Electrical Enclosure Market Size, Share & Industry Analysis, By Type (Wall-mounted, Floor-mounted/Freestanding, and Others), By Material Type ((Metallic (Stainless steel, Aluminum, and Others), Non-Metallic (Fiberglass, Plastic, and Others)), By Application (Industrial Control Systems (Manufacturing and Automotive), Energy and Power, Telecommunications, Oil and Gas, and Others), and Regional Forecast, 2026– 2034

Electrical Enclosure Market Current & Forecast Market Size

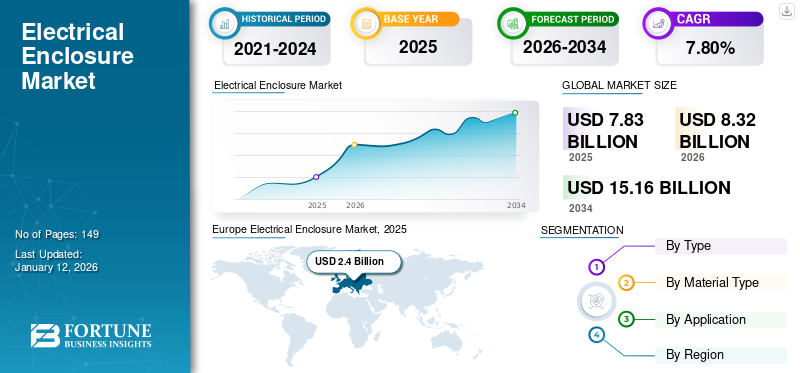

The global electrical enclosure market size was valued at USD 7.83 billion in 2025 and is projected to grow from USD 8.32 billion in 2026 to USD 15.16 billion by 2034, exhibiting a CAGR of 7.80% during the forecast period. Europe dominates the market, holding a 30.30% market share in 2025. Additionally, the U.S. electrical enclosure market is predicted to grow significantly, reaching an estimated value of USD 2,111.0 million by 2032.

An electrical enclosure refers to a housing for electrical or electronic equipment. Its purpose is to safeguard the electrical equipment from the external environment and protect the outside people from the equipment. It helps to protect people from the propagation of any explosion or electric shock. The outside environment comprises of various factors, such as moisture, adverse temperatures, weather, fire, and different hazards. Hence, these enclosures are made waterproof, fire-resistant, and have extreme durability.

With the ageing infrastructure, the rising necessity for electrical vehicle charging set-up magnifies the requirement to update the present infrastructure and obligates the addition of smart grids. It generates more demand for electrical components, including such enclosures. Thus, the demand for such enclosures is rising across different industries such as automotive, renewable energy, manufacturing, and many more, along with various customizations. For instance,

- In December 2023, Custom Stainless Enclosures, Inc. introduced 4Xxtreme electrical enclosures, which are intended to minimize the overall cost of equipment when deployed in the harshest environments. Several benefits added with these enclosures include a double-seal enclosure mechanism, double stud mounting, unlimited enclosure design competencies, and many more.

The COVID-19 pandemic accelerated the implementation of digital technologies, such as online ordering, supply chain management, and enhancements with emerging technologies in the automotive and manufacturing sectors, which eventually benefited the electrical enclosures industry. Hence, market players introduced various new solutions with features and benefits. In some regions, government stimulus packages aimed at boosting infrastructure and construction projects, which eventually added to the electrical enclosure industry growth across different nations.

Emerging Trends & Technological Advancements in Electrical Enclosures Market

Integration of Smart Tools within Enclosures in Different Applications to Fuel Market Growth

The incorporation of actuators, sensors, cooling units, and communication modules for actual-time data gathering and remote handling of electrical tools and equipment refers to smart electrical enclosures. Such enclosure helps improve operational efficiency, remote management, safety, and many other features.

The various other features include gas-protected switching systems and current and voltage converters tailored within that comprise components for interconnecting with the control centre, among other features. The fittings for such enclosures contain specifically built cooling units. They are predominately used in the thermal management of the electrical equipment in such enclosures.

With these features, the internal part of the enclosure can be safeguarded against corrosion, even in humid climates and in winter. And temperature can be retained constantly at an ideal range for the electronic modules. Hence, key players are advancing their offerings with such new mechanisms to offer their customers some added benefits. For instance,

- In August 2022, Rittal introduced e+ S smart cooling components for enclosures, delivering improved cooling results and smart proficiencies with sustainability. The modern generation of Blue e+ S cooling components has been developed for proficiency, aiding in ensuring a smaller footprint, offering energy savings, reducing CO2 emissions, and lesser costs.

Thus, these types of smart enclosures with enhancements can be used in various applications, such as industrial automation, smart buildings, renewable energy, electric vehicles, and others. Hence, the integration of such smart mechanisms within enclosures fuels the market progress across different applications.

Download Free sample to learn more about this report.

What factors are fueling growth in the Electrical Enclosure market?

Customized Application Tailored to Specific Industry Requirements to Drive Market Growth

The standard options for enclosures can often fall short of fulfilling specific project requirements. The customized enclosures offer tailor-made solutions for different, unique applications for demanding environments.

Custom-made solutions provide customers with precise fit and functionality, which are designed as per their intricate needs to accommodate specific wiring configurations and seamlessly incorporate with current systems. Such solutions enable capabilities, such as optimized ventilation, enhanced performance, integration of dedicated protection over environmental threats, and better protection.

It also includes other tailor-made options, such as size and shape of enclosures, material choice, compliance with standards, surface finishes, and different feature integration. Hence, various end-users prefer customized enclosure solutions as per their necessities and requirements, which is why various market players are keen on providing solutions as per user customizations. For instance,

- In March 2023, RS collaborated with Hammond Manufacturing to offer customized electronic and electrical enclosures to industrial and commercial consumers. The company provides over 4,900 fully tailor-made electrical and electronic enclosures from Hammond Manufacturing, with 2,900 plus supporting products.

Such customized competencies of enclosures for achieving optimal performance, safety, and functionality as per industry requirements drive market growth.

What are the key challenges limiting market growth?

Environmental and Operational Limitations can Hamper Market Growth

Without appropriate consideration, heat can certainly be generated inside electrical enclosures, initiating damage to the electronic and electrical components inside the enclosures. Such heat can also result in pressure inconsistencies, which can ultimately build up moisture and cause difficulties. It can lead to the potential for destruction of the sensitive electrical equipment within enclosures.

In an electrical enclosure, the air inside any bounded space can heat up remarkably rapidly, which can reduce the operating life of the equipment it comprises. It can also result in the formation of concentration, which would cause rust, short circuits, and other issues.

Also, depending on the environmental conditions, enclosures may require different coatings or material properties to withstand different weather conditions. If not managed carefully, it can result in moisture, corrosion, and degradation of electrical equipment. Managing the coatings as per different weather conditions is difficult and hence can affect the overall performance of such enclosures.

Hence, such environmental limitations can result in the potential for destruction of the sensitive tools and equipment within enclosures and hamper market growth.

Electrical Enclosure Market Segmentation Landscape

By Type Analysis

Usage of High-tech Mechanisms in Wall-Mounted Enclosures to Drive Wall-Mounted Segment Growth

Based on type, the market is categorized into wall-mounted, floor-mounted/freestanding, and others (pole, gasketed screw, underground, and others).

The Floor-mounted/Freestanding segment is projected to dominate the market with a share of 45.97% in 2026. The wall-mounted segment to dominate the market with a leading CAGR during the forecast period. The small and compact size, low power generated, and easy-to-install features drives the demand for these types of enclosures in the market. Thus, various market players are advancing these wall-mounted enclosures with new mechanisms. For instance,

- In January 2024, OKW introduced new smart panel wall-mounted enclosures for electric control centers. They can be used in various applications such as developing services systems, electrical deployments, offices, smart homes, security, measuring and control, and laboratory and medical technology. These enclosures have a very polished end section with a flat, settled area for interfaces such as USB or small USB.

The floor-mounted/freestanding segment accounted for the highest market share in 2023. The larger size of floor-mounted enclosures and the mobility of freestanding enclosures makes them a better choice for complex applications. They are also favored for the requirement of enclosure relocation, specifically in industrial applications. With such factors, these types of enclosures are installed across numerous applications, such as house large equipment, drawers, shelves, and many more.

By Material Type Analysis

Higher Durability and Corrosion Resistance Features of Non-metallic Material to Fuel Non-Metallic Segment Growth

By material type, the market is bifurcated into metallic (stainless steel, aluminum, and others) and non-metallic (fiberglass, plastic, and others).

The Metallic (Stainless steel, Aluminium, etc.) segment is expected to lead the market, contributing 52.81% globally in 2026. As per Fortune Business Insights, the non-metallic segment is anticipated to grow at a highest CAGR during the forecast period. Non-metallic material comprises of fiberglass, polycarbonate, and plastic, and others. These types of materials possess properties, such as fire retardant, insulation, heat resistance and many more, that aids the segment growth. The segment is also expected to grow due to its usage in the manufacturing of small and economical cars by the engineering and automotive industries.

The metallic segment held the highest market revenue share in 2024. Metallic enclosure materials include stainless steel, carbon or mild steel, aluminum, and others. Metallic enclosures offer superior durability, greater protection, and enhanced security. Hence, these types of enclosures are preferred by various industries, especially in areas with greater security concerns. As a result, it accounts for the maximum share of the market.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Interest in Alternate Energy Sources to Enhance the Demand for Electrical Enclosure to Boost Energy and Power Segment Growth

By application, the market is classified into industrial control systems (manufacturing and automotive), energy and power, telecommunications, oil and gas, and others (Food & Beverages and others).

The Energy and Power segment will account for 30.41% market share in 2026. The energy and power segment is anticipated to have the highest CAGR during the forecast period. The rising interest in alternate energy has generated innovations and implemented new technological solutions in energy technology that require outdoor enclosures to secure them. Outdoor enclosures are used for substitute energy equipment that requires resistance to extended sunlight and severe weather conditions.

The industrial control systems segment that comprises of manufacturing and automotive sectors accounted for the highest electrical enclosure market share in 2024. Enclosures provide an organized and safe space for housing control systems, electrical connections, and cables of big machinery in such sectors, thus, driving the implementation of these solutions across industrial control systems. It also protects wiring from dust, contaminations, and any physical damage while ensuring workers’ safety in such environments.

WHAT ARE THE KEY REGIONAL INSIGHTS FOR THE GLOBAL MARKET?

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and the Asia Pacific.

Europe Electrical Enclosure Market, 2025

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe dominated the market with a valuation of USD 2.4 billion in 2025 and USD 2.52 billion in 2026. Europe accounted for the highest market revenue share in 2024, with well-established infrastructure and increasing demand for renewable energy and industrial automation. The presence of prominent market players, such as Schneider Electric, Legrand SA, nVent, Fibox, Siemens, and others, contributes to the growth of the market in the region. Also, countries, such as Germany, France, the U.K., and Spain account for the major growth across industrial automation, smart enclosures, and renewable energy. The region also has high amounts of investments in digital technologies, electronics, industrial simulation, and others. The U.K. market is projected to reach USD 0.53 billion by 2026, while the Germany market is anticipated to reach USD 0.61 billion by 2026.For instance,

- In the financial year 2023, Siemens invested over USD 2.20 billion to fuel future growth, resilience, and innovation across electronics and digital twins and to support the development of digital business platforms.

Such investments and technological infrastructure advancements drive market growth in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

According to Fortune Business Insights, Asia Pacific dominates the market with the highest CAGR. The region has huge growth opportunities owing to the growing industrialization and rising economies such as Japan, India, and South Korea. Also, China accounts for one of the largest electrical manufacturing sectors contributing toward the region’s progress. Also, with the growing focus on renewable energy with prominent investments and technological advancements, the need for specialized enclosures for inverters, control systems, and power distribution has increased. This creates numerous market opportunities in the region. The Japan market is set to reach USD 0.47 billion by 2026, the China market is expected to reach USD 0.71 billion by 2026, and the India market is projected to reach USD 0.40 billion by 2026. For instance,

- In February 2022, Hartek India Pvt Ltd. formed a strategic alliance with Rittal to authorize a system mediator for power distribution solutions, which comprises dedicated TTA (Type-tested Panels) for Low-voltage solutions.

Technological developments, growing industrial sectors, and the implementation of high-tech machinery enhance the demand for smart and such enclosures in the region. Also, several government initiatives have been taken to ensure the security of its citizens from electrical equipment accidents, contributing to the rapidly growing market in the region. Hence, various key players are expanding their presence in North America with new solutions and collaborations. For instance,

- In April 2022, Rittal announced a partnership with TD SYNNEX in the United States to distribute IT rack enclosures, accessories, and other solutions to IT (Information Technology) customers through channel partner TD SYNNEX.

The growing industrial sectors' technological developments in energy and power, oil and gas, and food processing are opening up numerous new opportunities across the Middle East & Africa and South America. Also, the regions are gaining traction regarding the awareness of electrical enclosures, and the importance of their implementation is fueling the growth opportunities for the market in these regions. Various key players are expanding their reach in these regions for business expansion and growth.

List of Key Companies in Electrical Enclosure Market

Rising Collaborations and New Product Launches Globally Fortify Key Players’ Business Positions in Different Regional Markets

The key players are keen on combining new electrical solutions across different applications, such as manufacturing, renewable energy, oil and gas, and many others. Inventing new solutions with intensive mechanisms to aid numerous commercial and industrial users is one of the key strategies adopted by market players. Furthermore, prominent market players intentionally form alliances with new product releases and collaborate with various distributors for business expansion globally.

List of Top Electrical Enclosure Companies:

- Schneider Electric (France)

- Hubbell (U.S.)

- nVent (Eldon Holdings) (U.K.)

- Siemens (Germany)

- Rittal GmbH & Co. KG (Germany)

- Eaton (U.S.)

- Hammond Manufacturing Ltd (Canada)

- Saipwell Electric Co., Ltd. (China)

- Fibox (Finland)

- Equipto Electronics, Corp. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Rittal released the new addition to its product portfolio, the VX SE Floormount enclosure NEMA 12/3R. It is designed for a range of outdoor and indoor commercial and industrial uses, such as machine tools, material handling, and automotive. The freestanding enclosure is ideal for machine builders, panel builders, and system integrators.

- July 2023: Jameco Electronics announced the addition of FIBOX-enhanced quality outdoor and indoor enclosures to their product line, which is ideal for various applications, such as IoT, industrial control, and developing automation. Enclosures and cabinets are corrosion-resilient and RF-transparent, making them perfect for outdoor and indoor usage.

- January 2023: nVent introduced nVent HOFFMAN Extreme Environments product line of stainless-steel electrical enclosures. It is certified with industry-suited standards, and it offers a reliable, durable solution for comprehensive protection of crucial equipment and system machinery in the most challenging environments.

- July 2022: Schneider Electric introduced the PrismaSeT S range, new metal enclosures. The new line of metal enclosures, combined with wiring up to 160A and a selection of equipment, simplifies the deployment of electrical distribution in various small and medium-sized commercial constructions.

- March 2021: nVent expanded its industry enclosure solutions with the release of a freestanding enclosure product line. With the release, the company intends to provide a streamlined design with enhanced safety for workers and equipment in the industrial manufacturing sector.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market report provides a wide-ranging analysis of the market and highlights important characteristics such as leading vendors, product lines, and evolving new solution applications. Furthermore, it provides insights into the latest market advancements and delivers insights on crucial industry expansions. In addition to the aspects stated above, the report combines numerous dynamics that have contributed to the market development in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Material Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 15.16 billion by 2034.

In 2025, the market was valued at USD 7.83 billion.

The market is projected to grow at a CAGR of 7.80% during the forecast period.

Based on application, the industrial control systems segment held the highest share in terms of revenue in 2024.

Customized application tailored to specific industry requirements to drive market growth.

Rittal, Siemens, nVent (Eldon Holdings), and Hammond Manufacturing Ltd, and others are the top players in the market.

Europe held the highest market share in 2025.

By material type, the non-metallic segment is expected to grow with a leading CAGR during the projected period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us