Esoteric Testing Market Size, Share & Industry Analysis, By Technology (Enzyme-linked immunosorbent Assay, Chemiluminescence Immunoassay, Mass Spectrometry, Flow Cytometry, Polymerase Chain Reaction, and Others), By Test Type (Infectious Disease Testing, Endocrinology Testing, Oncology Testing, Toxicology Testing, and Others), By End-user (Hospital Based Laboratories and Independent and Referral Laboratories), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

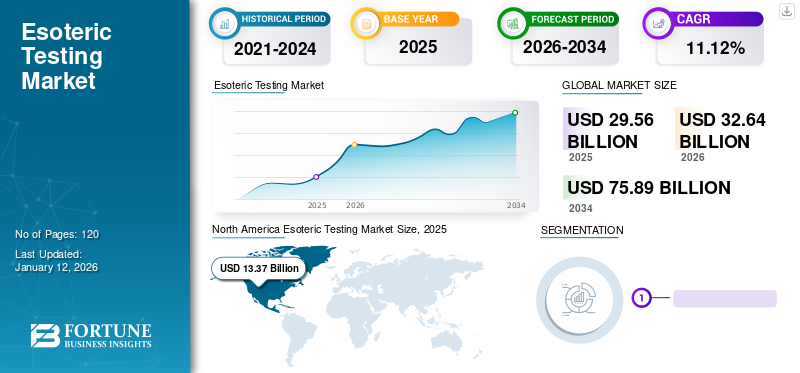

The global esoteric testing market size was USD 29.56 billion in 2025. The market is projected to grow from USD 32.64 billion in 2026 to USD 75.89 billion by 2034, exhibiting a CAGR of 11.12% during the forecast period. North America dominated the esoteric testing market with a market share of 45.22% in 2025.

Esoteric testing refers to the specialized medical tests that are not routinely performed and often require advanced techniques or technologies. Several prominent factors, such as the increasing demand for rare disease diagnostics, growing geriatric population, and advancements in molecular biology, drive the market expansion.

- For instance, according to the American Cancer Society, in 2023, the projected new cases of cancer in the U.S. were 1,958,310. Such a substantial population suffering from several forms of cancer is expected to drive the demand for esoteric diagnosis.

In addition to this, growing initiatives for research activities by market players are expected to spur market growth during the forecast period. These initiatives are being adopted to develop novel technologies for the diagnosis of various rare diseases.

Global Esoteric Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 29.56 billion

- 2026 Market Size: USD 32.64 billion

- 2034 Forecast Market Size: USD 75.89 billion

- CAGR: 11.12% from 2026–2034

Market Share:

- North America dominated the esoteric testing market with a 45.22% share in 2025, driven by the high prevalence of chronic diseases, rapid adoption of advanced diagnostic technologies like mass spectrometry, and strong presence of key market players.

- By technology, the chemiluminescence immunoassay segment held the largest share in 2026, owing to its high sensitivity and efficiency for chronic disease diagnostics. Mass spectrometry is projected to witness significant growth due to its precision in analyzing complex biomarkers.

Key Country Highlights:

- United States: Market growth is driven by a strong demand for advanced diagnostics, continuous rise in chronic disease cases, and robust initiatives for early disease detection by healthcare organizations.

- India: Government initiatives like the National Rare Disease Policy, which promotes newborn screening using advanced diagnostic technologies, are propelling the adoption of esoteric tests in the country.

- China: Increasing investments in healthcare infrastructure and growing collaborations with global diagnostic service providers are supporting the expansion of esoteric testing services.

- Europe: Regional growth is fueled by rising awareness about precision diagnostics, high prevalence of infectious diseases, and supportive healthcare policies promoting advanced diagnostic technologies.

COVID-19 IMPACT

Increased Demand for Disease Diagnosis Boosted Market Expansion amid COVID-19 Pandemic

The COVID-19 pandemic positively influenced the market growth. The sudden increase in the demand for the diagnosis of COVID-19, growing disease cases, and the emerging need for precise diagnosis were some of the major factors responsible for the positive impact on the market.

The COVID-19 pandemic also led to an increase in the focus of healthcare systems on these testing services across the globe. Furthermore, there was an increased demand for real-time polymerase chain reaction (RT-PCR) tests and enzyme-linked immunosorbent assay (ELISA) tests for the detection of COVID-19 in 2020.

For instance, in 2020, the U.S. FDA granted Emergency Use Authorization (EUA) to Laboratory Corporation of America Holdings, allowing it to test self-collected nasal swab samples from patients suspected of COVID-19 through its RT-PCR test. This testing was conducted at LabCorp’s Center for Esoteric Testing and other Clinical Laboratory Improvement Amendments (CLIA)-certified high-complexity laboratories designed by the company.

Moreover, with the relaxation of lockdown restrictions, the number of clinic visits for chronic diseases significantly increased in 2021. The revenue recovered from the diagnosis of chronic diseases resulted in positive global growth of the market in 2021. The market is anticipated to grow at a substantial growth rate during the forecast period due to the surge in the awareness of these testing services during the pandemic.

Esoteric Testing Market Trends

Technological Advancements in Esoteric Tests is Identified as a Significant Trend

In recent years, the market has observed an adoption of esoteric testing due to several technological advancements, which help in the diagnosis of complex substances and rare diseases. The adoption of esoteric tests has surged due to their precision and accuracy, which can be attributed to advanced technologies such as next-generation sequencing (NGS), mass spectrometry, and advanced imaging techniques. These technologies have allowed healthcare providers to diagnose rare diseases, genetic disorders, and complex conditions.

The development of these technologies has also provided an opportunity for personalized medicine. By analyzing an individual's genetic makeup, biomarkers, and unique molecular profiles, healthcare professionals can provide treatment plans and therapies that cater to the specific needs of each patient by optimizing outcomes and minimizing adverse effects. Furthermore, it has been observed that various laboratories have increased their focus on including advanced technologies in testing to provide better services.

- North America witnessed a esoteric testing market growth from USD 13.37 Billion in 2025 to USD 14.78 Billion in 2026.

Download Free sample to learn more about this report.

Esoteric Testing Market Growth Factors

Growing Burden of Chronic Diseases to Propel Market Growth

The growing prevalence of chronic diseases, such as functional gastrointestinal disorders, eczema, arthritis, cancers, asthma, chronic obstructive pulmonary disease, autoimmune diseases, genetic disorders, and other viral diseases, is one of the major factors contributing to the market growth of esoteric testing. For instance, according to data published by the World Health Organization (WHO), in 2020, the number of lung and breast cancer cases was estimated to be 2.21 million and 2.26 million, respectively.

These factors, coupled with the increasing focus of the market players on developing and introducing new advanced products and technology for the diagnosis of conditions, are expected to boost product adoption during the forecast period.

Growing Awareness of Early Diagnosis of Diseases to Boost Market Growth

The growing prevalence of chronic diseases across the globe has increased the adoption of esoteric tests among healthcare professionals. The increased adoption is amplified by the growing awareness of early disease detection worldwide through these advanced diagnostics.

For instance, the National Organization for Rare Diseases aims to diagnose, identify, and treat rare diseases through various programs. Some of these programs include patient service, advocacy, research, and education.

Furthermore, the COVID-19 pandemic elevated the awareness of diagnostic testing. The chronic disease testing campaigns worldwide presented the significance of accurate and timely diagnostics, drawing attention to the value of these testing techniques, such as PCR and serology testing. For instance, in July 2023, Ann & Robert H. Lurie Children's Hospital initiated an awareness campaign to reduce missed or delayed diagnosis of cystic fibrosis after newborn screening. Such initiatives to expand knowledge regarding complex diagnosis for genetic and non-genetic rare diseases are expected to propel the esoteric testing market growth during the forecast period.

RESTRAINING FACTORS

Lack of Specialized Professionals for Esoteric Testing May Limit Market Growth

Esoteric tests involve highly specialized and complex diagnostic procedures to diagnose rare diseases. However, the dearth of trained professionals, especially in developing regions, poses several challenges, hindering market growth.

These tests often require sophisticated equipment, advanced laboratory techniques, and a better understanding of complex diseases. Inadequate access to well-trained professionals in developing regions hampers the adoption of these testing services in the market. This could lead to the misinterpretation of results and inappropriate treatments, negatively impacting patient care.

Furthermore, the shortage of skilled professionals limits the capacity of laboratories to handle testing efficiently. The tests will take longer turnaround times, and reduced testing capabilities might deter doctors and researchers from utilizing these tests, which will affect patient care and hamper revenue generation in the future.

- For instance, according to the study published by BMJ Journals, the skilled health workforce in India does not meet the minimum threshold of 22.8 skilled workers per 10,000 population recommended by the WHO.

Such a dearth of skilled professionals, particularly in developing regions, presents a significant barrier to the growth of the esoteric testing market.

Esoteric Testing Market Segmentation Analysis

By Technology Analysis

Chemiluminescence Immunoassay Segment Held Major Share in 2026 Due to the Growing Burden of Chronic Diseases

Based on technology, the market is segmented into enzyme-linked immunosorbent assay, chemiluminescence immunoassay, mass spectrometry, flow cytometry, polymerase chain reaction, and others.

The chemiluminescence immunoassay segment held the highest market with a share of 45.04% in 2026 and is expected to expand at a substantial CAGR during the forecast period. The large share of the segment is attributed to the positive factors of this technology, such as higher sensitivity, wide assay range, precision, efficiency, and the ability to detect low-level biomarkers. Furthermore, the growing prevalence of chronic diseases, such as cancer, obesity, and diabetes, is expected to increase the demand for chemiluminescence immunoassay.

The mass spectrometry segment is anticipated to grow at a substantial CAGR during the analysis period. This segmental expansion can be attributed to an increase in the demand for this technology owing to the associated benefits. These include accuracy and the ability to analyze a wide range of molecules. Moreover, the growing prevalence of infections, hepatitis, and neurological disorders and the surge in the demand for these diagnostic testing services is expected to drive its demand in the future.

According to the Indian Policy of National Rare Disease 2021, new-born screening should be offered for small molecule inborn errors of metabolism by liquid chromatography – tandem mass spectrometry. This should be offered in cases where the diagnosis could not be established during the prenatal period.

- The Enzyme-linked immunosorbent Assay segment is expected to hold a 21.8% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Test Type Analysis

Infectious Disease Testing Segment Dominated the Market in 2026 Due to Increased Demand for Diagnosis of Several Forms of Infectious Diseases

Based on test type, the market is fragmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, and others.

The infectious disease testing segment accounted for the highest esoteric testing market accounting for 41.26% market share in 2026 and is estimated to grow at a substantial CAGR during the study period. The growing incidence of several types of infectious diseases coupled with the growing demand for these tests for their diagnosis is the primary factors favoring the dominance of the segment. The segmental growth is driven by the technological advancements in molecular diagnostics technology and the increased demand for diagnosis.

The oncology testing segment is anticipated to expand at a substantial CAGR during the forecast period, 2026-2034. The growth of the segment is attributed to the rise in the cases of cancers coupled with growing research on cancer diagnostics.

- For instance, according to a report published by the American Cancer Society, Inc., the estimated number of new cases of breast cancer was 287,850 in 2022. Such a high number of cases is expected to increase the adoption of such testing services in key markets such as the U.S. for indications such as occult breast cancer.

By End-user Analysis

Independent and Referral Laboratories Segment to Expand at the Highest CAGR Due to Substantial Volume of Patient Caseloads

Based on end-user, the market is segmented into independent and referral laboratories and hospital based laboratories.

In 2026, the independent and referral laboratories segment held the highest market share of 54.42% and is expected to expand at the highest CAGR during the forecast period, 2026–2034. This segmental growth is attributed to the increasing demand for the diagnosis of chronic diseases in these laboratories from doctors across the globe. Moreover, factors such as the large presence of these labs across the world and the various healthcare providers tied-up with them for complex esoteric tests drive their dominance in the market.

- In June 2022, SRL Diagnostics introduced a reference laboratory in Chennai, India. The laboratory can conduct more than one lakh tests, ranging from the most routine tests to esoteric and genetic tests.

The hospital based laboratories segment is expected to expand at a substantial CAGR during the forecast period, 2026-2034. The segmental growth is due to the awareness of early diagnosis of rare and chronic diseases coupled with a growing section of the population suffering from chronic diseases. Furthermore, the benefit of on-site testing in hospital settings is expected to drive segmental growth during the forecast period.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Esoteric Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 13.37 billion in 2025 and is slated to continue its dominance over the analysis period. The rapid adoption of mass spectrometry and other advanced techniques and the increasing awareness of the early diagnosis of diseases are expected to fuel the market expansion in the region. The U.S. market is projected to reach USD 13.57 billion by 2026.

Moreover, the growing number of cancer cases and a strong presence of companies in the region is expected to drive industry expansion across the region.

- For instance, according to a report published by the American Cancer Society, Inc., the estimated number of new cases of prostate cancer in the U.S. was 268,490 in 2022. Such a high number of cases is expected to increase the adoption of esoteric testing in the country.

Europe

Europe accounted for the second-highest share of the market in 2024 and is estimated to expand at a moderate growth rate over the analysis period. The growth is attributed to a surge in the prevalence of infectious diseases and robust healthcare infrastructure supporting advanced diagnostics. Furthermore, the growing awareness of precision diagnostics resulting in the increased number of laboratory visits for disease diagnosis drives the market in the region. The UK market is projected to reach USD 2.54 billion by 2026, while the Germany market is projected to reach USD 2.3 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to rise at the highest CAGR over the analysis period. The regional market expansion is attributed to the strong focus on the improvement of healthcare infrastructure and the increasing introduction of advanced technology for diagnosis in the region. The Japan market is projected to reach USD 1.41 billion by 2026, the China market is projected to reach USD 1.26 billion by 2026, and the India market is projected to reach USD 1.06 billion by 2026.

The market in the rest of the world is expected to grow at a comparatively lower CAGR over the study period. The growth is credited to the improvement in healthcare infrastructure, rising expenditure on healthcare, and growing awareness regarding the early detection of chronic diseases across the region.

- For instance, in March 2022, GC Labs, along with two partners, Bio Lab in Bahrain and Biotrust in Cambodia, announced a new lab testing services agreement. This strategic partnership would increase the adoption of testing in Latin America.

List of Key Esoteric Testing Market Companies

Quest Diagnostics Incorporated Held Leading Position in the Market in 2022 Owing to Diversified Testing Portfolio

The market for esoteric testing is consolidated due to the presence of prominent players with significant market share. Industry players such as Quest Diagnostics Incorporated and Laboratory Corporation of America Holdings were the leading players in the market in 2024.

Quest Diagnostics Incorporated dominated the market in 2024. The company's diversified testing services portfolio is one of the key factors contributing to its dominance in the market. Moreover, factors such as a strong direct and indirect market presence and the adoption of advanced technology in diagnosis are anticipated to help strengthen its market share further.

Other companies such as Eurofins Scientific, ACM Global Laboratories, Mayo Foundation for Medical Education and Research, and others are also undertaking various strategic activities to increase their market shares during the forecast period. These include initiatives for the expansion of their testing services portfolios, acquisitions, and mergers.

LIST OF KEY COMPANIES PROFILED:

- Eurofins Scientific (Luxembourg)

- Quest Diagnostics Incorporated (U.S)

- Laboratory Corporation of America Holdings (U.S.)

- ACM Global Laboratories (U.S.)

- Mayo Foundation for Medical Education and Research (U.S.)

- Sonic Healthcare Limited (Australia)

- ARUP Laboratories (U.S.)

- OPKO Health, Inc. (U.S.)

- Thyrocare (India)

KEY INDUSTRY DEVELOPMENTS:

- August 2022: Myriad Genetics, Inc. announced the grant-expanded coverage by Japan’s Ministry of Health for the use of its BRAC Analysis Diagnostic System. The system would be used as a companion diagnostic to identify patients with breast cancer.

- June 2022: Sentinel Diagnostics introduced SENTiFIT 800, an automated and high-throughput instrument for fecal tests. SENTiFIT 800 is for the quantification of fecal occult blood and calprotectin and the diagnosis of gastrointestinal diseases. These devices can be further utilized in esoteric testing.

- November 2021: ARUP Laboratories collaborated with PacBio for a study to evaluate whether the solve rate for rare disease cases can be increased. These rare diseases can be detected through esoteric testing.

- May 2021: Inova Diagnostics announced the Emergency Use Authorization of QUANTA Flash SARS-CoV-2 IgG by the U.S. FDA for use on the BIO-FLASH random access chemiluminescent analyzer. These analyzers can be further used in esoteric testing.

- February 2021: Quest Diagnostics Incorporated and GRAIL, Inc. entered a collaboration. The partnership was aimed at providing phlebotomy services to support Galleri, a multi-cancer early detection blood test offered by GRAIL.

REPORT COVERAGE

The esoteric testing market research report offers qualitative and quantitative insights on the products and services offered and a detailed analysis of the market’s size and growth rate. Along with this, the report provides the incidence/prevalence of major diseases in key countries and competitive landscape. Key insights offered in the report include technological advancements, key industry developments in the market, and key industry trends. In addition, the impact of COVID-19 and the industry overview during the pandemic are covered in the report.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 11.12% from 2026-2034 |

|

By Technology, Test Type, End-user, and Region |

|

|

Segmentation |

By Technology

|

|

By Test Type

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global esoteric testing market is projected to grow from USD 32.64 billion in 2026 to USD 75.89 billion by 2034.

The market is expected to exhibit a CAGR of 11.12% during the forecast period (2026-2034).

Key trends include the adoption of next-generation sequencing (NGS), AI-based diagnostic tools, and increased demand for personalized medicine and genetic testing for rare conditions.

By technology, the chemiluminescence immunoassay segment led the market in 2026.

North America dominated the esoteric testing market with a market share of 45.22% in 2025.

The market is driven by the rising prevalence of chronic and rare diseases, advancements in molecular diagnostics, and increased awareness of early and accurate disease diagnosis across healthcare systems.

Quest Diagnostics Incorporated and Laboratory Corporation of America are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us