Europe Photo Printing & Merchandise Market Size, Share & Industry Analysis, By Type (Photo Printing and Merchandise), By Product (Photobooks, Calendars, Apparel, and Others), By Distribution Channel (Retail Stores, Online Stores, Instant Kiosks, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

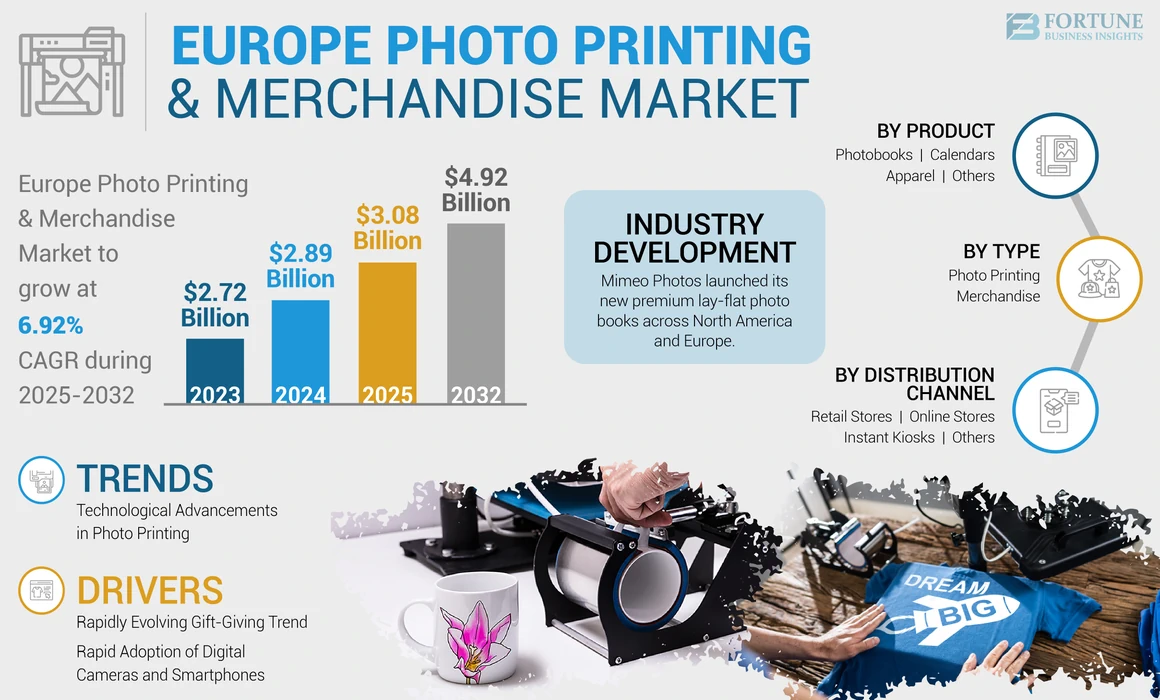

The Europe photo printing & merchandise market size was valued at USD 2.89 billion in 2024. The market is projected to grow from USD 3.08 billion in 2025 to USD 4.92 billion by 2032, exhibiting a CAGR of 6.92% during the forecast period.

The emerging smartphone replacement trend and increasing consumers' necessity to store smartphone-clicked photographs in the form of on-demand photo printing & merchandise, including albums, gift cards, frames, and posters, drives market growth.

The increasing number of married couples boosts the demand for premium wedding photography services, including wedding photobooks and albums. Moreover, the rising trend of guest wedding photobooks and photo gifts drives market growth in Europe.

Rising demand for personalized photo gift packages, increasing demand for smartphones, and evolving festival celebration & gift-giving trends among households will likely accelerate the sales of photo merchandising products in Europe. At a macro level, the rising influence of social media and emerging trends in the global market, including North America and the Middle East & Africa, positively influence Europe’s market growth rate.

Several prominent photo printing & merchandise companies are focusing on partnerships to introduce innovative products. For instance, in October 2023, Mixbook, a California-based photo products company, partnered with PetSmart, a U.S.-based pet products retail chain, to launch a new Mixbook collection. The company's latest collection features holiday-themed, giftable photobooks, cards, and calendars for pet parents.

The COVID-19 pandemic had a severe impact on the Europe photo printing & merchandise market. The pandemic led to cancellation or postponement of various events, including weddings and engagements owing to lockdowns imposed by the government across the region. Moreover, the decline of international and domestic tourists across countries due to travel restrictions in the region limited the market growth.

Europe Photo Printing & Merchandise Market Trends

Technological Advancements in Photo Printing to Favor Market Growth

Photo product manufacturers are strategically integrating advanced technologies to improve the quality of their product offerings, given the increasing demand for photo printing. They offer products based on advanced technological features, such as higher-resolution printing, enhanced color accuracy, and integrated printing techniques. These technological advancements collectively result in the development of visually appealing and professional-grade photo merchandising products, aligning with consumers' evolving expectations in the digital age. For instance, in August 2023, nphoto.com, a Zaczernie, Poland-based Photo product manufacturer, introduced a new photo album featuring a round spine design to support product durability, especially for larger book blocks exceeding 30 pages.

Download Free sample to learn more about this report.

Europe Photo Printing & Merchandise Market Growth Factors

Rapidly Evolving Gift-Giving Trend to Favor Photo Printing & Merchandise Market Expansion

Photo products, including personalized photo books, calendars, and merchandising items, hold a profound sentimental value and are considered a preferred gift-giving option among European consumers. The growing trend of gifting photo printing products during festive occasions and special events favors product demand in Europe. Furthermore, the increasing adoption of a gift-giving culture among corporate professionals as part of team-building activities positively influences the Europe photo printing & merchandise market trends.

According to the Survey conducted by TK Maxx, a retail company, in October 2023, around 25% of U.K. females tend to receive gift cards and other gift products during special occasions and festive events.

Rapid Adoption of Digital Cameras and Smartphones to Fuel Photo Printing & Merchandise Adoption

Surging demand for digital cameras and smartphones increases consumers’ need to print personal photographs, driving the Europe photo printing & merchandise market growth. Furthermore, technological advancements in developing high-resolution cameras and smartphones and the increasing necessity of communication and connectivity favor the consumption of photo merchandising products across Europe.

RESTRAINING FACTORS

Cloud Storage Advancements to Limit Photo Printing & Merchandise Demand

Advancements in cloud storage technologies enable users to store photographs on cloud platforms. Cloud computing platforms enable users to view, share, and organize digital photographs on multiple devices. These aspects are influencing cloud platform users to preserve personal photographs in digital formats, limiting consumers' spending on physical photo printing products across Europe.

Additionally, the growing awareness of the environmental concerns of waste generation from plastic-based photo frames and photo cards can influence users to opt for digital printing storage methods, negatively impacting the Europe photo printing & merchandise market growth over the forecast period.

Europe Photo Printing & Merchandise Market Segmentation Analysis

By Type Analysis

Increasing Usage of Digital Photo Prints Propelled Segment Growth

Based on type, the market is segmented into photo printing and merchandise. The photo printing segment dominated the market in 2024 owing to the increasing usage of digital photo prints in producing handbooks, journals, and photo books. Various players in the photo printing industry are using sustainable and organic photo printing products for wedding invitations, photo books, and gift cards that are made with recycled materials, boosting demand among eco-conscious consumers.

The merchandise segment is expected to grow significantly throughout the forecast period owing to evolving home decoration & renovation trends and increasing household consumers’ demand for photo-printed homewares, including wall art, pillows, floor mats, coasters, covers, and drinking mugs.

To know how our report can help streamline your business, Speak to Analyst

By Product Analysis

Growing Number of Domestic Tourists Fueled Demand for Photobooks

By product, the market is segmented into photobooks, calendars, apparel, and others. The photobooks segment dominated the market in 2024 owing to the increased number of domestic tourists and changing consumer inclination from creating travel scrapbooks to photobooks to restore their exclusive vacation memories.

The calendars segment is expected to grow significantly over the forecast period. Increasing usage of personalized calendars among households and corporate infrastructure facilities drives calendars' segmental growth. Moreover, increasing consumer preference for minimalistic personalized calendars of elegant designs and affordable size options favor segmental revenues across Europe.

By Distribution Channel Analysis

Increasing Popularity of Print-on-demand Products Accelerated Product Sales through Retail Stores

By distribution channel, the market is segmented into retail stores, online stores, instant kiosks, and others. The retail stores segment led the market in 2024 owing to the increasing number of retail stores offering print-on-demand products. For instance, in 2021, allcop Farbbild-Service GmbH & Co. KG established a partnership with German specialty photo product retailers to increase its product reach across Germany.

The online stores segment is expected to grow significantly over the forecast period. Rising demand for Print-on-Demand (POD) merchandising products and the evolving European drop shipping industry mainly drive product revenues from online retailing channels. Furthermore, regular e-commerce shopping sites’ provision of discounted printed apparel with free delivery options influences youngsters to order photo products online, favoring online segmental growth.

COUNTRY INSIGHTS

The market is studied across Germany, France, the U.K., Russia, Spain, Austria, Poland, the Netherlands, Greece, Portugal, Switzerland, Italy, and the rest of Europe.

Germany dominates the market owing to the dominance of prominent market players, including Cewe, ORWO NET GmbH, and Photobook Worldwide, as well as rising home renovation and remodeling across the country. Additionally, growing disposable income and the rising popularity of giving gifts during festivals, such as Christmas, New Year, and Halloween, increase the Europe photo printing & merchandise market share.

France is set to rise significantly in the coming years due to a rise in domestic tourists and their expenditure on travel-theme-based photobooks and calendars to save travel-related memoirs. Moreover, the increasing consumer need to generate photobooks to store holiday activity-related photographic information and emerging outdoor recreation and relaxation trends are assisting market growth in the country.

KEY INDUSTRY PLAYERS

Prominent Players Focus on Mergers to Strengthen Brand Presence

Intense competitive rivalry characterizes the market for photo printing & merchandise. In recent years, market players have focused on mergers as one of their key tactics to gain a competitive edge and strengthen their brand presence. For instance, in January 2022, Photobox, a U.K.-based photo products company, merged with Albelli, a Netherland-based photo product company. According to the company, the merger is to expand its reach across Europe.

List of Top Europe Photo Printing & Merchandise Companies:

- CEWE (Germany)

- Fujifilm (Japan)

- Saal Digital (Germany)

- Cimpress Vistaprint (Ireland)

- Photobox Group (U.K.)

- ifolor Group (Switzerland)

- Smartphoto Group (Belgium)

- Shutterfly (U.S.)

- Mixbook (U.S.)

- EXACOMPTA CLAIREFONTAINE (France)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: A Poland-based photo printing business named nPhoto introduced a new softcover photo book made of cellulose fibers with interiors made from mohawk eggshell and arctic matte papers.

- September 2023: Mimeo Photos, a New York, U.S.-based photo products company, launched its new premium lay-flat photo books across North America and Europe. According to the company, the new photobook features a 20-page base count and pearl-textured photographic paper.

- May 2023: allcop Farbbild-Service GmbH & Co. KG, a Germany-based photo and personalized products company, launched its new sustainably designed photo book, Natur Pur Fotobuch. According to the company, the product is made using 100% Blue Angel-certified recycled paper.

- October 2021: Shutterfly, a U.S.-based photography products company, partnered with Marie Kondo, a Japanese TV presenter and organizing consultant, to launch a new collection. The Shutterfly x KonMari collection includes photo books, ornaments, calendars, cards, and home decor.

- May 2021: Fujifilm Corporation, a Japanese photography products company, launched its new online photo retailing brand ‘myFUJIFILM’ in the U.K. According to the company, the new brand offers various photo products, including photo mugs, photo books, calendars, and soft furnishings.

REPORT COVERAGE

The photo printing & merchandise market research report analyzes the market in-depth and highlights crucial aspects such as prominent companies, products, type analysis, and distribution channels. Besides this, the report provides insights into the market trends, price trend analysis, and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.92% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Distribution Channel

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 2.89 billion in 2024 and is anticipated to reach USD 4.92 billion by 2032.

The market will ascend at a CAGR of 6.92% over the forecast period of 2025-2032.

By type, the photo printing segment is expected to dominate the market throughout the forecast period.

The rapidly evolving gift-giving trend accelerates product sales.

CEWE, Fujifilm, Snapfish, Cimpress (Vistaprint), Photobox Group, and Ifolor Group are the leading companies in Europe.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us