Endodontic Consumables Market Size, Share & Industry Analysis, By Product (Dental Burs & Drills, Endodontic Files, Dental Dams, Gutta-Percha Points, Dental Sealers, and Others), By Procedure (Access Preparation, Shaping & Cleaning, and Obturation), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

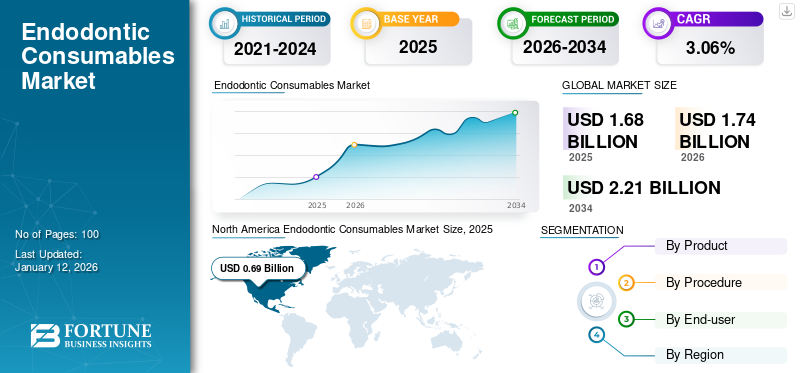

The global endodontic consumables market size was valued at USD 1.68 billion in 2025 and is projected to grow from USD 1.74 billion in 2026 to USD 2.21 billion by 2034, exhibiting a CAGR of 3.06% during the forecast period. North America dominated the endodontic consumables market with a market share of 41.04% in 2025.

Endodontics refers to a specialized branch of dentistry that primarily deals with the dental pulp and the surrounding tissues within the teeth. These consumables include the tools and products used in the access, shaping, cleaning, and obturation processes during surgical and non-surgical root canal treatments. These products include endodontic burs & drills, paper points, endodontic files, reamers, irrigation solutions, lubricants, gutta-percha, endodontic sealers, regenerative cement, and other obturation accessories.

The global endodontic consumables market is anticipated to grow significantly in the coming years. The rising incidence of dental issues, such as cavities, gum diseases, and tooth decay is fueling the demand for endodontic treatments as an increasing number of individuals require root canalling and other endodontic procedures to manage these ailments. Hence, the demand for endodontic consumables will rise accordingly. Additionally, growing awareness about the importance of oral health and preventive dental care is expected to boost the market for endodontics consumables. Furthermore, the technological innovations in endodontic materials and launch of advanced fillers are expected to fuel the market growth.

The market reported challenges in 2020 as the COVID-19 pandemic led to a decline in the number of restorative procedures globally. However, in 2021, there was a notable increase in the number of patient visits to dental clinics and hospitals as the government restrictions were relaxed. The market rebounded to pre-pandemic levels in 2022 and is expected to experience steady growth in the future.

Endodontic Consumables Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.74 billion

- 2034 Forecast Market Size: USD 2.21 billion

- CAGR: 3.06% from 2026–2034

Market Share:

- North America dominated the global endodontic consumables market with a 53.7% share in 2024, driven by the high prevalence of dental caries, widespread adoption of advanced endodontic materials, and robust dental infrastructure.

- By product, endodontic files held the largest market share in 2024 due to their critical role in shaping and cleaning procedures and the growing number of non-surgical root canal procedures. The segment’s growth is also fueled by technological advancements, including NiTi-based instruments.

Key Country Highlights:

- Japan: Market growth is supported by the aging population, increased awareness about dental health, and the use of technologically advanced endodontic tools such as bioceramic sealers and flexible NiTi files.

- United States: Leads global demand due to a well-established dental care ecosystem, increased number of solo dental practices, and growing consumer awareness about the link between oral health and systemic diseases such as cardiovascular and respiratory conditions.

- China: Rising disposable incomes, increasing geriatric population, and expanding access to dental care—especially in urban areas—are boosting the adoption of endodontic procedures and consumables.

- Europe: Significant market growth supported by public health policies encouraging preventive dental care, and the high incidence of periodontal disease driving demand for endodontic treatment products such as gutta-percha and sealers.

Endodontic Consumables Market Trends

Use of Bioceramic Root Sealers to Increase Significantly

The use of bioceramic-based root canal sealers is growing significantly, which offer improved sealing ability, biocompatibility, and antibacterial properties compared to traditional sealers. This is supported by various studies published on bioceramic root sealers, including their physical properties, biocompatibility, sealing ability, adhesion, solubility, and antibacterial effectiveness. These sealers were found to be biocompatible and similar to other commonly used sealers.

Additionally, new product launches by key market players will increase the adoption of these products during the forecast period.

- For instance, in December 2022, Septodont Holding launched BioRoot Flow, a bioceramic root canal sealer. This product is designed to be used for both warm and cold obturation techniques. Such advanced product launches are increasing the use of these sealers in the market.

Download Free sample to learn more about this report.

Endodontic Consumables Market Growth Factors

Rising Prevalence of Periodontal Disease to Boost Market Growth

Periodontal disease, also known as gum disease, is a serious bacterial infection that affects the gums and the bone that supports the teeth. It is a progressive inflammatory condition and the leading cause of tooth loss in adults.

- According to the data updated by the WHO in March 2023, it was estimated that severe periodontal diseases impact approximately 19% of adults globally, totaling over 1 million cases worldwide. As the prevalence of advanced periodontal diseases continues to rise, the demand for endodontic consumables is expected to increase in the coming years.

Periodontal disease can lead to conditions that necessitate endodontic treatment, such as pulpitis or abscesses. As the periodontal disease progresses, it can compromise the health of the tooth pulp, increasing the demand for root canal treatments and other endodontic interventions. Additionally, advancements in these consumables are expected to drive the market. These factors and the growing awareness among patients about oral health are expected to fuel the global endodontic consumables market growth in the coming years.

Increased Awareness About Link Between Oral and Overall Health to Stimulate Market Growth

Increased awareness about the connection between oral and overall health is expected to fuel the growth of the market. Research has shown that poor oral health can have a significant impact on overall health, leading to conditions, such as heart disease, diabetes, and respiratory infections.

- For instance, a study published in Nature Scientific Reports in August 2021 stated that periodontal disease was linked to higher mortality rates caused by cardiovascular diseases, while the buildup of oral health issues and tooth loss was associated with increased mortality caused by respiratory infections. This has prompted more people to prioritize their oral health and seek treatment for dental issues, including root canal therapy provided by endodontists.

More people have become aware of the importance of maintaining good oral health, which has increased the demand for endodontic procedures and products used in those procedures. This is expected to drive the need for endodontic consumables, such as files, obturation materials, and irrigation solutions, which are essential for performing root canal treatments.

Furthermore, advancements in technologies and materials used in the field of endodontics are also expected to contribute to the market’s growth. The development of innovative products and techniques that improve the efficiency and outcomes of root canal therapy are factors further driving the market growth.

RESTRAINING FACTORS

Risks Associated with Endodontic Procedures Can Limit Market Growth

One of the main risks associated with endodontic procedures is the potential for complications, such as instrument separation, perforation, or incomplete canal cleaning. Additionally, improper canal sealing can lead to treatment failure and risk of reinfection. These complications can lead to patient dissatisfaction, which may result in lower demand for endodontic treatments and consumables.

- For instance, a survey published in the Saudi Endodontic Journal in April 2020 showed that fracturing of instruments was a frequent occurrence during exploring the root canal at 72.58% and during canal shaping at 55.47%. This can increase the risk of swelling and infection rate in patients.

Furthermore, endodontic procedures can damage the nerves in the tooth or surrounding area, which can cause pain, numbness, or tingling. Moreover, allergic reactions and tooth fractures could potentially limit the market growth.

Endodontic Consumables Market Segmentation Analysis

By Product Analysis

Greater Utilization in Procedures Drove Endodontic File Segment’s Dominance in 2024

Based on product, the market is classified into dental burs & drills, endodontic files, dental dams, gutta-percha points, dental sealers, and others.

The endodontic files segment dominated the global endodontic consumables market share in 2024. The rising number of non-surgical root canal procedures, coupled with the increased incidence of cavities, are expected to boost the segment’s growth. Additionally, rising launch of efficient files is anticipated to propel the segment growth in the future.

The dental burs & drills segment recorded the second-highest revenue in the market and is expected to record a considerable CAGR in the coming years. The growth of the segment can be attributed to the rising launch of new products in the market and increasing number of endodontics procedures, including surgical and non-surgical root canals.

- For instance, Kerr Dental, a subsidiary of Envista, launched a new SimpliCut rotary product, a pre-sterilized single-patient use diamond burs line. Such product launches can boost the adoption of single-use products, thereby increasing the segment’s growth.

The dental sealers segment is anticipated to record a higher CAGR during the forecast period. The use of bioceramic sealers and launch of highly compatible bioceramic sealers are trending in the market. Additionally, the increasing number of distribution collaborations can proliferate product penetration in the future.

The gutta-percha points segment recorded significant revenue in 2024. Technological advancements in these products are increasing their demand. The dental dams segment also registered considerable revenue in 2024. The increased demand for root canal procedures is driving the segment’s growth as these products are used to isolate a specific area of the mouth, during root canals or other treatments, to keep the area dry and free of saliva. Additionally, wide availability of these products increase their adoption in dental practices.

The others segment includes pins & posts, pluggers & spreaders, sealers & root, repair materials. This segment is expected to grow considerably. These are essential products in endodontic treatments, and the segment is expected to grow as the demand for root canal treatment increases.

To know how our report can help streamline your business, Speak to Analyst

By Procedure Analysis

Advancements in Endodontic Files Drove Dominance of Shaping & Cleaning Segment

In terms of procedure, the market is segmented into access preparation, shaping & cleaning, and obturation. The shaping & cleaning segment dominated the market in 2026 with share 42.73%. The endodontic files play a crucial role in shaping and cleaning during root canal treatments, which has led to their significant technological advancements. The development of new materials, such as nickel-titanium (NiTi) alloys has enhanced the flexibility and efficiency of endodontic files. These developments will boost the growth of the segment during the forecast period.

The access preparation segment recorded the second-highest revenue in 2024. Growing awareness about oral health and importance of dental care among consumers will increase the number of regular dental visits and treatments. This will lead to higher demand for endodontic services and access preparation consumables.

By End-user Analysis

Competitive Pricing Contributed to Solo Practices’ Market Dominance

Based on end-user, the market is divided into solo practices, DSO/group practices, and others.

The solo practices segment dominated the market with a 64.94% share in 2026. Solo practices are the preferred choice for endodontic treatment among many patients, leading to their dominance in the market. The segment’s growth can also be attributed to factors, such as competitive & lower treatment costs and personalized treatments. Additionally, a larger proportion of solo practicing clinics allows a higher number of endodontic procedures, which will increase the demand for endodontic consumables in these settings.

The DSO/group practices segment is expected to record a higher CAGR due to a shift toward DSO affiliation in developed countries. The strategic expansions and acquisitions by DSO companies will drive this segment, leading to an increase in the volume of endodontic procedures and overall demand for endodontic consumables. Furthermore, the others segment, which includes hospitals and research institutes, is also predicted to experience significant growth. The rising number of endodontic procedures being performed in these settings will drive the demand for endodontic consumables and the growth of the market during the forecast period.

REGIONAL INSIGHTS

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Endodontic Consumables Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of 0.69 billion in 2025. The increasing prevalence of dental caries increases the demand for root canal and other endodontic treatments. Additionally, the availability of advanced products will boost the adoption of endodontic consumables in the region.

Europe

Europe has a substantial market share and is projected to experience significant growth in the coming years. The market expansion in the region is driven by the growing prevalence of dental caries and tooth-filling procedures, and increased investment in oral healthcare services. Furthermore, the introduction of new products is expected to stimulate the market’s growth in the region. The UK market is valued at USD 0.07 billion by 2026, while the Germany market is valued at USD 0.13 billion by 2026

Asia Pacific

In Asia Pacific, the market is expected to record a higher CAGR during the forecast period. The increasing presence of local companies and advancements in research and development efforts to introduce novel and cost-effective products will drive the market’s growth in the region. Additionally, the growing geriatric population and public consciousness regarding dental health and rising expenditure on dental treatments are anticipated to significantly boost the market's expansion in the region. The Japan market is valued at USD 0.09 billion by 2026, the China market is valued at USD 0.12 billion by 2026, and the India market is valued at USD 0.04 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are also witnessing growth, driven by improvement in healthcare facilities and a growing focus on oral health. Additionally, the high prevalence of oral diseases is anticipated to drive the market growth in these regions.

- According to a March 2023 report by the World Health Organization (WHO), approximately 44% of people in the African region were found to be affected by oral health issues. This will increase the demand for endodontic procedures, further augmenting the sales of endodontic consumables in the coming years.

KEY INDUSTRY PLAYERS

Dentsply Sirona Dominated Market Due to Its Wide Range of Endodontic Consumables

In terms of the competitive landscape, the market is consolidated. Dentsply Sirona holds a prominent share of the market due to its wide range of products. Additionally, the new product launches and strategic acquisitions by the company support its growth in the global market.

Other major players, such as Envista, Brasseler USA, Ultradent Products, and Septodont Holding have a significant presence in the global endodontic consumables market. Brasseler USA companies have strong product portfolios and are constantly involved in new product launches. Additionally, strategic initiatives, such as collaborations are anticipated to expand these companies’ shares in the market. Septodont Holding and Ultradent Products are focused on strategic acquisitions and advanced product developments that enable them to hold considerable shares in the market.

List of Top Endodontic Consumables Companies:

- Envista (U.S.)

- Dentsply Sirona (U.S.)

- Septodont Holding (U.S.)

- COLTENE Group (Switzerland)

- Brasseler USA (U.S.)

- MANI, INC. (Japan)

- DiaDent (South Korea)

- Ivoclar Vivadent (Switzerland)

- Ultradent Products Inc. (U.S.)

- FKG Dentaire Sàrl (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- February 2022 – Ultradent Products, Inc. launched MTApex bioceramic root canal sealer to expand its endodontic product portfolio.

- July 2021 – Septodont Holding announced the acquisition of four dental brands from Sanofi to broaden its existing dental portfolio, including endodontics consumables.

- June 2021 – COLTENE Group launched MicroMega One RECI, a new file for reciprocating preparation that is used in root canal treatment.

- February 2021 – Ultradent Products Inc. announced its partnership with American Orthodontics to distribute its Opal Orthodontics branded products, thereby increasing its revenue.

- March 2019 – BIOLASE, Inc. announced an exclusive distributor agreement with Sinclair Dental for all of its products and services to expand its customer reach across the globe.

REPORT COVERAGE

The report delivers a comprehensive analysis of the market, highlighting various segments, including the products, procedures, and end-users. It also presents a forecast for the market’s outlook, considering the current market dynamics, impact of COVID-19, and emerging trends. Furthermore, the report details the market share of these products across different segments and identifies the factors that are driving the market growth. It includes the key players in the market, overview of the competitive landscape, key insights into the annual number of root canal treatments, recent advancements in these products, and prevalence of significant dental diseases.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.06% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Procedure

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global endodontic consumables market size was valued at USD 1.74 billion in 2026 and is projected to reach USD 2.21 billion by 2034, exhibiting a CAGR of 3.06% during the forecast period.

In 2025, the market value in North America stood at USD 0.69 billion.

The market will exhibit a steady CAGR of 3.06% during the forecast period of 2026-2034.

Currently, the endodontic files segment is leading the market by product.

Rising prevalence of periodontal disease and increasing awareness about oral health are the key drivers of the market.

Dentsply Sirona, Envista, Brasseler USA, and Septodont are some of the top players in the market.

North America dominated the market in 2025 in terms of share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us