Fire Protection System Market Size, Share & Industry Analysis, By Product Type (Fire Detection, Fire Suppression, Fire Sprinkler System, Alarm and Notification Systems, and Fire Response), By Service (Installations & Replacements, System Inspections & Maintenance, Fire Alarm & Fire Sprinkler Monitoring, Fire Extinguisher Training, and Others), By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Fire Protection System Market Size

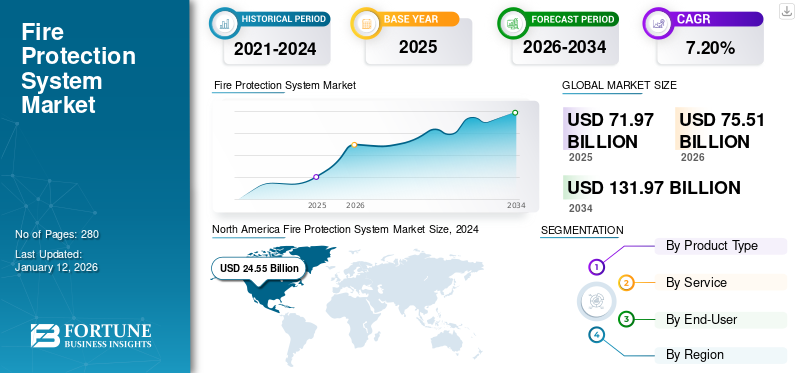

The global fire protection system market size was valued at USD 71.97 billion in 2025. The market is projected to grow from USD 75.51 billion in 2026 to USD 131.97 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. North America dominated the global market with a share of 35.70% in 2025.

A fire protection system is a comprehensive set of equipment, devices, and strategies designed to detect, control, suppress, and mitigate fire hazards in buildings, structures, or various areas. It is an integrated network of devices and measures implemented to detect fire, alert occupants, control smoke, suppress flames, and facilitate safe evacuation, with the ultimate goals of protecting life, minimizing property damage, and reducing the impact of fire incidents. Fire detection, fire suppression systems, fire extinguishing, fire alarms, fire sprinklers, fire response are fire safety equipment used in the market. In this scope, we have considered the net sales generated by product and the services.

Rapid urbanization and the development of commercial, industrial, and residential infrastructures necessitate the installation of fire protection systems to ensure safety. The expansion of the construction industry, particularly in emerging economies, is leading to increased installations of both active fire protection and passive fire protection systems in new buildings and structures. For instance, according to the Ceramic World Web report, the construction sector in India increased by 13.3% in 2023 compared to 2022.

Global Fire Protection System Market Overview

Market Size:

- 2025 Value: USD 71.97 billion

- 2026 Value: USD 75.51 billion

- 2034 Forecast Value: USD 131.97 billion

- CAGR: 7.20% (2026–2034)

Market Share:

- Regional Leader: North America held the highest share (35.70%) in 2025, backed by strong fire safety regulations and infrastructure investment

- Product Segment Leader: Fire detection systems led the market in 2024

- Service Segment Leader: The installations & replacements segment accounted for the biggest share in service-related revenue

- End-User Leader: The commercial sector dominated in 2023 and is projected to continue leading through 2032; industrial and residential segments follow in scale and growth rate

Industry Trends:

- Growing adoption of IoT- and AI-enabled fire detection and monitoring systems

- Expansion in smart smoke and flame detection, enhanced analytics, and cloud-based system integration

- Increasing preference for integrated fire safety solutions, combining detection, suppression, alarms, and maintenance services

- Ongoing innovation in fire detection technologies, including smartphone/mobile-enabled alarm control and cloud integration

Driving Factors:

- Rapid urbanization and infrastructure development, especially in emerging economies, driving demand for comprehensive fire safety systems

- Rising number of fire incidents worldwide, increasing awareness and prompting investments in prevention and protection

- Strict regulatory mandates and building codes requiring fire system installations in new and existing constructions

- Need for external support services including system inspections, maintenance, alarm monitoring, and professional training

Moreover, a rising number of fire cases registered across the globe, which resulted in several injuries and deaths in recent years, creates the demand for such systems to ensure safety in commercial and industrial premises. For instance, according to the National Safety Council, in the year 2022, around 1504,500 fire cases were registered globally, which caused 13,250 injuries and 3,790 deaths. Such a surge in the rising number of fire cases globally drives the market growth.

The COVID-19 pandemic had a mixed impact on the fire protection system market. This is owing to disruptions in the global supply chain and halted construction-related projects, which negatively impacted market growth. Moreover, the pandemic heightened awareness about safety and health, leading some organizations to prioritize investments in such systems to ensure the safety of their facilities, which provides lucrative opportunities for market growth.

Fire Protection System Market Trends

Technological Advancements in Fire Protection Solutions to Propel Industry Growth

Key players such as Johnson Controls International Plc, Eaton, Halma Plc, Siemens AG, Schneider Electric, and Carrier, among others, are bringing new technologically advanced fire systems, including fire detection solutions, fire suppression systems, and fire sprinkler systems, to the market. Moreover, key players are engaged in introducing new AI-enabled, IoT-enabled technologies in such systems, which is set to drive the growth of the market. For instance, in June 2022, Siemens AG introduced a new Cerberus PRO fire safety product for commercial and industrial applications. It is an enabled system that is connected to a smartphone and operates with Cloud Apps.

Download Free sample to learn more about this report.

Fire Protection System Market Growth Factors

Rising Urbanization and Industrialization to Boost Market Growth

Rapid urbanization and infrastructure development across the globe increase the product demand. New constructions and renovations of existing buildings necessitate the installation of advanced fire safety systems. In addition, the expansion of industries, especially in developing countries, increases the demand for fire protection in manufacturing plants, warehouses, and other industrial facilities.

Moreover, rising investment in the construction of new buildings, which subsequently leads to an upsurge in the demand for such systems to ensure safety among working and residential premises, driving market expansion. For instance, in 2023, the degree of urbanization in China is 66% and is projected to increase up to 75%-80% by 2035. Moreover, according to the U.S. Census Bureau, construction spending in the U.S. increased by 6.4% in May 2024 compared to May 2023.

RESTRAINING FACTORS

High Initial Capital Investment May Restrain Industry Growth

Fire protection system often requires a significant upfront investment, including equipment integration and installation services. In addition, modern systems often incorporate advanced technologies such as IoT-enabled devices, AI-based monitoring, and automated suppression systems. These technologies, while enhancing efficiency and effectiveness, come at a high price. The cost of installing an equipment ranges from USD 10,000 to USD 125,000, depending on enterprise size. Moreover, it slows the adoption rate, especially in small to medium-scale enterprises, which limits the growth of the market.

Fire Protection System Market Segmentation Analysis

By Product Type Analysis

Fire Detection Segment Led Market Driven by Increasing Adoption from Residential, Commercial, and Industrial Sectors

Based on product type, the market is divided into fire detection, fire suppression, fire sprinkler system, alarm and notification systems, and fire response.

The fire detection segment is projected to dominate the market with a share of 31.57% in 2026, owing to growing awareness about fire safety and the benefits of early fire detection systems among businesses, individuals, and other institutes. Furthermore, the rising demand for smoke detectors, heat detectors, flame detectors, and gas detectors in residential, commercial, and industrial sectors.

The fire suppression segment is anticipated to grow at the highest CAGR during the forecast period. This is owing to the rising demand for such systems through application substances such as water, foam, gas, and chemical agents. Moreover, increasing the construction of high-rise buildings, industrial facilities, and commercial spaces will drive segment growth.

The fire sprinkler system segment is anticipated to record moderate growth during the analysis period. This is owing to the growing construction sector, which in turn raises the need for safety from the risk of fire, which drives the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Service Analysis

Installations & Replacements is the Leading Service Due to Rising Number of Installed Fire Protection System

Based on service, the market is segregated into installations & replacements, system inspections & maintenance, fire alarm & fire sprinkler monitoring, fire extinguisher training, and others. The others segment consists of engineering services.

The installations & replacements segment is expected to account for 38.90% of the market in 2026 owing to the rising number of installed systems and the growth of the construction industry. Moreover, the rising demand for installation and replacement services for such systems, drives the market growth.

The system inspection & maintenance segment is anticipated to exhibit the highest growth rate during the forecast period. This is owing to the rising demand for visual inspection services, functional testing, maintenance services, bundled services, design services, and customizable solution services for fire detection, fire protection, and fire sprinkler systems.

The fire alarm & fire sprinkler monitoring services segment is projected to depict steady growth during the forecast period owing to increasing adoption of fire protection and also rising demand for continuous surveillance of such equipment. Furthermore, these services consist of specialized fire protection services, fire alarm monitoring, 24/7 monitoring of fire protection services, and also monitor water and pressure levels in fire safety systems.

The fire extinguisher training services segment is anticipated to exhibit moderate growth during the forecast period as it is an essential component of comprehensive fire safety systems. Fire protection equipment manufacturers provide these services and specialized fire safety training companies and in-house safety departments serve in small and large-scale enterprises.

The others segment includes engineering services and risk management services. This segment is projected to grow decently during the forecast period. This is owing to rapid urbanization and the increasing demand for smart and integrated fire safety solutions among various end users.

By End-User Analysis

Commercial Segment Holds Leading Position with Increasing Construction of High-rise Commercial Buildings

Based on end-user, the market is subdivided into residential, commercial, and industrial.

The commercial segment will account for 48.21% market share in 2026 and is anticipated to exhibit the highest growth during the forecast period. This is due to rising investment in the construction of high-rise buildings, offices, hotels, and retail spaces. Such growth in the commercial sector drives the demand for advanced fire protection systems.

The industrial segment ranks second and is growing steadily due to increasing awareness of fire risks and stringent regulations for installing such systems in manufacturing plants, warehouses, chemical plants, oil & gas refineries, and power plants. Moreover, rising expansion of industrial facilities and establishment of new plants creates the product demand, fueling the market growth.

The residential segment is slated to grow moderately during the forecast period. This is owing to the rising construction of residential buildings and rising awareness about ensuring safety among residential and apartment areas.

REGIONAL INSIGHTS

By region, the market has been studied across North America, Asia Pacific, Europe, South America, and the Middle East & Africa.

North America Fire Protection System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 25.68 billion in 2025 and USD 26.99 billion in 2026 owing to rising non-residential fire accidents and growing investments in the construction sector, which drove the demand for fire protection systems across the U.S., Mexico, and Canada. For instance, according to the U.S. Census Bureau, the construction sector in the U.S. recorded an 11.3% expansion in 2023 compared to 2022. Moreover, according to the National Interagency Fire Center (NIFC), in the U.S., around 66,255 fire cases were registered in 2022, which increased by 10.9% than those in 2021.

U.S. Set to Dominate Market Due to Adoption of Smart Building Practices and Increasing Awareness about Fire Safety

The U.S. market is projected to reach USD 19.05 billion by 2026. Moreover, rising fire accidents across residential, commercial, and industrial spaces have positively impacted the demand for such systems. For instance, the United States Fire Administration (USFA) estimated that 116,500 fire accidents were reported in 2021, showing a double-digit increase of about 12.7% in the number of non-residential building fires, resulting in robust product demand across the country.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is projected to depict the highest growth during the forecast period owing to rapid urbanization, rising safety awareness, and globally mounting infrastructure development. In addition, the rising construction of high-rise buildings and industrial plants generates the demand for such systems, fueling the fire protection system market growth. The Japan market is projected to reach USD 3.18 billion by 2026, the China market is projected to reach USD 7.34 billion by 2026, and the India market is projected to reach USD 2.69 billion by 2026.

Europe is expected to grow steadily during the forecast period. This is owing to stringent fire safety regulations, technological advancements in smart building systems, retrofitting of older buildings to meet current demand for fire sprinklers, and fire suppression systems, and integration of fire protection with building management systems. The UK market is projected to reach USD 3.57 billion by 2026, while the Germany market is projected to reach USD 5.23 billion by 2026.

South America and the Middle East & Africa are projected to exhibit moderate growth during the analysis period. This is owing to increasing construction activities, urbanization, and stringent fire safety building codes.

KEY INDUSTRY PLAYERS

Key Players Engaged in Product Launches and Developments as Key Strategies to Intensify Market Competition

Key players such as Eaton, Johnson Controls, Halma Plc, Siemens AG, Honeywell International, Schneider Electric, and Carrier, among others, are engaged in adopting product development, business expansion, and acquisition as key strategic moves to gain a competitive edge in the market. For instance, in November 2021, Johnson Controls introduced a new fire sprinkler monitoring solution for commercial and industrial spaces. It is a 24/7 operational system. It helps to reduce fire risk, reduce operational downtime, and prevent damage to buildings.

List of Top Fire Protection System Companies:

- Carrier (U.S.)

- Eaton (Ireland)

- Halma Plc (U.K.)

- Hochiki Corporation (Japan)

- Honeywell International Inc (U.S.)

- Johnson Controls (U.S.)

- Robert Bosch GmbH (Germany)

- Schrack Seconet AG (Austria)

- Schneider Electric (France)

- Siemens AG (Germany)

KEY INDUSTRY DEVELOPMENT:

- June 2024: Edwards, a subsidiary of Carrier, introduced a new Optica duct smoke detector for commercial and industrial areas. It is specially designed to detect HVAC smoke in commercial and industrial premises.

- April 2024: Honeywell International Inc introduced a new Fire Lite alarm system for residential, commercial, and industrial sectors. It is used for small and medium-scale enterprises. It offers features such as cloud support, remote operation, and improved compliance.

- August 2023: Johnson Controls International Plc launched a new simplex foundation series of fire protection systems, which is suitable for industrial and commercial applications. In this series, the company introduced four fire alarm control units that offer features such as reliability, innovation, and cost-efficiency.

- February 2023: Halma Plc acquired Thermocable Ltd based in the U.K., which deals in fire protection and fire detection systems. The acquisition was done for approximately USD 24.3 million. The basic aim of this acquisition was to improve the net sales of the company by 18 to 22%.

- August 2022: Honeywell International Inc launched a new Morley Max fire alarm and fire detection system, which would enhance the safety of residential and industrial premises. The solution is powerful, compact, has IoT-enabled devices, and 7 inch touch screen panels for operation.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on product type, services, end user, and regions. It provides various key insights, recent industry developments in the market such as mergers & acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Service, End-User, and Region |

|

Segmentation |

By Product Type

By Service

By End-User

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market was valued at USD 71.97 billion in 2025.

In 2034, the market is expected to reach USD 131.97 billion.

The market is projected to grow at a CAGR of 7.20% during the forecast period.

By product type, the fire detection segment led the market in 2025.

Rising urbanization and industrialization are the key factors driving the growth of the market.

Johnson Controls, Eaton, Halma Plc, Hochiki Corporation, Robert Bosch GmbH, Siemens AG, Honeywell International Inc, Schneider Electric, Schrack Seconet AG, and Carrier are the leading companies in this market.

North America held the largest share in 2025 owing to stringent fire safety regulations.

Escalating technological advancements in fire protection systems is the latest trend in the market.

Installations & replacements is the leading service and is expected to dominate the market over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us