Feminine Hygiene Products Market Size, Share & Industry Analysis, By Product Type (Menstrual Care Products and Cleaning & Deodorizing Products), By Nature (Disposable and Reusable), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

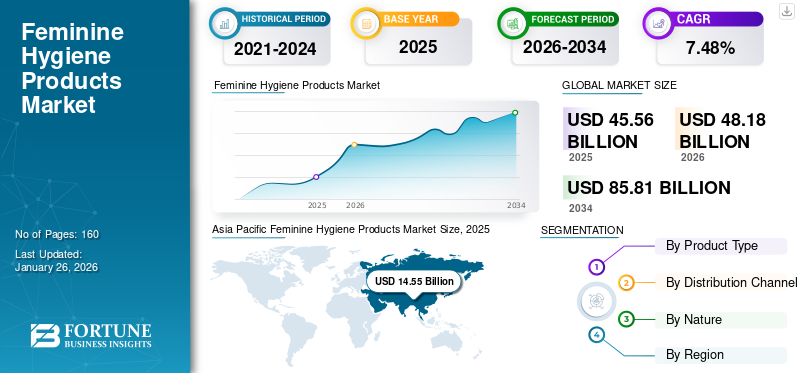

The global feminine hygiene products market size was valued at USD 45.56 billion in 2025 and is anticipated to grow from USD 48.18 billion in 2026 to USD 85.81 billion by 2036, exhibiting a CAGR of 7.48% during the forecast period. Asia Pacific dominated the feminine hygiene products market with a market share of 31.94% in 2025.

Today, technological advancements and availability of quality education have helped women better understand important aspects of their bodies, such as the menstruation cycle. Poor sanitation of genital areas can lead to temporary infections and certain severe conditions, such as infertility. Therefore, healthcare professionals are continuously recommending menstrual care products to prevent the occurrence of such conditions. This factor will support the market growth in the future. The Procter & Gamble Company reported a 9% growth in its baby, feminine, and family care business segment and reached USD 20,217 million in the first half of 2023. Rise in its segment's revenue is attributed to the increasing consumer demand for feminine care products during the period.

Global Feminine Hygiene Products Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 45.56 billion

- 2026 Market Size: USD 48.18 billion

- 2034 Forecast Market Size: USD 85.81 billion

- CAGR: 6.98% from 2026–2034

Market Share:

- Asia Pacific dominated the feminine hygiene products market with a 31.94% share in 2025, driven by rising hygiene awareness, urbanization, and increasing disposable income among working women in countries like India and China.

- By product type, menstrual care products held the largest market share due to their regular usage and government initiatives promoting awareness and accessibility.

- By nature, disposable feminine hygiene products dominated the market with rising demand for eco-friendly materials such as organic cotton and bamboo.

- By distribution channel, hypermarkets/supermarkets led the market due to bulk purchasing preferences, followed by drug stores with their trusted brands and convenience.

Key Country Highlights:

- India & China: Growth fueled by rising hygiene awareness, urbanization, and increasing working female population with higher disposable incomes.

- United States: Market expansion supported by continuous manufacturing base growth and strong brand promotions like Kotex and Tampax.

- Western Europe: Highest usage of feminine hygiene products with more than 380 units per woman per year, driven by better sanitation practices and higher income levels.

- South America & Middle East & Africa: Market growth supported by government initiatives such as Kenya’s Menstrual Hygiene Management Policy.

Feminine Hygiene Products Market Trends

Rising Waste Reduction Efforts to Bode Well for Market Growth

Reusable and alternative green products are being promoted to reduce the burden of waste generation due to single-use pads & tampons and disposable deodorizing wipes. According to the United Nations Environment Programme (UNEP), single-use plastic-based menstrual products take more than 500 years to decompose. Therefore, reusable menstrual cups, period underwear, and pads are a few solutions that are gaining traction for minimizing waste generation. According to the article 'Making Menstrual Products Eco-friendly,' published by Plastic Oceans International in February 2021, globally, near 45 billion menstrual products are being used annually, and on average, a pad user uses 4,125 plastic bags over a lifetime.

Use of safer and less toxic fragrance additives in deodorizing products, biodegradable wipes, and recyclable packaging is being heavily promoted by companies among customers. For instance, Bodywise (U.K.) Limited offers a natracare product range of tampons, panty liners, wipes, and pads. These products are made with 100% organic cotton, sustainably sourced wood pulp, and compostable bioplastic free from synthetic dyes, and certified vegan.

Asia Pacific witnessed feminine hygiene products market growth from USD 13.23 billion in 2023 to USD 13.83 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increase in Menstrual Literacy Rate to Propel Market Growth

Feminine hygiene products make it easier for women to control their blood flow while going through their menstrual cycle. Increased education levels, rising female workforce, and a better menstrual literacy among teenage girls are largely supporting the market's expansion. According to an article titled 'Periods Shouldn't be a Financial Burden, Here's How One Retailer is Helping' published by the World Economic Forum, the U.S. spending on menstrual products in 2020 reached USD 2 billion. Furthermore, increased awareness of menstrual hygiene among women consumers to avoid bacterial infection during the COVID-19 pandemic amplified the product demand globally.

The feminine hygiene products market growth is also driven by a rising number of diseases, such as infection in the lower reproductive tract owing to poor hygiene of genital areas. Growing awareness regarding maintaining hygiene during menstruation and the need to eliminate odor are increasing the product's popularity.

Growing Hygiene-related Initiatives to Increase Product Sales

Several initiatives, such as Menstrual Hygiene Day (May 28th), initiated by a German non-profit organization and WASH United are likely to increase hygiene awareness among women. Such programs will also remove several related taboos, thereby increasing the demand for feminine hygiene products.

Similarly, Menstrual Health and Hygiene (MHH) activities are considered among the five core priorities for adolescent girls in UNICEF's Gender Action Plan (2018-2021), which is planning to provide basic knowledge and improve access to menstrual care materials and facilities. For instance, in June 2022, Essity and UNICEF extended their agreement to promote the importance of following menstrual hygiene practices. Since 2019, nearly 200,000 Mexican people, including 42,000 public servants and 3,200 teachers, have benefitted from this partnership. Therefore, rising efforts by global healthcare organizations and players operating in the market to educate girls and women will likely increase the adoption of feminine hygiene products.

Market Restraints

Incidences of Skin Rashes Due to Prolonged Product Usage to Limit Market Growth

Incidences of skin rashes and skin infection due to the usage of reusable tampons, sanitary pads, and cups for a longer duration can restrain the product demand among global consumers. Furthermore, lack of awareness of efficient use of the product and limited product availability can hamper the product consumption rate across emerging and undeveloped countries.

Market Opportunities

Increasing Biodegradable Materials' Usage in Menstrual Pads to Create Newer Market Growth Opportunities

Advancements in the development of biodegradable materials including organic cotton, banana fiber, bamboo, and others used in various products such as tampons, reusable menstrual cups, period underwear, and others. is expected to create newer market growth opportunities. In addition, emergence of industry innovator-made menstrual hygiene tracking applications increases the adoption of personal hygiene products among health conscious consumers, creating newer market growth avenues.

Market Challenges

Higher Product Cost to Challenge Business Players Expand in Underprivileged Developing Markets

Higher cost of menstrual hygiene-related personal care products limit its demand among the middle and lower-income consumer groups across underprivileged developing markets. In addition, easy consumers' accessibility to the affordable reusable cloth nappies and supporters are expected to pose challenges to the market growth worldwide.

Segmentation Analysis

By Product Type

Menstrual Care Products to Gain Notable Traction Due to their Higher Usage

Based on product type, the market is segmented into menstrual care products and cleaning & deodorizing products.

The menstrual care products segment dominated the global feminine hygiene products market share by 74.63% in 2026, as women use these products every month across the globe. Additionally, the growing government initiatives for increasing awareness and access to feminine hygiene products will aid market expansion. For instance, in October 2021, the government of Ontario, Canada started distributing 6 million free period products to schools located across the Ontario province.

The menstrual care products segment is further divided into sanitary napkins/pads, panty liners, tampons, and others. Sanitary napkins/pads segment is slated to grow at a second fastest rate during the forecast period of 2025-2032. The segment is also expected to acquire 36.91% of the market share in 2025. The increased governmental health programs and eduation building consumers attitude toward hygiene has uplifted the demand for the sanitary pads across many countries. Advancements in the development of ultra-thin, organic, and biodegradable pads, appealing eco-consious consumers’ menstrual care needs positively contributed to the sanitary napkins/pads’ segments growth.

Tampons segment is slated to increase at a fastest growth rate due to the accelerating women consumers’ demand for the organic, chemical-free, and biodegradable tampons worldwide. In addition, rising number of women sportsman using tampons to maintain their hygiene needs during sports and other outdoor activities favor tampons segment’s revenue growth during 2025-2032.

Panty liners segment are likely to exhibit a CAGR of 5.88% during the forecast period, gaining popularity among working women professionals seeking convenience and comfort during lighter menstrual days. Increasing consumers’ shift toward natural, fragrance-free, and organic panty liners create newer segment revenue growth opportunities worldwide.

Others segment covering the analysis on other menstrual care products including menstrual cups and period panties. Rising demand for the medical-grade silicone or rubber-based menstrual cups and sustainable period panties to significantly cut down menstrual waste fueled the others segment’s growth.

The need to get rid of bad body odor has become an important factor among teenagers and working women, thereby increasing the adoption of deodorizing products. High-income groups invest heavily in deodorizing products to enhance their personal hygiene. .

By Nature

Disposable Segment Holds Major Share due to Regular Introduction of Innovative Products

Based on nature, the market is bifurcated into disposable and reusable.

Disposable feminine hygiene products are anticipated to stay dominant during the forecast period. There is an increasing demand for eco-friendly manufactured disposable products made from materials such as plant-based fibers, natural cotton, bamboo, and others. Therefore, various manufacturers across the globe are trying to introduce sustainable products to meet consumer needs.

Additionally, the need for reusable feminine hygiene products such as adult diapers is increasing due to the aging population. However, to increase the demand for the product and stabilize the market, marketers need to change their marketing strategies..

By Distribution Channel

To know how our report can help streamline your business, Speak to Analyst

Hypermarket/Supermarket Segment to Remain Dominant Due to Bulk Purchasing Options

Based on distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, drug stores, and others.

The hypermarkets/supermarket segment is dominating the market as women prefer to buy their hygiene products in bulk at these stores. These channels offer heavy discounts on bulk purchases, attracting consumers to buy tampons and pads that are usually highly priced and not affordable for low-income groups. Hypermarkets are a one-stop destination for females to purchase several required period products where various brands can be compared before making the final decision. This segment is forecasted to gain 33.36% of the market share in 2026.

Pharmacies and drug stores usually offer limited product range. However, the drug stores segment held a significant market share due to the presence of trusted brands, easy store access, and easy payment options. Drug stores are expected to record CAGR of 7.69% during the forecast period.

FEMININE HYGIENE PRODUCTS MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Feminine Hygiene Products Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market value stood at USD 14.55 billion in 2025, and in 2026, the market value was at USD 15.37billion. This region is expected to dominate the feminine hygiene products market growth due to rising hygiene awareness and urbanization in India and China. The growing number of working women in these countries has resulted in higher disposable income, which enables them to spend more on their health and body. The continuous development of reusable products will further foster the regional market growth. Reusable products provide a cost-effective solution against purchasing new disposable products every time for the next use. For instance, as per a survey conducted by the Government of Scotland in May 2020, 42% of the Scotland population uses disposable menstrual items. The market in China is estimated to be USD 5.91 billion in 2025.

- The India’s market size is foreseen to be valued at USD 2.55 billion and Japan’s likely to be USD 1.66 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America and Europe

North America region is to be anticipated the third-largest market with USD 10.63 billion in 2026. Consistent Kotex, Tampax, Always, and other brands' provision of feminine hygiene education through social media campaigns and advertisements increases the American consumers' demand for menstrual care products, driving the market growth in the U.S. The U.S. market is predicted to stand at USD 7.19 billion in 2026. In addition, continual manufacturers' production base expansion activities support the development of the market in the U.S. For instance, in July 2022, Ontex Group opened a new manufacturing facility for essential hygiene products in Stokesdale, North Carolina, U.S.

North America and Europe are mature markets owing to higher standard of living, better sanitation practices, and greater income levels for women. Europe to be anticipated the second-largest market with USD 11.89 billion in 2025, recording the second-largest CAGR of 7.53% during the forecast period. These factors have resulted in the regions holding a significant market share. For instance, according to the annual sustainability report published by Essity AB, a leading hygiene products maker, in 2020, the highest usage of feminine hygiene products was witnessed in Western Europe, followed by North America and Eastern Europe. As per the same source, women in Western Europe aged 10 to 54 use more than 380 units of feminine hygiene products per year. The market in U.K. is estimated to be USD 1.74 billion in 2026.

- The Germany’s market size is foreseen to be valued at USD 3.64 billion in 2026 and France’s likely to be USD 3.17 billion in 2025.

South America and the Middle East & Africa

South America region is to be anticipated the fourth-largest market with USD 5.28 billion in 2026. Favorable government initiatives in South America and the Middle East & Africa will increase the demand for feminine hygiene products. For instance, in May 2020, Kenya's Ministry of Health launched the country's first Menstrual Hygiene Management (MHM) Policy and Strategy with support from the Water Supply and Sanitation Collaborative Council (WSSCC). A few key strategies in the policy included mainstreaming the development of MHM for Water, Sanitation and Hygiene (WASH) infrastructure and strengthening MHM education and awareness. The UAE market size is estimated to hit USD 0.490 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Companies to Focus on Product Development to Consolidate their Market Positions

The market is characterized by prominent players, such as Procter & Gamble, Unilever, Kimberley Clark, and several local and startup companies. Manufacturers are focusing on developing safer and easy-to-use hygiene products. Designing products with softer materials to minimize allergic reactions and rashes, and developing sustainable products are important aspects to be considered by market players while making new products.

Manufacturers are also focusing on geographic expansions and product optimization based on consumer feedback to cater to their changing preferences. For instance, in March 2021, Care Form Labs Private Limited, Pune, an India-based social innovation startup, launched menstrual cups that are easy to use and switch by users. Furthermore, in January 2023, HLL Lifecare Limited launched three brands of environment-friendly and easy-to-use menstrual cups for women across the globe.

LIST OF TOP FEMININE HYGIENE PRODUCTS COMPANIES

- Procter & Gamble Company (U.S.)

- Unicharm Corporation (Japan)

- Essity AB (Sweden)

- Kimberly-Clark Corporation (U.S.)

- Ontex Group NV (Belgium)

- Edgewell Personal Care (U.S.)

- Maxim Hygiene (U.S.)

- Hengan International Group (China)

- Johnson & Johnson (U.S.)

- Unilever Plc. (U.K.)

KEY INDUSTRY DEVELOPMENTS

- January 2024 – Compass Diversified (CODI), a publicly traded company, invested USD 380 million to acquire The Honey Pot Company, an Atlanta, U.S.-based feminine care brand operating in more than 33,000 U.S. retail stores. Through this partnership, the brand will be able to increase its product reach across the U.S.

- November 2022 – The Edgewell Personal Care Company acquired Billie Inc., a U.S.-based consumer brand company, to expand its portfolio of women's personal care products.

- February 2022 – Sirona Hygiene Private Limited, an Indian menstrual cup manufacturer, acquired women's safety brand, Impower, to generate revenue from women's safety products in India.

- January 2022 – Essity AB acquired Australian company Modibodi and Canadian firm Knix Wear, Inc., providers of leakage-proof intimate apparel products, to expand its presence in the global intimate apparel products industry.

- January 2021 – Essity AB launched a range of washable & absorbent underwear within its incontinence products category. These products are highly efficient in bladder leakage and menstruation management.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as competitive landscape, distribution channels, and leading product types. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.48% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Nature

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 45.56 billion in 2025 and is projected to reach USD 85.81 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 14.55 billion.

Registering a CAGR of 7.48%, the market will exhibit a steady growth rate during the forecast period of 2026-2034.

Based on product type, the menstrual care product segment is expected to lead this market during the forecast period.

Rising hygiene awareness, increasing menstrual literacy, and growing government initiatives are driving the markets growth.

Procter & Gamble, Unicharm Corporation, Kimberly Clark Corporation, and Essity are a few major players in the global market.

Asia Pacific dominated the market in 2025.

Greener and reusable products made from sustainably sourced natural materials are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us