Ethnic Food Market Size, Share & Industry Analysis, By Cuisine Type (Asian, Italian, Mexican, and Others), By Food Type (Veg and Non-Veg), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, and Online Sales Channels), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

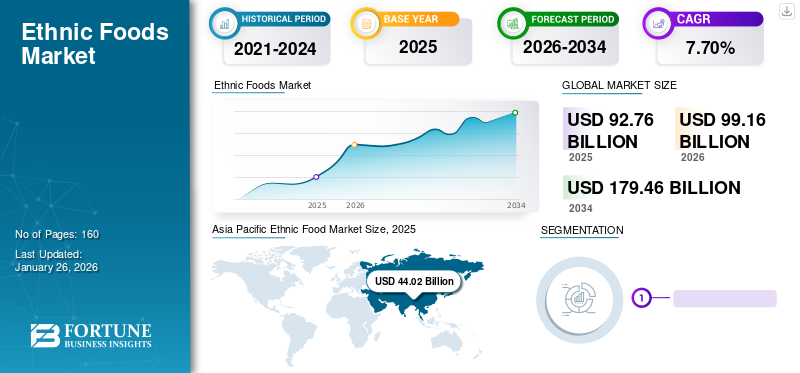

The global ethnic food market size was valued at USD 92.76 billion in 2025. The market is projected to grow from USD 99.16 billion in 2026 to USD 179.46 billion by 2034, exhibiting a CAGR of 7.70% during the forecast period. Asia Pacific dominated the ethnic food market with a market share of 47.45% in 2025.

Ethnic foods are defined as foods originating from the heritage and culture of an ethnic group that uses their knowledge of local ingredients of plants and animal sources. The innovation in the packaged and frozen food sector has grown steadily in the last few years. In addition, market players focus on expanding their product lines in every region by launching local food products in international markets. New and creative business models are being implemented to tackle the problems manufacturers face due to the COVID-19 pandemic. Innovative marketing strategies are expected to expand manufacturers' global reach and offer them lucrative opportunities in how local ethnic cuisine is marketed and sold during the forecast period. Furthermore, the increased frequency of travel will also help the market grow by bringing more travelers to local ethnic food joints.

Asia Pacific is the leading producer of packaged ethnic food globally. However, ethnic food production and export in the Asia Pacific region in 2020 was delayed due to the COVID-19 pandemic. China, one of the world's largest ethnic group food producers, faced challenges in producing and exporting ethnic cuisine products. Many factories globally were shut down after the COVID-19 pandemic. Therefore, production reached the lowest levels.

Ethnic Food Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 92.76 billion

- 2026 Market Size: USD 99.16 billion

- 2034 Forecast Market Size: USD 179.46 billion

- CAGR: 7.70% from 2026–2034

Market Share:

- Asia Pacific dominated the Ethnic Food Market with a 47.45% share in 2025, driven by high regional production and growing consumption of traditional cuisines.

- The Asian cuisine segment led the market due to widespread migration and demand for familiar flavors globally.

Key Country Highlights:

- China: Major exporter of ethnic cuisine, faced temporary disruptions in 2020 due to COVID-19.

- India: Largest source of international migrants; growing demand for Indian ethnic food abroad.

- U.S.: Rising demand for frozen and Asian ethnic foods driven by relocation and immigration trends.

- UAE: High migrant population supports strong demand for Asian and Hispanic ethnic foods.

- Japan, Thailand, South Korea: Leading exporters of ethnic food products.

- Mexico: Popularity of Mexican ethnic food products such as tacos and burritos growing internationally.

- Brazil & Argentina: Key contributors to ethnic food production in South America.

Ethnic Food Market Trends

Rising Preference for Frozen Foods to Offer Promising Opportunities

A key market trend has been the adoption of frozen food products in the last few years. In the early days, there were misconceptions and a lack of clarity about the freshness of frozen food products. However, as the years passed, consumers have become aware of the new technologies used to preserve frozen food while transporting it via international fleets and to various markets. Therefore, consumers prefer frozen food products more than ever with rising awareness about their benefits. Besides, manufacturers are launching new products in the frozen food categories and attracting consumers to their products.

Pizza, ready-to-eat (RTE) noodles, Chinese food products, Japanese food items, and ready-to-eat hot dogs are some of the products that are most consumed in this category. These products doubted to remain fresh after freezing, are now widely accepted in all the international markets with the latest cooling and preservation technologies. In developed places such as the U.K., Canada, Germany, Italy, the UAE, and the U.S., where the relocation is high, the consumer demand for local Asian/Italian food continuously increases.

Download Free sample to learn more about this report.

Ethnic Food Market Growth Factors

Increasing Migration/Relocation of Consumers in Various Regions to Drive the Market Growth

According to the World Economic Forum, there are an estimated 272 million international migrants, which makes up to 3.5% of the world's population. People's willingness to work abroad has increased globally in the last few years. While the share of international migrants is around 3.5% of the world's population, it has already surpassed some projections for 2050 made by the WEF. According to the forum, since 1970, the number of people living in a country other than where they were born has tripled. The U.S. is the primary destination for migrants, though as a proportion of its population, while the UAE has the largest migrant contingent.

The Gulf Cooperation Council (GCC) states have also seen significant population changes due to migration. Many consumers move to this region for work and migrants make up most of the population in GCC countries except Oman and Saudi Arabia. India continues to be the main origin of international migrants, with 17.5 million Indian-born people living abroad. Mexico and China have over 10 million former residents living worldwide. With a vast majority of the population relocating to various countries, their demand for local, regional food products has also grown in the last few years. With the easy availability of ethnic cuisine in international markets, consumers' spending has increased toward their local ethnic cuisine. With the Asian population being the major group of migrants, the demand for Asian food is increasing significantly.

Globalization of Regional Products and Rise of Online Sales to Drive Market Growth

The majority of the production of ethnic food in the Asia Pacific region takes place in countries such as Japan, China, India, Thailand, and South Korea. Hence, this region is dominating the global ethnic cuisine food production by a large margin. With the increasing demand for Asian food products such as Japanese, Thai, Chinese, Indian food, and Vietnamese cuisine throughout the world, these countries are emerging as major exporters of ethnic group foods to the world. With the demand for traditional ethnic group food continuously increasing, these nations are also getting exposure to various new types of ethnic group foods and are gaining recognition in the global markets.

Moreover, with fast-growing online sales channels, the market is now wide open for consumers to buy their favorite local food from any corner of the globe. These factors contribute positively toward the market growth and are expected to do so during the forecast period.

RESTRAINING FACTORS

Consumer Demand for Fully Natural Products to Restrain the Growth of Preserved Food Items

Since the last few years, mainly after the 2000s, consumers' awareness of consuming natural food products has been growing. Ethnic group food products are mainly transported from one country to another and to do so, they need to use some edible chemical preservatives, but as the awareness about the use of natural ingredients in food products is increasing, they might face challenges related to the addition of chemicals to preserve the products for a longer time. Moreover, as the major means of transportation in the world is the sea, it takes time for the products to travel to their destination. In such cases, the use of natural ingredients may not always be feasible to keep the good shelf life of the products. To overcome these restraining factors, local manufacturers need to partner with some of the international manufacturers settled in various regions of the world. Considering the presence of a large number of local and small manufacturers, shifting from chemical ingredients to natural ingredients might be difficult, and this would act as a restraining factor for the growth of the global market.

Ethnic Food Market Segmentation Analysis

By Cuisine Type Analysis

Asian Segment Holds Major Market Share Due to High Consumption and Easy Availability

Based on cuisine type, the market is subdivided into Asian, Italian, Mexican, and others. The Asian segment dominates the market owing to its wide acceptance and favoritism in almost all regions. Due to the huge migration of working groups from Asia, its population is widespread in many countries of the world. With the population widespread in almost every country, demand for regional ethnic cuisine food is increasing. Moreover, the demand for Italian food types such as pasta, pizza, and lasagna is also increasing owing to the wide acceptance and presence of these foods in ready-to-cook form, even in the smallest markets of the world. The asian segment is projected to dominate the market with a share of 38.88% in 2026.

The Mexican segment is expected to showcase a promising market growth on account of their growing consumption in Asian & North American countries. In countries such as the U.S., Canada, Mexico, the UAE, and India, the product consumption has been increasing over the last few years. This factor offers promising growth opportunities for the expansion of the global market.

To know how our report can help streamline your business, Speak to Analyst

By Food Type Analysis

Non-Veg Food to Hold Major Share Owing to High Demand and Consumption

The non-veg segment dominates the global market and is expected to retain its dominance during the forecast period. Non-veg food is part of the daily diet in almost every European, North America, South America, Chinese, and Middle Eastern household. Their daily meals consist of a larger amount of non-veg food compared to veg food. Non-veg consumption globally is much higher than veg consumption. Hence, the market share of non-veg ethnic food is also high. The non-veg type segment will account for 65.98% market share in 2026.

However, with awareness about the benefits of vegan diets and vegetarian food consumption, some consumers are also leaning toward vegetarian diets. This factor is expected to boost the veg segment during the forecast period making it the fastest-growing segment over the study period.

By Distribution Channel Analysis

Hypermarkets/Supermarkets to Remain Dominant Due to Strong Product Sales

Based on distribution channel, the market is divided into hypermarkets/supermarkets, grocery stores, convenience stores, and online sales channels. The hypermarkets/supermarkets segment dominated the global market, owing to the availability of a wide range of products. Also, migration due to studying and working abroad has necessitated these mass merchandisers to offer cuisines of various countries. The hypermarkets/supermarkets segment is expected to lead the market, contributing 36.15% globally in 2026.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Ethnic Food Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held a major market share in 2024. This is mainly due to the growing adoption rate of ethnic food and ingredients in traditional cuisines of various countries such as the U.S., Italy, Germany, China, Japan, India, Australia, and the UAE. In addition, the growing product demand from the food service sector propels the ethnic food market growth in the region. The Japan market is projected to reach USD 8.43 billion by 2026, the China market is projected to reach USD 15.28 billion by 2026, and the India market is projected to reach USD 12.46 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America, which includes the U.S., Canada, and Mexico, is expected to experience steady growth owing to the growing demand for Asian cuisine such as Thai caused by the growth in the relocation of Asian consumers in the region. Moreover, the rise in the popularity of Asian food products and other new ethnic cuisine foods in the North American region has propelled the demand for the import of various regional ethnic group foods. The increasing popularity of frozen foods and regional food products from smaller countries such as Thailand, Vietnam, and the Philippines has attracted consumers to this food sector. Ongoing developments and technological advancements in the preservation and freezing of ethnic cuisine foods are expected to drive the growth of the U.S. ethnic cuisine food market majorly in the region. Evolving demographic trends, including better diversity due to immigration, caused consumer demand for ethnic foods to grow faster over the last few decades. Asian, Mexican, and African cuisines have a rich history that are rooted in the indigenous cultures of various countries and have later evolved with the establishment of foreign colonies in these regions. Many Mexican ethnic food products are a diverse blend of indigenous, African, European, and Asian cuisines and are known for their bold flavors. Tacos, enchiladas, burritos, tamales, mole, and pozole are a few examples of the Mexican ethnic food products that are popular in the international markets. The growing consumer inclination toward these products is boosting the growth of the Mexican ethnic foods. The U.S. market is projected to reach USD 10.75 billion by 2026.

Europe

The ethnic food market share in Europe is expected to exhibit comparatively slower growth as compared to the other developed regions. In Europe, the presence of local ethnic group food products such as Italian, Spanish, French, and Greek products restrict the exponential growth of other ethnic group food categories in Europe. However, the demand is expected to grow steadily. There has been a high demand for Italian and Spanish food for a long time and hence the consumption of Mexican cuisine is not highly increasing but experiencing slow and steady market growth. The UK market is projected to reach USD 3.05 billion by 2026, while the Germany market is projected to reach USD 3.56 billion by 2026.

South America

The South America market is expected to exhibit a stable growth rate during the forecast period owing to its geographical area, which includes various oceanic landscapes. The major countries contributing to the production of ethnic cuisine food and specialty food in South America are Brazil and Argentina. The ethnic group food market in this region is expected to offer promising opportunities by improving freezing technologies and making other ethnic cuisine food items available in this region.

Middle East and Africa

The market in the Middle East and Africa is still at the nascent stage. Asian food is one of the most consumed ethnic group foods in this region as the region is the most-sought by individuals from Asian countries who are willing to relocate for jobs and explore new locations. The market is expected to experience steady growth attributed to the rising demand for Asian and Hispanic food from middle-income groups.

List of Key Companies in Ethnic Food Market

Key Players to Focus On Expansion of Businesses in New Geographies to Stay Competitive

The ethnic foods industry comprises local players, which exceed the number of international players. Local players are continuously trying to expand their inter country food business footprint in new countries. Considering the increasing demand for various ethnic cuisines, food industry players are making their products available in international markets by expanding in the market by themselves or by entering into partnerships with other local players in the respective markets. Brands such as Beyond Meat have launched pork food in China, considering Chinese consumers' increasing demand for pork. In another move, the Mizkan Group expanded its Mizkan brand of Japanese sauces and rice vinegar in the U.S. by launching Mizkan America offerings.

The authentic Thai Dragon brand entered the Thai cuisine market in Thailand in 2020. Its line of Thai snacks includes five Thai-inspired sauces. These included Thai Dragon Sriracha Hot Chilli Sauce Original, Thai Dragon Sriracha Hot Chilli Sauce Wasabi Flavor, Thai Dragon Black Fire Extra Hot Chilli Sauce, Thai Dragon Sriracha Chilli Mayo Sauce (vegan), and Thai Dragon Sweet Chilli Sauce. With such product innovations, market players are trying to grab opportunities to enter new markets.

List of Key Companies Profiled:

- Ajinomoto Co. Inc. (Japan)

- Associated British Foods PLC (U.K.)

- McCormick & Company Inc. (U.S.)

- MTR Foods (India)

- Nestle S.A. (Switzerland)

- General Mills (U.S.)

- Conagra Brands Inc. (U.S.)

- Tasty Bite Edibles Pvt. Ltd. (India)

- Taco Bell (U.S.)

- B&G Foods (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Haldiram’s Foods International Pvt. Ltd. entered the premium chocolate market to compete with established players in the Indian market, such as ITC and Mondelez. Haldiram’s Foods is planning to expand its frozen foods and bakery businesses to strengthen its presence in the sweets & snacks market.

- June 2022: O'Food, which offers traditional seasonings for ready-to-eat meals, launched its first frozen food, mandu. Mandu is a classic Korean dumpling that is steamed, boiled, or fried. Mandu products are made of thin casings and stuffed with traditional Korean ingredients. O' food launched two different flavors, kimchi and plant-based mandu. The company's motive to increase its customer base was to provide new flavors to its customers, and Korean-inspired ready meals continue to make a culinary impact on consumers.

- October 2021: General Mills partnered with U.S. chip brand Takis to introduce new flavors of taco shells and expand its Old El Paso product line. The company offers the 'Hot Chili Pepper and lime flavored Stand'n Stuff taco shell. The product was first made available at Walmart stores.

- February 2020: The Mizkan Group launched its brand “Mizkan”, which specialises in producing Japanese sauces and rice vinegar, in the U.S. market, starting by launching Mizkan America offerings. Mizkan’s product line of rice vinegar features non-GMO products.

- November 2020: McCormick & Company acquired Cholula Food Company for USD 800 million. Cholula Food Company is a Mexican company that provides authentic Mexican-flavored hot sauces. Through this acquisition, McCormick aimed to expand its offering to consumers and food service providers in the rapidly growing hot sauce segment.

REPORT COVERAGE

An Infographic Representation of Ethnic Foods Market

To get information on various segments, share your queries with us

The research report provides a detailed analysis of the market and focuses on key aspects such as major players, competitive landscape, product types, and product application areas. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cuisine Type

|

|

By Food Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the market size was valued at USD 92.76 billion in 2025.

The market is likely to record a CAGR of 7.70% over the forecast period of 2026-2034.

The Asian segment is expected to be the leading segment in this market during the forecast period.

Globalization of regional products and rise in online sales are the key factors that are driving this market.

Ajinomoto Co. Inc., Nestle, and Conagra are the major players in the market.

Asia Pacific dominated the market with a share of 47.45% in 2025.

Consumer demand for fully natural products may restrain the growth of preserved food items.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic