Frozen Cocktail Market Size, Share, & Industry Analysis, By Type (Margarita, Mojito, Pina Colada, and Others), By Distribution Channel (On-Trade and Off-Trade), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

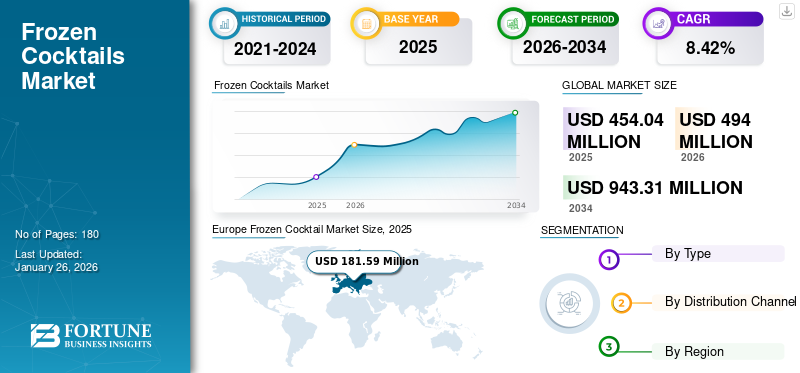

The global frozen cocktail market size was valued at USD 454.04 million in 2025. The market is estimated to grow from USD 494.00 million in 2026 to USD 943.31 million by 2034, exhibiting a CAGR of 8.42% during the forecast period. Europe dominated the frozen cocktail market with a market share of 39.99% in 2025. Moreover, the frozen cocktails market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 190.04 million by 2032, driven by strong demand for RTD cocktails and high prevalence of cocktail-based popsicles.

A frozen alcoholic drink is also called an alcoholic slushy and is made with liquor. It contains alcoholic and non-alcoholic ingredients prepared in a blender to form a slush surface and a cocktail of rum, lemon or lime juice, and sugar.

Frozen cocktails are available in different flavors and forms, such as margaritas, mojitos, pina coladas, and others. They are also available in ice popsicles, pouch drinks, and many more distinct forms. The popularity of frozen beverages is increasing among consumers due to their convenience. Higher preference for ready-to-drink options, such as frozen cocktails, allows the consumer to enjoy a bar-like experience at home. Moreover, manufacturers focus on launching new products in different flavors to increase their market presence. For instance, LIC Frozen Cocktails launched a cocktail with a 10% ABV. The product is made with premium plantation rum in three flavors, such as mojito, piña colada, and daiquiri.

The COVID-19 pandemic changed several aspects of everyday life globally in early 2020. The lockdown restriction during COVID-19, a ban on socializing, nightclubs, and the closure of all restaurants and pubs during the pandemic in 2020-2021 impacted consumers' purchase behavior, resulting in lower consumption.

Frozen Cocktail Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 454.04 million

- 2026 Market Size: USD 494.00 million

- 2034 Forecast Market Size: USD 943.31 million

- CAGR: 8.42% from 2026–2034

Market Share:

- Europe dominated the frozen cocktail market with a 39.99% share in 2025, supported by growing demand for premium cocktail experiences, wide product availability, and strong manufacturer presence in countries like the U.K., Russia, and Germany.

- By type, mojito is expected to retain the largest market share in 2025, driven by its refreshing taste, availability in diverse flavors, and widespread consumer appeal.

Key Country Highlights:

- United States: Projected to reach USD 190.04 million by 2032, driven by strong demand for RTD cocktails, innovative frozen formats, and regionally popular products like cocktail popsicles.

- United Kingdom: Home to several leading frozen cocktail brands offering diverse flavors and formats, reinforcing its leadership within the European market.

- Germany: Rising popularity of ready-to-drink alcoholic slush beverages contributes to sustained demand in the country.

- China: Rapid urbanization and evolving consumer lifestyles support frozen cocktail consumption, particularly among the younger population.

- United Arab Emirates: Growth in the tourism sector and rising demand for innovative alcoholic beverages are enhancing market presence in the region.

Frozen Cocktail Market Trends

Product Diversification and Innovation Fuel the Growth of the Global Market

The rising trend of new flavors and packaging among manufacturers is helping the industry to attract new customers. Companies are launching products to expand their competitiveness in the market and capture more market share. A wide range of products is available in various flavors, such as passion fruit, patron tequila, peach, peppered peach, Picante de la casa, pina colada, and others. Frozen drinks require different techniques to blend, shake, or stir the cocktails. It has various methods, such as power mixing machines, slushy machines, and others. Manufacturers opt for new machines to make innovative cocktail mixes available to attract more consumers. Equipment manufacturers are also trying to capitalize on this trend by making special machines only for cocktails. For instance, in May 2019, The Vollrath Company, LLC, a kitchen equipment manufacturer, launched a frozen beverage granite machine for dispensing a variety of high-margin cocktails, slush, and smoothies.

Download Free sample to learn more about this report.

Frozen Cocktail Market Growth Factors

Growing Demand for RTD Beverages Driving the Global Market Growth

The frozen cocktail sector is another emerging market segment within the ready-to-drink beverages market. Global consumers have grown accustomed to the convenience and variety of flavors offered by ready-to-drinks, which has increasingly led consumers to shift toward spirit-based or alcohol-based RTD beverages. Since consumers are increasingly prioritizing convenience, exotic taste, varieties in flavor and product quality, spirit-based RTD beverage manufacturers are intensifying their R&D and innovation activities to develop novel products to serve the consumers' needs. Numerous companies emphasize ingredients and trending additives such as agave nectar and fruits to develop unique flavors in RTD beverages. For instance, in July 2022, Aupale Vodka, a Canadian company, launched a ready-to-drink cocktail - The Aupale Grapefruit Seltzer! The product is cold-pressed and made from fruits, contains all-natural flavors, is unpasteurized, and has no preservatives or artificial sugar. This product is packed in 40% recyclable glass bottles.

Availability of Products through Multiple Distribution Channels is driving the Adoption of Cocktails

The availability of cocktails across various distribution channels is helping the market grow by increasing product visibility and consequently increasing sales. Cocktail popsicles, available in specialty stores, frequently include high-quality flavor combinations, usually unavailable in standard general stores. Besides, specialty and convenience stores tend to have a more carefully curated determination that caters to specialty inclinations. Customers, specific about certain flavor profiles, fixings, or brands, may discover a more personalized and custom-fitted grouping in specialty stores. Online retailers use aggressive marketing strategies, including targeted advertisements, social media campaigns, and influencer collaborations. These strategies help brands create a strong online presence, attract new customers, build brand loyalty, and drive their product's market penetration.

RESTRAINING FACTORS

Rising Consumer Inclination to Consume Non-Alcoholic Drinks May Hamper Market Growth

The presence of popular non-alcoholic drinks, such as diet coke, protein drinks, and plant-based drinks, in the market is a major obstacle to the growth of cocktails. The inclination of consumers toward non-alcoholic drinks is rising due to health awareness among consumers and the adverse effects of alcohol on body functions. According to the Institute of Food Technologies (IFT) research study, one in five consumers globally has reduced alcohol-based drink consumption to make healthier beverage choices, which may impede the frozen cocktail market growth. Moreover, lower acceptance for premium or high-priced cocktails across some developing markets can also hinder growth.

Frozen Cocktail Market Segmentation Analysis

By Type Analysis

Mojito is Anticipated to be the Prominent Revenue Contributor Due to its Easy Availability and Taste

Based on type, the market is segmented into margarita, mojito, pina colada, and others. The mojito cocktail drink is the most dominating type segment in the market share of 34.86% in 2026. It is available in different flavors, such as strawberry mojito, cranberry mojito, and others. It is one of the most popular cocktail drinks, and it is very popular with domestic and foreign tourists as it has a refreshing taste and aroma. Mojito cocktails are crafted by blending light rum with lime and some other flavors. Manufacturers use the flexibility to explore diverse fruit infusions, and rimming options, delivering consumers a broad spectrum of inventive and captivating mojito popsicle choices.

The other type is projected to witness significant growth rate over the upcoming period. Other flavors, such as margarita pops, pina colada, and more, are gaining substantial traction owing to innovative and unique taste profiles that are growing in the category.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Higher Convenience Associated with Off-Trade Channel to Fuel Segment Growth

By distribution channel, the market is segmented into on-trade and off-trade. The on-trade segment refers to the HoReCa and other food service establishments, while the off-trade segment refers to specialty stores, liquor stores, and online retailers.

The off-trade segment holds a dominant frozen cocktail market share of 86.89% in 2026, owing to the higher preference among consumers as it offers convenience in terms of choices for several brands and flavor prices. The extensive shelf space and strategic placement within these large retail spaces enhance the visibility of cocktails.

In addition, specialty stores offer significant choices with the availability of national and international product brands within these stores, which are expected to boost the segment's growth further.

The sale of cocktail products through on-trade is projected to intensify globally in the upcoming years, with a diverse product range available in bars, restaurants, and other channels. The on-trade segment is expected to grow moderately over the forecast period.

REGIONAL INSIGHTS

Based on region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Frozen Cocktail Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 181.59 million in 2025 and USD 196.75 million in 2026. The dominance of Europe is led by the increased demand for products that offer a premium experience owing to their authentic flavors and ingredients. Additionally, the on-the-go convenience of pouch products and packets and their resistance to breakage are factors drawing the consumer's attention. The U.K. is one of the largest markets in Europe, followed by Russia and Germany for frozen cocktails. Most companies are established in the U.K., such as LIC Frozen Cocktails, Manchester Drinks, POP'd LTD, and others. These companies provide various options in different flavors in the European market. The UK market is projected to reach USD 56.89 million by 2026, and the Germany market is projected to reach USD 25.42 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America holds the second-largest frozen cocktail market share. The demand for RTD cocktails is high, mainly in the U.S. and Canada, due to their taste, innovative flavors, and easy availability. The surge in cocktail sales may be driven by the want for cool and reviving treats, particularly amid hotter months. Presenting low-calorie and more advantageous choices within the popsicle may pull in health-conscious customers all over the U.S. Locally made popsicles are prevalent among Northeastern U.S. states, such as New York and New Jersey, as these popsicles are sold through an assortment of solidified treat shops and grocery stores in these areas, highlighting key brands, such as Cooloo. Cooloo offers solidified cocktail pops in flavors, such as pina colada and mai tai giving customers assorted choices. The items are locally made, contributing to their one-of-a-kind and unique flavor. The U.S. market is projected to reach USD 118.31 million by 2026.

Asia Pacific

The rapid growth in the last decade in developing markets such as China, India, Japan, and others has made the region one of the fastest-growing regions in the global market. Rapid urbanization, changing lifestyles, and a growing young population inclined toward cocktail beverages contribute to the market expansion. The Japan market is projected to reach USD 26.53 million by 2026, the China market is projected to reach USD 35.05 million by 2026, and the India market is projected to reach USD 24.11 million by 2026.

South America and Middle East & Africa

South America and the Middle East & Africa are expected to grow at a moderate rate. The tourism industry is expanding rapidly in the Middle East & Africa, and tourists want to try new alcoholic beverages, such as cocktails. The availability of these cocktails in different flavors will grow with the increasing demand for the product in these regions.

List of Key Companies in Frozen Cocktail Market

Key Players Focus on Product Development in Different Flavors to Stay Competitive

The global market is fragmented, with many small players. Market players, such as Harvest Hill Beverage Company, LIC Frozen Cocktails, and Manchester Drinks, are some players increasing their market share and establishing dominance in the global market. In the cocktails market, the companies have been adopting strategies, such as innovative product launches, packaging, and technologies for smooth product distribution, to increase their customer base and lead the global market. For instance, in 2022, SLIQ Spirited Ice launched their newest ice pop cocktails based on Whiskey, bringing the brand's products to nearly 25 states in the U.S.

LIST OF KEY COMPANIES PROFILED:

- Harvest Hill Beverage Company (U.S.)

- LIC Frozen Cocktails (U.K.)

- Manchester Drinks (U.K.)

- Snobar (U.S.)

- Flavorful Beverages International Inc. (U.S.)

- COOLOO (Netherlands)

- POP'd LTD (U.K.)

- Ellinor's Ice Cream (U.K.)

- 24 ICE (Netherlands)

- The Absolut Group (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- April 2022: Dailys, a ready-to-enjoy frozen adult beverage company, launched new frozen cocktails in different flavors, such as cone pouch flavors and red, white, and blue Poptails. Its products are available globally at major supermarkets, mass merchandisers, and liquor stores.

- July 2021: Cooloo launched a new variety cocktail pack containing four limited-time flavors to help sweeten the summer. The company launched four new flavors: mojito, strawberry daiquiri, happy bay twist, and paradise island. This product was made available in New York and helped the company increase its product portfolio in the market.

- May 2021: American Beverage Corporation launched ready-to-drink frozen cocktail pouches, "daily cocktails," which are smooth-tasting, bursting with fruit flavor, and completely portable. Its poptails are available in three fan-favorite flavors, such as strawberry, watermelon, and green apple, and they contain 6.8% ABV and 90 calories each. This new launch helped the company increase its product portfolio in the market.

- March 2021: Cutwater Spirits launched two new frozen margarita products, including frozen margarita pops and canned mango margs. Both products are made with real spirits and feature the brand's 100% blue agave tequila blanco. Frozen margarita pops come in a 12-pack variety with flavors, such as strawberry, mango, pineapple, and lime. An increased product portfolio helped the company stay competitive in the market.

- July 2019: Frozun Spirits Infusion launched "Frozun," a hand-crafted, all-natural line of alcohol-infused frozen cocktails and desserts. The company launched this new product variant as a unique blend of sorbet infused with tequila, bourbon, vodka, and rum, owing to the consumers' demand for innovative cocktail drinks.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies in the competitive landscape by type and distribution channel. Besides this, the report offers insights into the market trends, market dynamics, and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.42% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the market size was USD 454.04 million in 2025.

The market is likely to grow at a CAGR of 8.42% over the forecast period (2026-2034).

The mojito is expected to be the leading segment in the global market.

Growing demand for RTD beverages drives the market.

Harvest Hill Beverage Company, LIC Frozen Cocktails, Flavorful Beverages International Inc., the Absolut Group, and others are the major players in the market.

Europe dominated the frozen cocktail market with a market share of 39.99% in 2025.

Rising consumer inclination to consume non-alcoholic drinks may hamper market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us