical Co., Ltd. announced that a unit of 1600kVA-11/6.6kV dry type transformer was sent to South Africa. The transformer claims to have advanced design and manufacturing technology, rational structure & advanced material formation, strict & perfect testing technology. This transformer has a thin cast resin insulation.

- June 2021 - Hitachi ABB Power Grids launched groundbreaking traction transformers for sustainable mobility. The RESIBLOC Rail 25 kV and Natural Cooling Effilight traction transformers are designed to improve reliability and reduce the total cost of ownership.

REPORT COVERAGE

The report offers an in-depth analysis of the market. It provides details on the adoption of dry type transformers across several regions. Information on trends, drivers, opportunities, threats, and restraints of the market can further help stakeholders gain valuable insights into the market. The report offers a detailed analysis of the competitive landscape by presenting information on the key players in the market, along with their strategies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology , By Phase, By Rating, By Installation, By Application, and By Region |

|

Segmentation |

By Technology

By Phase

By Rating

By Installation

By Application

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was valued at USD 7.18 billion in 2026.

The global market is projected to record a CAGR of 6.80% over the forecast period.

Asia Pacific dominated the global market with a share of 36.02% in 2025.

Based on application, the industries segment holds a dominating share of the global market.

The global market size is expected to be worth USD 12.15 billion by 2034.

Higher adoption of environmentally friendly transformers will propel the market growth.

Hammond Power Solution, Siemens, and Eaton, among others, are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us