Electric Vehicle Powertrain Market Size, Share & Industry Analysis, By Vehicle Type (Two Wheeler, Three Wheeler, Microcars, Passenger Vehicle (Hatchback/Sedan and SUV), and Commercial Vehicle (Light Duty Vehicle & Medium & Heavy Duty Vehicle)), By Product Type (Motor (Motor Stator, Rotor, Shaft and Bearing, Permanent Magnet, Casing and Wiring & Connectors), Traction Inverter (IGBT/SiC Power Module, Microcontroller, Sensing Element)), & On-Board Charger), By Propulsion Type (BEV and PHEV), By Motor Power Rating (Below 50 KW, 50 kW to 250 kW, and Above 250 kW), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

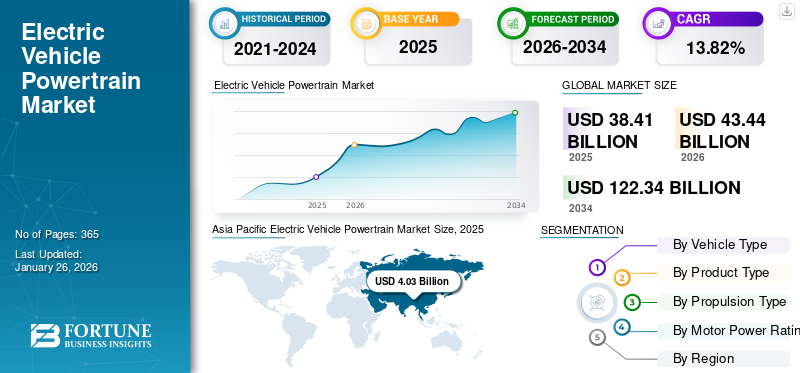

The global electric vehicle powertrain market size was valued at USD 38.41 billion in 2025 and is projected to grow from USD 43.44 billion in 2026 to USD 122.34 billion by 2034, exhibiting a CAGR of 13.82% during the forecast period. Asia Pacific dominated the electric vehicle powertrain market with a market share of 5.47% in 2025. The global market is witnessing significant expansion due to increasing demand for sustainable transportation and advancements in battery and motor efficiency. Market trends include the adoption of silicon carbide inverters, the development of high-voltage architectures, and the integration of e-axles, all aimed at improving performance.

Electric Vehicle Powertrain Market Overview

Market Size & Share:

- 2025 Market Value: USD 34.03 billion

- 2026 Estimate: USD 38.40 billion

- 2034 Forecast: USD 94.67 billion

- CAGR (2026–2034): 13.82%

- Top Region: Asia Pacific (5.47% share in 2025)

- Top Vehicle Segment: Passenger Vehicles

- High-Growth Segment: Electric Two-Wheelers & LCVs

Key Market Trends and Drivers:

- Design-to-Cost Manufacturing: Automakers are optimizing powertrain architecture to reduce cost and complexity (e.g., Tesla’s gigacasting, BYD’s in-house systems).

- Native EV Platforms: Purpose-built EV architectures improve space, safety, and performance (e.g., Minda-Flash partnership in India).

- Silicon Carbide Integration: Next-gen traction inverters using SiC enhance energy efficiency and reduce weight.

- Government Mandates: Stringent emissions regulations (EU ICE ban by 2035, ZEV programs) are accelerating EV powertrain innovation.

- Fuel Cost Pressure: Rising global fuel prices make EVs a cost-effective choice, increasing EV ownership across regions.

Market Challenges:

- Charging Standard Fragmentation: Lack of unified charging protocols limits cross-border interoperability.

- High Battery Costs: Battery packs account for up to 40% of EV costs, delaying mass adoption.

- Aftermarket Limitations: New entrants struggle to scale service and repair networks for EV-specific components.

The electric vehicle powertrain is the core system that converts electrical energy from the battery into mechanical motion to drive the growth of the electric vehicle forward. It consists of key components such as electric motor, inverter, battery pack, and transmission, all working together to ensure seamless power delivery. Unlike traditional ICE powertrains, EV systems offer higher efficiency, instant torque, and fewer moving parts, resulting in reduced maintenance needs. As electrification advances, innovations in battery technology and motor efficiency continue to enhance EV powertrain performance.

Key players such as Tesla, Bosch, and ZF are investing in next-gen powertrain technologies. Strategic mergers and collaborations, such as Schaeffler-Vitesco, are further shaping the competitive landscape.

During the COVID-19 pandemic, the market faced severe disruptions due to factory shutdowns, supply chain bottlenecks, and semiconductor shortages. However, post-pandemic recovery saw a surge in EV demand, driven by government incentives and a renewed global focus on clean energy. In response, automakers accelerated their electrification plans, leading to increased investment in battery technology and powertrain innovation.

Electric Vehicle Powertrain Market Trends

Design to Cost Approach and Building a Native Platform for EVs are the Latest Market Trends

The Design to Cost (DTC) approach focuses on designing and manufacturing electric powertrain components and systems at the lowest possible cost while maintaining performance and quality. Automakers and powertrain manufacturers are shifting to a cost-driven design philosophy, focusing on reducing material usage, manufacturing complexity, and operational costs. For instance, Tesla’s gigacasting technology reduces the number of parts required for the vehicle’s body frame, thereby cutting manufacturing costs and simplifying assembly. BYD’s in-house production of batteries and motors allows better control over costs and improves supply chain efficiency.

- For example, in December 2024, TELO announced new pricing and trim packages for its EV powertrain, emphasizing cost reduction through efficient design and localized manufacturing. By optimizing component integration, the company aims to make high-performance battery electric vehicle bev more affordable while maintaining quality and innovation.

A native EV platform is a vehicle architecture that allows better integration of the battery pack and electric drivetrain, enhancing vehicle handling and safety, maximizing interior space and passenger comfort, increasing vehicle range, and reducing powertrain load.

- In January 2025, Minda Corporation announced a partnership with Flash Electronics to co-develop an advanced EV platform, focusing on localized production of key components. This collaboration aims to enhance India’s EV ecosystem by integrating innovative powertrain and electronic solutions, supporting the industry’s shift toward sustainable mobility.

Download Free sample to learn more about this report.

MAREKT DYNAMICS

MARKET DRIVERS

Stringent Emission Regulations and Rising Fuel Prices To Drive the Market Growth

Stringent emission regulations are pushing automakers to transition from internal combustion engines to electric powertrains. Governments worldwide are implementing strict carbon reduction targets, phasing out gasoline-powered vehicles, and providing financial incentives to promote EV adoption. Regulatory mandates, such as the ZEV requirements in California and the European Union’s ban on new ICE vehicles by 2035, are accelerating investments in advanced EV powertrain technologies.

- According to the European Environment Agency (EEA) report on electric vehicles, GHG emissions of electric vehicles evs were about 17-30% lower than those of petrol and diesel cars. Additionally, by 2050, the life-cycle emissions of a typical electric vehicle could be cut by at least 73%.

Rising fuel prices and fluctuating global oil markets are making EVs a more cost-effective alternative to gasoline and diesel vehicles. Higher fuel costs have increased the total costs of ownership for ICE vehicles, while electricity prices remain more stable. Expanding charging infrastructure and incentives for fleet electrification by companies such as Amazon and Uber are further driving demand for EV powertrains. For instance, charging a Tesla Model 3 at home costs approximately USD 0.05 to USD 0.10 per mile, whereas fueling an ICE vehicle costs USD 0.12 to USD 0.20 per mile at current fuel prices.

- A T&E analysis of household electricity prices in EU capitals and weekly fuel prices showed that, as of September 2022, driving 100 kilometers with a petrol car was on average 80% more expensive and with a diesel car 50% more expensive than driving an average electric car. Charging at home costs about USD 7.50 for 100 kilometers,

MARKET RESTRAINTS

Lack of Standardized Charging Infrastructure to Restrain Market Growth

The absence of a globally unified and standardized EV charging infrastructure presents significant challenges to the adoption of electric powertrains, affecting electric vehicle powertrain market growth. Different regions and automakers have adopted varying charging standards, leading to fragmented charging infrastructure. The lack of compatibility between charging standards creates inconvenience for EV owners and limits cross-border travel. For instance, the Nissan Leaf (CHAdeMO) cannot directly access CCS charging stations in Europe without an adapter, reducing charging accessibility and flexibility.

- According to J.D. Power’s 2024 study highlights, user satisfaction with slower Level 2 chargers is declining, while reception to fast chargers is gradually improving. However, many EV owners still face dissatisfaction over long charging times and unreliable stations. Nearly one in five EV users have encountered out-of-service chargers or longer wait times, negatively impacting the overall charging experience.

The higher initial purchase cost of electric vehicles compared to internal combustion engine (ICE) vehicles acts as a significant barrier to mass-market adoption and limits powertrain market expansion. Batteries alone account for 30% to 40% of the total cost of an electric vehicle. High production costs stem from expensive raw materials such as lithium, cobalt, and nickel, along with complex manufacturing processes for battery cells and modules. For instance, in 2023, the average cost of lithium-ion batteries was approximately USD 139/kWh – still higher than the USD 100/kWh threshold considered essential for cost parity with ICE vehicles.

MARKET OPPORTUNITIES

Fleet Electrification and Purpose-Built Designs to Provide Market Growth Opportunities

Passenger cars currently represent the largest segment of the electric vehicle market, accounting for the highest volume of electric powertrain demand. The shift toward electric passenger vehicles are being driven by government regulations, financial incentives, growing consumer adoption, and the growing improvements in vehicle performance and efficiency. For instance, Tesla's dual-motor setup in the Model 3 and Model Y enhances acceleration and driving range while also reducing production complexity.

The growing demand for electric light commercial vehicles (eLCVs) for urban deliveries and last-mile logistics is driving the need for specialized electric powertrain solutions. Major companies such as Amazon, FedEx, and DHL are transitioning to electric delivery vehicles to meet their sustainability goals. In response, automakers are launching purpose-built electric LCVs with optimized powertrain configurations. For instance, Ford’s E-Transit and Rivian’s EDV (Electric Delivery Van) are designed with single-motor configurations to balance cost, range, and load capacity.

Additionally, the growing popularity of electric two-wheelers and three-wheelers in emerging markets is driving the need for compact and efficient powertrains. Electric two-wheelers are increasingly being adopted for personal transportation and delivery services due to lower operating costs and reduced fuel dependency, high demand for last-mile delivery in urban areas, and government incentives for electric scooters and motorcycles. For instance, Harley-Davidson’s LiveWire electric motorcycle features a high-torque motor delivering 105 horsepower and a range of 146 miles, demonstrating the performance potential of electric two-wheelers.

Besides, electrification of off-highway vehicles, including agriculture vehicles, and military and special purpose vehicles drives the demand for the electric vehicle powertrain during the forecasted period.

MARKET CHALLENGES

Providing Robust Aftersales Services is One of the Significant Challenging Factors for New Players Entering the Market

Establishing a robust service network for after-sales of electric vehicles is vital for ensuring customer satisfaction and long-term retention. Unlike traditional internal combustion engine vehicles, EVs require specialized knowledge and skills for maintenance and repairs due to their unique powertrain systems, software, and battery technologies. A well-organized after-sales service infrastructure can provide timely and efficient support for routine maintenance, troubleshooting, and repairs, which is essential to build consumer trust and confidence in the reliability of EVs. Additionally, educating service technicians about the intricacies of EV technology and ensuring they have access to the right tools and resources are crucial for effective service delivery.

A comprehensive after-sales support system not only enhances the ownership experience but also addresses any concerns consumers may have about maintenance costs or service accessibility, ultimately fostering loyalty and encouraging new customers to consider electric vehicles in the future. As the EV market grows, companies that prioritize after-sales service will have a competitive advantage, cementing their position in a rapidly evolving landscape.

SEGMENTATION ANALYSIS

By Vehicle Type

Increasing Demand for Sustainable Transportation Boosted Passenger Vehicle Segment Growth

By vehicle type, the market is segmented into two wheeler, three wheeler, microcars, passenger vehicle, and commercial vehicle.

The passenger vehicle segment held the largest share of the market of 60.20% in 2026. Rising environmental awareness and the global shift toward sustainable transportation are fueling the dominance of electric passenger cars. Urbanization and traffic congestion are further accelerating the adoption, especially in metropolitan areas where EVs offer a cleaner alternative. Continued advancements in driving range, charging infrastructure, and vehicle performance are strengthening consumer confidence.

- According to IEA (International Energy Agency), almost 14 million new electric cars were registered globally in 2023, a figure more than six times higher than in 2018. This highlights that growth remains robust as the electric car market matures.

The two wheeler segment is emerging as the fastest-growing segment due to increasing urbanization and worsening traffic congestion. Their compact size makes them a preferred, cost-effective commuting option in densely populated cities.

The three wheeler segment is witnessing steady growth as demand for affordable last-mile transportation solutions rises, particularly in urban and semi-urban areas. Their affordability and efficiency in passenger and cargo transport make them a viable alternative to traditional fuel-powered rickshaws.

- According to the Global EV Outlook 2024 report by IEA, China and India are the top two sellers of electric two- and three-wheelers. China accounted for 78% of global electric 2W sales, with nearly 6 million electric 2W sold in 2023. India’s Electric Mobility Promotion Scheme (EMPS) aims to support the deployment of an additional 372 thousand electric 2/3Ws equipped with Li-ion batteries.

To know how our report can help streamline your business, Speak to Analyst

By Product Type

Traction Inverter Segment to Dominate, Driven by Transition to Advanced Semiconductor Materials

By product type, the market is classified into motor, traction inverter, and on-board charger.

The traction inverter segment is expected to dominate the market share with 48.00% in 2026 during the forecast period. The transition from traditional silicon to advanced semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) is significantly enhancing inverter efficiency. These next-generation inverters operate at higher temperatures and switching frequencies, reducing energy loss and improving overall motor performance. Their compact and lightweight design enables more efficient powertrain integration into EV powertrains, making them a critical component in modern EV development.

- January 2023, Onsemi, a leader in intelligent power and sensing technologies, announced a collaboration with Hyundai Motor Company to use its E-GMP platform for SiC-based inverters, improving energy efficiency by up to 5% and increasing driving range by approximately 5%.

The motor segment is expected to show the fastest growth in the market owing to the innovations in thermal management that enhance energy efficiency and driving range. Innovations such as 800V architectures and advanced cooling mechanisms are reducing energy losses, optimizing performance, and lowering production costs. Continuous advancements in electric motor technology are making EVs more powerful, cost-effective, and capable of longer ranges.

The increasing adoption of battery electric and plug-in hybrid vehicles is driving the demand for efficient on-board charging systems. These systems play a crucial role in optimizing battery performance, enabling faster charging, and improving overall vehicle efficiency. As EV production scales up, the need for advanced, high-capacity OBCs continues to grow across various vehicle segments.

By Propulsion Type

BEV Segment to Dominate the Market Owing to Technological Advancements

By propulsion type, the market is categorized into BEV and PHEV.

The BEV segment is expected to dominate the market with share of 64.97% in 2026, owing to significant advancements in battery technology, including solid-state batteries and high-nickel cathodes, which are boosting energy density and extending driving range. Cost reductions in battery production and economies of scale are making BEVs more accessible to a wider consumer base. Additionally, expanding charging infrastructure and government incentives continue to drive BEV adoption globally.

- For instance, CATL’s Qilin battery offers a driving range of up to 1,000 km with a charging time of just 10 minutes, while Tesla’s 4680 battery increases energy density by 5% and reduces production costs by 14%.

The PHEV segment is the fastest growing segment as it offers a practical transition between internal combustion engine (ICE) vehicles and fully electric cars by reducing range anxiety while improving fuel efficiency. The combination of an electric motor and a gasoline engine provides enhanced performance and extended driving range. As charging infrastructure continues to improve, PHEVs are gaining popularity among consumers seeking driving flexibility without full dependence on charging stations.

By Motor Power Rating

50 kW to 250 kW Segment Lead due to Rising Government Incentives

By Motor Power Rating, the market is segmented into below 50 kW, 50kW to 250 kW, and above 250 kW.

The 50 kW to 250 kW range segment dominates the market with share of 43.44% in 2026, due to its widespread use in electric passenger vehicles, SUVs, and light commercial vehicles. Increasing demand for higher acceleration, torque, and performance-oriented EVs is driving the adoption of motors within this category. Moreover, government incentives and fleet electrification are further boosting market growth.

The below 50 kW segment is experiencing rapid growth, driven by the rise in popularity of electric two-wheelers, three-wheelers, and compact urban vehicles. As urbanization increases, cost-effective and energy-efficient micro-EVs are emerging as a preferred choice for city commuting and last-mile delivery.

The above 250 kW segment is gaining traction as high-performance EVs, heavy-duty trucks, and electric buses require powerful motors for improved torque, load capacity, and long-distance travel. Growing advancements in powertrain technology and increasing adoption of electric commercial fleets are driving steady growth in above 250 kW segment.

ELECTRIC VEHICLE POWERTRAIN MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Electric Vehicle Powertrain Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

High Urban congestion and Fuel Costs to Drive the Asia Pacific Market Growth

The Asia Pacific region holds the largest electric vehicle powertrain market share at valued USD 4.03 billion. High levels of urban congestion and rising fuel costs are driving demand for low-cost electric two-wheelers and compact EVs. Leading two-wheeler markets such as India, Indonesia, and others are adopting electric scooters and motorcycles, fueling the growth of the market across the region. Governments are actively promoting EV adoption through incentives and infrastructure development. Expanding manufacturing capabilities, particularly in China and India, further strengthen the region’s leadership in the market. The Japan market is projected to reach USD 0.68 billion by 2026, the China market is projected to reach USD 25.3 billion by 2026, and the India market is projected to reach USD 1.13 billion by 2026.

Europe

Europe is witnessing the fastest growth, driven by stringent CO2 emission regulations and aggressive plans to phase out internal combustion engine vehicles. Countries such as Germany, France, and the U.K. are aggressively investing in charging networks and battery technology. European automakers are accelerating their transition to electric fleets in alignment with government sustainability goals. The UK market is projected to reach USD 1.09 billion by 2026, and the Germany market is projected to reach USD 2.06 billion by 2026.

North America

The market in North America is expanding steadily, supported by the development of fast-charging networks and the increasing adoption of home charging solutions. Consumers are more inclined toward long-range EVs, prompting automakers to improve battery efficiency. Federal incentives and investments in clean energy further bolster market growth. The U.S. is anticipated to hold the largest market share. The country has been a frontrunner in the adoption of electric vehicles, fueled by increasing consumer interest in sustainability and eco-friendly solutions. Major automakers, including Tesla, Ford, General Motors, and numerous emerging startups, are heavily investing in EV technology and powertrain innovation, significantly expanding their product offerings. The U.S. market is projected to reach USD 2.37 billion by 2026.

Rest Of The World

In the rest of the world, including South America and the Middle East & Africa, EV adoption is likely to increase as governments introduce policies aimed at reducing reliance on fossil fuels. In Africa, while EV adoption remains slow, it is gaining traction in selective markets due to improved charging infrastructure and renewable energy integration.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasize on Investments to Boost Their Market Presence

Robert Bosch is a leading player in the electric vehicle powertrain market, known for its integrated electric axle drive (e-Axle) and inverter technology. The company’s powertrain solutions include charger converters, charging sockets, vehicle control units, e-Axles, inverters, electric motors, and gearboxes, focusing on energy efficiency and system complexity. Bosch invests heavily in R&D to develop high-performance, cost-efficient powertrain components. Its strategic partnerships with automakers strengthen its market presence, particularly in Europe and Asia. Bosch’s competitive edge lies in its advanced system integration capabilities and strong focus on improving vehicle range and performance through optimized powertrain designs.

Valeo SA is one of the key players in the electric vehicle powertrain market, specializing in 48V mild hybrid systems and high-voltage power electronics. The company's product portfolio includes powertrain electrification, electric motors, power electronics, electric axles, actuators, sensors, and transmissions. Valeo’s strength lies in its expertise in improving power density and thermal efficiency, helping reduce energy loss in electric powertrains. The company’s strategic focus is on expanding its high-voltage powertrain components and strengthening partnerships with global automakers. Valeo’s competitive advantage stems from its strong presence in Europe and its leadership in mild hybrid technology and integrated electric drivetrain systems.

LIST OF KEY ELECTRIC VEHICLE POWERTRAIN COMPANIES PROFILED

- Robert Bosch Gmbh (Germany)

- Mitsubishi Electric (Japan)

- Magna International Inc (Canada)

- Valeo (France)

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- Hitachi Astemo Ltd (Japan)

- DANA TM4 INC (Canada)

- Denso Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Schaeffler (Germany)

KEY INDUSTRY DEVELOPMENTS

- March 2025- Bosch is enhancing its powertrain solutions by focusing on hydrogen and fuel cell technologies at its České Budějovice facility in the Czech Republic. This initiative move underscores Bosch’s commitment to advancing sustainable mobility solutions.

- March 2025- Mitsubishi Motors announced plans to outsource electric vehicle (EV) production to Taiwan’s Foxconn in an effort to reduce costs and accelerate product development. This collaboration enables Foxconn to expand its presence in the EV market while supporting Mitsubishi’s push toward electrification.

- February 2025 -EKA Mobility and KPIT Technologies have entered into a memorandum of understanding to collaborate on the development of electric powertrain technology components specifically for commercial vehicles. This partnership will concentrate on the creation of traction motors, controllers, vehicle control units, and battery management systems.

- December 2024- Valeo inaugurated a new 7,000-square-meter production facility in Pune, India, to bolster its electrification capabilities. This facility would manufacture the On-Board Power Supply 3-in-1 unit, integrating an On-Board Charger, DC-DC converter, and Power Distribution Unit, addressing the increasing demand for electric vehicle components. The site also emphasizes workforce diversity and sustainability initiatives.

- June 2024- NXP Semiconductors and ZF Friedrichshafen AG partnered to develop next-generation silicon carbide (SiC) - based traction inverter solutions for electric vehicles (EVs). By integrating NXP’s GD316x high-voltage isolated gate drivers into ZF’s 800-volt SiC–based traction inverters, the collaboration aimed to improve the safety, efficiency, range, and performance of EVs.

REPORT COVERAGE

The global electric vehicle powertrain market research report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology. Besides this, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Electric Vehicle Powertrain Market Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.82% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Units) |

|

Segmentation |

By Vehicle Type

By Product Type

By Propulsion Type

By Motor Power Rating

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 43.44 billion in 2026 and is projected to reach USD 122.34 billion by 2034.

The market is expected to register a CAGR of 13.82% during the forecast period.

Stringent emission regulations and rising fuel prices are predicted to drive the global market growth.

Asia Pacific leads the market.

China is expected to dominate the market due to the growing number of electric vehicle customers in the country.

Growing consumer interest in sustainable and environmentally friendly transportation options encourages manufacturers to develop and enhance electric vehicle powertrains.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us