Flow Battery Market Size, Share and Industry Analysis By Type (Hybrid, Redox), By Application (Utility, Automotive, Residential, Industrial,Energy Storage,Others)and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

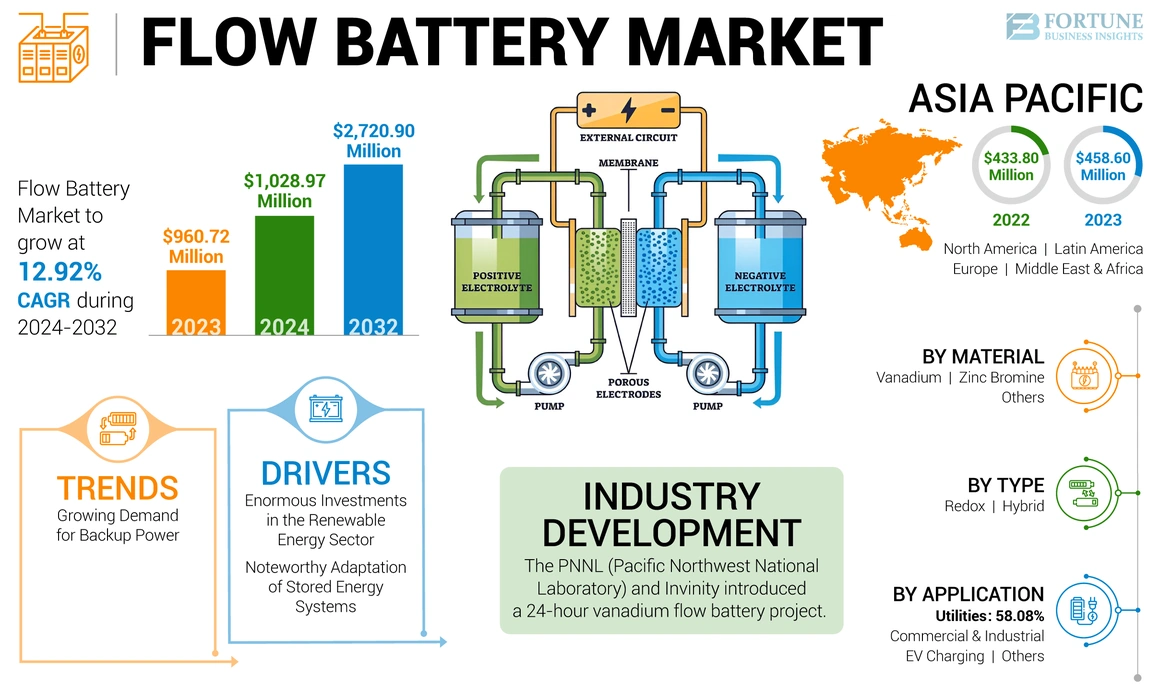

The global flow battery market size was valued at USD 960.72 million in 2023 and is projected to grow from USD 1,028.97 million in 2024 to USD 2,720.90 million by 2032, exhibiting a CAGR of 12.92% during the forecast period. Asia Pacific dominated the flow battery market with a market share of 47.73% in 2023.

Flow batteries are a type of rechargeable batteries where energy is kept in liquid electrolytes contained in external tanks. This design permits scalability and longer discharge times compared to outdated batteries. Key components include two electrolyte solutions, usually covering vanadium, zinc-bromine, and other metals, that flow through a cell stack, where electrochemical reactions occur. The adoption of flow batteries is particularly suited for large-scale energy storage applications, such as renewable energy, grid stability, and backup power systems. Their ability to decouple energy makes them versatile for various applications, unlike lithium-ion batteries, contributing to a more sustainable energy landscape and aiding in the transition to clean energy.

Global Flow Battery Market Overview

Market Size:

- 2023 Value: USD 960.72 million

- 2024 Value: USD 1,028.97 million

- 2032 Forecast Value: USD 2,720.90 million, with a CAGR of 12.92% from 2025–2032

Market Share:

- Regional Leader: Asia Pacific held approximately 47.73% of the market share in 2023, driven by rising renewable energy projects and grid-scale storage demands.

- Fastest-Growing Region: Asia Pacific is expected to maintain the highest growth rate, supported by clean energy initiatives in China, India, and Australia.

- End-User Leader: The Utility & Grid Storage segment leads the market due to flow batteries’ suitability for large-scale, long-duration energy storage applications.

Industry Trends:

- Grid-Scale Energy Storage Shift: The growing need for long-duration storage solutions to support renewable integration is driving flow battery demand.

- Asia Pacific Market Dominance: Major investments in solar and wind infrastructure across Asia Pacific are accelerating adoption.

- Technology Diversification: Innovations in vanadium redox, hybrid, and iron flow batteries are enhancing market competitiveness and application scope.

Driving Factors:

- Rising demand for long-duration energy storage solutions with scalability and long cycle life.

- Increasing penetration of intermittent renewable energy sources like solar and wind.

- Supportive government policies and clean energy targets encouraging flow battery deployment.

- Technological advancements in electrolyte chemistry and system design improving efficiency and cost.

- Flow batteries’ cost competitiveness in utility-scale, long-duration storage compared to lithium-ion alternatives.

MARKET DYNAMICS

Market Drivers

Enormous Investments in the Renewable Energy Sector is Fueling Market Growth

Huge investments in renewable technology are driving the growth of the market. This is credited to the global shift toward clean energy sources, such as solar and wind.

For instance, in January 2024, Queensland Renewable Energy proclaimed trials of locally made flow batteries for public energy storage as part of a USD 179 million investment in the next stages of its local network-connected batteries program.

Flow batteries can store large amounts of energy for long periods, making them ideal for balancing the supply and demand of stored energy. With more investment being funneled into renewable projects, companies are exploring flow batteries as a reliable option to store energy. This increased interest is helping to expand the market, making them essential in sustainable energy solutions.

Noteworthy Adaptation of Stored Energy Systems is Driving Battery Market Globally

During the unavailability of electricity many regions incline toward the use of stored energy. Technologies, such as batteries, energy storage systems, and grid are playing an important role in the power sector. Effective energy storage technologies become essential for balancing supply and demand. Hence, technologies, such as flow batteries and solid-state batteries are increasingly adopted in residential, commercial, and industrial settings. For instance, in January 2024, Power distribution company BSES, which supplies power to nearly two-thirds of Delhi, India, through its two firms, has been working on India’s first utility-scale standalone Battery Energy Storage System (BESS), which will be the largest in South Asia.

Download Free sample to learn more about this report.

Market Restraints

Absence of Technological Developments in Flow Batteries Hinders Market Growth

Flow battery comes with multiple disadvantages that are hindering market growth. As they still face challenges in energy density, efficiency, and cost-effectiveness compared to other battery technologies. Limited technological advancements in materials and designs have caused slower acceptance in both commercial and residential applications. Moreover, the complexity of battery systems can prevent potential investors and users from investing in mechanical work.

Market Opportunities

Push for Grid Modernization Will Unlock New Growth Potentials for the Market

Heavy investments in smart grids and energy management systems are creating a demand for reliable energy storage solutions, putting flow batteries as key players in enhancing grid stability. For instance, in 2024, ESS Tech, a manufacturer of energy storage systems, announced it had secured a USD 50 million investment from the Export-Import Bank of the U.S. (EXIM) to develop long-duration energy storage iron flow batteries. Such investments will create new opportunities in the battery market in the forecast years. In addition, factors, such as peak shaving, decentralized energy solutions, and regulatory support will also back the flow battery market growth.

Market Challenges

Availability of Alternative Batteries Create Hurdles for the Market’s Development

There are multiple battery types available in the market that may become a challenge to battery sales. Other battery types come with several advantages, such as higher energy density and technology maturity, whereas flow batteries are overlooked in commercial and residential applications for the long term. These technologies are advancing hastily, with ongoing innovations in materials and designs, enhancing their performance and reducing costs. If these developments continue, they could further solidify their market dominance over flow batteries.

In addition, flow batteries are less known compared to lead-acid and lithium-ion batteries. This lack of awareness can delay adoption, as businesses and consumers may default to familiar technologies.

FLOW BATTERY MARKET TRENDS

Growing Demand for Backup Power is a Leading Market Trend

Flow batteries play a crucial role in modern power distribution that enhances the reliability and efficiency of power networks. In addition, the growing demand for backup power in several commercial and industrial sectors is backing the market. The growing demand for the consumption of energy in data centers and hospitals also supports modern power distribution products, such as batteries.

For instance, in May 2024, Australian Vanadium Limited completed work relating to the Australian Government grant awarded in 2021 under the Modern Manufacturing Initiative. The company designed and constructed AVL’s commercial vanadium electrolyte manufacturing capacity to provision the rollout of vanadium flow batteries in Australia.

Impact of COVID-19

The COVID-19 pandemic negatively impacted the global market. The market’s negative growth can be owed to the pause in the industrial sectors, such as manufacturing, which led to high demand and lower supply. In addition, the inaccessibility of raw materials, shutdown of the import and export of goods, and closure of the borders stifled the flow battery market share.

SEGMENTATION ANALYSIS

By Type

Redox Flow Batteries Dominate the Market Due to Their High Demand in Multiple Applications

Based on type, the market is segmented into redox and hybrid. Redox is considered the dominating segment globally. This is driven by its wide use in multiple applications, such as renewable energy sources, microgrids, and grid stabilization. Redox flow batteries are extensively deployed in utility, commercial & industrial sectors to deliver consistent power.

Hybrid batteries are one of the fastest growing segments driven by their dual mechanism, which incorporates liquid electrolytes, such as traditional flow batteries, along with solid electrodes or other materials, allowing for enhanced energy density and efficiency.

By Material

Vanadium is the Highly Preferred Material Driven by its Advantages in Commercial and Utility Applications

Based on material, the market is segmented into vanadium, zinc bromine, and others. Vanadium is a dominating material due to its advantages that drive application smoothly. Vanadium flow batteries can be easily scaled to meet energy storage requirements by increasing the size of the electrolyte tanks. In addition, vanadium is non-toxic and the battery uses non-flammable electrolytes, which improves their safety compared to other battery technologies.

Zinc bromine flow batteries are also contributing to the global market. These batteries are cost-effective and have a long operational lifespan, allowing for many charge-discharge cycles without significant degradation in performance.

By Application

Utilities is the Leading Application Backed by the Expansion of the T&D Lines

Based on application, the market is segmented into utilities, commercial and industrial, EV charging, and others.

The utilities segment dominates and hold the largest flow battery market share, driven by the expansion of the transmission & distribution lines in rural areas. For instance, in July 2024, Toshiba India decided to expand its manufacturing capacity of power transformers and distribution transformers over the next three years with an investment of Japanese Yen (JPY) 10 billion (over USD 66 million). Such interest in power products is driving the flow of battery growth in the forecast years.

Commercial and industrial is one of the fastest growing segments driven by the developments in areas, such as data centers and hospitals that require continuous power supply. EV charging is creating new opportunities in the market as the sales of EV vehicles are growing in numbers year by year. For instance, in August 2024, 1.35 million units of EVs, fully electric or plug-in hybrid electric, were sold in July, which showed an upsurge in sales of EVs by 21% worldwide. This is due to the growing investment and development in China.

To know how our report can help streamline your business, Speak to Analyst

FLOW BATTERY MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific is considered the dominating region driven by rapid urbanization and industrialization. Heavy consumption of electricity during industrialization is backing the growth of flow batteries. China is leading the Asia Pacific market due to the focus on electrification and energy efficiency on a domestic level. In addition, China holds a substantial share of the battery market globally owing to its manufacturing dominance and strong supply chain. For instance, as per the data of Nikkei Asia, Chinese companies accounted for over 80% of global shipments of key lithium-ion battery components in 2023, driving a strong supply chain globally.

North America

The market in North America is witnessing substantial growth, owing to the focus on grid stability in utilities and other applications. In addition, regulatory frameworks, corporate sustainability initiatives, and technological advancements in the product line are driving the market growth.

The U.S. is the dominating country in North America, backed by investments in the renewable sector. For instance, the U.S. investment in renewable power technologies has grown suggestively over the last decades. In 2023, investments reached USD 92.9 million, in comparison to USD 29.1 million in 2013. Such investments are backing the growth of flow batteries as they are widely used as heavy storage systems.

Europe

Europe has been growing consistently in recent years owing to the requirements of continuous power in multiple applications that can be achieved through the battery systems. In addition, the availability of manufacturers in European countries is also driving the market growth. Germany is dominating the European market owing to the demand for energy storage systems.

Latin America

Latin American countries are actively participating in the market. The region seeks to improve its energy storage competencies, particularly in the context of cumulative renewable energy adoption. Brazil and Mexico are playing an important role in fulfilling the energy demand in Latin America. For instance, in 2024, The Brazilian Minister of Energy and Mining revealed an auction for battery energy storage projects to be held in 2025 to boost battery technologies in Latin America.

Middle East & Africa

The Middle East & Africa is witnessing significant growth, propelled by a focus on energy-efficient products, such as flow batteries. GCC countries are dominating the market growth backed by the interest in electrification. For instance, on November 3, 2022, Riyadh-based Tdafoq Energy and Indian firm Delectrik Systems announced their plan to commercialize vanadium redox battery products in Gulf Cooperation Council (GCC) markets and set up a manufacturing facility in Saudi Arabia.

COMPETITIVE LANDSCAPE

Key Industry Players

Top Players are Delivering a Wider Focus on Battery Products to Gain Competitive Edge

The global market is highly fragmented, with key players and some medium-scale regional players delivering a wider focus on battery products. Manufacturers are increasingly required to demonstrate their technology advancements helping countries to regulate requirements, making it easier for them to engage in electrification and climate change at the same time.

For instance, on 16th September 2024, Delectrik Systems launched a multi-megawatt hour (MWh) scale flow battery solution for large commercial & industrial, and utility-scale applications.

Some of the Key Flow Battery Companies Profiled:

- Ess Inc. (U.S.)

- Gildemeister Energy Solutions (Austria)

- Elestor (Europe)

- Redflow Limited (Australia)

- Sumitomo Electric Industries, Ltd. (Japan)

- Primus Power (U.S.)

- Vizn Energy Systems (U.S.)

- Redt Energy Plc. (U.K.)

- Ensync Energy Systems (U.S.)

- Schmid (Germany)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Scientists at the Dalian Institute of Chemical Physics developed advanced novel naphthalene-based organic redox-active molecules for aqueous organic flow batteries.

- April 2024: The U.S. Department of Energy’s (DOE) Office of Electricity (OE) introduced the selectees of USD 15 million in awards at the Long Duration Energy Storage (LDES) Council Summit on April 8, 2024. These projects will advance zinc, lead, and flow battery technologies in the upcoming period.

- May 2023: The PNNL (Pacific Northwest National Laboratory) and Invinity introduced a 24-hour vanadium flow battery project. The system will have a power rating of 525kW which will be able to discharge unceasingly for 24 hours.

- December 2022: Redflow, a zinc bromide flow battery manufacturer, kicked off the manufacture of its long-awaited third-generation “non-lithium” battery storage offering, with early orders on track for distribution.

- June 2021: The World's biggest flow battery was commissioned in China with the First phase of 800MWh. It has created new developments in the Asia pacific and global battery market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product process, competitive landscape, and leading source of the battery. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 12.92% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 960.72 million in 2023.

The market is likely to grow at a CAGR of 12.92% over the forecast period (2024-2032).

The utilities segment leads the market in terms of application.

The market size of Asia Pacific stood at USD 458.60 million in 2023.

Enormous investments in the renewable energy sector are fueling market growth.

Some of the top major players in the market are Ess Inc., Gildemeister Energy Solutions, and Elestor.

The global market size is expected to reach USD 2,720.90 million by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us